Torr Metals Inc. (TMET:TSX.V) announced that because of strong investor interest, it increased the size of its previously announced non-brokered private placement from total gross proceeds of up to CA$2.8 million to total gross proceeds of up to CA$4.57 million.

The expanded offering includes up to 5,626,765 flow-through units priced at CA$0.17 each. Each FT unit comprises one flow-through common share of the company and one-half of a common share purchase warrant, which allows the holder to purchase one additional non- flow-through common share of Torr at CA$0.25 per share for 24 months from the closing date of the offering.

Up to 8,753,767 non-flow-through units are priced at CA$0.13 each. Each NFT unit includes one non-flow-through common share of the company and one-half of a common share purchase warrant. Each NFT unit warrant permits the holder to acquire one additional warrant share at CA$0.21 per share for 24 months from the closing date.

Up to 11,909,382 charity flow-through units priced at CA$0.208 each. Each charity FT unit consists of one FT share and one-half of a common share purchase warrant. Each charity FT unit warrant enables the holder to purchase one warrant share at CA$0.21 per share for 24 months from the closing date.

All Warrants issued through the offering are subject to early expiration if the closing price of the common shares exceeds CA$0.35 for 10 consecutive trading days. The company may pay finders' fees in line with TSX Venture Exchange policies.

The gross proceeds from the sale of the FT units and charity FT units will be used to incur eligible “Canadian exploration expenses” that qualify as “flow-through critical mineral mining expenditures,” as defined in the Tax Act.

These expenditures will be directed toward Torr’s British Columbia assets, specifically its wholly-owned 275 km² Kolos Copper-Gold Project and the adjacent 57 km² Bertha Property, which was optioned in March 2025 with the right to earn full ownership, Torr noted.

Discovering New Copper-Gold in Accessible Mining Districts

Headquartered in Edmonton, Torr Metals is committed to discovering new copper and gold opportunities within well-established and easily accessible mining districts across Canada. These regions benefit from existing infrastructure and a growing demand for immediate resources.

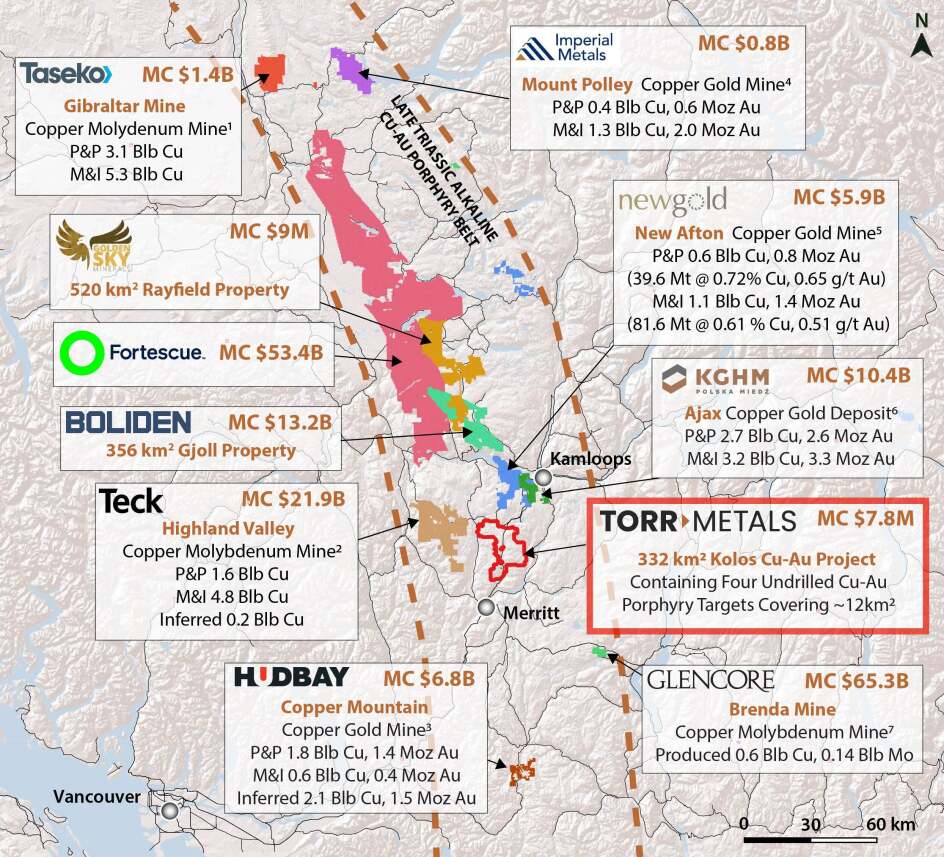

Torr's fully owned, district-scale properties are strategically located for cost-effective, year-round exploration and development. The 275 km² Kolos Copper-Gold Project and the strategically optioned 57 km² Bertha Property are situated in southern British Columbia's renowned Quesnel Terrane, just 30 kilometers southeast of the Highland Valley Copper Mine, Canada's largest open-pit copper operation, and 40 kilometers south of Kamloops along Highway 5.

In northern Ontario, the 261 km² Filion Gold Project covers a largely unexplored greenstone belt with significant high-grade orogenic gold potential. It is located just off Trans-Canada Highway 11, about 42 kilometers from Kapuskasing and 202 kilometers by road from the Timmins mining camp, home to world-class gold mines like Hollinger, McIntyre, and Dome.

In September, Torr announced results from the analysis of historical soil and rock grab samples at the Sonic copper-gold porphyry target on its wholly owned 275 km² Kolos Copper-Gold Project in south-central British Columbia. The historical data revealed a 4.5 km² copper-gold soil anomaly extending north of the Sonic Zone within Torr’s 100%-owned land, showing up to 4,510 parts per million (ppm) copper (Cu) and 590 parts per billion (ppb) gold (Au).

Additionally, field reconnaissance in 2025 within the Sonic Zone Cu-Au porphyry target area uncovered a new mineralized outcrop approximately 1 kilometer northeast of Torr’s 2024 discovery, the company said. This outcrop returned 1.1% Cu in a magnetite-rich grab sample along the edges of a highly promising high magnetic anomaly. The newly discovered outcrop returned 0.42% Cu from a strongly sheared quartz-carbonate vein hosted in Nicola Group volcanics, located near a pyritized monzonite intrusion and a silica-apatite dyke.

These features suggest potential vectors toward an alkalic Cu-Au porphyry center with gold enrichment, supported by structural links to nearby epithermal Au-Ag-Cu (gold-silver-copper) systems at the Meadow Creek and Plug targets, where historical trenching yielded 2.24 grams per tonne (g/t) Au and 400.6 g/t Ag over 4.4 meters as well as 20.8 g/t Au over 0.56 meters.

Company's Project Attracting Interest

As copper exploration gains momentum in British Columbia's Quesnel Trough, Torr is positioning itself for a potential new discovery, according to analyst John Newell of John Newell & Associates on October 6.*

With several undrilled copper-gold porphyry centers, robust infrastructure, and a streamlined share structure, the company's wholly owned Kolos Copper-Gold Project is attracting interest as it prepares for its inaugural drill program set to commence in October 2025, he said.

The Quesnel Trough is "home to some of Canada's largest and longest-lived copper mines, including Highland Valley (Teck), New Afton (New Gold), and Copper Mountain (Hudbay)," Newell wrote. The company's projects give "exposure to both copper and gold discovery opportunities across Canada, with Kolos leading the near-term news flow as the first drill program begins in Q4 2025," Newell wrote.

For investors looking to gain exposure to a new copper discovery narrative in one of Canada's safest and most productive mining areas, Newell said Torr Metals was considered a Speculative Buy at the price at the time of writing of CA$0.15. The technical price targets are set at CA$0.24, CA$0.48, and a longer-term target in the range of CA$0.60–CA$0.65, contingent upon a confirmed discovery-driven breakout, Newell said.

The Catalysts: The Energy Transition, Global Unrest

Copper plays a crucial role in the energy transition due to its significance as an electrical conductor. The demand for this vital metal "has been accelerating, as companies involved in all parts of the copper supply chain realize the structural supply deficit," according to Rick Mills, author of the newsletter Ahead of the Herd.

Mills noted, "They understand the need to find sources — existing mines, expansions, brownfield projects, greenfield projects, etc. — and are making deals to acquire the base metal, which is not only essential to electrification and decarbonization but industry in general."

Swiss bank UBS predicts that the copper supply gap will surpass 200,000 tons by 2025. Additionally, the International Energy Forum highlights that to meet the increasing demand, more than a billion tons of new copper mining capacity will be required annually until 2050.

Copper prices are anticipated to rise this fall, driven by seasonal demand and ongoing supply constraints, offering traders lucrative opportunities, Don Dawson reported for Yahoo! Finance on October 6. Home builders are stockpiling copper for spring construction, particularly for wiring and plumbing, with demand peaking from September to March. This seasonal trend, coupled with global economic factors, creates an ideal trading window, he said. The fall buying season aligns with U.S. housing starts, which are projected to grow by 4% in 2026, according to the National Association of Home Builders. This surge in demand further tightens an already constrained market.

Meanwhile, Dawson reported that the global copper supply is expected to face a 300,000-metric-ton shortfall in 2025 due to production challenges in Chile and Peru, including labor strikes and mine disruptions. Increasing price volatility is exacerbated by low inventories on the London Metal Exchange, sometimes covering less than a day's demand, Dawson wrote.

The energy transition — propelled by electric vehicles, solar power, and AI-driven data centers — continues to boost demand, with copper consumption rising annually since 2020, the story noted.

Gold prices surged to new record levels on Monday, nearing the US$4,100-per-ounce threshold, as renewed trade tensions between the U.S. and China increased the appeal of bullion as a safe-haven asset, reported Scott Kanowsky for Investing.com on October 13.

Spot gold rose 1.4% by 7:59 a.m. ET, while U.S. gold futures increased by 2.3%. Silver also reached an all-time high, benefiting from the momentum in precious metals. The spike in bullion prices followed U.S. President Donald Trump's escalation of a trade dispute with China late last week, which unsettled financial markets and drove investors toward the perceived safety of gold. The yellow metal is often seen as a secure investment during periods of economic or political uncertainty.

Ownership and Share Structure

According to Torr, about 21% of the company is owned by management and close associates and about 9% by institutions. The rest is retail.

Top shareholders include Torr Resources Corp. (owned by CEO Malcolm Dorsey) with 7.65%, Severin Holdings Inc. with 6.38%, John Williamson with 2.27%, Sean Richard William Mager with 1.24%, and Malcolm Dorsey with 0.11%, Refinitiv reported.

Torr has a market cap of CA$7.05 million and 52.26 million shares outstanding. It trades in a 52-week range between CA$0.08 and CA$0.18 per share.

| Want to be the first to know about interesting Copper, Silver and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Torr Metals Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Torr Metals Inc.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

* Disclosure for the quote from the John Newell article published on October 6, 2025

- For the quoted article (published on October 6, 2025), the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- Author Certification and Compensation: John Newell of John Newell and Associates was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.