New Copper-Gold Targets Taking Shape in the Quesnel Trough

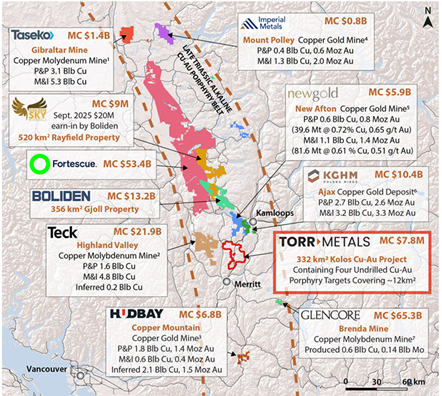

As copper exploration accelerates across British Columbia's Quesnel Trough, Torr Metals Inc. (TMET:TSX.V) is positioning itself for a new discovery.

With multiple undrilled copper-gold porphyry centers, strong infrastructure, and a tight share structure, the company's 100%-owned Kolos Copper-Gold Project is drawing attention ahead of its first drill program scheduled to begin in October 2025.

About the Company

Torr Metals Inc. (TMET:TSX.V) is a Canadian copper-gold exploration company focused on district-scale assets in Tier-1 jurisdictions.

The flagship Kolos Copper-Gold Project spans approximately 332 km² within the prolific Quesnel Trough, home to some of Canada's largest and longest-lived copper mines, including Highland Valley (Teck), New Afton (New Gold), and Copper Mountain (Hudbay).

The project benefits from year-round access via Highway 5, 23 km north of Merritt, with nearby grid power, services, and skilled labor from Kamloops, making it one of the most infrastructure-ready greenfield porphyry plays in Western Canada.

Within this vast land package, Torr has identified four undrilled copper-gold porphyry centers through geophysics, geochemistry, and mapping. The initial focus is the Bertha Target, where high-grade copper mineralization up to 16.9% copper occurs at surface adjacent to a 900-meter chargeability anomaly, followed by the Sonic Corridor, a 4.5 km² copper-gold soil anomaly with outcropping mineralization up to 1.1% copper and a large-scale alteration footprint.

Beyond Kolos, the company maintains two additional 100%-owned projects, providing regional diversification and exploration optionality:

Latham Copper-Gold Project, located in northern British Columbia, hosts the Gnat Pass copper-gold porphyry deposit along trend from the Red Chris and Saddle discoveries, together with three additional large-scale and undrilled Cu-Au centers defined by surface geochemistry and geophysics.

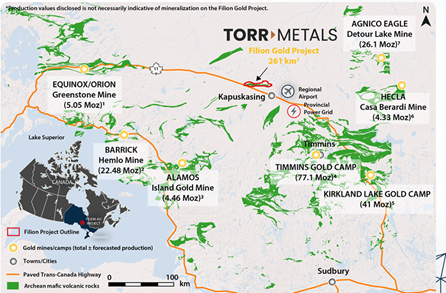

Filion Gold Project in Ontario's Abitibi Greenstone Belt, an orogenic gold system with historical high-grade samples and favorable structure near major regional breaks where the company has identified two significant undrilled geochemical and geophysical anomalies.

Together, these projects give Torr exposure to both copper and gold discovery opportunities across Canada, with Kolos leading the near-term news flow as the first drill program begins in Q4 2025.

Management

Malcolm Dorsey, M.Sc., P.Geo, President & CEO.

An exploration geologist with more than a decade of experience advancing copper-gold systems from early discovery through resource definition. Dorsey completed his master's degree thesis on the Quesnel Trough, giving him an exceptional understanding of the belt's complex geology and mineralization systems. That local expertise provides Torr with a strong technical edge as the company targets new porphyry centers within the same trend as Highland Valley and New Afton.

John Williamson, P.Geo, Chairman & Director.

A serial mining entrepreneur and founder of the Metals Group, Williamson has launched more than 20 public resource companies and raised over US$1 billion in equity. He has a long record of identifying early-stage opportunities, building strong technical teams, and turning ideas into discovery-driven companies. Many in the sector owe their start to his mentorship and commitment to responsible exploration — a contribution worth recognizing with deep gratitude.

Gordon Maxwell, P.Geo, Director.

With four decades at Noranda, Xstrata, and Glencore, Maxwell brings deep technical and operational experience from major mining companies, complemented by AME BC and PDAC awards for his contributions to the mining industry.

Taylor Niezen, CFO.

Finance and compliance specialist for TSX Venture issuers, ensuring Torr maintains lean but compliant capital operations.

Sean Mager, B.Comm, Director.

Senior mining executive with extensive experience in corporate strategy, operations, and capital markets.

This is a technically strong, market-savvy team with the right balance of geological depth, capital discipline, and entrepreneurial spirit to systematically advance a greenfield porphyry project.

Share Structure

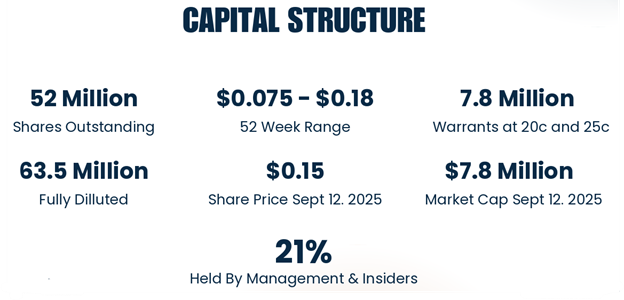

Torr Metals maintains a tight share structure, with only 52 million shares outstanding and approximately 63.5 million fully diluted. There are 7.8 million warrants exercisable at CA$0.20 and CA$0.25.

Insiders, including CEO Malcolm Dorsey and Chairman John Williamson, collectively own approximately 21% of the company, while the remainder is held by a concentrated group of about 30 high-net-worth investors.

At a recent trading range of CA$0.15–CA$0.16, Torr carries a market capitalization of roughly CA$8 million, a lean valuation for a 300+ km² land package in a Tier-1 copper belt. A CA$2.8 million financing, including CA$2.4 million in charity flow-through, is fully subscribed to fund up to 5,000 meters of drilling, starting with the Bertha target this fall.

Technical Analysis

Torr Metals reached its first target of CA$0.145 in early 2024 before the entire junior exploration sector was hit by a deep correction. As sentiment deteriorated across the TSX Venture, TMET pulled back in sympathy, retracing to its 0.618 Fibonacci corrective level — a zone that, in hindsight, marked the low of the move.

From that point, the shares began to build a constructive uptrend, establishing a sequence of higher lows that now define a rising trendline. Each rally has carried to the upper boundary of the back-price resistance zone near CA$0.165–CA$0.17, while volume has improved on advances and contracted during pullbacks, a healthy technical sign of accumulation.

The 50-day moving average has crossed above the 200-day, and momentum indicators such as the MACD and RSI have cycled through corrective phases without breaking down, reflecting sustained underlying strength.

The prior target at CA$0.145 was achieved and exceeded.

The next resistance zone lies near CA$0.24, representing the measured move from the current base.

The third target, based on the projected height of the base structure, remains CA$0.48, aligning with the upper range of the long-term recognition channel.

A decisive breakout through CA$0.17 with expanding volume would signal a "Point of Recognition," the phase where a new discovery or re-rating event attracts broader market attention. In that scenario, the stock could begin a multi-month advance toward the CA$0.24 and CA$0.48 objectives, with a big-picture potential toward the CA$0.60–CA$0.65 zone over time.

Support remains firm along the CA$0.13–CA$0.15 band, coinciding with the rising trendline and prior Fibonacci retracement area. A close below CA$0.12 would violate that structure and postpone the setup.

Technically, the chart reflects a textbook base and recovery pattern: a sharp corrective phase completed at 0.618 support, followed by higher lows, tightening price action, and an emerging uptrend, precisely the kind of structure that often precedes a significant move in well-positioned juniors entering a catalyst window.

Conclusion: Speculative Buy

Torr Metals combines all the ingredients speculators look for: a Tier-1 address, a tight share structure, insider alignment, and multiple undrilled copper-gold targets within a prolific belt.

With the inaugural drill program set to begin at Bertha in October 2025, results expected by early 2026, and ongoing groundwork at Sonic and Kirby/Lodi, Torr is entering a catalyst-rich phase that could redefine its valuation. Meanwhile, the Latham and Filion projects provide additional discovery leverage in other established mineral belts.

For those seeking exposure to a new copper discovery story in one of the safest and most productive mining regions in Canada, Torr Metals remains a Speculative Buy at the current price of CA$0.15 cents, with technical price objectives of CA$0.24, CA$0.48, and a longer-term big-picture target near CA$0.60–CA$0.65 on a confirmed discovery-driven breakout.

For more information, investors can visit www.torrmetals.com.

| Want to be the first to know about interesting Copper and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Torr Metals Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Torr Metals Inc.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.