Gold made a new record high today and many of our gold stocks, while silver will soon crack $50, but I would like to talk about copper and some of our copper stocks making strong moves.

You can see on the below chart that since the tariff related volatility, copper has been in a steady up trend.

One of the largest copper mines in the world will be shut down until next year. Copper's jump highlights how tight supply is in this market. Freeport-McMoRan Inc. (FCX:NYSE) last week declared force majeure at its Grasberg mine in Indonesia and said it is expecting consolidated sales to be lower for copper and gold in the third quarter, sending its shares down 10.4%.

Earlier this month, the company had temporarily halted mining at Grasberg after a large flow of wet material blocked access to parts of its underground mine, restricting evacuation routes for seven workers. There were two fatalities. The company said a phased restart and ramp-up of operations at Grasberg, may occur in the first half of 2026.

Meanwhile, our copper producer Capstone made new highs last week.

Capstone Copper

Recent Price - $11.55

Entry Price - $5.90

Opinion - Hold

Capstone Copper Mining Corp.'s (CS:TSX) Pinto Valley mine was awarded the Copper Mark in late August. It has the only operating mill in the prolific Globe-Miami mining district of Arizona. Receipt of The Copper Mark at this operation recognizes responsible mining practices in one of the oldest and most productive mining districts in the United States.

The Pinto Valley site is Capstone's third site globally to receive the award, following receipt of The Copper Mark at their Mantoverde and Mantos Blancos sites in Chile in 2023. The Copper Mark is the leading assurance framework for copper, created to demonstrate responsible production practices and the industry's contribution to the United Nations Sustainable Development Goals.

Capstone had record consolidated total copper production for Q2 2025 was 57,416 tonnes at cash costs of $2.45/lb. Total Q2 2025 copper sold of 53,977 payable tonnes was approximately 1,800 tonnes below payable production largely driven by timing of sales at Mantos Blancos. Record adjusted EBITDA of $215.6 million for Q2 2025 compared to $123.1 million for Q2 2024, primarily due to increased sulphide copper production and operating cash flow was about double compared to 2024

Analysts at National Bank believe the macroeconomic environment supports precious metal prices due to ongoing political uncertainty, declining real rates, persistent inflation and central banks continuing to be net purchasers.

And reported in The Globe, that the National Bank analysts continue to rate Capstone Copper "Outperform." The analysts gave their share target a $2.25 boost to $12. Analysts on average target the shares at $11.38. The stock has recovered from the tariff sell off and is breaking out to new highs today. We are up about 100%, but it is too early for profits.

Zonte Metals

Recent Price - $0.15

Entry Price - $0.09

Opinion – Buy

Zonte Metals Inc. (ZON:TSXV; EREPF:OTC) is another copper junior on the move, up about 200% in a month. I had the stock as a Strong Buy to $0.105 because that was technical resistance on the chart. It smashed through that last Thursday. I see the stock as still very cheap and a buy.

At $0.15 it has a market cap of about $12 million. It should be up around $25 to $30 million to be valued to similar copper juniors. That said, it has way more potential than those comparable s because Zonte has an IOCG copper district with 10 huge targets.

I believe the stock is undervalued because North American investors don't know much about IOCG systems. They are predominately in Australia and Chile. IOCG deposits are well known for their massive scale, often exceeding 100 million metric tons. The world's largest, and some have argued most valuable, single ore body is an IOCG deposit, BHP's Olympic Dam, located in South Australia.

Vale's (VALE:NYSE) low-cost IOCG Salobo and Sossego deposits are two of the biggest copper- producing deposits in Brazil. Chile's prolific Atacama IOCG Belt hosts such notable deposits as Lundin Mining Corp.'s (LUN:TSX; LUNMF:OTCMKTS) low-cost Candelaria open-pit mine, which has been in operation since 1993. Lundin paid Freeport-McMoRan US$1.8 billion for its 80 percent interest in Candelaria in 2014. The company has made a significant investment in exploration at Candelaria, extending the mine life from 14 years to over 20 years.

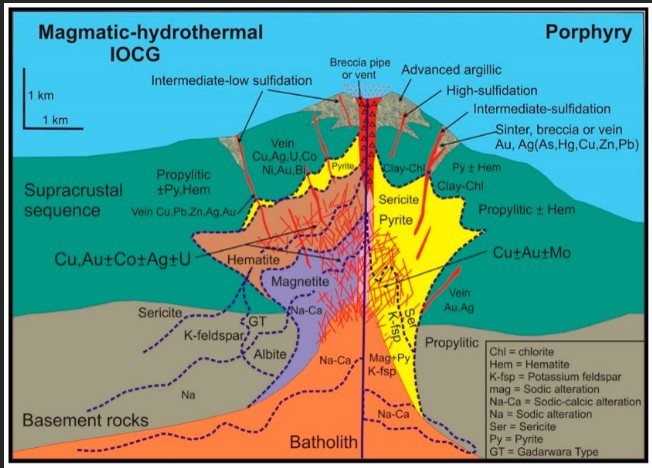

In the vast world of mineral deposits, few are as intriguing and economically significant as Iron Oxide Copper Gold (IOCG) deposits. Unlike other deposit types that follow a more predictable formation style, IOCGs are like nature's geological puzzles — complex, large, and often hiding vast resources of copper, gold, and other valuable elements.

IOCG systems can form large polymetallic mineral deposits with long mine life that are becoming the backbone of significant mining camps around the world. Canada is lagging behind in mineral exploration for IOCG deposits, but only because few know about Zonte Metals. As longer term shareholders can attest, Zonte's Cross Hills has been one of nature's geological puzzles.

I believe because there are no IOCG mines in North America, unless investors follow the senior companies listed above, they know nothing about the HUGE potential of IOCG deposits.

I found this graphic that compares an IOCG with Porphyry systems. Note the IOCG is quite different and larger. The signature here is over 2 km by 2 km similar to the sizes of Zonte's targets.

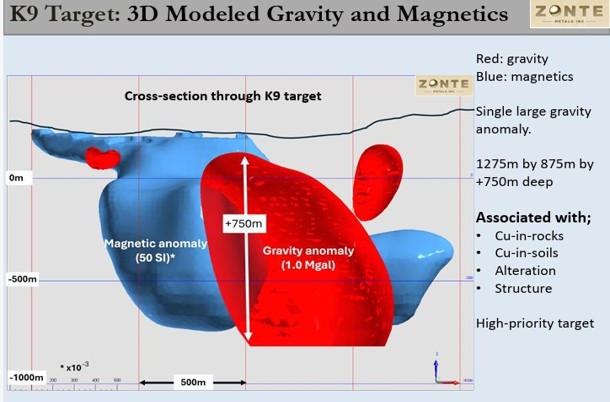

The major mining companies are interested in 500 million ton targets and higher. The reason the majors are talking with a small company like Zone is because Zonte's gravity anomalies at Cross Hills range in size from about 2.5 to 6 billion tonnes and are measuring very high on the gravity (g/cm3) scale.

Gravity anomalies are the main tool in finding IOCG deposits and important to highlight for some longer term shareholders, Zonte has just compiled this gravity data at Cross Hills in the past two years when junior explorers were being ignored so the big potential is relatively new data. Zonte has now identified 10 large targets. I think K9 is one of the better ones so will show that anomaly graphic.

Since the market turned and investors have been lifting the hood on some junior explorers the stock has recently been discovered by investors that have some clue about IOCGs.

I believe the stock will keep going higher until it is valued among the top of their peers. Since the market in general is moving higher, that could be a long way.

Looking at the chart, there could be some resistance in the $0.20s, so have that as the next target. However, should we get news of a large investment or JV with a major miner, the stock could fly right through my next target.

And I will add, the short position I talked about in my last update, I believe it was mostly covered a day or two after that update as there was unusually large buying from House Anomalous.

| Want to be the first to know about interesting Silver, Copper and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Ron Struthers: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.