Freeman Gold Corp. (FMAN:TSX; FMANF:OTCQB; 3WU:FSE) has released new assay results from the southern portion of its 2025 reverse circulation drill program at the Lemhi Gold Project in Idaho. The company reported high-grade gold mineralization in nine of thirteen holes, including 1.5 grams per tonne (g/t) gold over 22.9 meters and a higher-grade intercept of 2.6 g/t gold over 12.2 meters in drill hole FG25-013RC. According to the company, eight of the thirteen holes outperformed expectations based on its 2023 mineral resource estimate, either in thickness or grade.

The RC program consisted of approximately 2,860 meters across 30 holes, with the southern 13 holes focused on converting inferred resources to measured and indicated categories. These efforts are part of a broader strategy supporting a feasibility study currently underway. Freeman previously published a Preliminary Economic Assessment (PEA) for Lemhi in October 2023.

In a news release, CEO Bassam Moubarak stated, "These new batch of results bolsters the case for extending the Lemhi resource farther south, off the patented claims." He added that the company anticipates converting more ounces than initially expected based on the 2023 estimate.

The results will feed into an updated mineral resource estimate. Additionally, three core holes are currently being drilled in the southern area to follow up on the higher-grade results encountered in the RC program.

Drilling assays were analyzed at ALS Global Laboratories in Vancouver, an accredited facility, with Freeman Gold maintaining a quality assurance and quality control program that includes duplicate samples, blanks, and standards.

Gold at a Turning Point as Demand Outpaces Supply

Gold prices continued their strong performance in 2025, with a combination of economic uncertainty, tightening supply, and shifting investor sentiment contributing to the rally.

In a September 16 article for RiskHedge, Chris Reilly reported that gold had gained more than 40% year-to-date, pushing above US$3,700 per ounce. He noted that if current conditions persist, 2025 could mark gold's strongest annual performance since 1979. Reilly emphasized gold's independence from broader financial systems, stating that its value is not reliant on trade flows or economic growth. He characterized physical gold as a resilient long-term asset, resistant to digital disruption and institutional risk.

John Newell of John Newell & Associates issued a positive assessment of Freeman Gold Corp., assigning it a "Speculative Buy" rating.

He argued that traditional views dismissing gold as outdated are losing ground as monetary systems undergo structural stress. Piepenburg highlighted gold's reclassification as a Tier-1 asset by the Bank for International Settlements (BIS), a move that has reinforced its appeal as a store of value among central banks and institutional investors. He also pointed to growing concerns over long-term U.S. fiscal policy, which he said are prompting changes in global asset allocation strategies.

On September 18, Ahead of the Herd released a report examining persistent challenges on the supply side. While mine production reached a record 3,661.2 tonnes in 2024, global demand totaled 4,974.5 tonnes, requiring 1,370 tonnes of recycled gold to close the gap. The report described this trend as indicative of "peak gold," the point at which mined supply can no longer keep up with consumption. Despite efforts by producers to extract higher grades, the shortfall remains considerable.

The report also addressed a slowdown in major discoveries. According to S&P Global, only six large gold deposits have been identified since 2020, with average discovery size shrinking from 7.7 million ounces in the prior decade to 4.4 million ounces. Exploration budgets declined by 22% from 2023 to 2024, and greenfield exploration (early-stage search in new areas) accounted for just 19% of global exploration spending in 2024. Still, junior exploration companies reportedly raised more capital in early 2025 than in all of the previous year, signaling renewed investor interest in early-stage projects.

Analyst Sees Upside in Freeman's De-Risked Gold Project

*On September 23, John Newell of John Newell & Associates issued a positive assessment of Freeman Gold Corp., assigning it a "Speculative Buy" rating. According to Newell, Freeman Gold offered a "straightforward proposition: U.S. oxide gold ounces on patented land, fresh economics at today's gold price, and clear catalysts from expansion drilling and feasibility work." He highlighted the company's Lemhi Gold Project in Idaho as a shallow, oxide deposit situated largely on patented land, which he stated provides a permitting advantage compared to projects on federal land.

Newell referenced the company's October 2023 Preliminary Economic Assessment (PEA), which was updated in August 2025 to reflect a higher gold price environment and current cost structure. The revised case at US$2,200 per ounce gold showed an after-tax net present value at a 5% discount rate (NPV5) of approximately US$453 million and an internal rate of return (IRR) of 33.2%. At a gold price of US$2,900 per ounce, the NPV5 rose to roughly US$648 million with an IRR of 45.9%. He noted that the project's process route involves conventional milling with high recoveries, and that most of the defined mineralization is shallow, flat-lying oxide material.

From a technical perspective, Newell stated that Freeman Gold's stock had broken out of a long downtrend, forming a base in late 2024 with "a clear series of higher lows" and a "constructive uptrend." He added that recent price movements above CA$0.18 to CA$0.20 marked a shift in sentiment, with higher-than-average volume suggesting institutional or strategic interest. Momentum indicators, including the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), were also described as supportive of further price gains.

Newell pointed to multiple potential upside targets based on historical resistance levels, including CA$0.26, CA$0.40, and CA$0.90, with a longer-term technical projection of CA$1.30. He concluded that Freeman Gold appeared to be transitioning out of a prolonged bearish phase into a new stage of accumulation and growth. At a closing price of CA$0.17 on September 23, 2025, he reiterated his "Speculative Buy" rating, citing both the de-risked project fundamentals and the company's active exploration and development strategy.

Positioned for Expansion in a Top Jurisdiction

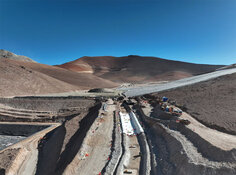

Freeman's Lemhi Gold Project is located in Idaho, a jurisdiction with a favorable permitting environment. Over 90% of known mineralization lies within patented claims, providing advantages for development. According to the company's investor materials, Lemhi contains a defined, high-grade, oxide, near-surface gold deposit with a 2023 NI 43-101 compliant mineral resource estimate of 988,100 ounces gold at 1.00 g/t in the measured and indicated category and an additional 234,700 ounces at 1.01 g/t in the inferred category.

The project's 2023 PEA showed an after-tax net present value (NPV) of US$212.4 million and an internal rate of return (IRR) of 22.8% at a base case gold price of US$1,750 per ounce. At a gold price of US$2,050 per ounce, the after-tax NPV increased to US$349 million with an IRR of 32.1%. Life-of-mine cash costs were estimated at US$812 per ounce with all-in sustaining costs of US$960 per ounce.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Freeman Gold Corp. (FMAN:TSX; FMANF:OTCQB; 3WU:FSE)

Freeman reports average annual gold production of 80,390 ounces in the first eight years of a projected mine life, with total life-of-mine output of 854,090 payable ounces. The company's resource expansion strategy includes following up on historical drilling that largely used reverse circulation methods, with some holes ending in mineralization. Additional brownfields targets identified through past exploration remain untested.

The Lemhi Project continues to be advanced through feasibility-stage work, supported by previously completed studies, permitting progress, and metallurgical testing that indicates suitability for heap leach processing.

Ownership & Share Structure

According to Refinitiv, 20.72% of Freeman Gold is held by management and insiders, with Michael Parker holding 10.30%, Bassam Moubarak holding 2.63%, and Paul Francis Matysek holding 2.41%. Strategic entities hold 4.61%. The rest is retail.

The company has 229.22 million free float shares, a market capitalization of CA$41.1 million, and a 52-week range of CA$0.07 to CA$0.23.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

1) James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

2) This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

* Disclosure for the quote from the John Newell article published on September 23, 2025

- For the quoted article (published on September 23, 2025), the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.