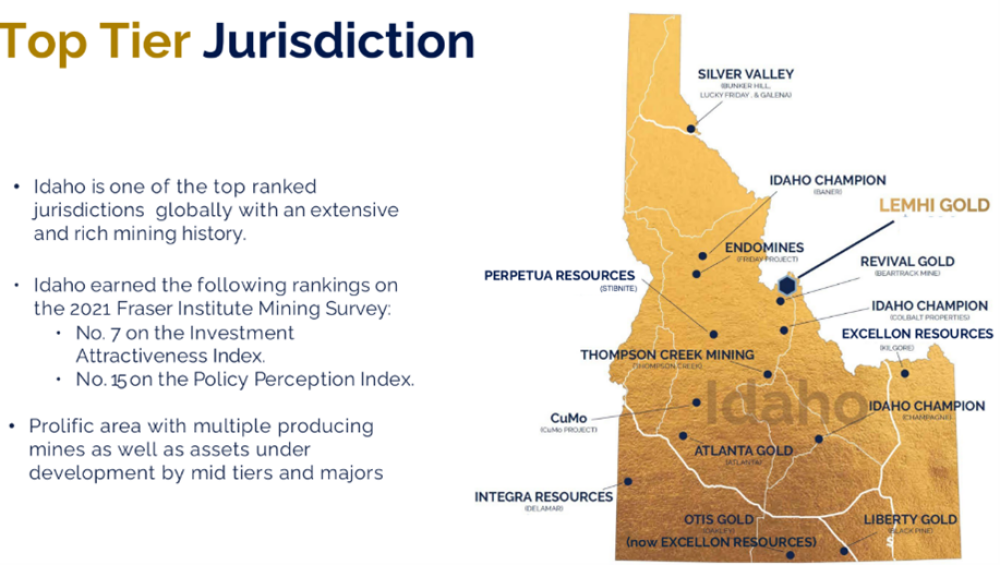

Freeman Gold Corp. (FMAN:TSX; FMANF:OTCQB; 3WU:FSE) is advancing the 100%-owned Lemhi (Lemhi/Lemhi County) Gold Project in Idaho, a Tier-1 U.S. jurisdiction.

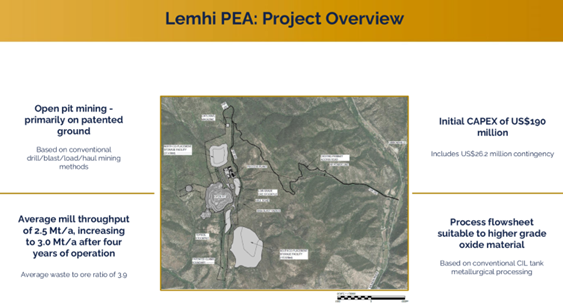

The deposit sits largely on privately owned, patented ground with shallow, flat-lying oxide mineralization and positive metallurgy — characteristics that can shorten timelines and simplify permitting versus projects on federal land.

Freeman is moving toward the formal permitting process and a bankable Feasibility Study targeted for Q1 2026.

What's already defined: an NI 43-101 resource of 998,100 oz Au Measured & Indicated at ~1.00 g/t and 234,700 oz Au Inferred at ~1.01 g/t, based on ~36,900 m of drilling (historic + modern). (Company guidance: an updated MRE is planned for this Fall.)

What the mine could look like: the October 2023 Preliminary Economic Assessment (PEA), updated in August 2025 for higher gold prices and current costs, contemplates an open-pit, conventional mill operation producing ~76,000 oz Au per year over 11.2 years (852 koz LOM), with ~96.7% recoveries. At US$2,200/oz Au, the updated case shows an after-tax NPV5 of ~US$453M and 33.2% IRR; at US$2,900/oz Au, the sensitivity table implies ~US$648M NPV5 and ~45.9% IRR.

A parallel exploration track continues to test step-outs, depth extensions, and satellite targets (e.g., the Beauty Zone, ~600 m west of Lemhi).

Why Now?

- De-risked starting point: shallow oxide ounces on patented land, positive met, and a PEA that was re-benchmarked for today's gold price/costs, not a dated study.

- Leverage to gold: the updated economics show materially higher value and returns at prevailing gold prices.

- Scalability: multiple open targets (along strike and at depth) plus nearby satellite zones provide room to grow toward a 1.5–2.0 Moz development case if drilling cooperates.

Management

- Executive Chairman Paul Matysek: serial company builder with multiple +$100M exits across gold and energy metals. He joined in a hands-on role to fast-track Lemhi.

- Chief Executive Officer Bassam Moubarak: capital markets and M&A specialist (CFO/finance roles on several mine development exits), now CEO and corporate secretary.

- Team focus: accelerate feasibility work and targeted drilling to expand and upgrade ounces while keeping capital efficiency front and center.

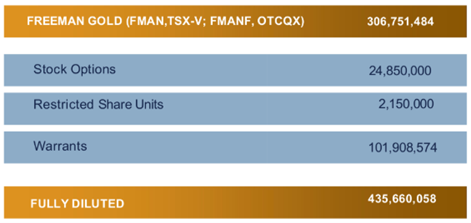

Share Structure & Market Capitalization

- Shares outstanding (basic): ~306 M

- Fully diluted: ~435.66M

- Market capitalization: ~CA$47.8–49.1M (recent figures provided)

- Recent financing: ~CA$10.5M closed, funding operations through the Feasibility Study.

- 52-week range: CA$0.065–0.21

The Project

- Jurisdiction: Idaho ranks near the top globally on multiple mining attractiveness surveys; Lemhi's patented-land footprint is a meaningful advantage for permitting.

- Resource base: ~1.233 Moz Au across Measured and Inferred, with room to grow; mineralization is near surface and largely oxide.

- Process route: conventional milling with high recoveries (PEA basis).

- Growth shots: step-outs east/west, deeper holes beneath the current pit shell, and the Beauty Zone (rock/soil anomaly and high-grade samples) within trucking distance.

- Economics that scale with gold: updated PEA demonstrates strong torque to spot-like prices (NPV/IRR improve materially from the 2023 base case).

Technical Analysis

Price Structure

Freeman Gold has emerged from a prolonged downtrend that extended through 2023 and most of 2024. Since late 2024, the stock has carved out a base with a clear series of higher lows, establishing a constructive uptrend. This type of structural turnaround is often seen in juniors when selling pressure has been fully exhausted, paving the way for accumulation.

The recent move above CA$0.18–CA$0.20 marks a shift in sentiment, with the chart suggesting entry into a new bullish leg. The breakout is supported by higher-than-average volume, a hallmark of institutional or strategic buying interest.

Moving Averages

The 50-day moving average has turned sharply upward and now sits above the 200-day moving average, confirming a bullish alignment.

Price is consolidating above both moving averages, with the 50-day providing near-term support around CA$0.17–CA$0.18.

The 200-day at ~CA$0.13 remains a critical longer-term support zone.

Volume & Accumulation

Volume has expanded materially since mid-2025, with accumulation days far outweighing distribution days. This confirms the stock is attracting attention after an extended dormant period.

Sustained higher trading activity supports the view that a point of recognition (POR) is underway, where the market begins to assign value to the story.

Momentum Indicators

RSI is trending around 60, comfortably below overbought levels, leaving room for additional upside.

MACD remains positive, consistent with the ongoing uptrend, though slightly flattening, suggesting a short pause before the next leg higher.

Price Targets

- First Target: $0.26 – first breakout resistance level.

- Second Target: $0.40 – mid-2022 resistance zone.

- Third Target: $0.90 – long-term congestion area.

- Big Picture Target: $1.30 from measured move of multi-year base pattern.

Risk Levels

- CA$0.17 – near-term support at rising trendline and 50-day MA.

- CA$0.13 – 200-day MA and longer-term support base.

A sustained breakdown below CA$0.13 would negate the emerging bullish pattern and delay the upside scenario.

Freeman Gold is showing the classic characteristics of a junior miner transitioning out of a long bear phase into early-stage accumulation and breakout. With higher lows, volume expansion, and a positive moving-average setup, the chart suggests further upside potential.

A decisive close above CA$0.20 strengthens the bullish case, with CA$0.26 as the near-term target and room to extend toward CA$0.40 and beyond. For speculative investors, the current setup offers attractive leverage to both the company's fundamental catalysts and broader sector sentiment.

Bottom Line

Freeman Gold offers a straightforward proposition: U.S. oxide gold ounces on patented land, fresh economics at today's gold price, and clear catalysts from expansion drilling and feasibility work.

Add a team with a record of building and monetizing assets, and you have a junior with both de-risked foundations and upside potential. At the current price of CA$0.17 on September 23, 2025, I rate Freeman Gold as a Speculative Buy.

For more information, start with the company site here.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.