Good day, fellow investors, it is very bright in our corner of the universe. I have not done as many mid-day reports because things are moving fast and busy on the precious metals front. We can't complain, as we are definitely headed for a year of triple digit average gains on the 56 stocks in the Selection List. I don't know if I will beat my record of 2009. That year 93 stocks on our list had a 154.9% gain and that was also recovering from the 2008 crash. This year we are not recovering from a crash but a way over sold position with precious metal stocks.

Currently our 19 gold and silver producers are up +124% YTD. Our 9 Advanced Juniors are up on average +160% YTD. Now our junior explorers are starting to move up +37%.

It is just a matter of how much our energy stocks drag down the average. They are down around -20% at this point. That said, there is a lot of value in holding these and better days are ahead. I just want to remind everyone that these are averages. Our precious metals stocks are up 124% on average so statistically, 1/2 of you are doing better than this and 1/2 not as well.

Gold Rocking

Morgan Stanley's Chief Investment Officer Mike Wilson has shifted attention away from the traditional 60/40 portfolio. In a recent discussion, he advocated a 60/20/20 mix between equities, bonds, and gold.

As Reuters reported on September 16, Wilson "suggested investors rethink the classic 60% stocks and 40% bonds allocation and instead diversify more broadly to include a 20% gold weighting."

Analysts at Goldman Sachs have also emphasized that the old and true 60/40 portfolio is dead. Gold now plays the neutral collateral trusted when bankers are not. In their eyes, this is the first shot across the bow for global money managers to take heed and start allocating some funds into Gold. Some of these bankers are talking about a 60/20/20 portfolio with gold equal to bonds.

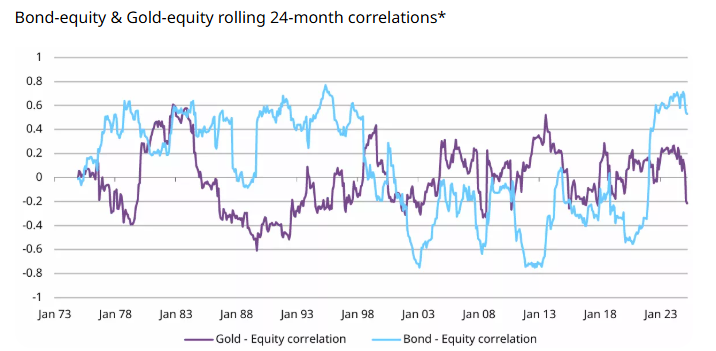

The above chart is from the World Gold Council. You can see that the Bong to Equity correlation has flipped in the last few years, verifying a period more like the 1970s/80s and early 1990s. I think a higher gold weighting is what really is required and goes back to the days of the last stagflation period in the 1970/89s. Then investment funds had an average weighting of over 6% in gold, and now it would be lucky to be 1.5% but is probably increasing.

Some reluctant gold investors will tell you gold has already had a big move, but not so in the longer-term lenses. Gold is up +45% YTD, but let's look at the last two major gold bull markets. There have been two major bull markets in gold, and I have no doubt that this is the third one. The percentage gain on this chart is not precise, as it depends on where you actually peg the start of the bull market and the top, but it is accurate enough for illustrative purposes.

The recent bull market that got started in 2024 looks like it is headed straight up like a rocket, but this is because we are using a chart that starts around $100. The point is, the last two major bull markets ran up about +400%, so far this one is only up +75%. This is why you constantly hear me saying that this bull market has just started, and it is early days. If this bull market runs 400%, gold is headed to $8,500. However, as I pointed out on previous charts, $4,000 is the short-term magnet.

Some Update on our stocks. . .

First Tellurium

Recent Price - $0.22

Entry Price - $0.35

Opinion – Sell

First Tellurium Corp. (FTEL:CSE; FSTTF:OTCQB) is an old junior explorer on our list that we held through the downturn. It is a play on gold and tellurium, and the stock recently spiked on news based on their tellurium-based thermoelectric generator technology.

News last week was about the completed testing of their thermoelectric modules that can extend the range of high payload drones powered by combustion engines.

The modules, which attach to the engine exhaust manifolds, use heat differentials to charge the batteries that power all the drone's on-board electronics.

The stock has been very volatile in years gone by on various news items, but nothing concrete ever seems to come of it. I suggest we use the recent price spike to sell if you still hold any of this.

It is now up +92% YTD.

Midnight Sun Mining

Recent Price - $1.41

Entry Price - $0.27

Opinion – Hold

Midnight Sun Mining Corp. (MMA:TSX.V; MDNGF:OTCQB) has been our best performing copper junior and has seen a strong move in August and September, propelling our 422% gain. Today, MMA moved a third diamond drill rig to its flagship Dumbwa target, a key component of the company's Solwezi project, located in the Domes region of Zambia.

The most recent drilling tender has been awarded to Chibuli Investments Ltd., a local drilling contractor based in Ndola, Zambia. Under the terms of the contract, a minimum of 6,000 meters of core drilling will be completed with the newly added rig. This initial phase of drilling is focused on the southern 11.5 kilometers of the approximately 20-kilometer Dumbwa target.

"The addition of a third rig allows us to fast-track our exploration efforts at Dumbwa," stated Midnight Sun chief executive officer Al Fabbro. "This is an incredibly exciting phase for the company, as we work to build upon our new geological model of the mineralization at Dumbwa. Our intensified drilling campaign reflects our structured approach and strong commitment to aggressive, but systematic, exploration. With drilling continuing to ramp up, we anticipate a consistent stream of results in the coming months."

We are sitting on huge gains, but just a bit early for profits. I am looking at taking first profits around $1.80 or when drill results are announced, whichever comes first.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Midnight Sun Mining.

- Ron Struthers: I, or members of my immediate household or family, own securities of: Midnight Sun Mining. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.