Regency Silver Corp. (RSMX:TSXV; RSMXF:OTCQB) announced that it has engaged Bylsa Drilling of Hermosillo for its upcoming drilling campaign.

In a release, the company said Bylsa successfully completed Regency’s other recent drilling programs.

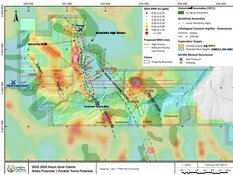

The drill has been inspected and is set to arrive on site by September 25. The necessary drill permit has been secured, and the drill pads are ready. The company plans to drill approximately 4,500 meters across six to eight holes in this program. The focus will be on exploring along-strike extensions of high-grade mineralization previously encountered at the Dios Padre project, including:

- 38 meters of 7.36 grams per tonne gold (g/t Au) in hole REG 23-21

- 36 meters of 6.84 g/t Au, 0.88% copper (Cu), and 21.8 g/t silver (Ag) in hole REG 22-01

- 29.4 meters of 6.32 g/t Au in hole REG 23-14

“We are excited to get back drilling to target the expansion of the significant high sulfidation Au-Cu-Ag discovery at Dios Padre,” Chairman and Chief Executive Officer Bruce Bragagnolo said.

Regency's main focus is the Dios Padre project in Sonora, Mexico, where recent drilling has significantly expanded the zone rich in gold, copper, and silver. Additionally, Regency has announced high-grade silver findings from drilling at the historic Dios Padre silver mine, including hole FMR 12-06 with 32.5 meters at 408 g/t Ag (with 1.9 meters at 3220 g/t Ag), hole FMR 15-06 with 28.8 meters at 467.8 g/t Ag, hole RDP 18-12 with 12.4 meters at 558 g/t Ag, and hole FMR 17-06 with 5.2 meters at 1145 g/t Ag.

Earlier this month, the company successfully closed its previously announced and oversubscribed brokered private placement. The offering involved the sale of 40,000,000 units, including the full exercise of the over-allotment option, at CA$0.10 per unit, raising total gross proceeds of CA$4 million.

Regency indicated that the net proceeds will be used to initiate drilling at Dios Padre this month, with results anticipated in January, and for general corporate purposes.

Some company insiders participated in the offering, purchasing a total of 3.62 million units under the same terms as other investors.

"Despite the lift in the gold price and silver, the market has really been rotten for explorers," Bragagnolo said at the time. "Until about May, and then there was a shift to a more positive sentiment, and I think it was gold passing US$3,500 for the first time that really got the move going. Now it looks like the market's picking up, although the junior explorers really haven't got a major lift yet. … It looks like our drill program is kicking off into a positive market. That's the plan: Just keep drilling."

Highway Access, Infrastructure Nearby

The site enjoys excellent infrastructure, including access to a major highway, small aircraft facilities, power, and a skilled workforce, the company said.

It's also situated in a prime location. Pan American Silver Corp.'s (PAAS:TSX; PAAS:NASDAQ) Dolores open-pit mine, located 80 kilometers away, has been operational since 2009. In 2022, it produced 2.24 million ounces of silver and 136,000 ounces of gold. The proven and probable reserves for 2022 were 21 million tonnes, containing 11 million ounces Moz Ag at 19 g/t and 318,000 ounces Au at 0.58 g/t, according to Pan American. Alamos Gold Inc.'s (AGI:TSX; AGI:NYSE) Mulatos mine, 40 kilometers away, includes both open-pit and underground operations and has produced over 2.3 Moz of gold. In 2022, it yielded 135,000 ounces of gold, as reported by Alamos. Agnico Eagle Mines Ltd.'s (AEM:TSX; AEM:NYSE) La India open-pit mine, 45 kilometers from the site, produced 75,000 ounces of gold and 429,000 ounces of silver in 2022, according to Agnico Eagle. Its Pinos Altos mine, which features both open-pit and underground operations and is located 75 kilometers from Dios Padre, reported 2022 production of 99,500 ounces of gold and 1 million ounces of silver.

According to the company's investor presentation, Bragagnolo has a strong track record of enhancing shareholder value in Mexico, backed by two decades of business activities in the region. He co-founded and previously served as CEO for both Timmins Gold Corp. and Silvermex Resources Ltd. Under his leadership, Timmins Gold went public in 2006, reached commercial production by 2010, and secured a listing on the NYSE-MKT in 2011, as noted by Regency. During his tenure, Timmins Gold successfully built the San Francisco Mine in Sonora, Mexico, adhering to both schedule and budget.

Dios Padre is a historical mining site located in Sonora, Mexico, roughly midway between Hermosillo, Sonora, and Chihuahua City, Chihuahua. With a 400-year legacy of silver extraction, Dios Padre holds significant historical importance.

Regency Silver has obtained a National Instrument 43-101 resource estimate for the project, effective as of March 2, 2023, indicating an inferred resource of 11.375 million ounces (Moz) silver equivalent (Ag Eq), based on 1.384 million tonnes (Mt) at 255.64 g/t Ag Eq.

'A Compelling Exploration Play'

*John Newell of Newell & Associates noted on September 10 that the company focuses on new discoveries to accelerate the investment cycle for shareholders, "capturing the value spike seen at the discovery stage rather than waiting years for production."

He described Dios Padre as a high sulfidation/porphyry mineralized system with significant potential. Located along the same mineral belt as some of Mexico's most productive gold and silver mines, Dios Padre is near producing headframes operated by major companies, supporting the idea that "the best place to find a new mine is near an old one."

"If building a mine proves the best way to deliver value, management has the experience and track record to finance and construct one, but the focus today is firmly on discovery, where the potential for outsized returns is strongest," Newell wrote.

The company's chart shows a prolonged decline during the challenging bear market that junior explorers faced over the past decade until a dramatic turnaround. The shares have been building a base through 2024–2025, followed by a surge on increasing volume as the price broke through a flat base, Newell noted.

Momentum has shifted from oversold, and the MACD has turned upward. Newell set the following price targets: first target, CA$0.45; second target, CA$0.65; third target, CA$0.95; and Big-Picture Target, CA$2.20.

"Regency Silver offers a discovery story with clear catalysts: high-grade intercepts in a growing breccia body, a historic silver resource beside existing workings, and a management team that has built mines and created value in Mexico before," the expert wrote. "The system remains open, and continued drilling has the potential to significantly expand the scale of the project. With experienced leadership advancing a gold-silver discovery during a historic precious metals bull market, Regency Silver stands out as a compelling exploration play. For these reasons, we view the company as a Speculative Buy at the current price of CA$0.14."

The Catalyst: Traders Closely Monitoring Metal's Pivots

Silver steadied on Thursday following a sharp decline earlier in the week, with spot prices attempting to recover from a US$41.14 low, FX Empire's James Hyerczyk noted on September 18.

Traders closely monitored the US$41.68 pivot as the market consolidated recent losses after the Federal Reserve's 25-basis-point rate cut. The outlook remains positive, provided key support levels hold, and broader macroeconomic factors favor silver.

The Federal Reserve's rate cut, lowering its benchmark rate to 4.00%–4.25%, was widely anticipated and marks the beginning of an easing cycle. However, Chair Jerome Powell refrained from offering forward guidance, stating that policy decisions will be made "meeting by meeting."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Regency Silver Corp. (RSMX:TSXV; RSMXF:OTCQB)

Despite the cautious tone, the market anticipates further action. CME's FedWatch tool indicates a 90% probability of another 25-basis-point cut in October. Easing monetary policy generally supports non-yielding assets like silver, particularly early in the cycle when real rates begin to decline.

Silver is currently standing out as a leading commodity, experiencing a resurgence in investor interest and robust fundamentals that have pushed its prices to the highest levels in 14 years, according to a Mining.com report from July 31.

Some analysts suggest that this upward trend is just beginning, making silver an attractive investment option, as highlighted in the report. On the supply side, HSBC expects silver mine production to grow gradually, with their supply-demand model forecasting a silver shortfall of 206 Moz in 2025 and 126 Moz in 2026, compared to a 167 Moz deficit in 2024. HSBC also pointed out that a weaker dollar this year is beneficial for silver, while ongoing discussions about Federal Reserve rate cuts and central bank strategies could influence future prices.

Ownership and Share Structure

According to the company, about 7% is owned by insiders and management and a strategic investment group from London owns nearly 6%. The rest is retail.

Some top shareholders include Bragagnolo with 8.13%, Director Michael Thomson with 2.09%, Director and Head Geologist Michael Tucker with 0.94%, and Director Patrick Elliott with 0.09%, Refinitiv reported.

Its market cap is CA$11.8 million with 56.04 million shares outstanding. It trades in a 52-week range of CA$0.32 and CA$0.09.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Regency Silver Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000. In addition, Regency Silver Corp. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Pan American Silver Corp. and Agnico Eagle Mines Ltd.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

* Disclosure for the quote from the John Newell article published on September 10, 2025

- For the quoted article (published on September 10, 2025), the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- Author Certification and Compensation: John Newell of John Newell and Associates was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.