Golden Cariboo Resources Ltd. (GCC:CSE; GCCFF:OTC; A402CQ:WKN; 3TZ:FSE) announced details of its upcoming 2025 fall-winter drilling campaign, which aims to extend the combined strike length of the Halo/Main zones at its Quesnelle Gold Quartz Mine property from nearly 600 meters to 2 kilometers.

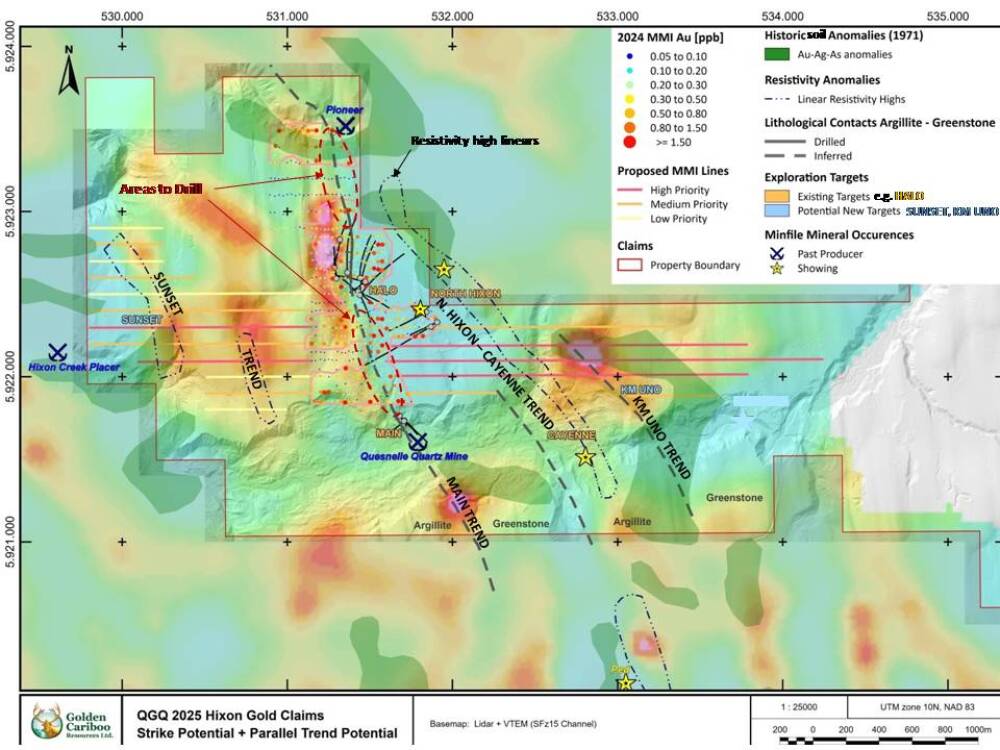

The company's existing permit allows for drill testing of the newly discovered Km Uno zone, the parallel North Hixon zone to the Cayenne trend, and the Sunset trend targets, Golden Cariboo said in a release.

"These targets are supported by significant drill results and a resistivity high anomaly from the North Hixon zone, a resistivity high anomaly at the Sunset, and promising initial rock geochemistry from the Km Uno zone," the release noted. "The four trends collectively span approximately 8 kilometers of prospective exploration potential, comparable to the Halo zone."

Vancouver-based Golden Cariboo is reigniting the Cariboo Gold Rush through targeted drilling and trenching efforts at the Quesnelle project. Quesnelle spans 94,899 hectares and is strategically located along a favorable corridor near the Spanish and Eureka thrust faults, adjacent to giants like Osisko Development Corp. (ODV:TSX.V).

Historically, over 101 placer gold creeks on the 90-kilometer trend from the Cariboo Hudson mine north to the Quesnelle property have recorded production, and successful placer mining persists in the area today.

"We're in elephant country and we may have another elephant," Golden Cariboo Chief Executive Officer Frank Callaghan told Streetwise Reports.

Km Uno Discovery

The campaign will include 15 drill holes to delineate the Halo zone’s extension along the black argillite-greenstone contact, targeting the Pioneer Minfile occurrence to the north-northwest and the Main zone to the south-southeast, the company said. This involves eight northerly step-out holes at roughly 100-meter intervals and nine southerly step-out holes at approximately 150-meter intervals.

Earlier this month, Golden Cariboo announced the discovery of Km Uno, a mineralized structure running parallel to the gold-silver bearing Halo zone discovered in 2024 at Quesnelle.

The company also provided an update on exploration activities at the site, located 4 kilometers from Hixon, British Columbia.

The Km Uno zone is a significant parallel mineralized trend situated about 2 kilometers southeast of the 2024 Halo zone discovery, with the Sunset trend located 1.4 kilometers to the west, effectively placing the Halo zone in the center. This arrangement of parallel structures — Km Uno, Halo, and Sunset — aligns with historical soil anomalies, resistivity highs, and geochemical indicators, suggesting a cohesive, district-scale gold system, according to Golden Cariboo.

Notably, these trends show a strong correlation with the argillite-greenstone lithological contact evident in the property’s geological mapping. This contact is a key feature that controls mineralization and is reminiscent of the geological controls observed in major gold-producing districts across the Abitibi Greenstone Belt from Val d’Or to Timmins, where such contacts have been crucial in defining extensive, high-grade deposits.

"The assay results from the Km Uno zone, a structure parallel to our 2024 Halo zone discovery, mark a major milestone for the Quesnelle Gold Quartz Mine property," Callaghan said at the time. "These findings confirm our geological model and highlight the potential for multiple mineralized zones across the property."

The Km Uno zone, identified through focused bedrock mapping and sampling, has produced initial results of up to 1.1 grams per tonne gold (g/t Au) and 8 g/t silver (Ag) from mineralized volcanic subcrops, the company said. These findings correlate with strong gold-silver-arsenic soil anomalies and geophysical features visible on the property's 2024 gold MMI soil map.

To help pay for the exploration program, Golden Cariboo also announced a non-brokered private placement of up to 30 million units priced at CA$0.05 per unit to raise up to CA$1.5 million. Each Unit will consist of one common share and one share purchase warrant, with each warrant exercisable for five years from the closing date at CA$0.075 in year one, CA$0.10 in year two, CA$0.15 in year three, CA$0.20 in year four, and CA$0.25 in year five.

Juniors Gaining Traction in Gold Bull Market?

According to Brien Lundin of The Gold Newsletter on June 16, junior miners like Golden Cariboo Resources are starting to gain traction in the current gold bull market. Although gold prices have reached record levels, junior miners had remained at long-term lows until recently.

"We've waited a long time in this new gold bull market for the excitement to trickle down to the junior mining sector," Lundin wrote. "Well, wait no longer. . . because it's happening now."

In a September 2024 research report, Couloir Capital Senior Mining Analyst Ron Wortel highlighted the intriguing aspects of Golden Cariboo's story. He noted that Quesnelle's location in the Cariboo Camp is similar to that of Barkerville, a historic hardrock gold mine. The Cariboo Camp features gold along its mining trends for over 175 kilometers, extending about 75 kilometers north of Wells–Barkerville. Despite its potential, the Cariboo region remains relatively underexplored.

"Some compare the camp with its several parallel trends and structures and length to the Abitibi Gold Camp of Ontario and Quebec," Wortel wrote. "We believe that Golden Cariboo's projects are well located to be part of this opportunity to fully explore the region and find more big gold deposits."

Wortel also pointed out that drilling at Quesnelle has revealed potential for bulk tonnage targets, and visible gold suggests the possibility of high-grade results from mineralized targets. He emphasized the expertise and experience of the team advancing Quesnelle.

"When investing in the highly risky junior mining market, many look to follow well-known names with a track record of success," the analyst wrote. "One may be able to add Frank Callaghan to this list for his success in the Cariboo Camp, and he is starting again where he found his mine." The analyst had a Buy rating on Golden Cariboo, with a price target suggesting a 471% return.

The Catalyst: Gold Hits New High

Gold prices are currently experiencing a significant surge, increasing 41.8% for the year and rising US$1,600 since 2023, Brian O'Connell wrote for the website Quartz on September 16. Furthermore, Goldman Sachs suggests that gold prices could climb to US$5,000 if investors move away from traditional safe-haven assets like U.S. Treasury bonds, especially if the economy leans toward a recession.

In such a scenario, investors tend to favor tangible assets like gold over the U.S. dollar. "The price target for gold for 2025 (end) is around US$3,750 if the interest rate is reduced," Jose Gomez, co-founder at Salt Lake City-based Summit Metals, told O'Connell. "The current price already reflects an interest rate reduction; however, if all things stay equal US$3,750 is possible."

According to Reuters on September 17, gold slipped on Wednesday as investors locked in profits after prices scaled the US$3,700-mark in the previous session, with the spotlight now on the Federal Reserve's looming policy verdict Wednesday.

Spot gold was down 0.1% at US$3,685.39 per ounce, as of 10:49 am ET, after hitting a record high of US$3,702.95 on Tuesday, the wire service reported.

Unlike previous crises, the current demand is being driven by policy uncertainty in Washington, concerns about the U.S. dollar, and geopolitical instability, wrote Rob Williams for Seeking Alpha on September 15. President Trump's trade realignments and ongoing tensions with the Federal Reserve have unsettled markets, while conflicts in Ukraine and other regions continue to fuel volatility.

Investors, ranging from retirees to hedge funds, are increasingly turning to gold.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Golden Cariboo Resources Ltd. (GCC:CSE; GCCFF:OTC; A0RLEP:WKN;3TZ:FSE)

"Strangeness seems to be the new norm," Nevada retiree Kenneth Pack, who moved part of his portfolio into gold this spring, told the Wall Street Journal, according to Williams' report.

Vault operators in London are also experiencing a surge of wealthy clients seeking secure storage, with IBV International Vaults planning to double its safe-deposit capacity, he reported.

Ownership and Share Structure

According to the company, three insiders own 9.7% of Golden Cariboo. They are president and CEO Frank Callaghan, the largest shareholder overall, with 8.9%, Elaine Callaghan, Andrew Rees and Laurence Smoliak.

The rest is in retail. There are no institutional investors at this time.

The Canadian explorer has 87.89 million outstanding shares, and 87.89 million free float traded shares. Its market cap is CA$5.27 million. Its 52-week range is CA$0.04–CA$0.24 per share.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Golden Cariboo Resources Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000. In addition, Golden Cariboo Resources Ltd. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Golden Cariboo Resources Ltd. and Osisko Development Corp.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.