Golden Cariboo Resources Ltd. (GCC:CSE; GCCFF:OTC; A402CQ:WKN; 3TZ:FSE) announced the discovery of the Km Uno zone, a mineralized structure running parallel to the gold-silver bearing Halo zone discovery made in 2024 at its Quesnelle Gold Quartz Mine property.

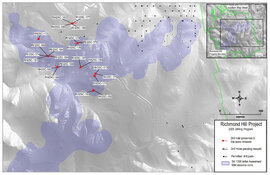

Additionally, the company has provided an update on exploration activities at the property, located 4 kilometers from Hixon, British Columbia. The Km Uno zone represents a significant parallel mineralized trend situated roughly 2 kilometers southeast of the 2024 Halo zone discovery, with the Sunset trend located 1.4 kilometers to the west, effectively positioning the Halo zone in the center.

This arrangement of parallel structures — Km Uno, Halo, and Sunset — aligns with historical soil anomalies, resistivity highs, and geochemical indicators, indicating a cohesive, district-scale gold system, Golden Cariboo said.

Notably, the trends show a strong correlation with the argillite-greenstone lithological contact evident in the property’s geological mapping, the company said. This contact is a key feature that controls mineralization and is reminiscent of the geological controls observed in major gold-producing districts across the Abitibi Greenstone Belt from Val d’Or to Timmins, where such contacts have been crucial in defining extensive, high-grade deposits.

"The assay results from the Km Uno zone, a structure parallel to our 2024 Halo zone discovery, mark a major milestone for the Quesnelle Gold Quartz Mine property," said Golden Cariboo President Frank Callaghan. "These findings confirm our geological model and highlight the potential for multiple mineralized zones across the property."

Callaghan continued, "With the confirmed gold-silver discovery at Km Uno and the Halo zone’s 390-meter strike length open for expansion, we're excited to continue exploring these promising gold systems."

The KM Uno zone, identified through focused bedrock mapping and sampling, has produced initial results of up to 1.1 grams per tonne gold (g/t Au) and 8.0 g/t silver (Ag) from mineralized volcanic subcrop. These findings correlate with strong gold-silver-arsenic soil anomalies and geophysical features visible on the property's 2024 gold MMI soil map.

Similarly, the Sunset trend shows promising signs of mineralization, with potential extensions toward historical producers like the Hixon Creek Placer. With the Halo zone already demonstrating a 390-meter drilled strike length open for expansion, these parallel zones, enhanced by their association with the greenstone contact, underscore the property's potential for multiple interconnected gold-bearing structures, the company said.

More Results Pending

Golden Cariboo said the spring drilling program concluded with the completion of four surface diamond drill holes, QGQ25-21 to 24, totaling 638.59 meters. These holes targeted robust quartz-carbonate vein stockwork along the argillite to greenstone contact and aimed to test the northwestern extension of gold-silver mineralization at the Halo zone. ALS Canada is close to finalizing PhotonAssay™ for gold and multi-element analysis, with results pending and to be released upon completion.

During the summer exploration season, additional work included reclamation, equipment maintenance, safety assessments, and continued data compilation from the extensive claim package staked in September 2024.

There were delays in receiving assay results due to a "lost" shipment of drill core and surface exploration samples by the freight carrier. The shipment was successfully retrieved after a month-long search. Further delays occurred due to the transition to PhotonAssay™ analysis, a more effective method for assaying coarse gold-bearing samples.

In August, Golden Cariboo announced that the PhotonAssay™ technology had successfully confirmed gold intercepts previously analyzed with traditional fire assay methods in one hole, QGQ24-20 in the Halo zone, resulting in a 5.9% increase in the overall gold grade.

"The reanalysis of QGQ24-20 by PhotonAssay™ not only validates the robustness of our original fire assay intercepts, but also enhances confidence in the presence of coarse, nuggety gold within the Halo zone," Callaghan said at the time.

'We've Waited a Long Time'

Based in Vancouver, Golden Cariboo Resources is reigniting the Cariboo Gold Rush through targeted drilling and trenching efforts at the Quesnelle project. This initiative includes the quartz gold-silver deposit, initially discovered in 1865 alongside placer mining activities, which historically yielded gold, silver, lead, and zinc. Smaller-scale placer operations have continued at Hixon Creek since the mid-1860s. Quesnelle spans 94,899 hectares and is strategically located along a favorable corridor near the Spanish and Eureka thrust faults, adjacent to Osisko Development Corp. (ODV:TSX.V).

Historically, over 101 placer gold creeks on the 90-kilometer trend from the Cariboo Hudson mine north to the Quesnelle property have recorded production, and successful placer mining persists in the area today.

According to Brien Lundin of The Gold Newsletter on June 16, junior miners like Golden Cariboo Resources are beginning to gain momentum during gold's current bull market. Despite gold prices reaching record highs, junior miners had remained at long-term lows until recently.

"We've waited a long time in this new gold bull market for the excitement to trickle down to the junior mining sector," Lundin wrote. "Well, wait no longer. . . because it's happening now." He highlighted an uptrend in the S&P/TSX Venture Composite Index (CNDX), which is largely composed of micro- to small-cap resource stocks.

In a September 2024 research report, Couloir Capital Senior Mining Analyst Ron Wortel highlighted the intriguing aspects of Golden Cariboo's story. He noted that Quesnelle's location in the Cariboo Camp is similar to that of Barkerville, a historic hardrock gold mine. The Cariboo Camp features gold along its mining trends for over 175 kilometers, extending about 75 kilometers north of Wells–Barkerville.

Despite its potential, the Cariboo region remains relatively underexplored. "Some compare the camp with its several parallel trends and structures and length to the Abitibi Gold Camp of Ontario and Quebec," Wortel wrote. "We believe that Golden Cariboo's projects are well located to be part of this opportunity to fully explore the region and find more big gold deposits."

Wortel also pointed out that drilling at Quesnelle has revealed potential for bulk tonnage targets, and visible gold suggests the possibility of high-grade results from mineralized targets. He emphasized the expertise and experience of the team advancing Quesnelle.

"When investing in the highly risky junior mining market, many look to follow well-known names with a track record of success," the analyst wrote. "One may be able to add Frank Callaghan to this list for his success in the Cariboo Camp, and he is starting again where he found his mine. The analyst had a Buy rating on Golden Cariboo, with a price target suggesting a 471% return.

The Catalyst: US$5,000/Oz Gold?

Gold prices are stronger and reached new contract and record highs during early U.S. trading on Tuesday, Jim Wyckoff reported for Kitco News on September 9. Positive fundamentals and technical charts continue to drive buying interest among investors and speculators. December gold was recently up US$12.40 at US$3,690.00.

Gold has climbed over 33% this year, surpassing $3,500 per troy ounce, Petter Gratton wrote for Investopedia on September 8. However, Goldman Sachs cautions that the price of gold could rise significantly if the Trump administration's efforts to undermine the independence of the U.S. Federal Reserve succeed.

They suggest such a scenario would lead to a shift away from traditional safe havens like the U.S. dollar and government bonds, according to the Investopedia report. In a comprehensive analysis released this week, the investment bank explored scenarios where gold could approach US$5,000 per ounce, stating that "if 1% of the privately owned U.S. treasury market were to flow into gold, the gold price would rise to nearly $5,000 [per troy ounce]." This represents a 42% increase from its current level.

The warning comes amid President Donald Trump's significant attempts to influence the Federal Reserve, including efforts to remove Fed Governor Lisa Cook, which are currently facing legal challenges. These actions have Wall Street preparing for what JPMorgan analysts have termed a "Fed independence trade" — strategies to adapt to a world where the dollar and U.S. Treasurys may no longer be perceived as the safest investments.

Investors are concerned that a politicized Fed might cut rates to boost the economy for short-term benefits, raising fears of increased inflation in the future, Gratton wrote.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Golden Cariboo Resources Ltd. (GCC:CSE; GCCFF:OTC; A0RLEP:WKN;3TZ:FSE)

Goldman's analysts were clear about the potential consequences: "A scenario where Fed independence is damaged would likely lead to higher inflation, lower stock and long-dated bond prices, and an erosion of the dollar's reserve currency status. In contrast, gold is a store of value that doesn't rely on institutional trust."

For these reasons, Goldman concluded that "gold remains our highest-conviction long recommendation" — indicating it is the best long-term investment option at present, Gratton reported.

Ownership and Share Structure

According to the company, three insiders own 9.7% of Golden Cariboo. They are president and CEO Frank Callaghan, the largest shareholder overall, with 8.9%, Elaine Callaghan, Andrew Rees and Laurence Smoliak.

The rest is in retail. There are no institutional investors at this time.

The Canadian explorer has 87.89 million outstanding shares and 61.65 million free float traded shares. Its market cap is CA$4.39 million. Its 52-week range is CA$0.04–0.27 per share.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Golden Cariboo Resources Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000. In addition, Golden Cariboo Resources Ltd. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Golden Cariboo Resources Ltd.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.