Our first article on Beeline Holdings Inc. (BLNE:NASDAQ) can be found here, and this is an update to that article.

While many financial companies remain bogged down in today's higher-rate environment, Beeline Holdings is moving in the opposite direction.

The company has not only eliminated US$7 million in debt but also expanded its proprietary AI sales agent "Bob," while guiding toward profitability by early 2026.

Shares recently broke through their first technical target at US$2.20, confirming momentum and opening the door for higher levels.

Management Update

CEO Nick Liuzza and his team continue to execute on a founder-led vision that blends fintech expertise with disruptive mortgage innovation. In a September shareholder letter, management emphasized debt-free status by October 1 and highlighted growth in both loan originations and its new fractional equity platform.

The leadership team's track record in scaling fintech businesses remains a key differentiator. COO Jess Kennedy, CFO Chris Moe, and CTO Cameron Slabosz have built platforms before, and their confidence in hitting operating profitability by January 2026 underlines that this isn't just a concept, but a roadmap.

Shareholders and Balance Sheet

Beeline now has 19.6 million shares outstanding, a market cap of around US$49 million at recent prices, and zero debt going into Q4.

Ladenburg Thalmann maintains a Buy rating with a US$4.50 target, citing the equity platform and AI expansion as growth drivers.

Technical Analysis

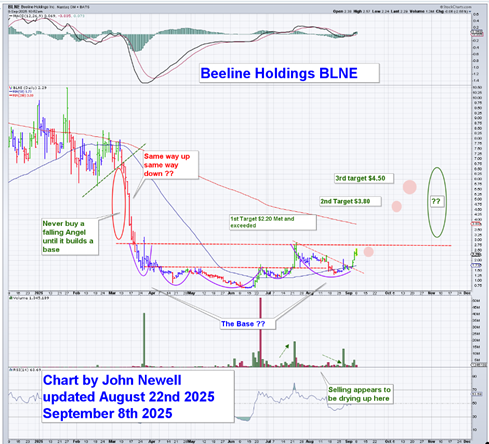

The technical picture has shifted. BLNE formed a multi-month base between US$1.00–US$1.80, absorbed selling pressure, and recently surged through the first target of US$2.20. Volume expanded into the breakout, suggesting institutional participation.

- First Target: US$2.20, met and exceeded.

- Second Target: US$3.80, aligning with prior resistance.

- Third Target: US$4.50, matching Ladenburg's analyst target and near the declining 200-day average.

Momentum indicators are turning positive, and with supply drying up, the stock looks poised for a potential continuation rally.

Conclusion

Beeline Holdings (NASDAQ: BLNE) is proving that fintech innovation, AI adoption, and disciplined financial management can change the trajectory of a small-cap stock. With debt eliminated, AI-driven lead generation expanding, and a proprietary equity release product about to scale, the company has multiple catalysts lining up.

At current levels, with the first technical target achieved, BLNE offers speculative investors a fresh opportunity with defined upside to US$3.80–US$4.50. We believe continues to be a Speculative Buy at current prices of US$2.25, and especially on any minor pullbacks.

For more information, investors can read the company's shareholder letter or visit its company website.

| Want to be the first to know about interesting Special Situations investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Beeline Holdings Inc.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.