While many financial companies are struggling in today's higher-rate environment, Beeline Holdings Inc. (BLNE:NASDAQ) is carving out a niche with AI-driven mortgage technology, a novel home equity platform, and a growing base of loyal customers.

The stock, now in the early stages of a technical base, is catching attention as both fundamentals and charts begin to align.

About the Company

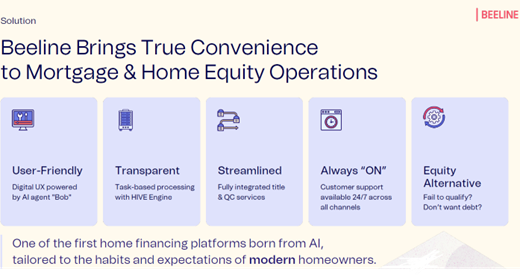

Beeline is a digital-first mortgage and home equity platform that integrates lending, title, and AI-driven sales tools.

Its proprietary technology, including the "Bob" AI agent and the Hive automation engine, allows the company to close loans in 14–21 days, about half the industry average.

In Q2 2025, Beeline reported revenue of US$1.7 million, up 27% sequentially, while reducing debt by US$2.7 million and cutting recurring monthly expenses by US$0.3 million. Adjusted EBITDA losses narrowed to US$2.8 million compared to US$3.5 million in Q1, reflecting the early benefits of cost discipline and efficiency gains.

What makes Beeline stand out, however, is its new Beeline Equity platform. This product allows homeowners to sell fractional equity stakes in their homes, unlocking liquidity without taking on new debt, interest payments, or monthly obligations. Management expects the product to be a major contributor to revenue beginning with its full launch in October.

Management Team

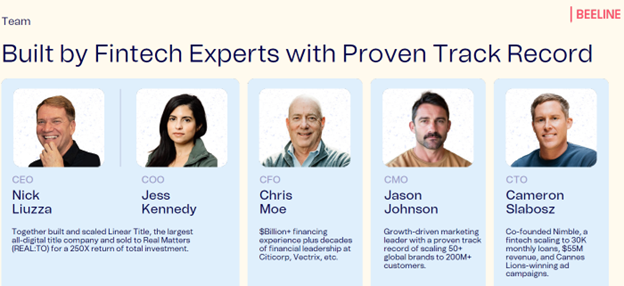

Beeline is led by CEO Nick Liuzza, a fintech veteran who previously co-founded Linear Title, which was later sold for a 250x return on investment.

COO Jess Kennedy and CFO Chris Moe bring decades of operational and financial expertise, while CMO Jason Johnson and CTO Cameron Slabosz add marketing and technical depth.

The team has already proven its ability to scale fintech businesses, and its founder-led commitment is a central reason analysts believe Beeline can capture outsized market share in a slow-to-evolve mortgage industry.

Share Structure

Beeline has approximately 19.6 million shares outstanding and a market capitalization of just US$32 million at recent prices around US$1.63. Ladenburg Thalmann initiated coverage with a Buy rating and a US$4.50 price target, citing unique product offerings, cost discipline, and significant upside from the equity product launch.

With US$5.2 million in debt already paid down in 2025 and full debt elimination expected by October, the balance sheet is rapidly strengthening. This sets the stage for operating profitability, which management believes is achievable by January 2026.

Technical Analysis

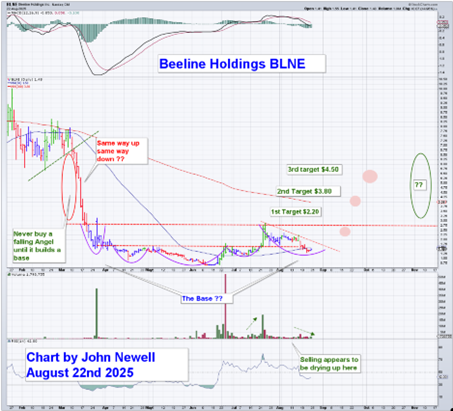

The stock collapsed from a 52-week high near US$30 into the low single digits, but is now stabilizing and forming a base between US$1.00 and US$1.80. This structure suggests institutional accumulation.

Key breakout levels and upside targets:

- First Target: US$2.20, confirmation of a breakout.

- Second Target: US$3.80, aligning with prior resistance.

- Third Target: US$4.50, matching Ladenburg's price target and near declining 200-day average.

Momentum indicators have flattened, selling pressure has eased, and volume spikes in July hint that the worst may be behind. A sustained move through US$2.20 could open the door for a recovery rally.

Technical Indicators

Momentum indicators such as RSI are neutral, consistent with a consolidation phase. Meanwhile, MACD has flattened, reflecting reduced downside momentum.

Importantly, selling volume has contracted significantly, suggesting supply may be exhausted and setting the stage for an upside resolution.

Pattern Consideration

The stocks' trajectory into the March peak was near-vertical, followed by an equally sharp collapse.

If the principle of "same way up, same way down" holds, the reverse could also apply: a strong breakout could fuel a recovery rally back toward prior levels faster than many expect.

Finally

Beeline Holdings appears to be transitioning from a falling-angel scenario into a base-building stage.

With supply drying up and buyers beginning to test resistance, the stock is positioned for a potential reversal.

A confirmed breakout through US$2.20 would set the stage for a technical recovery toward US$3.80–US$4.50.

Conclusion

Beeline Holdings is not without risk. The company must execute on its product launches, maintain regulatory compliance, and manage a challenging housing market. But the opportunity is compelling: an AI-driven mortgage platform gaining traction, a unique equity release product tapping into a US$36 trillion market, and a stock trading at just over US$30 million market cap.

For speculative investors, the setup is attractive: improving fundamentals, supportive management, a tightening share structure, and a technical chart pointing toward higher levels. At the current closing price, Beeline, US$1.48, merits a Speculative Buy recommendation.

Investors can read more information here on the company's website

Beeline Holdings Inc. (BLNE:NASDAQ) closed for trading at US$1.48 on August 22, 2025.

| Want to be the first to know about interesting Special Situations investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Beeline Holdings Inc.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.