Torr Metals Inc. (TMET:TSX.V) announced results from analysis of historical soil and rock grab samples covering an area adjacent to its Kolos project, the 57 kilometers² Bertha Property, which is strategically optioned for full ownership.

The coverage also extends north of the Sonic Zone within Torr’s 100% owned 275 km² Kolos Copper-Gold Project in south-central British Columbia.

The historical data revealed a 4.5 km² copper-gold soil anomaly north of the Sonic Zone on Torr's fully owned land, with copper levels reaching up to 4,510 ppm (parts per million) and gold up to 590 ppb (parts per billion), the company said in a release.

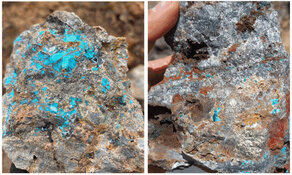

Additionally, field reconnaissance in 2025 within the Sonic Zone Cu-Au (copper-gold) porphyry target area uncovered a new mineralized outcrop about 1 kilometer northeast of Torr's 2024 discovery, the company said.

This outcrop returned 1.1% Cu in a magnetite-rich grab sample along the edge of a highly promising high magnetic anomaly. The newly found outcrop showed 0.42% Cu from a strongly sheared quartz-carbonate vein in Nicola Group volcanics, near a pyritized monzonite intrusion and silica-apatite dyke, further indicating potential vectors toward an alkalic Cu-Au porphyry center.

"The combination of historical data and our recent fieldwork continues to highlight the significant discovery potential at the highway-accessible Kolos Project," President and Chief Executive Officer Malcolm Dorsey said. "We are advancing the drill permit for the Sonic Zone and plan to fully evaluate the highly prospective 4 km² 'gap' area this year. Our inaugural Phase 1 drill program will begin at the Bertha target, where surface outcrop rock samples returned up to 16.9% copper, supported by a strong chargeability anomaly suggesting mineralization may extend beyond 500 vertical meters."

Dorsey continued, "These efforts mark the beginning of a broader strategy to unlock four high-impact opportunities within Canada's most productive copper belt."

Potential for Untested Large-Scale Porphyry Center

The 4.5 km² Cu-Au soil anomaly extends northeast of the Sonic Zone, with a strike length of 3.7 km and a width of 1.2 km, according to the historical data. The anomaly is characterized by copper values exceeding 200 ppm, with peak results reaching up to 4,510 ppm Cu and 590 ppb Au.

This geochemical trend aligns with two low-magnetic geophysical features, showcasing a dominant northeast orientation and a secondary northwest structural control more pronounced along the margins of a high-magnetic body to the southwest, highlighting a compelling exploration target, Torr Metals said.

According to the release, historical datasets have also outlined a more than 4 km Au-silver (Ag)-Cu epithermal corridor, potentially linked, extending northwest from the Sonic Zone porphyry target through the Plug and Meadow Creek occurrences. This corridor includes up to 700 ppb Au in soil and trenching results of 2.24 grams per tonne (g/t) Au over 4.4 meters, 20.78 g/t Au over 0.56 meters, and 6.24 g/t Au with 1,715 g/t Ag over 0.36 meters.

The company said there is potential for an untested large-scale porphyry center at Sonic.

"Multi-phase intrusions, widespread phyllic and localized potassic alteration, plus several silica-aplite dykes define the hallmarks of a fertile alkalic copper-gold system," Torr said in the release. "Within the 4 km² Sonic Zone 'gap' is a highly prospective area, with porphyry-style alteration and mineralization exposed at surface in outcrop with no soil sampling or drilling ever recorded."

Kolos, accessible by highway, hosts four large, undrilled copper-gold porphyry targets (Sonic, Bertha, Kirby, and Lodi) with surface geochemical anomalies covering a combined 11.8 km², the company said. Bertha, Kirby, and Lodi are fully drill-permitted, while Sonic is in the permitting phase.

Extensive geochemical and geophysical work over the past year has defined these targets, offering significant discovery potential with the capability for year-round operations within 30 to 50 km of the New Afton and Highland Valley mines, the latter being Canada’s largest open-pit copper mine.

The released noted that out of 6,941 historical soil samples tested for copper, 274 showed results greater than 100 ppm Cu, and 102 exceeded 200 ppm Cu. From the 997 historical soil samples analyzed for gold, 69 had results over 20 ppb Au, and 19 surpassed 60 ppb Au, with the highest reaching 700 ppb Au. Among 293 historical rock grab samples, 18 had copper concentrations above 0.5%, and 17 contained more than 0.2 g/t Au.

Mining Pace Increasing in Quesnel Trough

Also highlighting the accelerating pace of major mining activity in the Quesnel Trough is the definitive agreement announced on September 3 between Golden Sky Minerals Corp. (AUEN:TSX.V; LCKYF:OTC) and Boliden Mineral Canada Ltd., a wholly owned subsidiary of Swedish company Boliden AB. Under the agreement, Boliden can earn up to an 80% interest in Golden Sky’s Rayfield Copper-Gold Property by investing up to CA$20 million over six years. Upon completion of the earn-in, the Rayfield Property will be combined into a joint venture with Boliden’s adjacent Gjoll Property, with Golden Sky retaining a 20% interest. The two projects collectively span 87,660 hectares in the heart of the Quesnel Trough, Canada’s most productive copper belt.

This development is particularly notable given the strong geological ties between Golden Sky and Torr Metals, whose Kolos Project lies approximately 65 km to the south. Dorsey and Golden Sky’s Vice President Exploration Cameron Dorsey — who also serves as a technical advisor to Torr — are twin brothers that have both leveraged years of field experience working in the region to independently stake the Kolos and Rayfield properties for their respective companies. Dorsery said the exploration models used for both projects showcase a similar foundation, reflecting their shared technical approach and deep regional knowledge. Notably, these projects were secured ahead of the recent wave of major entrants into the district including Fortescue and Boliden.

As activity intensifies across this underexplored, well-endowed copper corridor it highlights the value of early, systematic exploration in unlocking the Quesnel Trough’s discovery potential.

Analyst Notes Co.'s Advantageous Position

*Technical Analyst Clive Maund, in a May 7 company report, noted that Torr Metals "could hardly be better positioned," given its diverse portfolio of promising copper and gold targets. He emphasized that the fundamentals for both metals are exceptionally strong, with copper facing a supply shortage and a surge in gold demand anticipated due to the escalating financial system crisis.

Maund pointed out that "Torr's 100%-owned, district-scale assets are strategically located for cost-effective, year-round exploration and development." These projects are situated in the Quesnel Terrane, Canada's most productive copper belt, known for its copper-gold porphyry deposits and various gold deposit types.

Kolos is conveniently located near Teck Resources Ltd.'s Highland Valley and New Gold Inc.'s New Afton copper-gold porphyry deposit.

Kolos "finds itself in good company next to copper giants," Maund said. "There are a lot of targets at the Kolos project where significant grades have already been found."

The analyst gave Torr Metals a "Very Strong Buy" rating for all investment timeframes, highlighting that the fundamentals have significantly improved since the start of the year.

After a gradual uptrend beginning in December, the stock pulled back to a support level, Maund wrote. The accumulation line increased, even as the price pulled back due to predominant upside volume; this divergence indicates a renewed advance.

"The case for a major bull market in Torr Metals is overwhelming, on both fundamental and technical grounds," Maund wrote. "With the stock at an excellent entry point after its recent dip, the question may fairly be asked, 'What's not to like?'" Maund identified the first target for a TMET upward move as CA$0.18–0.20 per share, suggesting a 64–82% return from the stock's price at both the August 4 market close and the time of his May report. The second target is CA$0.31–0.33, after which the share price is expected to rise to much higher levels.

The Catalyst: Imports Surge in First Half of Year

In the first half of 2025, U.S. copper imports surged significantly due to the anticipation of potential tariffs, as highlighted in a research article by J.P. Morgan on July 24.

By May, imports of refined copper in the U.S. had risen by 129% compared to the previous year, resulting in an unprecedented build-up of inventory. At the same time, Chinese demand exceeded expectations. Following a full-year growth of about 4.4% in 2024, China's apparent copper demand increased by approximately 10% year-over-year through May. Although the growth rate of Chinese demand has slowed since April, it remains stronger than initially expected.

Gregory Shearer, head of Base and Precious Metals Strategy at J.P. Morgan, noted, "Copper supply remains constrained overall. But rather than being exceptionally tight globally, visible copper inventory is significantly dislocated and imbalanced." He explained that "fundamentals have been tightened by U.S. imports and front-loaded Chinese demand."

As the U.S. reduces its copper imports, there will be a sudden shift in trade flows. "Copper will be diverted away from the U.S. and back to the rest of the world, helping to replenish LME inventories, loosening LME spreads and bringing about a stiffer headwind for LME copper prices over the balance of the year," Shearer added in the report.

The firm maintained a cautious outlook for copper prices in the coming months. The combination of tariff-induced market adjustments and the unwinding of inventory build-up is expected to exert downward pressure on prices. Shearer added, "We expect the hangover following the combined front-loading of U.S. imports and Chinese demand will weigh modestly on copper prices over the second half of the year. Nonetheless, absent a significant downturn in the macroeconomy, we still see prices being largely supported at or just above US$9,000/mt (metric tonne)."

Copper is a highly versatile and recyclable material, often regarded as one of humanity's most essential metals, according to a report by Minerals Make Life. Its use dates back thousands of years, and its unique properties have made it indispensable for modern society. Notably, copper is one of the few metals with antibacterial qualities, making it ideal for medical applications. Its recyclability also makes it an environmentally friendly option, as it can be reused multiple times. Copper's malleability allows it to be shaped into thin wires without breaking, and its excellent electrical and thermal conductivity makes it vital for electrical components across various industries worldwide. Applications such as smart devices (including the one you're using now), building wiring, telecommunications, and electronics account for about three-quarters of global copper consumption.

Ownership and Share Structure

According to Torr, about 21% of the company is owned by management and close associates and about 9% by institutions. The rest is retail.

Top shareholders include Torr Resources Corp. (owned by Malcolm Dorsey) with 7.65%, Severin Holdings Inc. with 6.38%, John Williamson with 2.27%, Sean Richard William Mager with 1.24%, and Malcolm Dorsey with 0.11%, Refinitiv reported.

Torr has a market cap of CA$8.1 million and 52.26 million shares outstanding. It trades in a 52-week range between CA$0.08 and CA$0.18 per share.

| Want to be the first to know about interesting Copper and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Torr Metals Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Torr Metals Inc. and Golden Sky Minerals.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

* Disclosure for the quote from the Clive Maund article published on May 7, 2025

- For the quoted article (published on May 7, 2025), the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing the article quoted. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in the article accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed

Clivemaund.com Disclosures

The quoted article represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.