Torr Metals Inc. (TMET:TSXV) is at a very favorable entry point now. It is in the latest stages of a giant Cup & Handle base pattern that promises a breakout into a major bull market soon, as we will see when we review its latest charts.

The company could hardly be better positioned, as it has a diversified portfolio of high-potential copper and gold targets, and the fundamentals for both of these metals could scarcely be better, with copper facing a supply crunch and a tidal wave of demand for gold incoming due to the ballooning crisis of the financial system.

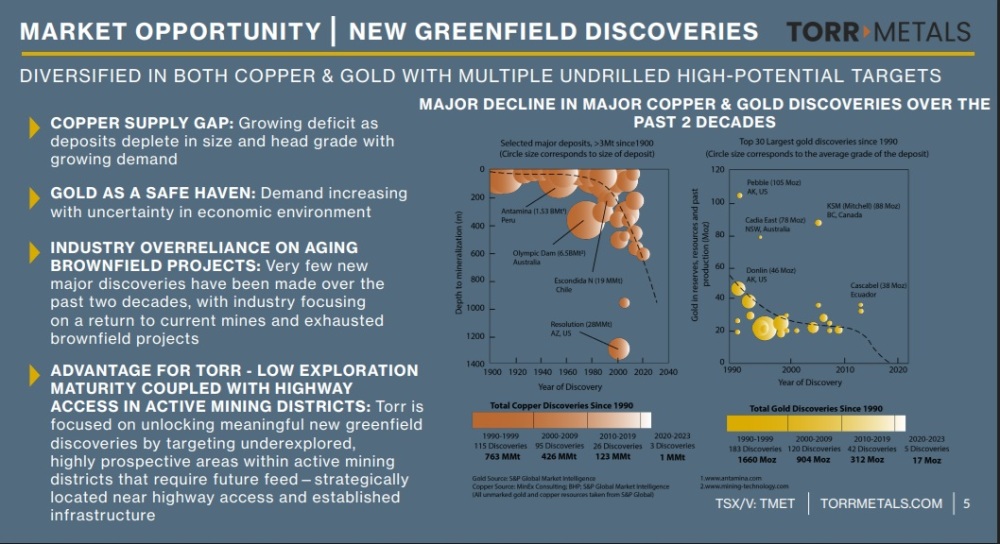

The following page from the April investor deck is very interesting as it makes clear that the discoveries of not just copper but gold have shriveled over the past two decades and with demand for both set to soar, copper for industrial reasons and gold for investment reasons relate to the deepening financial crisis, both metals will be at the center of a perfect storm as ballooning demand collides with shrinking supply.

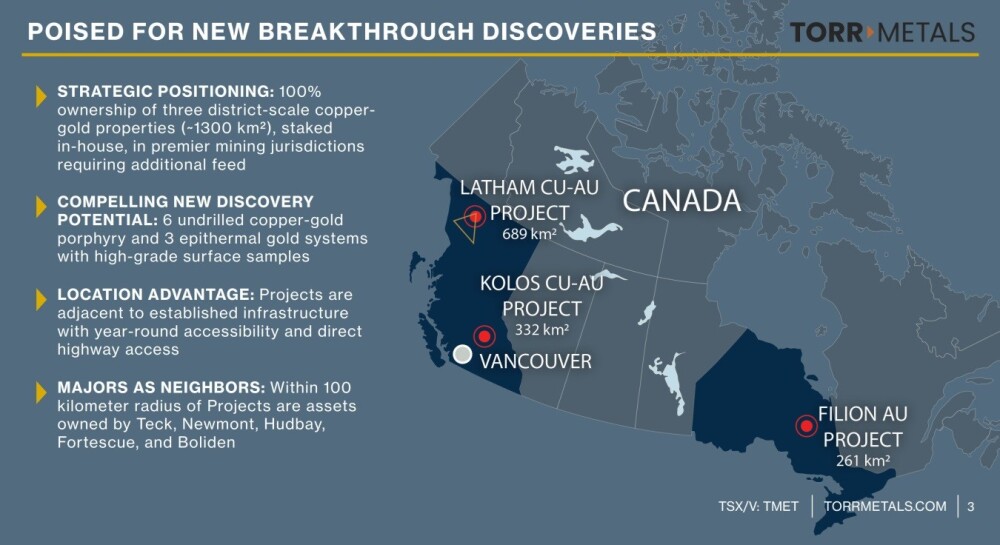

The company is in a very advantageous position, having three District Scale copper / gold properties, two in British Columbia and one in Ontario, whose combined land area totals 1300 square kilometers, which are all in prolific metal-bearing regions.

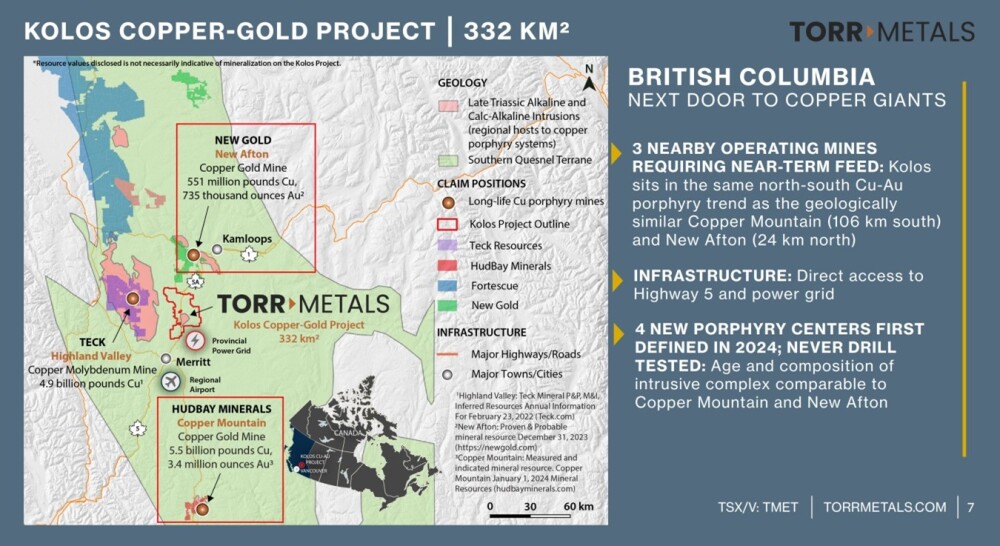

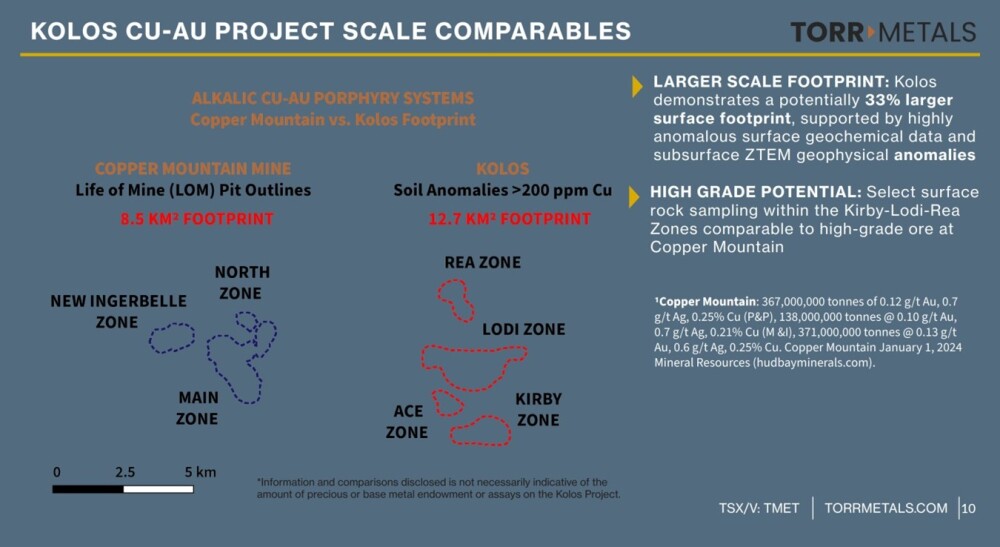

Torr Metals' Kolos copper-332 square kilometer district scale gold project finds itself in good company next to copper giants as it is surrounded by HudBay Minerals Inc.'s (HBM:TSX; HBM:NYSE) Copper Mountain copper-gold mine, New Gold Inc.'s (NGD:TSX; NGD:NYSE.MKT) New Afton copper-gold mine and Teck Resources Ltd.'s (TECK:TSX; TECK:NYSE) Highland Valley copper-molybdenum mine as can be seen on the following map.

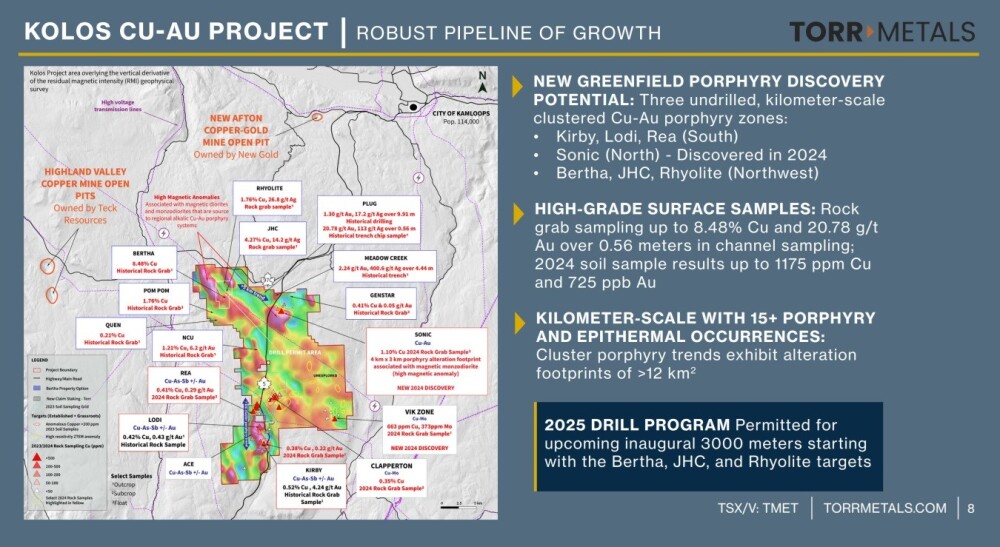

There are a lot of targets at the Kolos Project where significant grades have already been found.

The Kolos Project compares favorably with Hudbay's Copper Mountain which is not far off where huge amounts of copper have already been found.

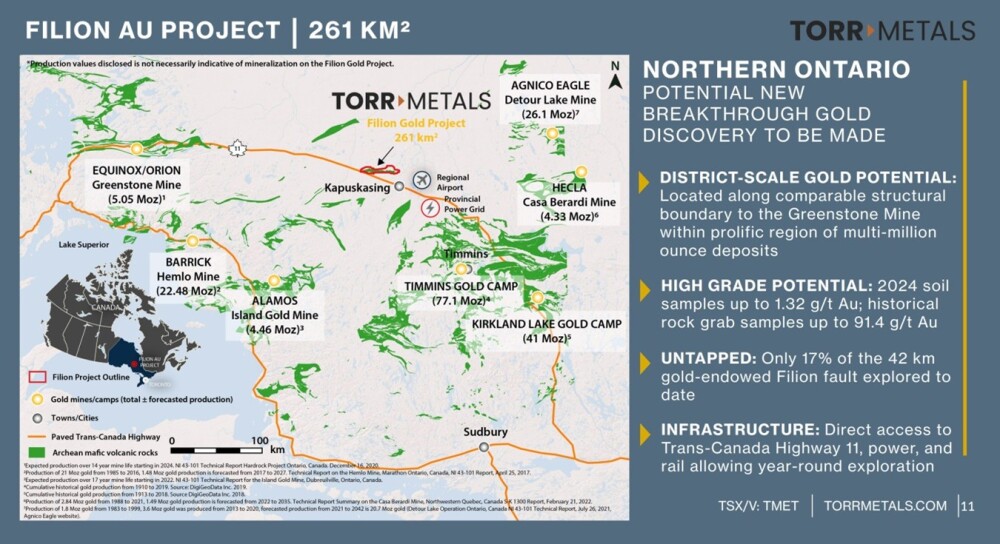

Meanwhile, Torr Metals' 261 square kilometer District Scale Filion Gold Project in the prolific Greenstone Belt in Ontario has huge discovery potential, especially as it is surrounded by "heavy hitters" including the likes of Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE), Alamos Gold Inc. (AGI:TSX; AGI:NYSE), Barrick Gold Corp. (ABX:TSX; GOLD:NYSE),Hecla Mining Co. (HL:NYSE), and the Kirkland Lake and Timmins Gold Camps.

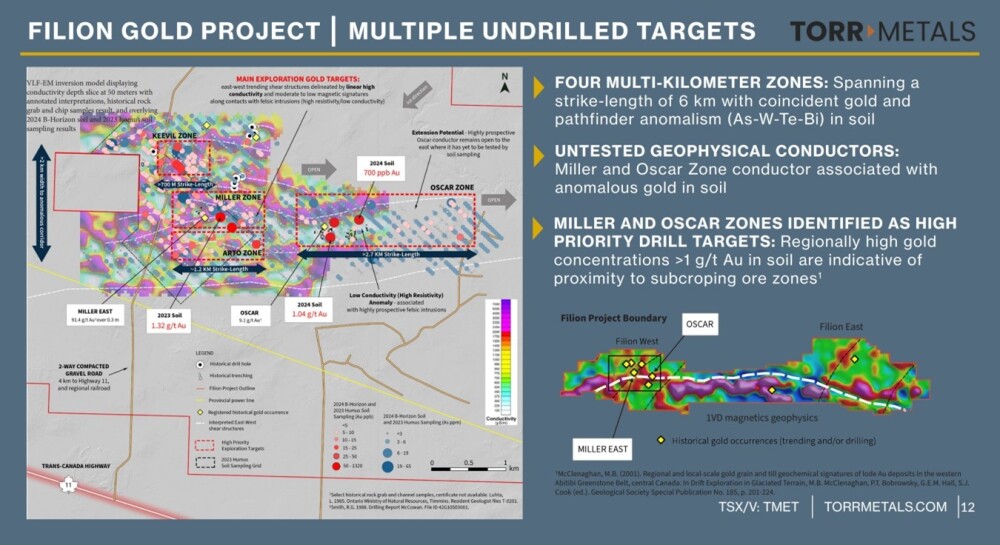

There are multiple undrilled targets at Filion.

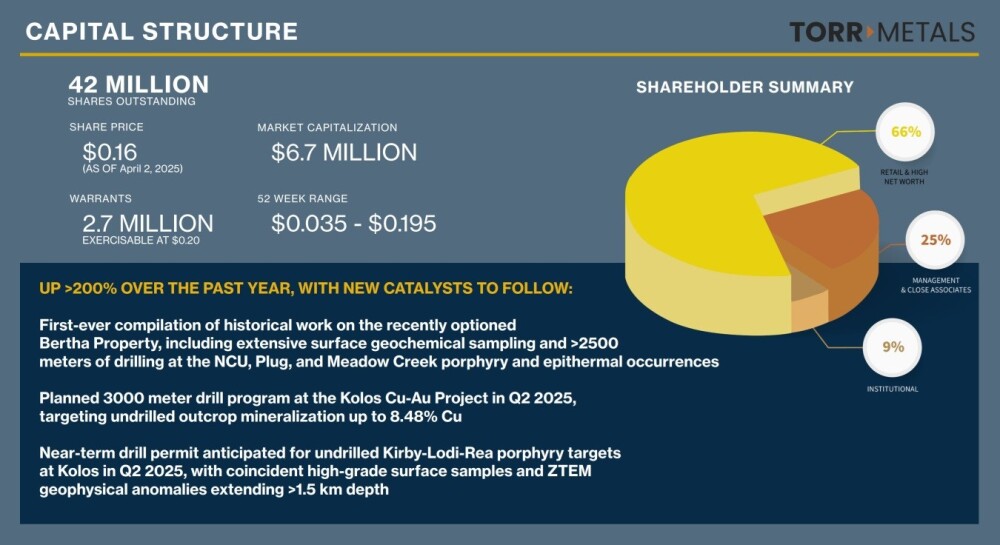

The following page shows the capital structure of the company — there are a relatively modest 42 million shares in issue and of these 24% are owned by management and close associates, with 9% held by institutional investors, leaving about 66% of the stock in the float, so there is plenty of scope for stock appreciation in response to increasing demand.

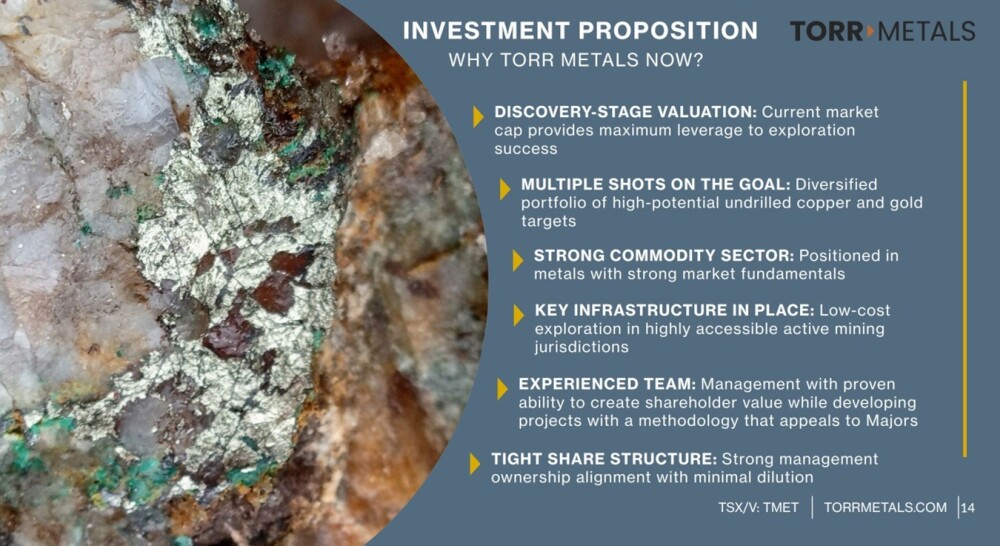

This last page summarizes why Torr Metals is a compelling investment in the sector now, especially as the stock has reacted back to a "buy spot" and in light of the extraordinarily positive outlook for copper and gold prices going forward.

Now, we will review the latest stock charts for Torr Metals.

Starting with the long-term 6-year chart, we see that after coming to market late in 2019, the price trended gently higher to peak late in 2021 at CA$0.33. It then tipped into a severe bear market that, by the time it had run its course early in 2023, had brought the price down to below CA$0.05. After bouncing back some, it went into another slow downtrend that brought it down to the final low at about CA$0.04 early in 2024, thus completing a Double Bottom with the early 2023 low. It then took off like a rocket on strong volume in the Spring of 2024 with a big spike up being followed by a long reaction that has continued up to the present.

With the benefit of the perspective afforded by this long-term chart, we can see that the entire pattern from early-mid 2022 is a giant Cup and Handle base. That the pattern is genuine is made clear by the persistent strong volume that drove the sharp rally to complete the right side of the Cup, which is a characteristic of this type of base pattern. The psychology behind its development is easy to explain; what happens is that before the sharp rally starts, "Smart Money" realizes that the company is "going to make it," and that better times are ahead, and that it is seriously undervalued. It buys increasingly aggressively, thus absorbing all the supply at the low level, and the price starts to take off.

Less sophisticated investors then "jump on the bandwagon," driving the price higher in a spike. This results in the stock "getting ahead of the fundamentals," which naturally takes time to improve. So the stock then "beds down" in a long consolidation pattern that allows time for the fundamentals to catch up.

Hence, the formation of the Handle of the pattern. The good news is that while the Handle of this pattern has been building out, the fundamentals have been improving in leaps and bounds, as not only has the company been advancing towards its objectives, but the prices of its future products, copper and gold, have been racing ahead, especially this year. This means that the time is nigh for the stock to break out of this giant base, which it will achieve by breaking out above the band of resistance that marks its upper boundary, which is at the CA$0.18 – CA$0.20 level. Once it gets above this level, we can expect it to accelerate to the upside, very possibly in a dramatic manner, and it won't be held in check for long by the limited resistance approaching the old highs in the CA$0.30 – CA$0.33 area.

The 18-month chart shows the latter part of the Cup & Handle base in much more detail. Of particular interest is the strong volume driving the rally to complete the right side of the Cup, and we can more readily see here how "Smart Money" began to mop up available supply before this break higher occurred.

The duration of the Handle consolidation has allowed time for the earlier overbought condition to unwind and for the 200-day moving average to catch up to the price, the better to support renewed advance and late in March we saw another bullish moving average cross which means that another upleg will quickly swing both moving averages into strongly positive alignment. The volume pattern remains strongly bullish with generally light volume as the Handle has formed, with upside volume building nicely this year, which is why the On-balance Volume line has recently been making new highs. So all in all, this is a very positive picture and we can expect renewed advances shortly.

The 6-month chart enables us to zoom in on recent action. It shows the latter part of the Handle of the Cup & Handle base and how, within it, a gentle uptrend from December has been followed by a normal reaction back to a support level.

It also makes clear that, from a timing standpoint, we are at an excellent point to buy the the stock for the recent reaction has more than fully unwound the earlier overbought condition thus restoring upside potential and thanks to the predominance of upside volume, the Accumulation line has even risen as the price has reacted back in recent weeks, a positive divergence that points to renewed advance.

The conclusion must be that the case for a major bull market in Torr Metals is overwhelming, on both fundamental and technical grounds, as has been demonstrated here, and with the stock at an excellent entry point after its recent dip.

The question may fairly be asked, "What's not to like?"

It is therefore rated a very Strong Buy for all time horizons. The first target for an advance is CA$0.18 – CA$.20. The second target is CA$0.31 – CA$0.33, with the stock expected to advance to much higher levels later.

Torr Metals' website.

Torr Metals Inc. (TMET:TSXV) closed for trading at CA$0.12 on May 6, 2025.

| Want to be the first to know about interesting Critical Metals, Gold and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Agnico Eagle Mines Ltd. and Barrick Gold Corp.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.