A week ago, I addressed the "Is It Showtime?" question of whether gold was ready to begin a mighty surge towards the $3800-$4000 target of the current congestion zone.

The good news is that "launch day" looks to be even closer now than it was then! To provide some insight into this exciting matter, here's a chart of technical significance for investors:

There's a rare but incredibly bullish inverse H&S pattern on the weekly chart Stochastics oscillator (14,5,5 series) for gold.

Also, note the position of gold in the bullish symmetrical pattern; it's about 2/3 of the way through it in terms of time, and that's technically the ideal point where a breakout occurs.

Here's a look at the daily chart:

The daily chart suggests the range trade is about to end and a big rally will begin; Stochastics is crossing into a bullish posture at the momentum zone of 50.

Also, note the rising dotted blue trendline of significance. It's turning the congestion zone into a bullish ascending triangle. A breakout seems imminent!

Gold is supreme money and gold companies mine it. With the U.S. stock market sporting a truly macabre SP500 CAPE ratio of 38 while the government pounds struggling citizens and small businesses with stagflationary tariff taxes. . .

Savvy money managers are now aggressively buying the miners.

Here's a look at one of the greatest charts in the history of markets, the long-term senior gold stocks (basis GDX) versus gold chart:

Unfortunately, many Western gold bugs may be missing the fabulous gold stocks action not simply by being obsessed with U.S. politics . . . but by linking their obsession to gold.

In a nutshell, the "blue hats" (aka the democrats) do typically spend, borrow, and regulate more than the red ones (republicans), but gold stocks can fall when the democrats are in power and surge when the republicans dominate.

What matters most is not politics, but how money managers view the miners in terms of valuation . . . and right now they are falling in love with them with increasing intensity!

Here's another of history's most fabulous charts, and this one showcases the junior mining stocks rising from a gargantuan base pattern:

As noted, gold stocks, both senior and junior, as not too high. They are far too low!

Here's a snapshot of what could potentially be a very hot one:

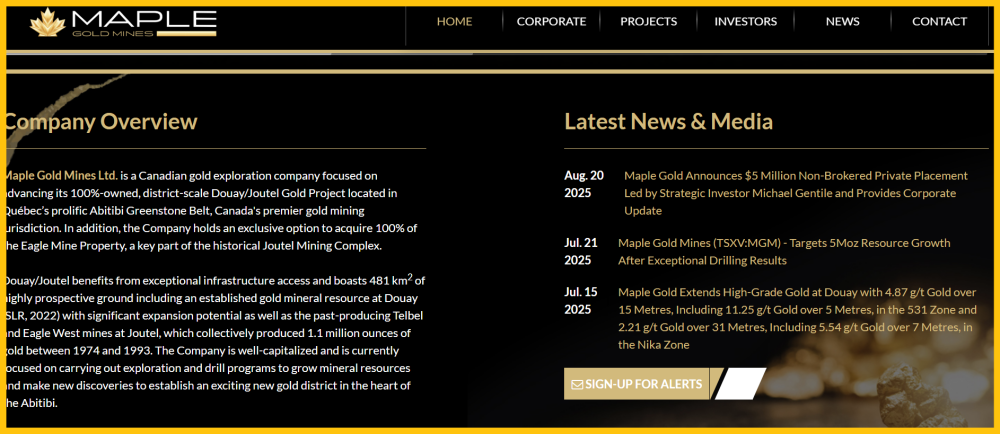

Maple Gold Mines (MGM:TSX.V; MGMLF:OTCQB) has an impressive board and the potential to build a substantial gold resource . . . and maybe a reserve of size too.

Here's a look at a fabulous chart for the company:

It's literally breaking out of the 10-year basing zone . . . today!

Note the new buy signal on the long-term TRIX indicator at the bottom of the chart. The stock seems ready to stage a "four-bagger" rally, and the only question about Maple and stocks like it should be: Are investors ready to board the gold stocks train?

I have another hot junior stock of interest to view, and it's King Copper Discovery Corp. (KCP:TSXV; TBXXF:OTCQB; 3RI:FRA).

Here's the chart:

The technical action is impressive. A large inverse H&S pattern on the weekly chart has been forming for the past two years . . . and this week the stock is staging is breaking out over the neckline.

The good news for all metals market investors is that there are still first-class seats on the gold stocks bull era train… seats that can be bought for economy-class prices. There's clearly only one more thing to say to investors, which of course is: Enjoy this golden gold stocks day!

Special Offer for Streetwise Readers: Please send me an Email to [email protected] and I'll send you my free "CDNX: Stocks That Are As Aggressive As T-Rex!" report. I highlight six prospective ten baggers and include precise buy and sell tactics for investors!

I write my junior resource stocks newsletter 2-3 times a week, and at just $199/12mths it's an investor favourite. I'm doing a special pricing this week of $169 for 14mths. Click this link or send me an email if you want the offer and I'll get you onboard. Thank-you.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Stewart Thomson: I, or members of my immediate household or family, own securities of: None. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Stewart Thomson Disclosures

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?