Is it showtime?

Is gold "finally" ready to blast above the $3440 resistance zone and surge straight to $3700-$4000?

Here's a look at the magnificent daily chart:

In actual fact, gold has been in this range trade only since April. That's not a long-term, although for restless gold bugs, even a week can feel like an eternity as they wait for their well-deserved upside breakout prize!

The charts suggest a breakout is likely imminent. What about the fundamentals? Well, U.S. jobs growth has slowed, and yesterday's CPI inflation report was benign. That opens the door for rate cuts from the Fed.

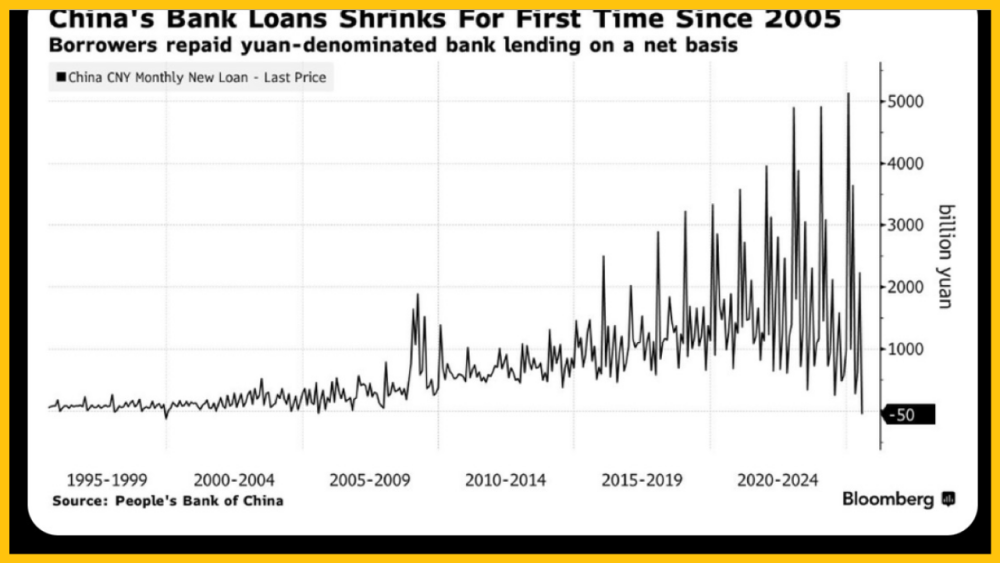

Bank loans in China have also collapsed, and it's happened without much warning.

Here's a look at a chart from Bloomberg:

Clearly, tailwinds for gold are beginning to blow from both the East and the West.

The miners have been on a tear, even with gold flat. So, one can only wonder about the incredible upside action that will almost certainly occur when the next big rally for gold begins!

Here's a look at a long-term rates chart with the key 40-year inflation/deflation cycle highlighted:

The current inflation cycle only began in 2020, and it doesn't end until 2060.

During the last inflation cycle (1940-1980), gold stocks rose thousands of percent. I'll dare to suggest that investors need to rethink their upside targets:

Over the coming 35 years, GDX $5000 and CDNX 100,000 are inflation cycle numbers to consider. . . especially if the cycle ends with the kind of speculative blowoff that took place in 1980.

Let's take a look at some of the hottest miners right now. Amex Exploration Inc. (AMX:TSX.V; AMXEF:OTCQX; MX0:FRA) just did an interesting $30 million deal with Eldorado Gold Corp. (ELD:TSX; EGO:NYSE).

Here's the Amex chart:

A massive bull wedge is in play, and the target zone of $3.40-$4.20 is likely to be acquired.

Benz Mining (BZ:TSX.V) is another hot junior that I've been highlighting for investors.

Here's a view of the weekly chart price action:

Is Benz "too high to buy"?

Well, it's been "too high" for months, and yet it keeps going higher!

This is the nature of a long-term inflation cycle. It's similar to the long stock market bull runs from the 1870s to 1900, from 1932 to 1966, and from 1982 to 2025. . .

Except that this cycle is about inflation, and as it proceeds, stocks are likely to move in the opposite direction (down) to the miners (up).

Here's a look at the monthly Benz chart:

Clearly, Benz is still in a massive base pattern and is actually "too low"!

No investor is going to call all the twists and turns of a 40-year inflation cycle. Trying to successfully jump in and out of the junior gold stocks market in the infancy of that cycle is a difficult feat to achieve . . . especially if it's done with the bulk of an investor's capital.

A big investing mantra in the junior mining sector is that if an investor buys lots of miners, a couple of them could become big winners. It's a lottery mindset.

In contrast, I'll submit that now, and perhaps for the next 35 years, miners that don't perform incredibly well are going to be in the minority.

The time to be nervous about gold stocks is during a deflationary cycle, because most rallies are not sustained and are followed by brutal declines. It's the opposite in an inflation cycle like this one; the declines tend to end fast, and most gains are sustained!

Special Offer for Streetwise Readers: Please send me an Email to [email protected] and I'll send you my free "SILJ & GDXJ: It's Time For Upside Play!" report. I highlight key stocks to consider for purchase in these spectacular ETFs, with winning buy and sell tactics included for investors! I write my junior resource stocks newsletter 2-3 times a week, and at just $199/12mths it's an investor favourite. I'm doing a special pricing this week of $169 for 14mths. Click this link or send me an email if you want the offer and I'll get you onboard. Thank-you.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Stewart Thomson: I, or members of my immediate household or family, own securities of: None. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Stewart Thomson Disclosures

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?