I will have to take my criticism of Trump yesterday back. It still was a dumb move militarily, but I believe it was the key factor to get the Iran/Israel ceasefire. Most likely, Trump had Israel agree to a ceasefire if he bombed the Fordow underground uranium facility with the U.S. bunker buster bombs.

Iran would likely agree because they just got pummeled with a lot of damage and were under constant air attack. This gives Iran a breather and a chance to rebuild and reorganize its forces. A lot of military leaders were taken out with the Israeli air strikes. Iran's enriched uranium and nuclear program was not completely destroyed; it has surely set back their nuclear program by one to three years.

Trump got India and Pakistan to cease their hostilities, and now Iran and Israel. It looks like a clear case of having to use a stick instead of a carrot. I hope, but I doubt this ceasefire will last because there is just too much hatred between the two sides.

As I often say, war is unpredictable, so who knows? Only time will tell.

Oil Market has it Wrong

Oil dropped in a knee-jerk reaction to the headlines.

Shortly after 6 pm, futures jumped and oil slumped even more in one of its biggest intraday reversals on record.

The key factor for oil in this war is shipping restrictions in the Strait of Hormuz. There is nothing in this ceasefire agreement that prevents Iran from disrupting or blocking the Strait.

It appears Iran has come up with a brilliant way to effectively close the Strait of Hormuz by jamming GPS signals. Large oil tankers will probably not navigate this without GPS because it is so narrow.

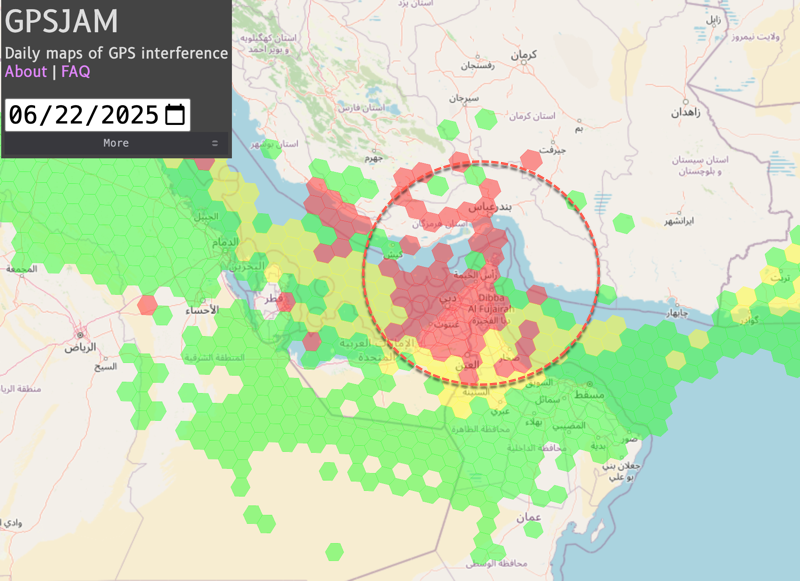

Earlier reports confirmed that six supertankers abruptly reversed course in the Strait of Hormuz. Have a look at this graphic from GPSJam, a site that publishes daily heat maps of GPS/GNSS disruptions. It now shows widespread "high-interference" GPS jamming across the critical maritime chokepoint. This suggests further disruptions to maritime navigation in the waterway. Two oil tankers have already collided a couple of weeks back because of GPS jamming.

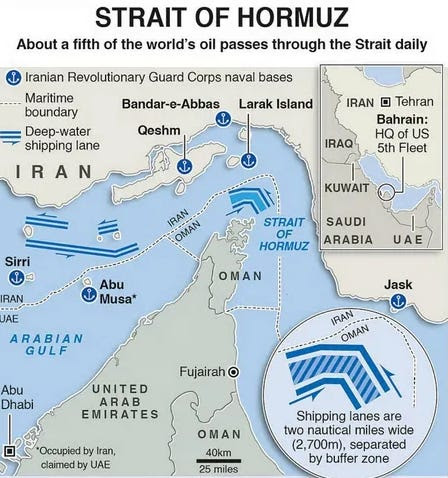

Iran could remove the jamming temporarily to allow their own tankers to navigate the narrow strait. It is just 2 miles wide, but this is not a lot for these huge tankers. Furthermore, Iran now has recent railway lines into China through China's Silk Road initiative.

"Maritime activity slows in Gulf," private data and analytics firm Kpler wrote on X.

Kpler vessel tracking indicates declines in maritime traffic in the Mideast #Gulf since the Israel-Iran conflict began on Friday, June 13. At that time there was also fears of missle strikes and while this risk has subsided, it is not eliminated with the ceasfire agreement.

Supertankers have performed U-turns in the Strait of Hormuz amid uncertainty over how Iran will retaliate against U.S. strikes on its nuclear sites. Six of the giant vessels, some capable of carrying 2m barrels of crude, turned back after entering the crucial trade route over the last 24 hours, according to vessel tracking data from Marine Traffic.

Goldman analysts laid out two scenarios:

- If only Iran supply were to drop by 1.75mb/d, they estimate that Brent would peak at around $90, with a decline back to the $60s in 2026;

- •If oil flows through the Strait of Hormuz were to drop by 50% for one month and then were to remain down 10% for another 11 months, they estimate that Brent would briefly jump to a peak of around $110.

I believe we are going to see the oil flow drop through the Strait. Higher oil prices benefit Iran and, at the same time, harm Israel and the U.S. economically.

This graphic of the strait shows the narrow passage way and Iran's naval bases that could harass and threaten shipping. Below highlights 1/5 of the world's oil, but it is a much higher 1/3 of all sea-bound oil shipments. Sure the U.S. could threaten Iran and move into the strait but this could upset the delicate ceasefire.

Comments like this highlight how fragile this ceasefire is

Party chairman Avigdor Liberman decried the absence of an Iranian "unconditional surrender," saying, "Already at the beginning of the war, I warned that there is nothing more dangerous than leaving a wounded lion."

And Dan Illouz of Netanyahu's Likud Party asked, "Has the enemy surrendered? Or is this just a round we won on points?"

I believe this is an opportunity to buy oil stocks. They are already beaten down and their valuations are very very cheap. We have to look no further than APA Corp.

APA Corp.

Recent Price - $18.38

Opinion – Buy

For an oil stock, it is selling at a low p/e of 7, only 2.2 times cash flow, and a nice dividend yield of 5.4%. APA Corp. (APA:NASDAQ) would qualify for my Millennium Index, but I already have enough energy-type stocks there.

On May 7, 2025, APA announced its financial and operational results for the first quarter of 2025 with net income attributable to common stock of $347 million, or $0.96 per diluted share.

When adjusted for items that impact the comparability of results, APA's first-quarter earnings were $385 million, or $1.06 per diluted share. Net cash provided by operating activities was $1.1 billion, and adjusted EBITDAX was $1.5 billion.

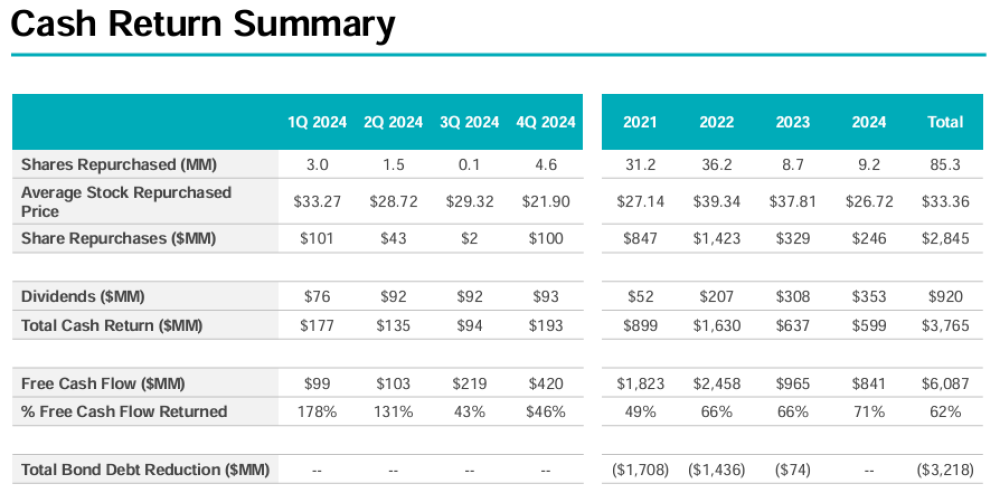

APA is making great cash flow in this lower oil price environment. In 2024, they high graded their U.S portfolio by selling more than $2 billion of non-core assets. The Callon acquisition last year (how we own the stock) increased APA's Permian production base and inventory of future development locations. Callon was purchased at a significantly lower cash flow multiple than the multiple received for divested U.S. in 2024, which includes: Kinetik common equity, East Texas, Permian minerals, and Permian conventional.

APA has been buying back shares, increasing cash flow, and increasing its dividend as the stock has consistently fallen. A complete disconnect and signal of very low investor sentiment in the sector.

Pro-forma 4Q24 U.S. production guide of 307 MBOE/D was 34% above 4Q23 production. APA achieved 313 MBOE/D in 4Q24. And their U.S. production in Q1 2025 was 298.3 MBOE/D. Production in 2025 is expected to be about 3% higher than in 2024. They also have significant production in Egypt of approximately. 134 MBOE/D.

And they have a nice discovery in Alaska announcing a second Alaska discovery well at Sockeye-2, which encountered a high-quality reservoir with approximately 25 feet of net oil pay. Subsequent to the first quarter, the company conducted a successful flow test, which indicated significantly higher reservoir quality compared to similar discoveries to the west. Technical evaluation is underway to determine next steps for appraisal and further exploration.

The down trend channel is not broken yet and the 200 Day MA is still containing the stock, but I am confident that the bottom is in with a strong bullish engulfing candle marking the bottom, but does not show in this 4 year chart, easy to see in a one year or 6-month chart. The 5.4% dividend yield should also help hold the stock up. The next dividend is payable to record holders on July 22, so buying the stock now would secure that next dividend payment.

I saw an article today in the Toronto Sun, highlighting a Bloomberg piece.

"The only reason you want to buy an equity is if it gives you a better return than just buying gold," Agnico Eagle Mines Ltd.'s (AEM:TSX; AEM:NYSE) CEO Ammar Al-Joundi said in an interview with Bloomberg.

Toronto-based Agnico Eagle is one of the few large-cap gold mining stocks to outperform bullion in the last year, rising 84% while gold has added 44%. Agnico has also more than doubled the performance of rivals Barrick Mining Corp. (ABX:TSX; B:NYSE) and Newmont Corp. (NEM:NYSE) — surpassing both on a market capitalization and a price-to-earnings basis in the process.

Meanwhile, a quarter of the stocks in the 56-member VanEck Gold Miners ETF have underperformed the commodity so far this year. Indeed, exchange-traded funds that track gold mining stocks have seen massive outflows this year, an indication that investors are taking profits in the stocks rather than seeing long-term value in the sector.

I have shunned Barrick and have not suggested Agnico Eagle. Newmont is on my Millennium Index because it's higher dividend, which is 2.6% for our buy level. However, it prompted me to compare our gold stocks to Agnico Eagle and I am happy to say, we are doing way better. This is a 1-year chart of Agnico Eagle with its 84% gain compared to our gold stocks.

Torex Gold Resources Inc. (TXG:TSX) is a little under Agnico Eagle, but five have done way better, especially New Gold Inc. (NGD:TSX; NGD:NYSE.MKT) and Discovery Metals Ltd. (DSV:TSX.V DSVMF:OTCQX).

B2Gold Corp. (BTG:NYSE; BTO:TSX; B2G:NSX) and Equinox Gold Corp. (EQX:TSX; EQX:NYSE.A) are our two laggards, and I have been highlighting them as the best buys lately.

Both stocks have strong growth profiles, and it seems the market is still fearful of cost over runs at development projects. However, this is looking in the rearview mirror.

B2Gold and Equinox remain my favorite buys right now. Equinox acquiring Calibre with the Valentine mine coming on stream, and B2Gold's Goose project should announce commercial production any time now.

| Want to be the first to know about interesting Oil & Gas - Exploration & Production and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Barrick Gold Corp. and Agnico Eagle Mines Ltd.

- Ron Struthers: I, or members of my immediate household or family, own securities of: APA Corp, Equinox Gold, B2Gold, Kinross, Discovery and NewGold. My company has a financial relationship with [None]. My company has purchased stocks mentioned in this article for my management clients: [None.] I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.