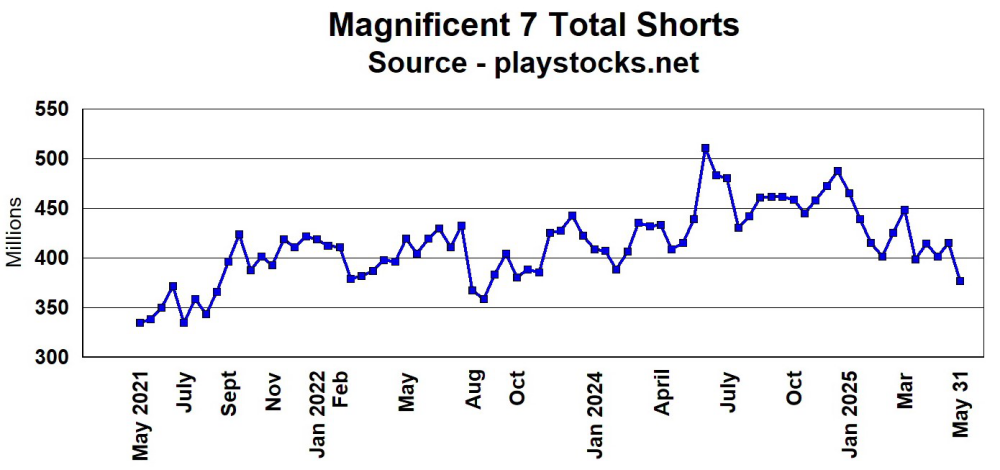

The Playstocks Mag 7 short barometer has dropped to levels not seen since August 2023.

Back then, the market soon saw a significant correction (-11%). I think this is telling us that the market is very complacent and is coming at a time, when the S&P 500 is putting in a possible double top.

And more economic news out yesterday continues to suggest the market is way too optimistic about the future. Construction of new homes fell 9.8% to 5 year lows in May, as builders pulled back amid waning demand from home buyers. Housing starts fell 4.6% to a 1.26 million annual pace from 1.39 million the previous month, the government said. And down by 9.8% from April.

Permits for the construction of new housing also declined in May, falling by 1.0% year-over-year and 2% month-over-month to 1,393,000. Permits for the construction of new single-family homes, at 898,000, fell by 6.4% year-over-year and by 2.7% month-to-month.

In my last update on the market, I expected we could see a test of 6,100 on the S&P 500, making a double top. This does not have to be precise, as the market has moved into the resistance level and would qualify as a double or triple top in my view. To me, market risk appears high, and larger cash positions are warranted.

I follow geopolitical events closely, and my sources are suggesting the risk is high that the Middle East war will escalate over the next couple of months. War is unpredictable, so anything can happen. I am sure you have watched the news of Israel and Iran trading missile strikes.

Now the U.S. is threatening Iran and moving another carrier group into the area. Russia is warning the U.S. not to get involved. This is going to be messy, but it will benefit our precious metal, oil, and gas positions. Both sides don't seem to mind civilian casualties; it is just shameful, and how many lives need to be lost?

A week ago, I provided an oil chart with a double bottom and a target of $80. Oil tried to break out last week, but it definitely has today. We are well-positioned with some good senior and mid-tier oil and gas producers, but today I want to update my top oil exploration stock.

Reconnaissance Energy Africa Ltd. or Recon Africa

Recent Price - CA$0.41

Entry Price - CA$0.56

Opinion – Strong Buy

Reconnaissance Energy Africa Ltd. (RECO:TSXV; RECAF:OTCQX; 0XD:FSE) has closed a $19 million financing at $0.50 with a two-year warrant exercisable at $0.60. These warrants will be listed in about a week or so and might be a good leveraged way to play this exploration program. Investors have become tired and impatient because RECO has not hit oil on their first few wells. However, this next exploration well, Kavango West, shows the best promise yet.

Management and insiders put $4.7 million in this financing, which shows to me that they have confidence and conviction. It does not mean the well will hit, but it is a positive sign.

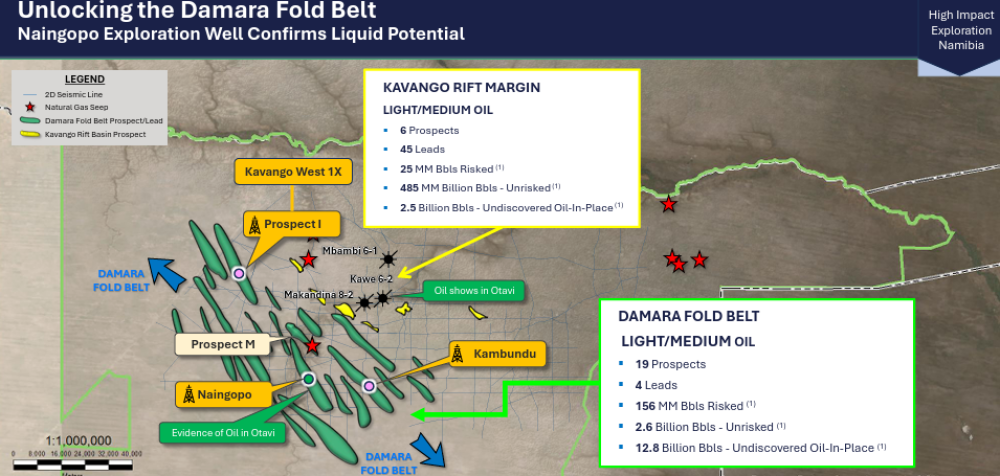

The Kavango West 1X exploration well will be the second test in the expansive Damara fold belt play. The prospect is a large fold identified on modern 2-D seismic data, which extends over 20 kilometers long by five kilometers wide and is expected to penetrate a thick Otavi carbonate reservoir section, which is the primary target in the play. The Kavango West 1X well will be drilled to a planned total depth of approximately 3,800 meters (12,500 feet) and is targeting 346 million barrels of gross unrisked.

Damara fold belt play across 11.5 million acres in Namibia and Angola:

The Damara fold belt trend is identified in the subsurface by a grid of 2-D seismic data, and the company has mapped 19 prospects and four leads on the Namibia side of the play. The Namibia area is estimated to hold 2.6 billion barrels of unrisked prospective light/medium crude oil resources and 157 million barrels of risked prospective light/medium crude oil resources from the Damara fold belt play prospects on PEL 73.

RECO holds a massive land position of 11.5 million acres in this oil and gas play. The potential is so huge, it is hard to imagine, but it is just potential at this point in time. If they do hit on this well, the stock should make a huge move.

There has been success in Namibia offshore, and I maintain my outlook that for RECO, it is only a matter of when, not if, they make an onshore discovery. There is a lot of attention in the area with majors, as shown in a recent fight for Namibia Oil. Defying recent write-downs from Shell's Graff discovery, French oil major Total Energies (TTE:NYSE) is reportedly poised to outbid rivals such as Petrobras for a huge stake in Namibia's Mopane discovery as Portugal's Galp (ELI:GALP) is seeking a farm-in.

It is amazing how far down and cheap RECO stock has dropped. This recent drop is driven by the recent financing. Many shareholders have given up and thrown in the towel on this stock. In the short term, the stock is oversold with RSI about 23 (not shown on the chart), and we have a double bottom, but the stock has dipped a bit lower today. On the US$ chart, RECAF shows a triple bottom at $0.30. At today's price, we can buy at significantly less than the brokers and management/insiders that just paid $0.50.

The huge potential and upside have not changed; only the stock price has, and it is currently for the worse.

Buy when others are afraid? This could be an example?

| Want to be the first to know about interesting Oil & Gas - Exploration & Production investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Ron Struthers: I, or members of my immediate household or family, own securities of: Reconnaissance Energy Africa Ltd. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.