Dear reader, it is hard to believe that an advanced-stage multi-million ounce gold deposit that is fully permitted and in a tier one mining district is valued at just $15 per ounce in this gold market.

It is a reflection of how beat up the junior mining market was over the past few years. I am talking about Vista Gold.

Vista Gold

Recent Price - CA$1.38, US$1.02

52-Week Trading Range - CA$0.63 to CA$1.84

Shares Outstanding - 124.5 million

Cash on Hand - US$15 million

Major Shareholders - Sun Valley Gold 13.2%, Management 4.2%

Vista Gold Corp. (VGZ:NYSE.MKT; VGZ:TSX) started to recover from the junior bear market in the last half of 2024 and continued higher in 2025. However, it sold off in June after they released their Q1 financial results. I saw nothing negative in those results, as they still have ample cash to advance their feasibility. Perhaps the market thinking financing coming soon?

I think this pull back to support is a buying opportunity.

Vista holds the Mt. Todd gold project, a ready-to-build development-stage gold deposit located in the Tier 1 mining jurisdiction of Northern Territory, Australia. Mt. Todd is a leading development opportunity within the gold sector. The project offers significant scale, development optionality, growth opportunities, advanced local infrastructure, community support, and demonstrated economic feasibility. All major environmental and operating permits necessary to initiate the development of Mt. Todd are in place.

Management has a wealth of experience and previous success. Frederick Earnest is President and CEO with 35 years of industry experience. Former President of Pacific Rim El Salvador, GM of Compania Minera Dayton in Chile, and former director of Midas Gold.

Brent Murdock, GM of Mt. Todd, has 25 years of experience in mine start-ups and large projects. He was Ore Processing manager at Solomon mine in Western Australia, former GM of Manganese Pty Ltd, and GM construction of Harmony Gold at the Hidden Valley Mine.

Tracy Stevenson is Chairman and was the former director of Uranium Resources, non-executive chairman of Quaterra Resources, and former director of Ivanhoe Mines Ltd. He was also the former Head of Information Systems at Rio Tinto.

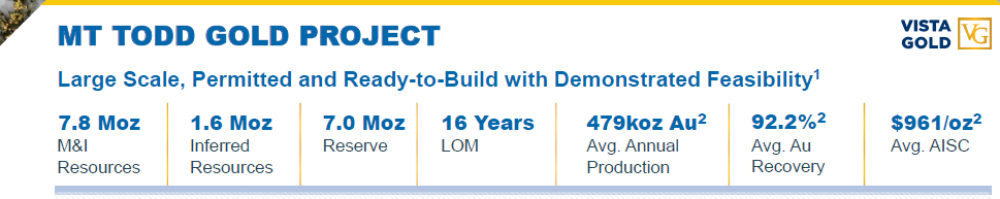

Mt Todd has proven and probable reserves of 6.98 million ounces or 7.8 million ounces M&I resources. Deposits of this size are becoming more scarce, and it is of the size that could attract mid and major size gold producers.

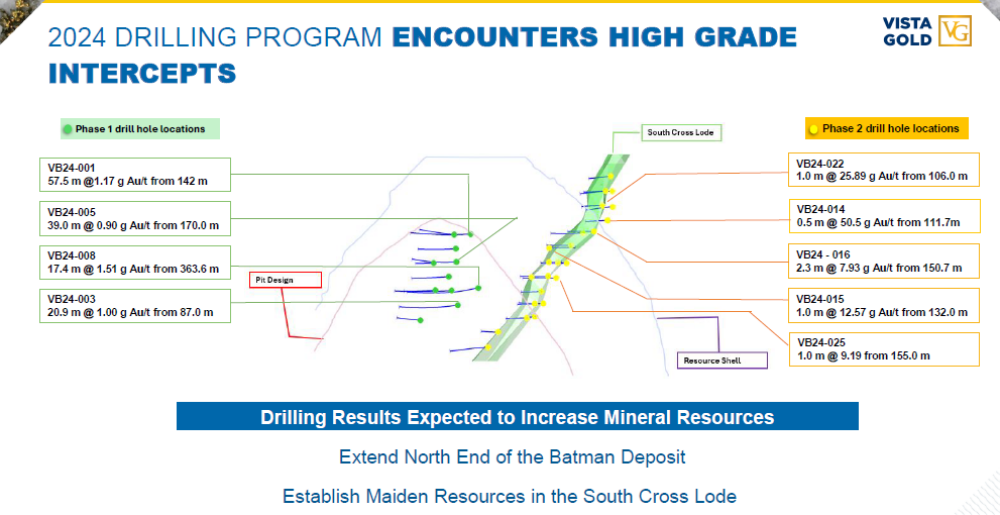

This is a district scale size project with lots of potential for expansion, another factor that interests the major gold producers.

Recent drill results verify the expansion potential.

Conclusion

Mt Todd is a low grade deposit around 1 g/t gold but as far as open pit gold mines go, it is better than most.

Their 2024 feasibility envisioned a 50,000 tpd mine, producing 479,000 ounces per year for the first 7 years. Cash costs were $845 per ounce, and All-in Sustaining Costs were $961 per ounce. These are quite low, indicating a low-cost mine, and this feasibility was done at a US$1,800 gold price, and gold prices are almost double now.

The IRR was calculated at 20.4% and jumps to 49,9% at $3,000 gold.

The Capex for this mine was estimated $1.03 billion.

New Feasibility Study

Vista is currently working on an updated feasibility that should be out by mid-2025, so anytime now. This will focus on starting with a smaller mine and a much lower capex. Potentially something Vista could move into development and production if a buyout does not come soon. As history shows, the best way to sell a mining project is to threaten to build it yourself.

The 15,000 tpd Mt Todd feasibility study aims to increase the reserve grade to 1 gram gold per tonne by applying a higher cut-off grade. It will also incorporate mine scheduling optimization strategies that prioritize higher-grade ore during the early years of operation. Additionally, the study aims to reduce initial capex by 60% to $400 million, while averaging annual gold production of 150,000 to 200,000 ounces. This study will leverage prior technical studies, preserve the potential for future expansion, and demonstrate the opportunity for Mt Todd to deliver attractive economic returns with a smaller initial capital investment.

Vista has 124.5 million shares outstanding and at $1.02 has a market cap of US$ $126.99 million.

Fully diluted 129.2 million shares, so a fully diluted market cap of US$131.8 million. Vista has no debt, and if we subtract $10 million of their $15 million cash, we get an EV of $12.8 million, divided by 7.8 million ounces of M&I, it comes out to $15.61 per ounce on a fully diluted basis.

This is extremely cheap, especially at $3,000 plus gold.

The stock trades way more volume on the U.S. side, so I am using the US$ price chart. The stock was around $1.40 in 2020 and 2021 when Mt. Todd was far less developed. It bottomed out at $0.30 and the stock saw a break out in September 2024. The stock popped above its uptrend line in mid-May, perhaps a delayed reaction to rising gold, or more likely a large investor or fund establishing a position. I believe the pull back into the support zone is a great entry price.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Ron Struthers: I, or members of my immediate household or family, own securities of: None. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.