Laramide Resources Ltd. (LAM:TSX; LMRXF:OTCQX: LAM:ASX) is a uranium developer with in-situ and hard-rock uranium deposits in the southwestern United States and Queensland, Australia.

This month, the company announced that two of its advanced-stage uranium advancement projects, Crownpoint-Churchrock and La Jara Mesa (both in New Mexico), have received designation as FAST-41 covered projects by the Federal Permitting Improvement Steering Council.

The classification is a part of the federal infrastructure permitting program established under Title 41 of the Fixing America's Surface Transportation ("FAST-41") Act, demonstrating the strategic significance of Laramide's strategic importance and streamlines the evaluation procedure.

Significantly, the La Jara Mesa Project has advanced from a FAST-41 transparency project to a completely covered project, aligning its permitting status with Crownpoint-Churchrock and simplifying its progression under U.S. federal oversight, the company said.

"We commend the Trump administration for the Executive Order announced on May 23, supporting the acceleration of nuclear energy development in the United States," said President and Chief Executive Officer Marc Henderson. "As momentum builds around a new era for nuclear power, it is important to recognize that uranium is the fundamental starting point of the entire fuel cycle."

'A National Effort' to Rebuild Nuclear Fuel Cycle

The uranium sector has transitioned into a period of heightened focus as the U.S. seeks to revitalize the domestic atomic energy industry and its related supply infrastructure.

Based on a June 9 analysis from Forbes, the White House recently released four Executive Orders to modernize the atomic sector. These encompassed actions to restructure the Nuclear Regulatory Commission and expedite the implementation of advanced reactor technologies. The policies were crafted to "usher in a nuclear energy renaissance," with particular emphasis on rebuilding the domestic uranium supply chain for national security reasons.

Henderson said the Crownpoint-Churchrock project is one of the largest undeveloped uranium deposits in the U.S. and has the potential to play a central role in securing a domestic supply of this critical mineral.

"The inclusion of our projects under FAST-41 is a meaningful step, but continued policy support will be essential to overcome the longstanding regulatory and permitting challenges that have constrained U.S. uranium production," he said. "We are encouraged by this progress and proud to be part of a national effort to rebuild the nuclear fuel cycle from the ground up."

Analyst: Co. Positioned to Benefit From Supply Deficit

*Technical Analyst Clive Maund wrote on June 10 that Laramide "is very well positioned to benefit from the looming supply deficit that looks set to drive up the price of uranium and the push for domestic production of uranium in the U.S. and the sourcing of uranium from top tier jurisdictions, such as Australia."

Maund continued, "After many years of languishing at a low level, Laramide’s stock is in position to embark on a major bull market in response to these factors."

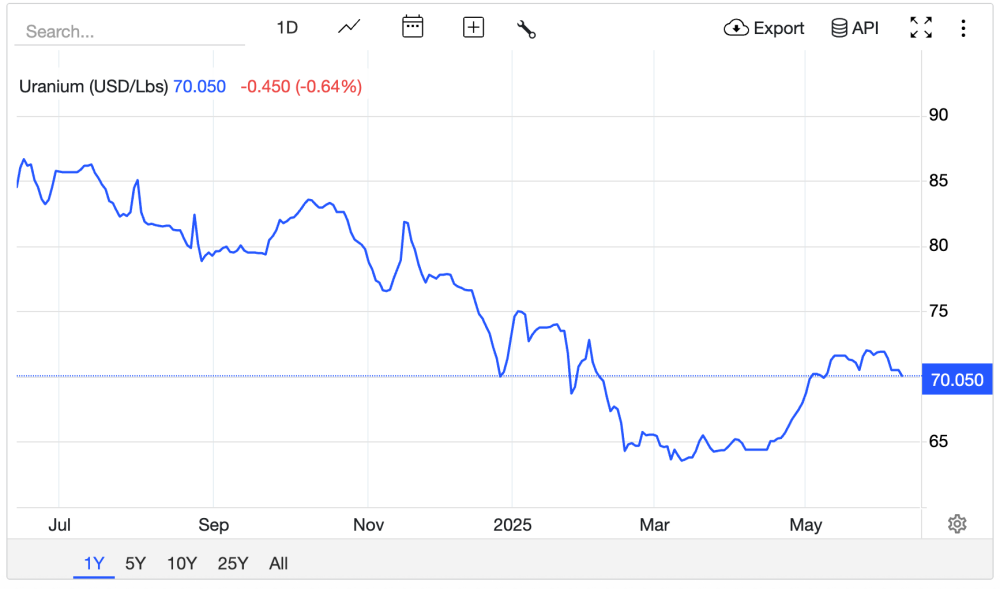

"Uranium has been trending higher and accelerating to the upside following lows it put in in 2016 and 2017," Maund wrote. "Right now, it is believed to be starting higher again following a deeper correction from its January highs back to the support of a parabolic uptrend."

A consolidation pattern that formed on its charts following a rally in 2021 has taken the form of a "Fish Head Triangle," the analyst said, "Which is a potent pattern because it involves the price 'coiling' within Triangle boundaries that converge ever more rapidly. This generates compression that typically leads to a big move, and the strong upside volume over the past 10 months that has driven the Accumulation line steadily higher is a powerful indication that the breakout from the Fish Head Triangle will move to the upside. With the price pushing into the apex of the Triangle, breakout looks set to occur soon."

"With an upside breakout looking set to occur soon that will lead to a substantial upleg, Laramide Resources is a strong buy here for all time horizons," Maund wrote, setting a first price target at CA$1.10 and a second at CA$3.

Co. 'Scans Very Well on Value'

Laramide's Churchrock venture in New Mexico represents a development-ready holding, SCP Equity Research analysts J. Chan, E. Magdzinski, and K. Kormpis noted in a research note on June 3.

The company's January 2024 PEA projected a 31-year operational timeline generating 31.2 million pounds at an all-in sustaining cost of US$34.83 per pound utilizing ISR extraction techniques. At a US$75 per pound uranium valuation, this created a US$239 million after-tax NPV, substantially supporting Laramide's assessment. The prospect involves developing wellfields more rapidly to boost output to 2-3Mlbs, yielding a reduced operational duration but enhanced financial performance.

"We think Laramide scans very well on value, with two projects of reasonable size/scale in the U.S. and Australia (arguably two of the top three jurisdictions in today’s geopolitically bifurcating market)," the analysts noted, rating the stock a Buy with a CA$1.35 per share target price.

J.P. Morgan in May initiated coverage on partner company Boss Energy with a Neutral rating and a price target of AU$4. The company holds 20% of Laramide, according to Henderson.

"Laramide's key asset is the Westmoreland Uranium Project in Queensland, which has a current moratorium on uranium mining," the firm wrote. "The project has a total resource of 66Mlb (million pounds) U3O8."

According to a research report by James Bullen for Canaccord Genuity Capital Markets on May 6, La Jara Mesa was among the most recent additions to the FAST-41 program.

"Upon completion of any conditions in the ROD (record of decision), LAM will be eligible to receive permits allowing underground development activities and mine production," wrote Bullen, who rated the stock a Speculative Buy with a price target of AU$1.25.

"With US reactors requiring annual demand of ~50Mlbs, against a meagre ~1Mlbs of domestic supply, it is our view that these projects could have regulatory burdens alleviated," he continued. "Whilst La Jara Mesa is not one of LAM's 2 flagship projects, this could present a potential pathway to medium-term cash flows."

The Catalyst: Electric Grids Facing Serious Crunch

As the fuel for nuclear power, uranium is one of the most important elements for the energy transition. Our electricity grids are facing a serious crunch as the need for more power to drive artificial intelligence (AI) and data centers clashes with air conditioners working harder than ever before to cool our buildings as global temperatures rise.

However, "American domestic uranium production is reportedly only 2% of the U.S. reactor demand and a U.S. ban on Russian uranium imports puts a premium on U.S. domestic uranium supply," Stockhead reported on May 28.

According to a report by Mrinalika Roy for Reuters on Tuesday, industry experts said Trump's latest orders seeking to revitalize the U.S. nuclear energy industry could pull the uranium market out of its current lull and boost investor interest.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Laramide Resources Ltd. (LAM:TSX; LMRXF:OTCQX: LAM:ASX)

"Spot uranium prices have fallen about 30% from peaks hit in 2023 as institutional investors pulled out, spooked by recession fears and geopolitical instability," Roy wrote.

According to an October report on CarbonCredits.com, BMO Capital Markets projects a strong outlook for uranium demand, predicting it to grow at an annual rate of 2.9% through 2035, largely driven by China's aggressive push to build new nuclear reactors and the potential for reactor restarts in North America.

Ownership and Share Structure

According to Refinitiv, about 9% of the company is held by insiders and management, 20% by strategic corporate entities, and 17% by institutions. The rest is retail.

Top shareholders include Boss Energy Ltd. with 20%, Alps Advisors Inc. with 10.52%, the CEO Henderson with 7.13%, Mirae Asset Global Investments with 4.83%, and Vident Investment Advisory LLC with 1.11%.

Its market cap is CA$162.29 million with 262.3 million shares outstanding. It trades in a 52-week range of CA$0.41 and CA$0.83.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

* Disclosure for the quote from the Clive Maund article published on June 10, 2025

- For the quoted article (published on June 10, 2025), the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing the article quoted. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in the article accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed

Clivemaund.com Disclosures

The quoted article represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.