In January this year, I showed a chart with US$50 as the magnet this year. Spot silver prices broke out on the chart last Thursday and below here is the futures price, nearest contract July. We got a solid break out Monday with the Comex future prices yesterday and they are at US$36.50 today at this writing. I would want to see prices hold above US$36, but keep in mind that there still is a lot of short Bankster traders with Comex silver.

I expect gold prices could continue consolidating in the near term, so silver is where the action could be for the next few months as the price plays catch up to gold. The current gold to silver ratio is around 90 and a more normal ratio is around 60 which would propel silver to record highs above US$50.

Longer term as the bull market in gold and silver continues, I expect we will see silver prices between US100 and US$200. Silver has been in a supply deficit for a few years with growing demand from solar panels. However, all bull markets are driven by investment demand and that has hardly started yet.

Today I am adding silver producer Hecla Mining Co. (HL:NYSE) to the Selection List. It has been a long time since we owned Hecla. We sold it in 2011 for a 420% gain at US$6.80. We cannot buy it for US$1.25 like we did in 2008, but ironically we can buy it for less than what we sold it for in 2011.

Of course Hecla has grown and become a better silver miner since then, so is a bargain today.

Hecla Mining - - - NY:HL - - 52 week trading range US$4.41 to US$7.68

Shares outstanding 632.5 million

The reason I am adding this to the Selection List now is the chart break out in silver and in Hecla and Hecla is the largest primary silver producer in North America. The company has been around for 130 years and is the oldest NYSE listed precious metals company. This makes Hecla well known in the investment world and as I have said a number of times, it is always investment demand that drives a silver and gold bull market.

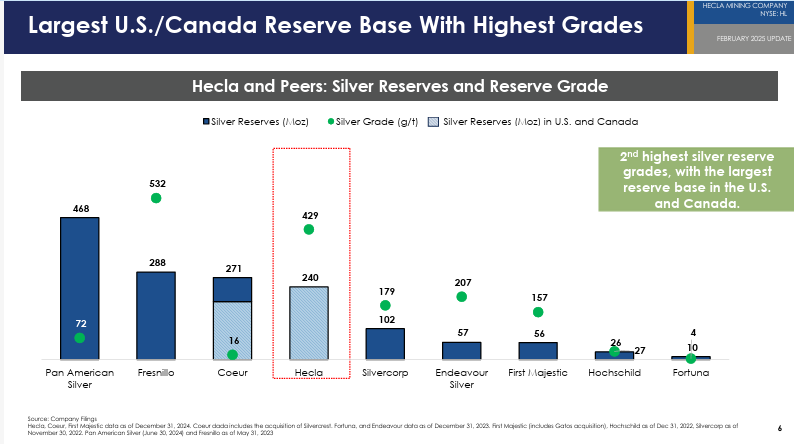

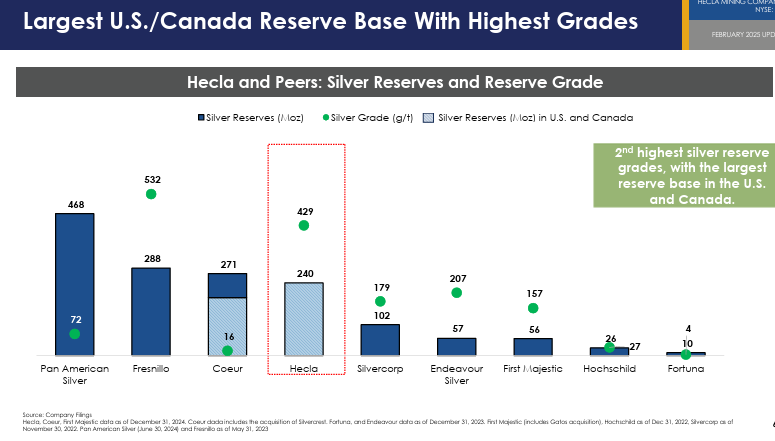

The company is performing very well. In 2024, Hecla delivered silver reserves of 240 million ounces, produced 16.2 million ounces of silver, both are the second highest in Company history. And Hecla generated record total sales of US$929.9 million.

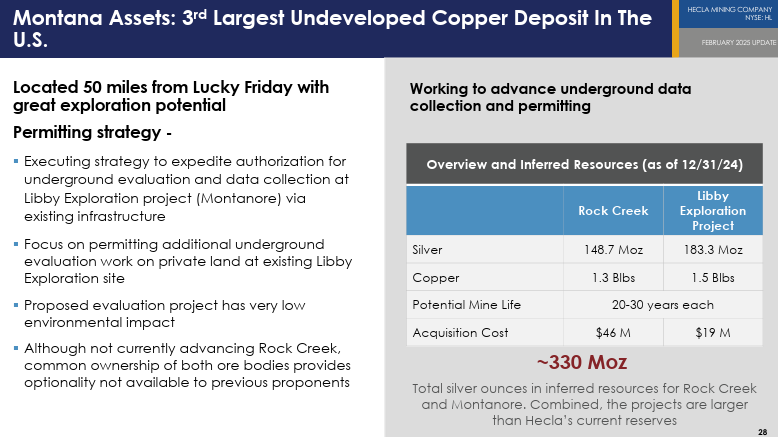

Another reason to buy is that Hecla's Libby Exploration Project in Montana was included in the Trump Administration’s March 18, 2025, announcement of advancing critical mineral projects under Executive Order 14241, Immediate Measures to Increase American Mineral Production.

As a result, the Project has been placed on the Federal Permitting Improvement Steering Council’s FAST-41 permitting dashboard, which will ensure the environmental review and authorizations schedule for the project is publicly available and allows all stakeholders to benefit from increased transparency.

“We're pleased that the Libby Exploration Project has been recognized in the White House's critical minerals initiative and added to the FAST-41 dashboard. This priority status acknowledges the strategic importance of developing domestic silver and copper resources and should help streamline the remaining permitting process as we move toward a final Record of Decision.” said Rob Krcmarov, President and CEO. “Having a fully permitted project would add significant optionality to our portfolio, and this milestone positions us well for the future.”

The project is a large silver and copper deposit located 50 miles from the Company’s Lucky Friday mine. Upon permitting approval the next steps would be to dewater and rehabilitate approximately 7,000 feet of the existing 14,000 foot Libby Adit, extend the adit by approximately 4,200 feet, and construct lateral drifts to conduct exploration activities. As of December 31, 2024, the project had Inferred resources of 183.3 million ounces of silver and 759 thousand tons of copper.

Their Rock Creek project is just a few miles away (trucking distance) and has a similar inferred resource of 148,688 ounces of silver and 658,410 tons of copper.

Silver Mines

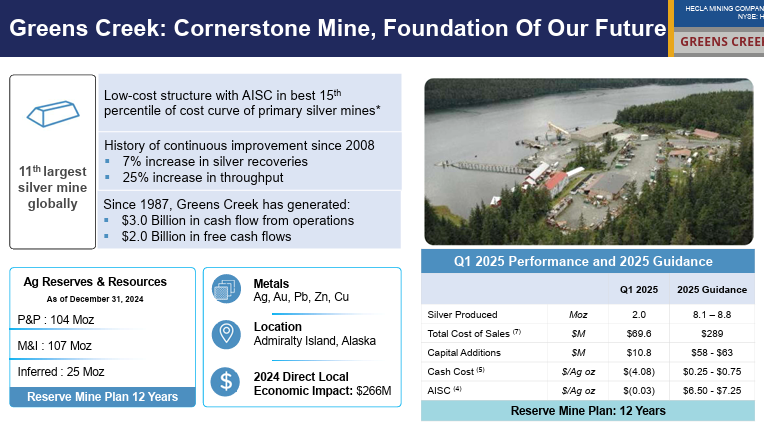

Hecla 100% owns and operates mines in Alaska (Greens Creek), Idaho (Lucky Friday), Quebec, Canada (Casa Berardi), and Yukon Territory, Canada (Keno Hill).

I am going to use slides from Hecla's presentation to highlight their three silver operations and their Montana copper/silver project. The Casa Berardi mine in Quebec is a gold producer with 1.3 million ounces of reserves and is producing around 80,000 ounces per year. A very good cash flow generator at today's gold price.

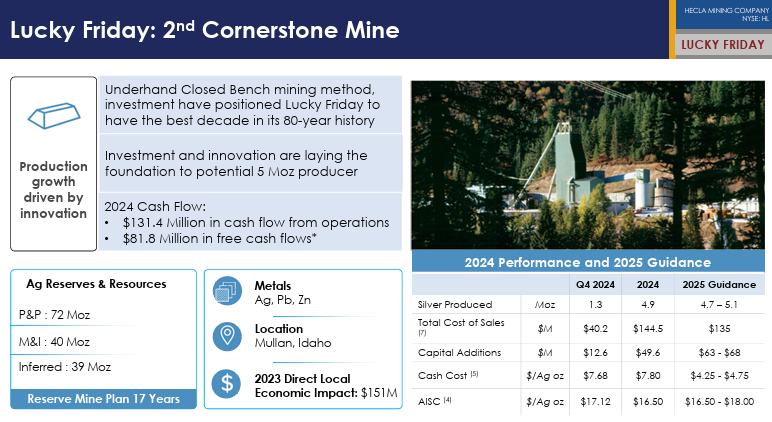

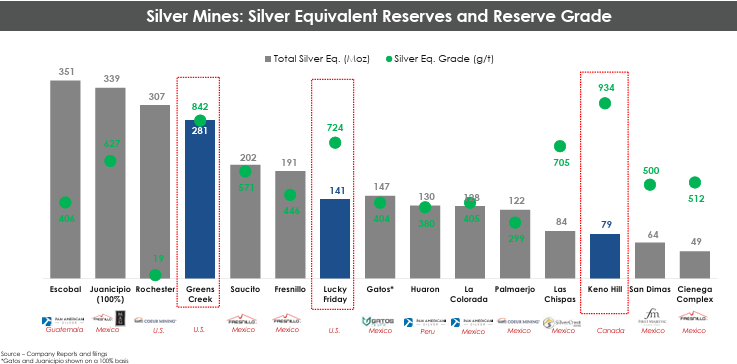

Lucky Friday and this next slide, Greens Creek are their most important silver producers and both are long term solid mines.

Keno Hill is the new mine since we last owned Hecla. I have visited this mine site, but at that time it was not in operation and sitting dormant. It is adjacent to Zonte's MJ Project and Alexco Resource opened the mine up again, then Hecla bought out Alexco in 2022, gaining 100% ownership. It is high grade with reserves at 24 ounces per ton silver. Historically, from 1913 to 1989, Keno producer over 200 million ounces of silver with and average grade of 44 ounces per ton. The mine is ramping up and operating around 300 tpd and Hecla's plan is to get this to around 400 tpd to make it much more profitable.

Financial

For Q1 2025 Hecla generated record sales of US$261.3 million, an increase of 5% over the prior quarter. Hecla reported net income applicable to common stockholders of US$28.7 million, or US$0.05 per share. They achieved record Adjusted EBITDA of US$90.8 million during the quarter, US$357.1 million during the last 12 months resulting in an improved net leverage ratio.

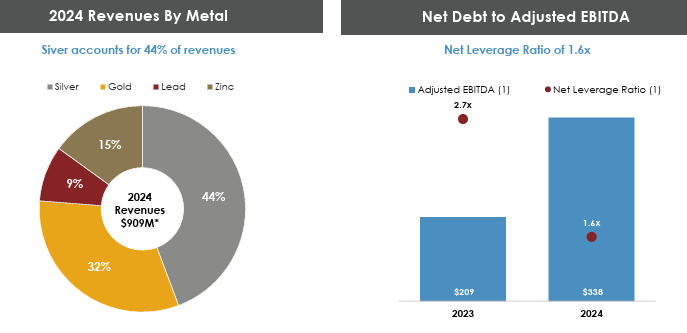

This chart is 2024 data but it highlights the significant contribution from gold. A number of stocks that investors consider silver stocks like Hecla, have ignored the positive effect of the significant gold revenue (at US$3,000 plus) they receive from their mines. This provides us better buying value.

Conclusions

Hecla has the highest grade silver mines in North America and the grades of their three silver mines are well above their peer averages.

The high grade of their silver mines is a big competitive advantage to peers.

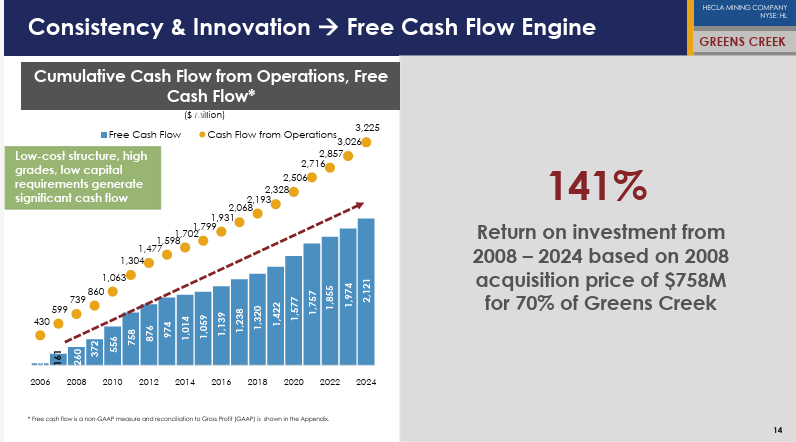

Hecla's silver assets were generating positive margins after covering all-in sustaining costs even in the previous low-price environment. This is a excellent slide to show how much better Hecla is now since we sold it in 2011. They have consistently increased cash flow, and now with silver prices going higher, this will jump big time.

In the last six months, insiders have purchased 713,135 shares vs. 98,667 sells.

Ignoring lead and zinc reserves, but adding in gold Hecla has 435,395 million ounces of proven and probable silver reserves at their producing mines. Including US$527 million debt, less cash, Hecla has a market valuation of US$4.43 billion. The market is putting a value of their silver reserves of about US$10 per ounce.

Hecla is a significant zince producer with 15% of 2024 revenues from zinc. Their mines are quite high grade with 6.2% grade at Greens Creek and 3.5% zinc at Lucky Friday. Zinc prices have been pretty decent since 2018.

The stock chart is quite interesting. It has basically been trading between US$4 and US$6 for almostfour years. However, in the past year it has put in a triple bottom around US$4.50 and has broken above the recent down trend. The stock did break resistance and make a higher high last Thursday but it could not hold on to this break out, so it might weaken a bit more.

I suspect if it drops further it will gain support from the 200-day MA around $US5.75. You could buy some now and more on any weakness down around US$5.80

Option traders could consider the January 2027 US$7 calls. They are around US$1.40 but give you about a 1.5-year time horizon.

| Want to be the first to know about interesting Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Ron Struthers: I, or members of my immediate household or family, own securities of: Hecla Mining Co. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.