Dryden Gold Corp. (DRY:TSXV; DRYGF:OTCQB) has announced the closing of its upsized equity financing, raising CA$5.1 million. Initially targeted at CA$2 million, the offering was increased three times due to strong demand from both institutional and high-net-worth investors. The financing included the issuance of 40,640,569 common shares and 12,942,137 warrants.

CEO Trey Wasser highlighted the exceptional interest in the company, stating in the news release, "In what is still a difficult market for junior exploration companies, we are very pleased to have had such an extraordinary reception to the Dryden Gold story. We upsized the offering 3 times, from $2 million to over $5 million. We now have the funds to continue drilling into 2025, to meet our 2025 final payment obligations, for re-logging of historic core and to complete all our planned regional exploration program. Dryden Gold would like to acknowledge the participation of several new institutional accounts, over 90 new high net worth investors from across Quebec and other provinces as well as our loyal existing shareholders who participated in the Upsized Financing.”

The Golden Market

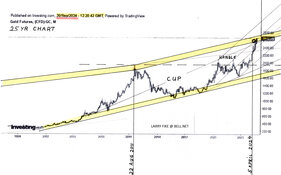

As Reuters reported on September 19, gold prices surged over 1%, approaching the CA$2,600 mark following the U.S. Federal Reserve’s monetary easing. This increase reflected the rising appeal of gold as a safe asset amidst ongoing economic uncertainty, with expectations for further growth into 2025.

UBS noted, “This rally could go further, in our view. We target CA$2,700/oz by mid-2025,” emphasizing the continued bullish outlook for gold.

Similarly, 321 Gold remarked on September 17 that gold is in a favorable position, where both investors and speculators could see significant gains. The publication noted that “Western ETF buyers could trigger a parabolic blowoff," potentially driving gold prices to new heights. This highlights the advantageous timing for Dryden Gold, as increased demand for gold could provide further support for their strategic drilling programs and land development.

Stockhead, in its September 13 report, highlighted how the recent surge in gold prices to US$2,568/oz has spurred renewed investor interest, particularly among money managers. This is reflected in Dryden Gold’s ability to secure substantial funding through its upsized financing, providing it with the capital necessary to advance its exploration efforts in Ontario, an area known for its high-grade gold systems.

Finally, as Kitco wrote on September 18, the sustained momentum in the gold market has invigorated the mining sector. Warwick Smith emphasized that mining stocks, particularly those of junior miners like Dryden Gold, stood to benefit significantly from this trend. Smith also noted that improving market sentiment could translate into greater value recognition for mining companies as gold prices continue to climb. This aligns with Dryden’s recent developments, which will enable them to expand their drilling activities and capitalize on favorable market conditions.

Dryden Gold Catalysts

The successful equity financing positions Dryden Gold for continued growth, with plans to extend exploration efforts and develop its flagship Dryden Gold Property in northwestern Ontario.

According to the company's October 2024 investor presentation, key catalysts include the re-logging of historic core, aggressive drilling campaigns, and the completion of regional exploration work to target high-grade gold systems. The company’s strong strategic land package and experienced management team offer additional upside potential, especially given the proximity of active players like Kinross Gold Corp. (K:TSX; KGC:NYSE),NexGold Mining Corp. (NEXG.V:TSXV; NXGCF:OTCQX; TRC1.F:FRA) and Kenorland Minerals Ltd. . (KLD.V:TSXV; KLDCF:OTCQX) . Furthermore, Dryden's landholdings cover a prolific gold-bearing structure, offering significant opportunity for future M&A activity .

Analysis of Dryden Gold

As Technical Analyst Clive Maund wrote on September 10, Dryden Gold Corp. was considered a “Strong Buy,” with both technical and fundamental factors supporting this recommendation. Maund highlighted that while the stock price was somewhat higher than its entry point in May.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Dryden Gold Corp. (DRY:TSXV; DRYGF:OTCQB)

Maund cited that the company's technical condition had "continually improved" and that Dryden's substantial district-scale land package, located in a favorable jurisdiction with excellent infrastructure, was a significant strength. Additionally, he emphasized the the already "very impressive results" from the company's ongoing exploration program and the cost-effective re-logging of drill cores.

Maund further noted that Dryden Gold’s land package lies within the prolific Greenstone Belt, an area known for important discoveries, which adds to the potential for Dryden to make significant finds. The presence of other major mining companies in the area, such as Kinross and NexGold, underscored the region's prospects. Dryden’s exploration focus on the Gold Rock Camp, which has shown near-surface high-grade gold, was also considered a key driver for future growth.

Ownership and Share Structure

According to Refinitiv, Stategic entities own 31.10% of Dryden with Alamos Gold Inc. (AGI:TSX; AGI:NYSE) holding an almost 10.73% stake in it, Eric Sprott owns 2.97%, Rob McEwen owns 2.48 %, Dynamic Funds owns 3.38% and other important stakeholders including management and insiders own 9.02%. Only 60% of the 134.53 million shares are available to retail investors.

According to Reuters, Euro Pacific Asset Management also owns about 5.43 % of the company.

Its market cap is CA$21.52 million, and it trades in a 52-week range of CA$0.40 and CA$0.10.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Dryden Gold Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own Dryden Gold Corp securities.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.