Bob Moriarty of 321Gold sat down with Robert Sinn Goldfinger Capital to discuss the current state of gold, silver, and a few gold companies Moriarty believes are worth keeping an eye on.

The two spoke about the Beaver Creek Precious Metals Summit, which Sinn attended. Sinn spoke about how busy the conference was and how there were many people there with packed schedules.

He said the summit's tone was very formal, and this is because while gold has hit US$2,600, the stocks have not followed.

Bob Moriarty stated that he agrees that we are just getting started with gold and silver. He stated, "Silver has just come along for the ride, and I think silver will go a lot higher, but US$2600 gold is just absolutely extraordinary." He believes that we will see a lot of mergers and takeovers in the future as the majors are "eating their young." Moriarty noted that the majors have ceased funding juniors, which he believes will cost them in the end.

Sinn commented that the merger and acquisitions cycle may be in an upswing.

Silver

They then went on to discuss silver, which Moriarty described as "always the last to show up to the party." He went on to say that the biggest indicator of a massive bullish move in silver would be that the penny dreadfuls are not doing anything.

Sinn reported that this could be for a myriad of reasons, including the high cost of capital and the poor performance of seniors in 2022 and 2023. He stated that once larger companies like Newmont hit higher, the juniors should follow, though he pointed out that while we are close, we are not there yet.

Moriarty agreed.

The Best Mining Jurisdiction

Sinn then asked what would be the premier mining jurisdiction since this has been a hot-button issue.

While self-admittedly very biased, Moriarty said he thinks the best jurisdiction would be Canada, with the United States (specifically Nevada) as a second.

He said the question that should be asked is who should be avoided, rather than who should be sought out. In terms of companies to avoid, Morairty stated Mexico is not friendly at the moment as they have "cut their own throats" through resource nationalization, which "destroys the mining industry." He noted that this nationalization occurred in Bolivia in 1954 and has since taken 70 years to rebound (though it is a great jurisdiction now).

Among other companies to avoid, Moriarty listed Peru and Colombia.

Then Moriarty pointed out an outlier as while Australia tends to be very good, the Australian juniors tend to have lower valuations. Canada seems to be the most popular pick.

When asked what specific area of Canada he likes, Moriarty pointed out the vast amount of gold in Ontario, but also brought up the great projects currently in the Yukon.

Snowline Gold

The conversation then pivoted to Snowline Gold Corp. (SGD:CSE; SNWGF:OTCQB) in the Yukon, which Moriarty believes is a "slam dunk for a takeover." He mentioned they are getting $85 an ounce but that he thinks they should be getting $200 to $400 in a takeover and they're getting 85

The most junior of exploration companies were getting 100 back in 2011, he said.

Sinn said Snowline was a favorite of his. The company has a "beautiful ore body that could definitely fetch 200 an ounce but they need to derisk it further and there has been some negative optics in the Yukon in 2024 . . . they need to work through that and prove that they have strong support from the First Nations in their area.

Perpetua

Sinn then pivoted to Perpetua Resources Stibnite Gold Project in Idaho, which the company received its Federal permits from the US forest service.

"That's a big deal," Sinn said. "The state of Idaho is coming of age again," as it was once a big mining state in the late 1800s. This Stibnite project was mined for antimony in WW2, for which Sinn commented "the U.S. Army left it as an environmental mess. Ever since, it has been seen as a reclamation project, and Sinn believes Perpetua has moved it back to being a permented mining operation, with a large deposit of gold and antimony as well.

When asked his thoughts, Moriarty first commented on the recent news that China has restricted sales of antimony, which can greatly impact the two main sources of domestic antimony in Southern and Northern Idaho.

"I think there's a bright future for antimony if for no other reason than the geopolitical tensions between the US and China."

Sinn then pivoted and asked "let's assume we are in a bull market in the junior mining sector, at some point some of these stocks may be up quite a bit and people may have profits on their hands."

"What are some sentiment tools that you look for when deciding when to sell junior mining stocks.

Moriarty said "when everyone wants it ."

"The sentiment around juniors is horrible, which I think is a good thing because I'm a contrarian but when everyone wants to buy it like they did in 2008 and 2011, that is a good time [to sell]. One of the things I emphasize in my books is that you need to figure out why you are in the market in the first place. You can never go wrong selling at a profit. Because if you don't sell at a profit the only alternative is to sell at a loss. You cannot be apart of the herd, the heard always gets slaughtered. You have to be a contrarian," rather than a victim.

Sinn then asked if it didn't matter how good the news is if everyone already owns it.

Moriarty said yes you have to ignore the news at some point and sell when everyone wants it. He pointed out Nvidia as an example. "When everyone wants in, you want out, and when everyone wants out, you want in."

Sinn then asked about companies Morairty wanted to talk about before wrapping up. Moriarty asked Sinn's POV on Sitka's latest results

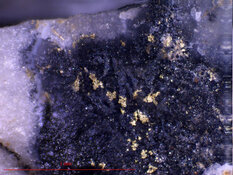

Sinn said there was a lot of physical gold, and Bob pointed out it was a 700 meter hole at 680 meters appeared to be mineralized with 48 examples of VG, cluster near the bottom of the hole.

"It is my opinion that it is another valley deposit and it is going to compare to snowline. and here's where it gets beautiful. Sika has a 75 million market cap and 1.4 mill ounces in a resources. Snowline has an 838 million market cap and snowline is worth `11 times more than sika but I believe the assets out in 2-3 weeks are going to be barn burner and its going to be an intercept of several hundred meters. I asked Quenten and he said it would be in the neighborhood of 1.3 to 1.5 grams. I have never seen that much vg in any hold ever so I think it's going to be higher than that, but Siko is an absolute sleeper. They announced the hold, the stock went up, but that's it."