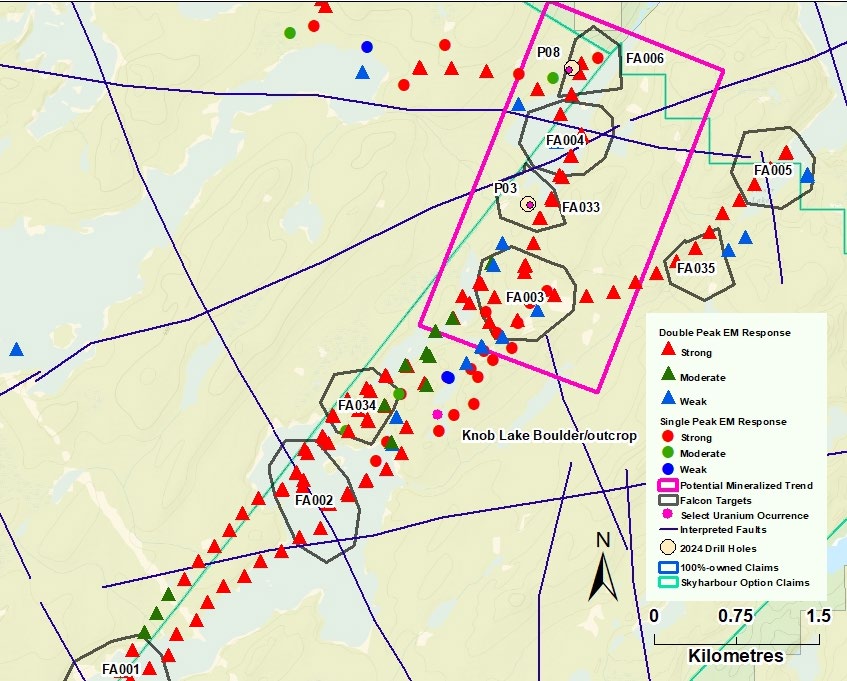

North Shore Uranium Ltd. (NSU:TSX) identified 12 targets and prioritized three of them for possible future drilling, in Zone 1 at its Falcon uranium project in Saskatchewan's Athabasca Basin, noted a news release.

"We believe that the eastern margin of the prolific Athabasca Basin is a great setting for a major new uranium discovery," President and Chief Executive Officer Brooke Clements said in the release. "Building upon our maiden 2024 Falcon drill program, our target generation work is allowing us to build a quality pipeline of potential drill targets."

North Shore identified all targets through electromagnetic data from three airborne surveys, data from airborne gravity-magnetic-radiometric surveys, data from significant historical exploration programs and structural interpretation.

Falcon's Zone 1 is one of three exploration zones into which North Shore has divided the Falcon project. Within this zone, the exploration priority area includes the northeast-southwest trending conductor/structural zone where near-surface uranium mineralization was discovered via drilling of P03 and P08 in early 2024. P03 is a zone from 196.6–209 meters (196.6–209m), from which samples returned 345 parts

per million (345 ppm) and 378 ppm of U3O8. P08 is a 4.7m interval from 42.3–47m, from which samples returned 316 ppm and 572 ppm of U3O8.

North Shore's newly prioritized targets in Zone 1 are:

1) A 3 kilometer (3 km) trend from targets FA006 to FA003, which includes the new uranium discoveries at P03 and P08. This trend also encompasses target FA004, where two interpreted faults intersect and the electromagnetic (EM) conductor is offset.

2) Target FA003. Within the 3 km trend, two prominent parallel northeast-trending EM conductors each change orientatio

n at FA003. This occurrence and a prominent gravity low anomaly may indicate a potentially significant structure is present there.

3) Target FA002. This target is defined by two strong parallel EM conductors and a parallel magnetic low. An interpreted cross-cutting fault intersects the conductor system.

To date, across Zones 1, 2 and 3, North Shore has identified 36 targets.

Executing its Exploration Strategy

As well as at Falcon, British Columbia-based North Shore also is prioritizing uranium exploration targets, in preparation for future field work including potential drill programs, at its other project West Bear, 90 km away.

"As the company continues to execute on its exploration strategy at Falcon and West Bear, we believe that the stock has the potential to rerate," Red Cloud Securities Analyst David Talbot wrote in a research report earlier this year.

Falcon consists of 15 mineral claims, four of which, covering 12,791 hectares (12,791 ha), North Shore owns, explained the analyst. As for the remaining 11 claims, spanning 42,908 ha, the company has an earn-in option with Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE) to earn up to an 80% interest in them. Later, it will have the option to purchase the remaining 20%.

Talbot highlighted that Falcon is "within a great location," a tier one area for discovering new mineable, high-grade uranium deposits. The property is prospective for shallow basement-hosted unconformity-style (Athabasca style) and pegmatite-hosted mineralization similar to that discovered at the Fraser Lakes Zone B, about 3 km to the south, with an Inferred uranium resource of 10,400,000 tons (10.4 Mt) of 0.03% U3O8, or 7,000,000 pounds (7 Mlb) of U3O8. Also, Falcon is on the Wollaston trend notable for two recent discoveries, Baselode Energy Corp.'s (FIND:TSX.V; BSENF:OTCQB) ACKIO and Cosa Resources Corp.'s (COSA:CNSX; COSA:CSE) GMZ. Further, Falcon is 35 km east of the active Key Lake uranium mill and former mine having produced 209.9 Mlb of U3O8 at an average grade of over 2%.

Prior to North Shore's maiden drill program earlier this year, Falcon has seen limited drilling, noted Talbot. Twenty-two holes were completed in only four areas between 1969 and 1971, and 28 holes were drilled east of the property in 2008.

Regarding the 4,511 ha West Bear project, North Shore has the option to earn up to 100% interest in the five claims comprising the project, noted the news release, by completing certain payments, exploration work and other commitments by April 2025, according to its agreement with Gem Oil Inc.

West Bear is just south of Uranium Energy Corp.'s (UEC:NYSE AMERICAN) West Bear cobalt-nickel deposit that hosts probable reserves of 1.4 Mlb of U3O8, Talbot wrote.

In addition to exploration, North Shore also continues to evaluate opportunities to expand its portfolio of uranium properties.

Need for More Production

The longer-term outlook for uranium indicates additional production will need to come online to meet demand, according to industry experts.

"From the beginning of the next decade, planned mines and prospective mines, in addition to increasing quantities of unspecified supply, will need to be brought into production," according to the World Nuclear Association (WNA), Reuters reported in a Sept. 7 article.

Demand for uranium in nuclear reactors is expected to climb 28% to 83,840 tons by 2030, up from 65,650 tons this year, and by 2040, nearly double to reach 130,000 tons. The association forecasts nuclear capacity to rise 14% by 2030 and surge 76% by 2040. The WNA attributes this increase to growing interest in nuclear power worldwide.

According to Citi, as reported by Market Index in an Aug. 24 article, the cumulative need for uranium between now and 2030 is projected to be 40 Mlb, exceeding forecasted supply by 2 Mlb. Power consumption is expected to rise 11% by 2030, in large part due to artificial intelligence and data storage centers, and this will drive demand growth. Another contributor will be the increasing need for low-carbon emission power generation globally, to meet green energy goals.

As for uranium production, Citi forecasts it will increase between now and 2026, with 17 Mlb being added this year, 14 Mlb in 2025 and 12 Mlb in 2026. After, however, production is expected to fall off sharply, with 9 Mlb being added in 2027, 2 Mlb in 2028 and 1 Mlb in 2029.

While inventories of U3O8 should balance the market in the near term, according to Citi, they are expected to decline by 20 Mlb to only 18 Mlb by 2030.

Regarding the uranium price, Citi analysts expect an imminent recovery. Their base case forecast has the uranium price reaching US$98 per pound (US$98/lb) later this year but averaging about $94/lb. For 2025, Citi forecasts an average price of US$110/lb. (The uranium price now is about US$79.50/lb.)

The Catalyst

North Shore indicated in the news release it will continue prioritizing targets at Falcon to maximize the chances of discovery success in its next drill program. As of now, the program would consist of follow-up drilling along the 3 km trend and testing of new targets in Zone 1 and possibly elsewhere.

In the meantime, the company will continue to provide updates on this work.

Stock is a Buy, Per Analyst

Technical Analyst Clive Maund recommended North Shore Uranium as immediate Strong Speculative Buy in a May report when it was CA$0.17 per share. Now it is trading significantly lower.

Then, the stock was at a good entry point, Maund wrote. The trading pattern had formed the second low of a double bottom, and the price subsequently had not moved up much.

"The stock looks ready to break out of this base pattern soon to commence the expected new bull market," he noted.

Ownership and Share Structure

According to Reuters, four insiders own 7.39%, or 2.72 million (2.72M) shares, of North Shore. They are President, Chief Executive Officer and Director Brooke Clements with 3.55% or 2.72M shares, Director Doris Meyer with 2.10% or 0.78M shares, Director James Arthur with 1.58% or 0.58M shares and Director James Thom with 0.16% or 0.06M shares.

Retail investors hold the remaining 92.61% of the company. There are no institutional investors at this time.

North Shore has 36.83M outstanding shares and 34.11M free float traded shares.

Its market cap is CA$1.76M, and its 52-week trading range is CA$0.055–$0.30 per share.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |