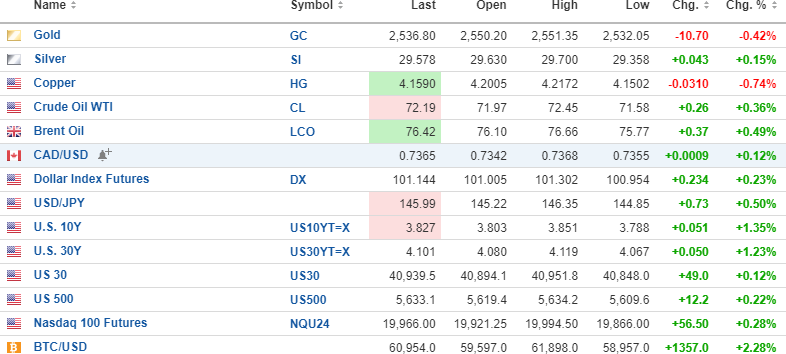

USD dollar index is up again today taking yields higher with 10-yr. yield now 3.833% and the 30- yr. at 4.108%. Metals are mixed with gold (-.50%), and copper (-.90%) losing ground but silver (+.15%),. Oil (+.36%) is advancing. Stock futures are up .12% (DJIA) to .28% (NASDAQ) with the S&P 500 (+.22%) modestly higher. Risk barometer Bitcoin has once again scaled $60,000 up 2.28% at $60,954.

Results of the FOMC meeting were released yesterday during which it was conceded that a 25- 50 basis point rate cut is warranted at the September 9th meeting. Economic data is weakening at a rapid clip and it did not help that the Bureau of Labour Statistics released the revisions to their employment numbers (“jobs”) and reported that they overstated payrolls by 818,000 jobs. In other words, they fabricated those phony new jobs through the use of their economic “models” what included the “birth-death adjustment” that always enhances the number. It illustrates the uselessness of those CNBC drama kings and queens sitting around a table all guessing “the number” every other Friday morning when the BLS releases their bogus findings. Then the “expert commentators congratulate themselves on how and why they arrived at their estimate knowing full well that “the number” is flawed, wrong, and ultimately subject to egregious revisions. Total horsefeathers!

The next big sideshow will be tomorrow when Fed Chairman Jerome Powell addresses the Jackson Hole cabal with his keynote speech that should shed some light on policy giving the

CNBC moderators and “expert commentators” something to prattle on about nothing.

New idea

There is a tendency for markets to rally in anticipation of rate cuts but then sell off after those cuts are initiated. Since the Fed has now telegraphed their intentions to cut rates, I look for the equity markets to begin to move lower as trepidation over “WHY” they are cutting becomes the new narrative, as in, they must be seeing something in the data that is spooking them. A modest replacement of the volatility trade may be in order as a speculation of a negative marker reaction after September 9th.

Ø BUY 1/3 position (3,000 shares) VIX futures ETF (@X’s) (UVIX:US) @ $4.50

Target: $10.00 by end of October

American Eagle Gold Corp. (AE:TSXV / AMEGF:US) traded down to within a penny of my CAD

$.40 purchase price before rallying to close at $.50. Thee are six trading sessions left in the

month so I am going to see if there is some month-end book-squaring pressure still to come and leave the “buy” order at $.40.

I had two very informative discussions with management of Vortex Minerals Inc. (VMS:TSXV / VMSSF:US OTC Qx) yesterday first with CEO Vikas Ranjan followed by colleague and friend Michael Williams (Chairman and Co-Founder). The Illapel project in Chile has just completed sampling of rock chips in areas not previously believed to contain copper-bearing mineralization but it now looks lie they may be onto rock geochemistry with IOCG (“iron-oxide-copper-gold”) characteristics. The old workings (adits) at Illapel are known to contain economic-grade copper bearing material in the rock walls so the upcoming drill program expected to commence before month-end is a matter of scale and not so much grade. Because the RIO-27 mine is operating right next door, if they can put together a resource with size, it could really light up in the absence of serious CAPEX requirements, thanks largely to the operating mill located adjacent to Illapel.

The stock has backed off from the 52-week high last seen on May 21st on no volume largely due to no news. I am bidding CAD $.085 in hope that month-end liquidations will cooperate and think it is an excellent risk-reward trade-off.

BUY 200,000 VMS:TSXV/VMSSF:US OTC Qx) @ CAD $.085 / USD $.06

| Want to be the first to know about interesting Critical Metals, Gold and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |