Prosper Gold Corp. (PGX:TSX.V; PGXFF:OTC) has shaped up nicely since it was recommended at CA$0.095 early in July and shows signs of being in the earliest stages of a major new bull market. Before reviewing the latest charts for the stock, we will overview the positive fundamentals of the company again in the context of the emerging major bullmarket in gold, assisted by slides from its latest investor deck, and then consider the latest news from the company, which is also positive.

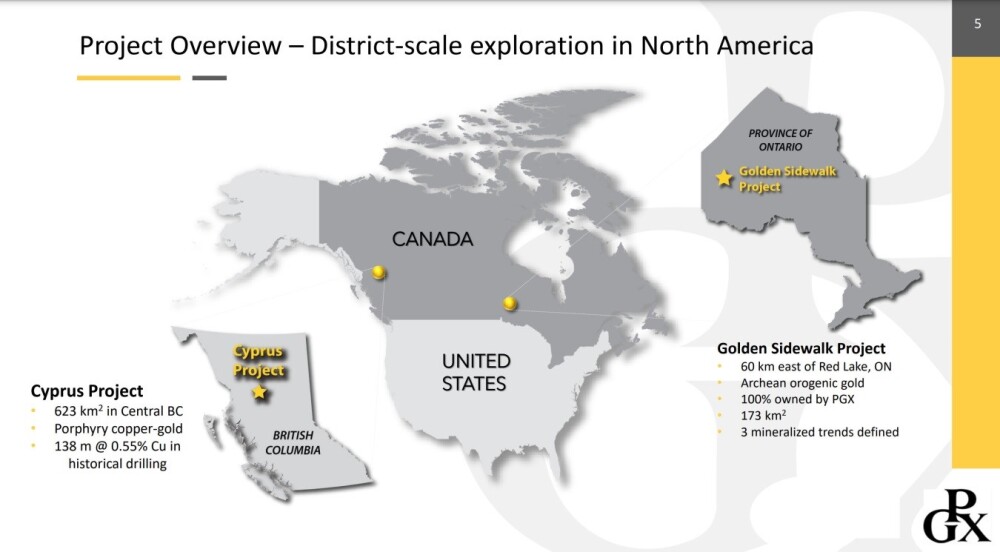

The company has two potential district scale projects ongoing in Canada, the one in British Columbia in the west being the Cyprus Project which covers an impressive 623 square kilometers and the one in the center of the country being the Golden Sidewalk Project which is 60 kms east and Red Lake and has a land area of 173 square kilometers as show non this slide.

We do not normally dwell on personalities in these reports, but before going any further, it is a good point to mention that Prosper Gold has an experienced and outstanding management team. This team includes Peter Bernier, an experienced prospector who, in 2005, teamed up with renowned research geologist Dirk Templeman-Kluit to create Richfield Ventures.

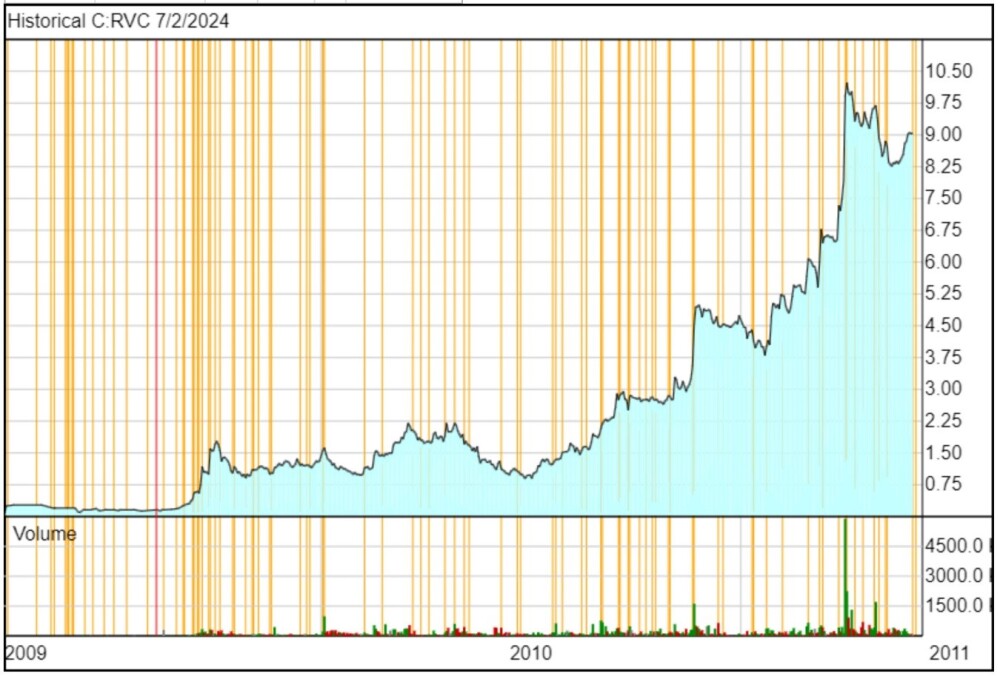

They made a major find in central BC, for by mid-2010, drilling had defined a significant bulk tonnage deposit. An initial resource estimate (indicated and inferred) containing 4.2 million ounces of gold was announced in March of 2011, and to cut a long story short, Richfield was bought out by New Gold in 2011 for $550 million , and New Gold has continued to advance the project as a potential large scale open pit mine.

You can read the full story about this discovery here. Needless to say, the effect of the discovery and the subsequent buyout on Richfield's stock was spectacular, as the following chart shows.

The point is that people of this calibre are not going to mess around with something that has little potential which means that as they are part of the management team of Prosper Gold, it clearly has a very good chance of making a significant discovery or discoveries. After all, if Peter Bernier can do what he did with Richfield Ventures once, he can do it again.

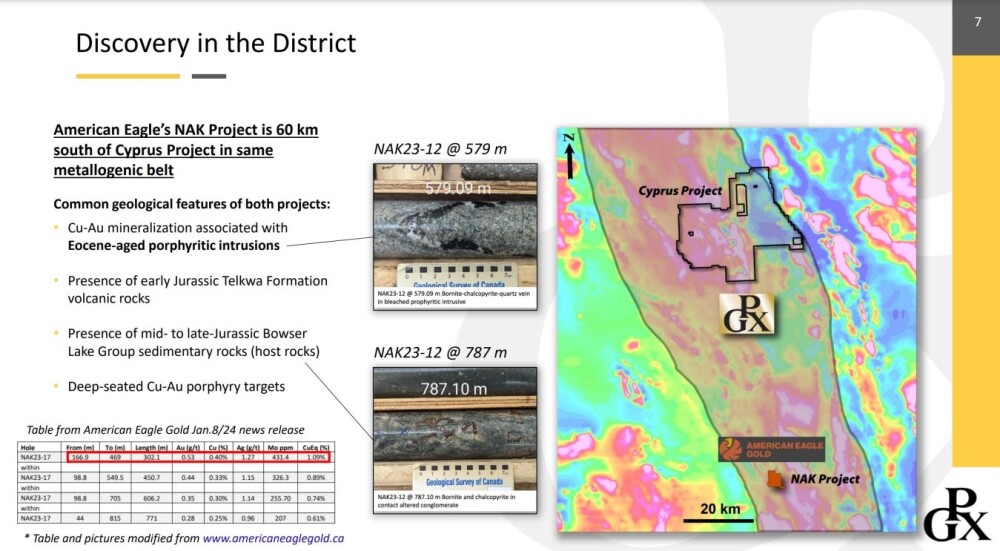

Before considering the Cyprus Property itself it is worth noting that it is not far away from the American Eagle's NAK Project which is 60 kms to the south in the same metallogenic belt, where significant discoveries have been made. Whilst this doesn't guarantee the same sort of results at Cyprus, it certainly augurs well.

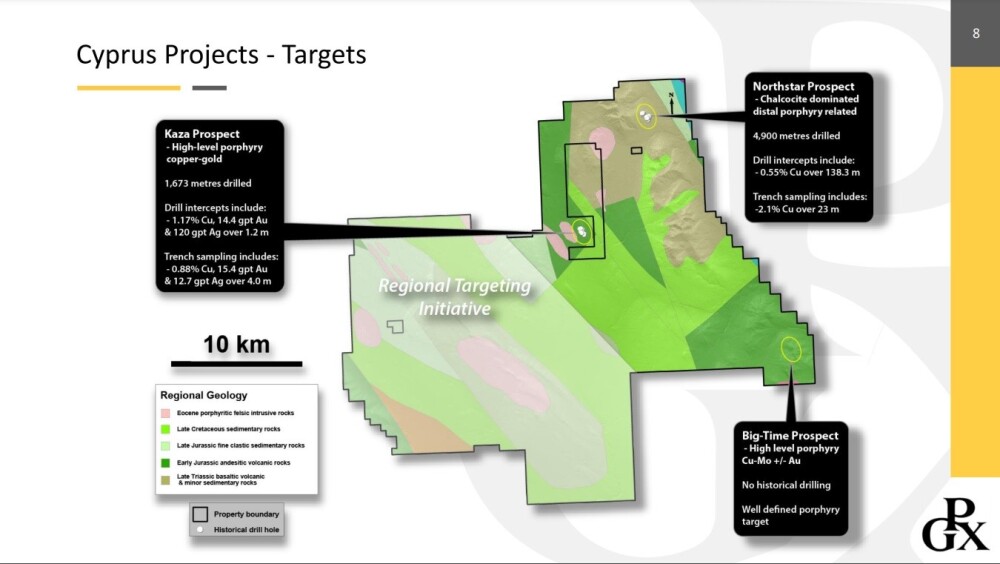

The following slide shows the geography of the Cyprus Project and details the main prospects within it.

Back in February, the company announced a massive expansion of this project to a land position of 61,880 hectares so that it is now one of the largest in the region. This is viewed as a very positive sign since the company would not have done this without good reason, and this announcement followed soon after the company entered into an option agreement to acquire 100% of the project.

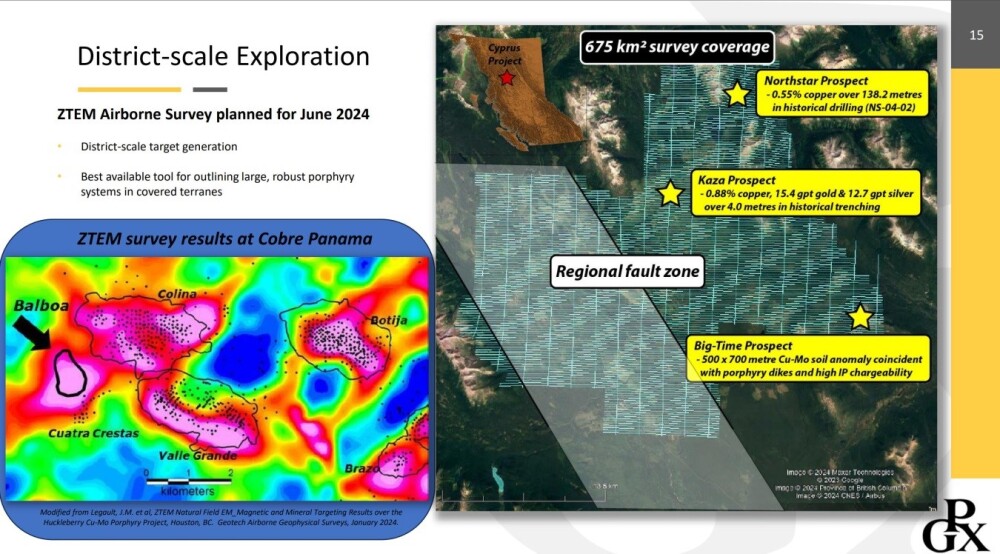

The company is currently undertaking a ZTEM aerial survey of the Cyprus Project, and the pending results could act as a catalyst for the shares' price. The next slide shows what such a survey uncovered at Cobre Panama.

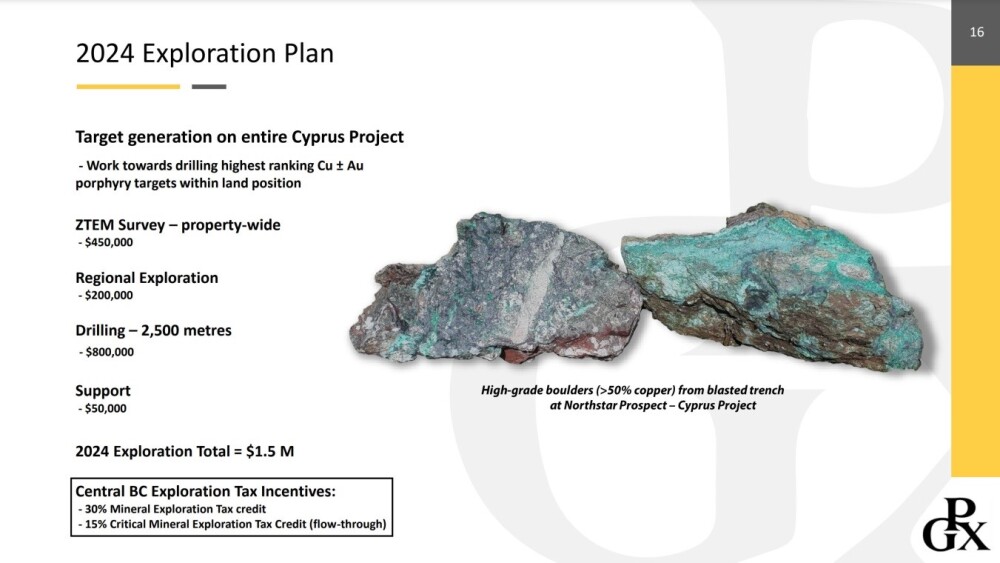

This next slide summarizes the 2024 exploration plan.

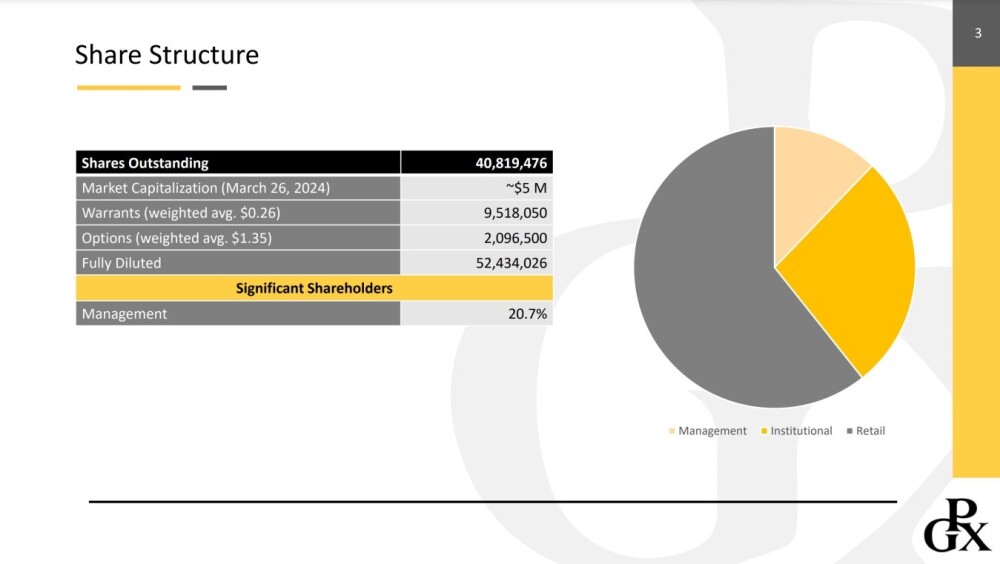

This last slide shows the share structure, and on it, we see that of the 40.8 million shares in issue, about 60% are in the float, meaning less than 30 million, which is a very reasonable figure given how long the company has been around.

Since we last looked at Prosper Gold, the company has closed a $465,000 financing whose proceeds will be used to finance exploration activities at the company's Cyprus Project, and the closing of the financing, of course, removes a constraint on the share price and very soon after that on the next day it was revealed that President and CEO Peter Bernier purchased 715,000 units of the company on the July 25 through a non-brokered private placement which clearly bodes well for the company as it is an indication that the person who knows as much about the company as anyone, if not more, is sufficiently confident of its future that he has acquired a substantial stake in it.

Turning now to the latest stock charts, we see that Prosper Gold has shaped up nicely since it was recommended at CA$0.095 early in July. On its 10-month chart we can see that right after we looked at it, it broke out of a Cup base and rose sharply to make a 50% gain in a week. After that, it had a normal correction back to the now rising 50-day moving average where it was again a Buy — and it still is as it is believed to be in the early stages of a second upleg.

The breakout just described is probably better classified as a preliminary breakout as it didn't break the price completely clear of the base or result in a cross of the moving averages. However, the second upleg should accomplish both, and, this being so, there is thought to be a good chance that the next upleg will be substantially larger.

The 5-year chart continues to show a very positive picture indeed. The most important point to observe on it is the big buildup in volume from last November through to the present which is revealed to have been largely upside volume by the steeply climbing Accumulation line.

This is very bullish and is an indication of the "smart money" position-taking ahead of a major new bull market in the stock. It also means that once all available supply at this level has been soaked up, the price will take off higher and recent action suggests that it is starting to.

We, therefore, stay long, and Prosper Gold Corp is therefore rated an Immediate Strong Buy for all time horizons.

Prosper Gold Corp.'s website.

Prosper Gold Corp. (PGX:TSX.V; PGXFF:OTC) closed for trading at CA$0.125, US$0.0852 on August 12, 2024.

Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of American Eagle Gold Corp.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.