Canter Resources Corp. (CRC:CSE; CNRCF:OTC; 601:FRA) has provided a significant update on its Columbus Lithium-Boron Project, located near Tonopah, Nevada. The project has made notable advancements since November 2023, marking substantial milestones that have enhanced the project's value and de-risked it ahead of further drilling operations.

CEO Joness Lang highlighted the project's potential, noting in the news release, "Our comprehensive modeling and shallow drilling to-date have demonstrated that multi-commodity potential and reinforced our conviction that a major brine discovery can be delivered in this unique basin." The Columbus project targets a mix of lithium and boron, similar to Ioneer's Rhyolite Ridge Project, and has shown promising results through recent strategic actions and exploration efforts.

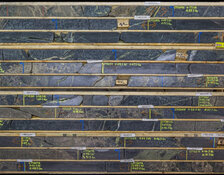

In the past few months, Canter Resources completed the strategic acquisition of Altitude Ventures, secured CA$3.5M in financing, strengthened their corporate and technical teams, and obtained critical water rights and key permits. The company's Phase I drill campaign, consisting of 15 holes, validated the 3D geological model and consistently intersected shallow aquifers with widespread lithium and boron mineralization.

A Look Into Lithium

The lithium sector has been evolving rapidly, driven by technological advancements and a growing focus on sustainability. Historically, lithium mining was criticized for its environmental footprint. However, as Carboncredits.com noted in July, "And while it’s not exactly great for the soil (neither is farming for that matter) – it’s not nearly as bad as many make it out to be. To give you a comparison – it’s far less destructive to the environment than oil fracking is." This highlights the relative environmental benefits of lithium mining compared to other extractive industries.

Recent technological advancements have further improved the environmental impact of lithium extraction. Carboncredits.com reported, "Recently – we’ve seen even greater increases in technology and efficiency that will help the social perception of lithium mining. In fact – multiple European Union officials (many with aggressive pro-environment stances) now say that it’s 'crucial' to show local populations that lithium mining is no longer a 'dirty operation'." This shift is bolstered by new methods being developed in places like California's ‘Lithium Valley,’ where companies are using clean energy sources such as geothermal power to extract lithium, significantly reducing the environmental impact.

Michael McKibben, a geochemist and professor at the University of California, emphasized the environmental benefits of these new extraction methods. He stated, "It’s important not to call it mining. . . because compared with conventional lithium mining, this process has minimal environmental impacts."

Further advancements in direct lithium extraction (DLE) have been promising. According to McKinsey & Co., this approach offers several benefits over traditional methods, including increased lithium recoveries from around 40% to over 80%, significantly reducing the footprint of evaporation ponds, and lowering the need for fresh water and production times.

The growing demand for lithium is also driven by its critical role in renewable energy and electric vehicles (EVs). Investopedia highlighted, "In particular, lithium goes into the batteries of electric vehicles (EVs), wind turbines, and electronic (smart) grids, all of which lower global CO2 emissions." The use of lithium-ion (Li-ion) batteries has exploded over the last decade due to their high energy density and long life cycle. "Li-ion batteries, pound for pound, are some of the most energetic rechargeable batteries available. They are much lighter than other types of rechargeable batteries of the same size and have a high energy density, which means that they can store more energy than other batteries of the same size," Investopedia reported on July 24.

The cost of lithium-ion batteries has also dropped dramatically, making them more accessible. Carboncredits.com noted, "With modern innovations and greater productive capacity – we’ve seen the cost of using lithium batteries plunge over 97% between 1991 and 2018 (from US$7,500 to US$181). That’s 41x cheaper in less than 30 years." Between 2014 and 2018, the cost of lithium-ion batteries decreased by 50% in just four years.

Major energy companies are also recognizing the potential of lithium. Mining.com wrote on July 27, "The move into lithium makes a lot of sense for these large international energy companies. Unlike some other niche metals, lithium is relatively abundant, so the resource needed to match rising demand for batteries is there, it just needs to be efficiently extracted." These companies bring the necessary technology and expertise to identify, characterize, and produce lithium-bearing brines from deep underground.

ExxonMobil, for instance, has committed a significant part of its US$20 billion budget for low-carbon projects through 2027 to lithium. Darren Woods, ExxonMobil CEO, stated in an April 30 conference call, "ExxonMobil is aiming to supply enough of the battery metal to power 1 million vehicles by 2030."

Company Catalysts

Looking ahead, Canter Resources has engaged Cascade Drilling LP for the Phase II drill program, set to commence in mid-August. This phase will test a third aquifer zone target and demonstrate lateral continuity between previous drill grids while also exploring additional regional targets to the north. Expected outcomes from Phase II include brine results in Q3 2024, sediment results, and multi-element analysis in early Q4 2024, along with an updated 3D model and finalized plans for subsequent drilling phases.

Additionally, reconnaissance surface sampling at the Beaver Creek Lithium Project will take place in the second half of 2024. The company has also commissioned Applied Hydrologic to complete a NI-43-101 Technical Report for the Columbus Project within the same period. Canter's multi-phased drilling approach aims to provide a comprehensive dataset for mapping and profiling the shallow aquifers at Columbus, with a focus on preliminary mineral resource considerations.

Canter is actively engaging with prospective partners, including direct extraction companies, government and educational research centers, and larger mining companies, to expand and accelerate exploration efforts at Columbus. This collaborative approach is expected to enhance the project's development and bring further value to the company's stakeholders.

Outside Views on Canter Resources

On July 30, Jeff Clark from The Gold Advisor expressed positive sentiments about Canter Resources' recent drilling results. He highlighted the widespread mineralization observed in the Phase I drill program, noting, "These results continue to demonstrate widespread mineralization. And it starts right at surface." Clark also pointed out the significant potential for deeper, higher-grade brines, stating, "These Phase I Geoprobe results confirm the presence of significant concentrations of lithium and boron in multiple zones. And there is strong evidence for deeper, higher-grade brines, which the company will test in Phase II drilling."

Additionally, Chen Lin mentioned Canter Resources positively in the July 30 "What's Chen Buying? What's Chen Selling" newsletter. He noted, "CRC had good lithium boron results coming out, they are planning the next phase of drilling soon." This further underscores the promising prospects for Canter Resources as they advance their drilling program.

Ownership and Share Structure

Streetwise Ownership Overview*

Canter Resources Corp. (CRC:CSE; CNRCF:OTC; 601:FRA)

According to the company, managers and insiders own about 9.6% of Canter Resources, and strategic investors (including the founding group and Michael Gentile & Advisors) own about 12%.

The investors with the largest stake are all insiders. They are CEO and Director Joness Lang with 3.39%, Director and Strategic Adviser Warwick Smith with 2.18%, Director and Technical Adviser Kenneth Cunningham with 1.95%, Chief Financial Officer Alnesh Mohan with 0.97%, and Director and Technical Adviser Eric Saderholm with 0.58%, and Gentile, who owns about 4% personally.

Four institutions or funds, including Euro Pacific Asset Management, collectively hold 3%. Retail investors own the remaining.

The Canadian explorer has 51.29 million outstanding shares, 46.45 million free float traded shares with a CA$7.44 million market cap.

Over the past 52 weeks, Canter has traded between CA$0.07 and CA$0.99 per share.

| Want to be the first to know about interesting Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Canter Resources Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Canter Resources Corp.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.