There has been quite a severe drop in Lithos Group Ltd. (LITS:CBOE.CA; LITSF:OTCMKTS; FSE:YU8; WKN:A3ES4Q) stock since we last looked at it for capital markets reasons, yet the fundamental reasons for owning the stock remain much the same, and despite the drop in price it has remained under accumulation as we will see and while this admittedly is little consolation if you are holding the stock it does greatly increase the chances of a powerful rebound.

A number of reasons for the drop have emerged, which include 15% of the stock coming out of escrow at the end of April, which was then dumped, and in addition, the analyst covering the stock at Beacon Securities quit, but the important point is that while these negative factors were in play those "in the know" continued to buy the stock which explains why the Accumulation line has continued to rise even as the price has dropped and the reasons that they have continued to buy even in the face of some heavy selling is that there is a range of powerful catalysts in play that should drive the stock much higher and probably sooner rather than later since some of them are set to impact very soon.

These include. . .

- The company is still in the running for a US$30 million DOE (US Department of Energy) grant, which the company applied for back in January that is expected to be announced shortly, meaning during the next few weeks. If awarded, this grant exceeds the capitalization of the company.

- The company is negotiating three multimillion-dollar pilots after spectacular lab results with three of the largest lithium brine producers in the Western hemisphere, two of which are in Chile and one in Argentina.

- The company is in line for a number of contracts worth CA$5 to CA$6 million.

- The company is expecting to get an independant stamp of approval or validation from a reputable engineering firm on the quality of its technology and its recovery rates.

A big technical reason for reviewing it again here, in addition to the unrelenting accumulation, is that it appears to be making the second low of a Double Bottom and to be ready to advance anew, and in fact, it is looking like a "coiled spring" here so the rebound could be dramatic, especially if there is significant positive news out of the company.

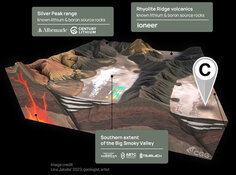

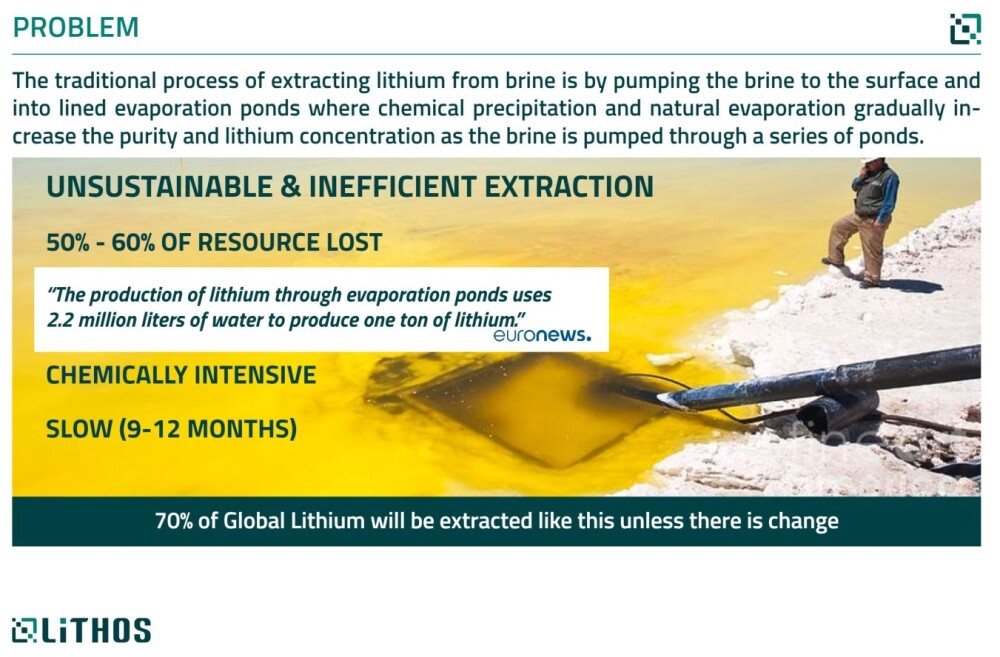

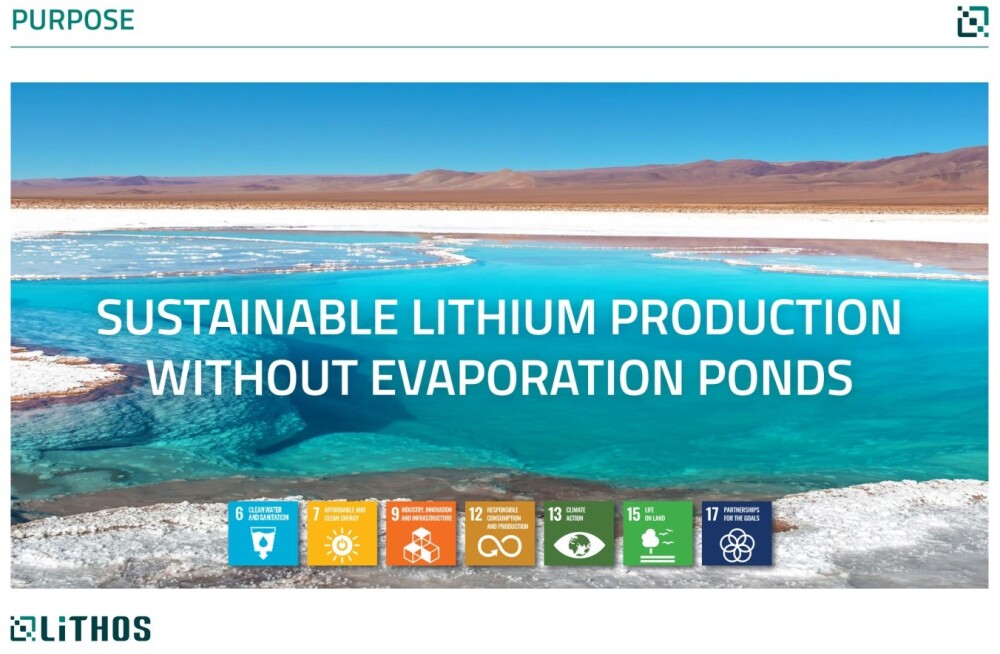

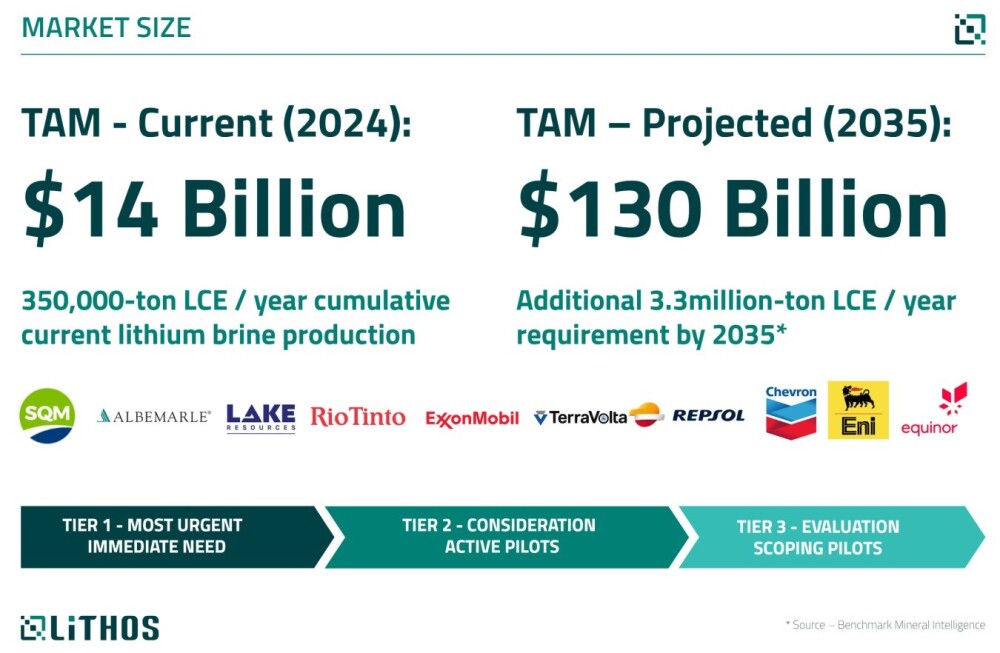

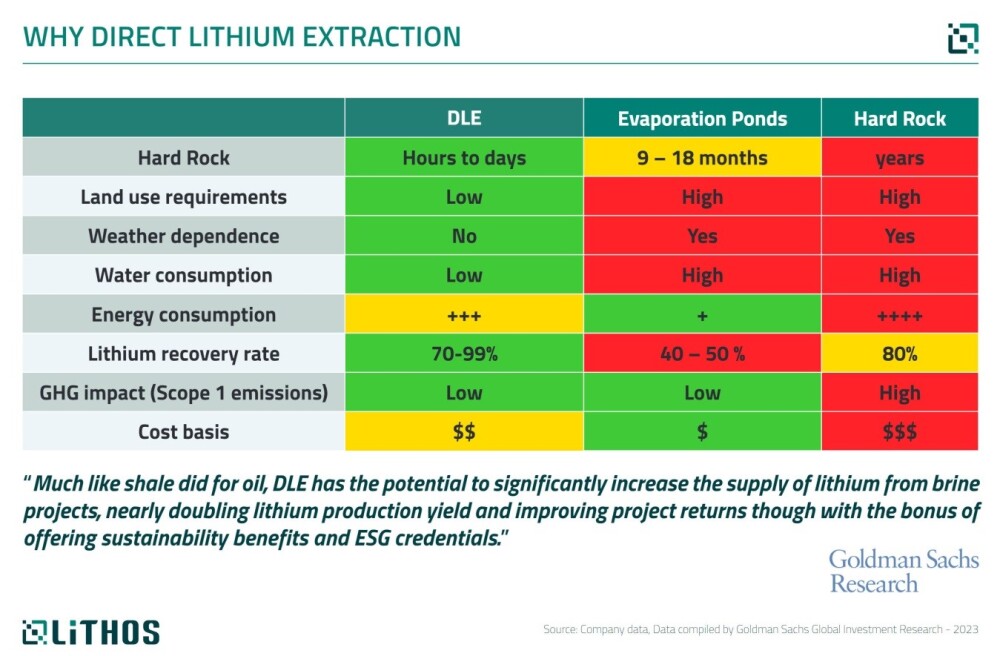

Before considering its latest chart, it is worth taking another look at what the company brings to the lithium extraction industry with its proprietary DEL technology, which eliminates the need for extraction ponds and greatly improves the production yield.

Following are some very illuminating slides lifted from the company's investor deck.

Slide 7 shows the problem that Lithos' pioneering technology does away with.

Slide 5 shows the company's technology, which makes sustainable lithium production possible without the need for evaporation ponds.

Slide 9 shows the over 9-fold increase in demand for lithium by 2035.

Slide 16 shows the huge increase in production yield from brine projects afforded by the company's proprietary DEL technology.

Turning now to the chart for Lithos, we can see on its latest 6-month chart that, having broken below its moving averages, it accelerated to the downside into what looks like a final low early in June. Then, after stabilizing and attempting to rally last month, it dipped back to mark out what looks like the second low of a Double Bottom early this month, with a prominent bullish "dragonfly doji" appearing on the chart about a week ago whose intraday low is believed to mark the low for the downtrend in force from the February peak.

What is truly remarkable about the action of recent months in Lithos is that, even though the price has continued relentlessly lower, its Accumulation line has continued to climb and make new highs, and while, as mentioned above, this is little consolation to holders of the stock, it is an indication of inner strength and suggests a strong possibility that a powerful "snapback rally" is in the works, and from the look of the chart this could happen soon, especially given that downside momentum as shown by the MACD indicator is steadily dropping out.

Holders of Lithos Group should, therefore, stay long and perhaps add to holdings, and the stock is rated an Immediate Strong Buy here. It is available to U.S. investors on the OTC market, where it trades in healthy volumes.

Lithos Group's website.

Lithos Group Ltd. (LITS:CBOE.CA; LITSF:OTCMKTS; FSE:YU8; WKN:A3ES4Q) closed at CA$0.27, US$0195 on July 12, 2024.