The stock charts for Infinico Metals Corp. (INFM:TSX) that we will examine in due course clearly show that it is in a position to embark on a potentially major bull market as it has completed a very large base pattern. The nickel sector was slammed several months ago, and the stock is still at a very low price, especially relative to its exploration potential.

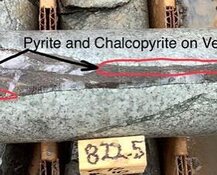

Thus, it is interesting to learn that the company made a very significant high-grade nickel intercept at its Nicobi Magmatic Nickel Sulphide Project in the Abitibi region of Quebec back in February as a result of a modest Winter drill program when it also discovered extension of mineralization in a 120 meter step out.

In addition, the company recently received (April 2024) encouraging results from borehole electromagnetic (BHEM) surveys completed during the January 2024 drill program and newly interpreted conductive features identified from surface electromagnetic surveys conducted in 2015 and 2023 at Nicobi.

Internationally renowned exploration geologist Dr. Quinton Hennigh said, "High-quality magmatic nickel sulfide discoveries are quite rare lately. Infinico has encountered 1.4% Ni over 52 meters in hole NBI-24-001 starting at grassroots at its Nicobi Project in Quebec. This hole appears to have encountered mineralization in an area on the edge of a huge magnetic feature interpreted to be a mafic-ultramafic intrusive body. Recently collected EM data indicates the presence of multiple conductive zones potentially representing new, even larger, bodies of such sulfide mineralization. With drilling imminent, this could turn into a very exciting discovery story very quickly."

Any exploration company with an intercept of 50 plus meters at over 1% nickel is trading at a minimum valuation of CA$20 million to CA$30 million yet Infinico is currently valued at about CA$3 – CA$4 million, having hit an intercept of almost 52 meters at 1.63% with assays on the site turning up grades as high as 8% and known mineralization proven to at least 80 meters depth.

This should give you an idea of the potential for revaluation of the company.

It should, therefore, be of great interest to investors to learn that the company is now mobilizing to delineate the resource and show scale with a permitted and targeted 2500-meter drilling program set to begin in the middle of this month and with assay results expected to be returned from mid-August through into September, it is clear that the stock is certainly not lacking catalysts going forward.

As internationally renowned exploration geologist Dr. Quinton Hennigh recently commented. . .

"High-quality magmatic nickel sulfide discoveries are quite rare lately. Infinico has encountered 1.4% Ni over 52 meters in hole NBI-24-001 starting at grassroots at its Nicobi Project in Quebec. This hole appears to have encountered mineralization in an area on the edge of a huge magnetic feature interpreted to be a mafic-ultramafic intrusive body. Recently collected EM data indicates the presence of multiple conductive zones potentially representing new, even larger, bodies of such sulfide mineralization. With drilling imminent, this could turn into a very exciting discovery story very quickly."

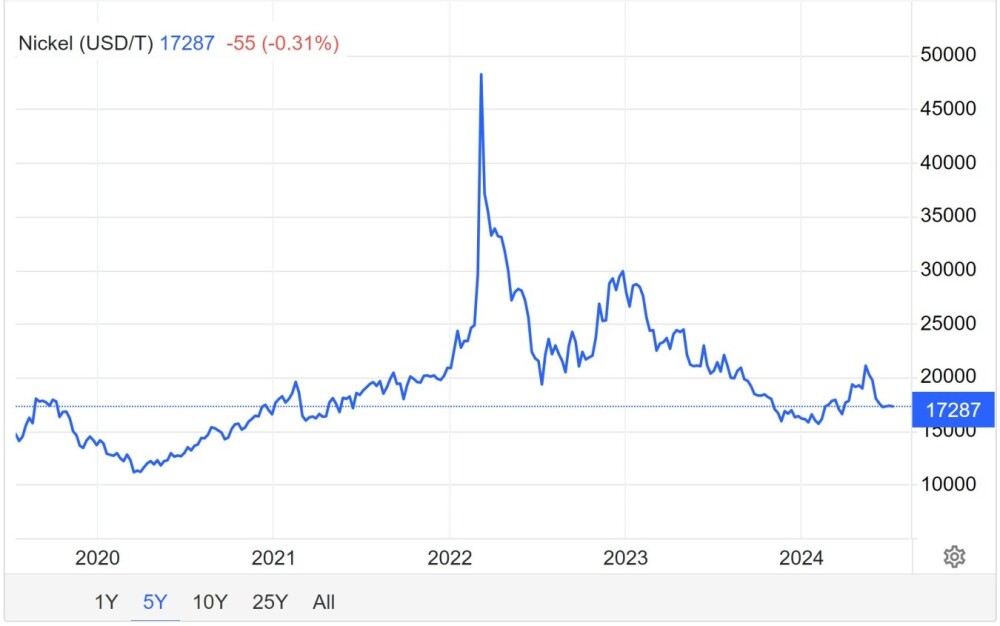

Another positive background factor for the company and its stock that is worth taking into consideration is that the nickel price looks like it has been basing since late last year after the severe bear market that followed the 2022 price spike, as we can see on nickel's latest 5-year chart shown below.

In addition to nickel, which is in high demand not just for Steel production but also for its use in the production of batteries for EVs and other purposes, the company is also exploring for other critical raw materials including copper, cobalt and lithium with lithium having recently been discovered at the company's Dalhousie Project.

Now, we will proceed to overview the fundamentals of the company using slides from its latest investor deck before examining its stock charts.

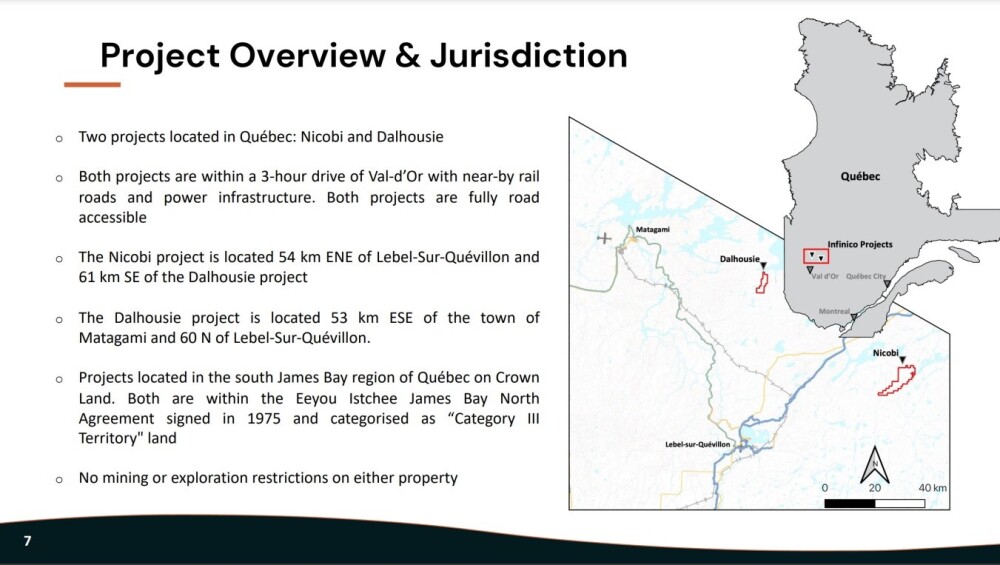

The company has two projects, Nicobi and Dalhousie, located in Quebec Canada and, following the high grade nickel intercept on the property in February, Nicobi will be the principal focus of activity this year as the company seeks to delineate this resource and it is also noteworthy that the company found lithium at Dalhousie last November. The first slide shows the location of these projects and provides some relevant geographical information.

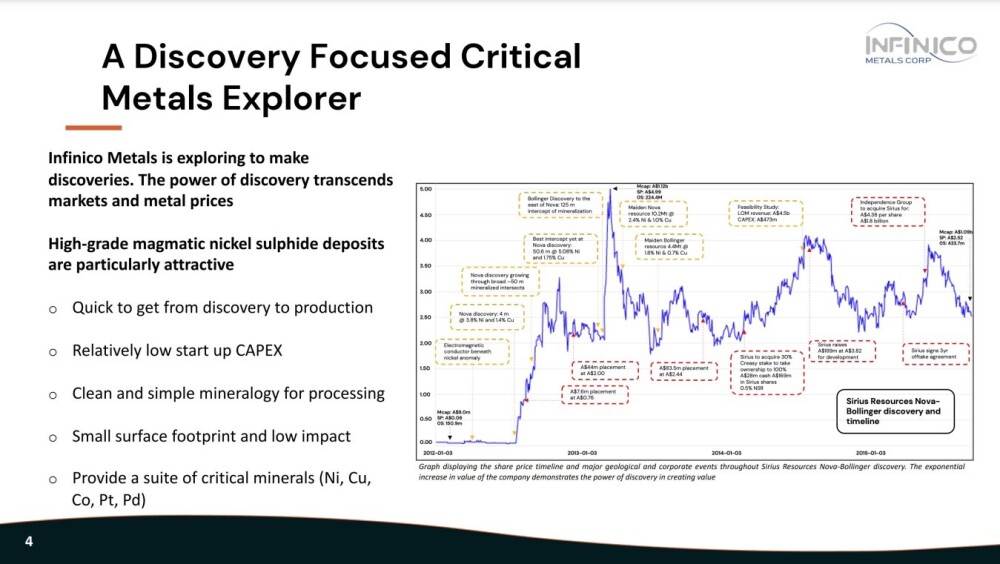

The next slide sets out the "modus operandi" of the company and interestingly it also shows what happened to the stock of a company that in its early stages was not dissimilar from Infinico — Sirius Resources went from a market cap of $9 million to $70 million in just one week following a big discovery and went on to eventually be valued at $1.8 billion.

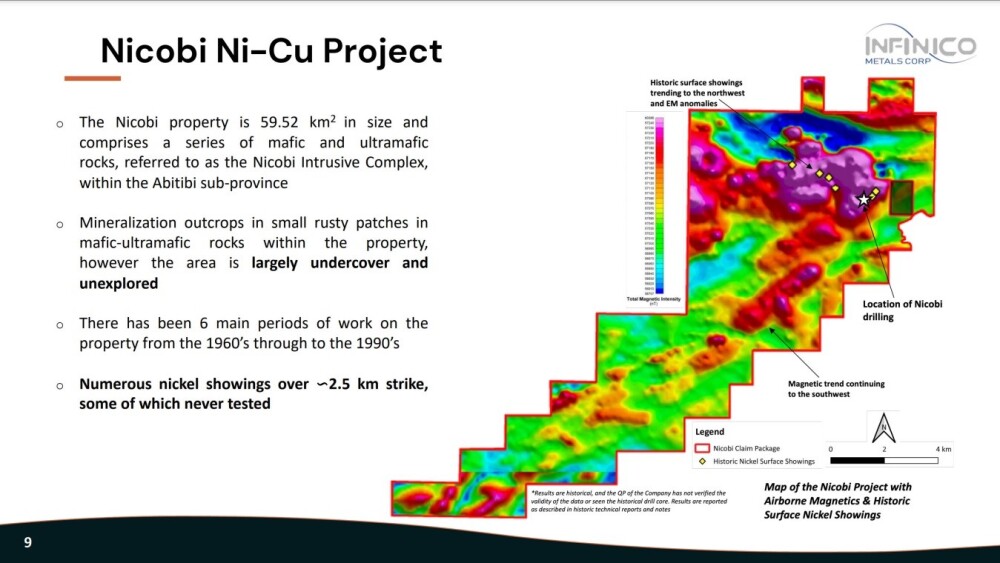

The following slide shows the geography of the Nicobi property in more detail and highlights the airborne magnetics and historic surface nickel showings and it is worth noting that even if this Summer's drill program does not produce the hoped for results, there are plenty of other nickel targets on the property to be explored.

Here it is worth mentioning that the company has the advantage that it is able to capitalize on work done back in the 60's by Noranda and Inco who discovered the mineralisation at what is now Nicobi back then.

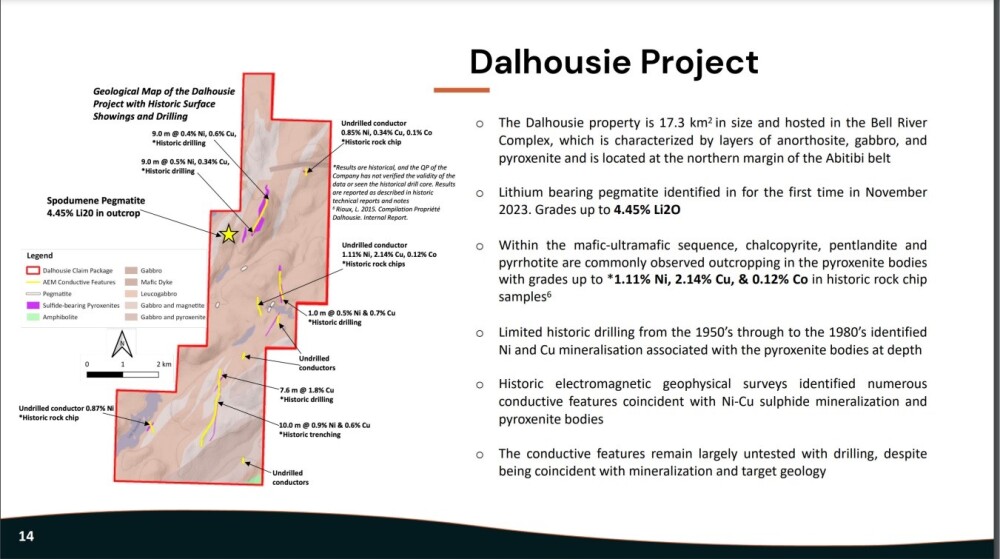

Meanwhile, the company's smaller Dalhousie Project in the same general area awaits further exploration. Last November, the company found significant lithium grades on the property, and there are indications that there is plenty of cobalt, too.

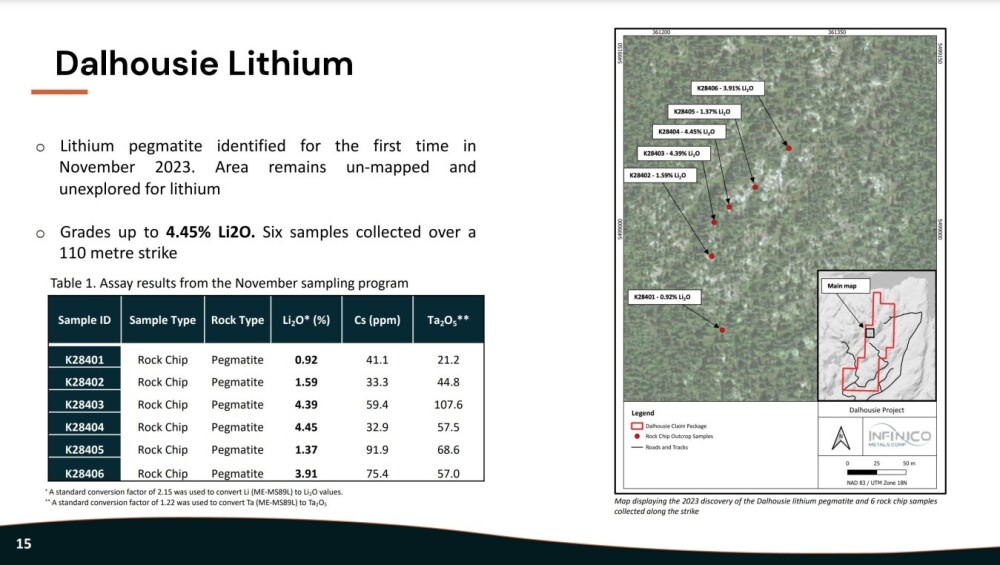

This slide shows details of the six samples gathered at Dalhousie and their lithium grades.

The pie chart on the side shows the ownership of the company.

Currently, Infinico Metlas has 57.7 million shares.

According to Infinico Metals Corp., as of July 2024, 3% of the company is owned by management and insiders.

40% is with institutional investors.

6% of institutional holdings is with SIDEX.

28% of institutional holdings is with Plethora PE.

The rest is with retail.

There are 12.4 million warrants in issue.

These warrants have an exercise price of CA$0.15.

These will expire in November 2025 and June 2026.

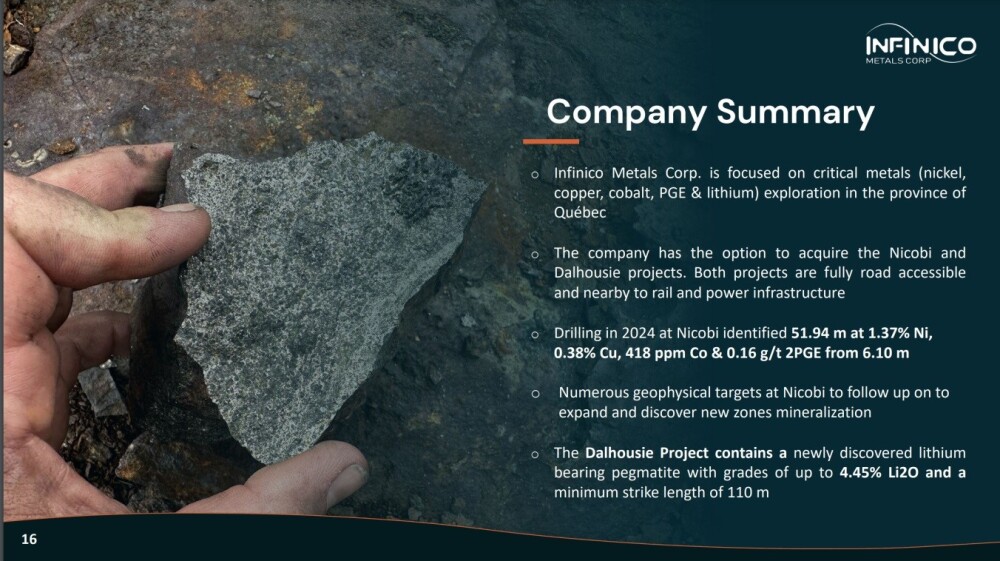

This last slide provides a summary of the company.

Now, we will examine the latest charts for Infinico Metals stock.

Technically, this is an excellent point to accumulate / buy Infinico Metals stock for.

As we will see, it is now in the latest stage of a giant Cup and Handle base that has been building out at a low level since mid-late 2022.

On the 3-year log chart, we can see that the day it started trading late in 2021 was its best day.

Immediately afterward, it went into a severe bear market that, by the time it had hit bottom in mid-2023, had erased about 95% of the stock's value at its highs.

However, the giant base pattern that has been drawn on the chart started to form well before, late in 2022, and it has been building out right up to the present.

Now, this base pattern looks complete with a rather elongated Handle part of it having formed to complement the Cup, and with the price and it's now horizontally trending moving averages bunched quite closely together, this is a potent setup that could trigger a breakout, especially if a catalyst comes into play like good drilling results.

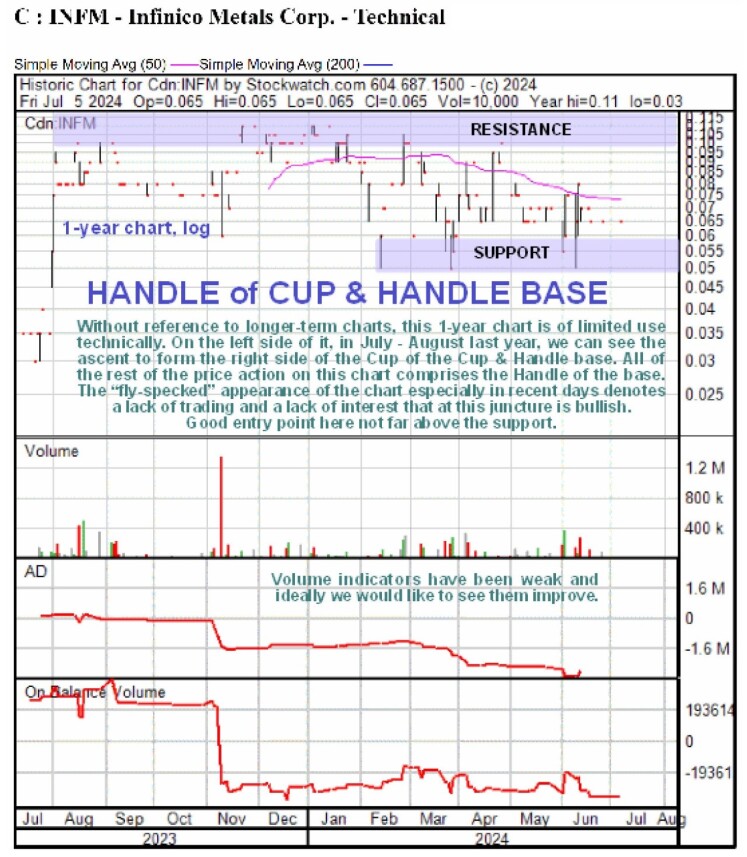

Whilst it is of limited use technically, especially without reference to longer-term charts, the 1-year chart does enable us to see the Handle part of the pattern in detail (the sharp rally to form the right side of the Cup can be seen on the left of the chart). This chart looks "fly-specked," with the numerous dots denoting days when little or no stock was traded.

This lack of interest as a low base pattern forms is quite normal, and it reveals that selling has dried up and buyers have yet to show up; it is therefore construed as bullish, for when buyers do finally make an appearance, they will find a market in which little or no stock is available and they will have to bid the price up to bring out sellers.

The conclusion is that Infinico Metals is in the latest stage of a fine, clear base pattern and, therefore, in a position to break out into a major new bull market, and once a catalyst appears, like positive drill results, it can be expected to break out. The current quiet trading conditions are, therefore, presenting investors with the perfect opportunity to accumulate / buy the stock at a good price in a favorable environment. It is rated an Immediate Strong Buy in this area, and the news just out (after the close on 8th) that the company has just closed the second and final tranche of a non-brokered private placement removes a constraint on the stock price.

Infinico Metals Corp.'s website.

Infinico Metals Corp. (INFM:TSX) closed at CA$0.065 on July 10, 2024.

Want to be the first to know about interesting Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- Infinico Metals Corp. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, between US$1,500 and US$2,250.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Infinico Metals Corp.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.