Xplore Resources Corp. (XPLR:TSX) appointed John Newell to its board of directors and closed its acquisition of the property at the northern border of its flagship Surge project, the company announced in a news release.

As for the board addition, Newell brings with him several decades of experience in financing and managing successful resource exploration and development companies, the company said. He is the president and chief executive officer (CEO) of Golden Sky Minerals Corp., which owns the copper-gold Rayfield project in south central British Columbia that will see its inaugural drill program later this year, two discovery-rich gold projects in the Yukon, and the Auden project in Timmins Ontario. Newell also is a regular contributor to and guest commentator for multiple mining and investment publications.

Compelling Critical Metal Company

Headquartered in Vancouver, Canada, Xplore is an attractive investment opportunity for five reasons, Technical Analyst Clive Mand wrote in a May report. He listed them.

One, the lithium explorer owns strategic land positions along the 10-kilometer (10 km)-long prospective Root Bay lithium trend in the top tier mining jurisdiction of northern Ontario. Xplore's overall land package includes its Surge project, its Perrigo project, and five properties the company may fully acquire over three years per an existing option agreement. These properties, totaling 11,000 hectares (11,000 ha), are Root North, Root Falls, Cathy Creek, Raggy Creek, and Aerial Lake.

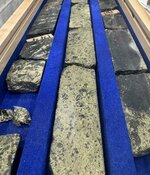

Surge spans 12,480 ha on the eastern extension of the Root Bay trend, near Lithium One Metals' Root South project and associated with lithium-bearing pegmatite at Green Technology Metals' newly discovered Root Bay deposit at its Root project, according to Xplore's 2024 Corporate Presentation. New results of Green Technology's drilling on its property near its border with Surge returned intercepts, including 23.3 meters (23.3m) of 1.16% lithium oxide (Li2O) and 11.7m of 1.12% Li2O.

Xplore's 3,400 ha Perrigo project is adjacent to Green Technology Metals' Allison Lake project, in the region's lithium-cesium-tantalum "Goldilocks" zone, an area in which lithium is found usually 1−4 km away from a source batholith, in this case the Allison Lake batholith. Also, within 3 km is the Ouroboros Pegmatite, of which channel sample assays showed up to 950 parts per million (ppm) lithium, 1,510 ppm tantalum, 321.2 ppm niobium, and 1,620 ppm cesium.

Two, given the potential of its properties, Xplore is considered a likely takeout target, Maund pointed out.

Three, Xplore recently closed a financing, Maund wrote, "so this constraint on appreciation of the stock is no longer in play." Through a private placement, the company generated CA$2.1 million (CA$2.1M) in gross proceeds.

Four, the company plans to actively explore Surge in the near term.

The Catalyst: Start of Drilling

Xplore President and CEO Dominic Verdejo expects a catalyst-filled period of growth ahead, he wrote in the release.

With permits now in hand, the Canadian explorer anticipates starting a diamond drill program at Surge soon.

Details are yet to be released. Also slated for the project this year, according to its corporate presentation, are prospecting, mapping and sampling followed by outcrop stripping and, later in the year, generating additional drill targets.

Lithium Breakout Likely Soon

Maund's fifth reason for why Xplore is compelling is that a near-term rebound in lithium is likely after months of being in the doldrums. The expected breakout into a new bull market would rekindle interest in the sector.

Gerardo del Real, editor of Resource Stock Digest, wrote in a June 17 newsletter, "It's been a rough couple of months in the lithium space, but I do believe we're beginning to see a bottom."

Global demand for the critical metal is projected to continue its steady rise, which began in 2020, up to at least 2035, Statista data show. By then, demand will have reached an estimated 3,829,000 metric tons of lithium carbonate equivalent, a 317.5% increase over demand in 2023 of 917,000 metric tons.

The lithium market is projected to expand at a 20.4% compound annual growth rate (CAGR) to US$6.4 billion (US$6.4B) by 2028 from US$2.5B in 2023, according to Markets and Markets.

"Investors are going to need the best lithium stocks in their portfolio so that they can capitalize on the growing prices that growing demand is going to bring with it," wrote Managing Editor Jason Williams in the Wealth Daily newsletter last month.

Good Entry Point for Stock

Technical charts indicate Xplore's stock is at a good place to buy, Maund purported, and thus he rates it a "Strong Speculative Buy for all timeframes."

He relayed that the stock, which began trading in 2017, has hit two bottoms, one in late 2022 and the other a year later. Subsequently, however, it rebounded and rose to CA$0.20 per share. Since, the stock has been in a wide trading range, the pattern of which has taken the shape of a diamond.

"Diamonds can be either consolidation patterns or tops," explained Maund. "In the case of Xplore, this diamond is thought to be the former, a consolidation pattern that will lead to renewed advance."

Ownership and Share Structure

Xplore Resources Corp. is owned by a small set of insiders and retail investors, no institutions, according to Reuters. Insiders hold a total of 4.21%, or 2.12M shares. They are Executive Chairman Wesley Hanson with 2.46% or 1.24M shares, Director Charles Edgeworth with 1.67% or 0.84 shares and David Walters with 0.08% or 0.04M shares.

Retail investors own the remaining 95.79%.

The company has 50.31M outstanding shares and 48.19M free float traded shares.

Its market cap is CA$4.4M. The price range in which it traded over the past 52 weeks is CA$0.075−0.20 per share.

| Want to be the first to know about interesting Critical Metals and Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |