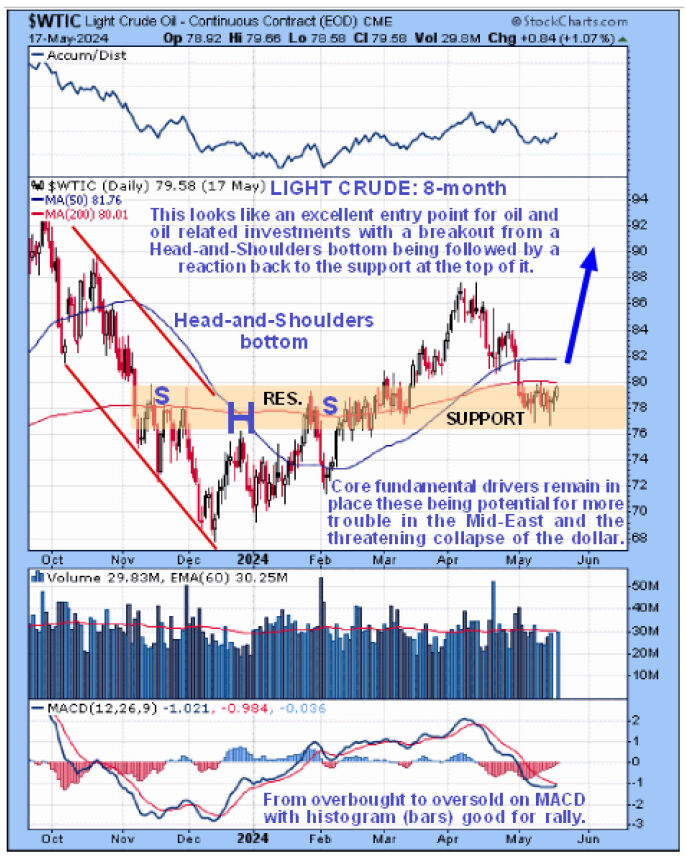

With the main fundamental drivers for a higher oil price remaining in play, namely continuing strife in the Mid-East with the ongoing risk of flare ups and the growing risk of a dollar collapse, this looks like a good point to buy oil and oil related investments after the corrective phase of the past five weeks or so.

On the 8-month chart for Light Crude we can see how oil ran up in late March and early April following a breakout from a Head-and-Shoulders bottom. Then we saw what looks like a normal post-breakout reaction back to test the support at the top of the pattern with an intermediate base pattern forming in this support this month, within which are a couple of "bull hammers," which are long-tailed bullish candles, which are more easily seen on shorter-term charts. This correction has more than fully unwound the earlier overbought condition and has put oil in a position to advance anew soon.

Turning now to oil stocks, we see on the 8-month chart for the Amex Oil Index (XOI:INDEXNYSEGIS) that they had quite a strong runup on the back of the rise in the oil price in March and April, but from early April, we see that this index has reacted back in what looks like a classic bull Flag / Pennant that will lead to renewed advance.

We can see that the duration of this corrective pattern has allowed time for the earlier heavily overbought condition shown by the MACD indicator to fully unwind, thus restoring upside potential, and for its bullishly aligned moving averages to partially catch up, thus creating the conditions for renewed advance. This, therefore, is believed to be a good time to buy selected oil stocks.

A good vehicle for playing renewed advance by the energy sector is the Energy Select Sector SPDR Fund (XLE:NYSEARC), and on its 8-month chart, we see that it has corrected back over the past five weeks or so in sympathy with the sector to arrive at the lower rail of a powerful uptrend channel, which has allowed time for its earlier heavily overbought condition to fully unwind.

This correction is believed to be a bull Flag that will lead soon to another strong upleg, an interpretation that is given added weight by the fact that the Accumulation line has held up very well on the correction and is even on the point of making new highs even though the price has not yet broken out of the Flag. This is very bullish, so XLE is rated as a Strong Buy here.

Whilst XLE is not viewed as especially speculative in this environment, buyers here may want to place a stop some way beneath the lower rail of the channel or to reduce the risk of being shaken out before a big rally, it's perhaps better to place a stop beneath the support level at approximately $90 - $91.50.

| Want to be the first to know about interesting Oil & Gas - Exploration & Production investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.