The intensifying debt crisis is expected to lead to a capital flight from all debt instruments and fiat generally into tangible assets and specifically into commodities such as graphite, all of which are expected to soar. This being so we are now believed to be at a favorable point to buy Graphite One Inc. (GPH:TSX.V;GPHOF:OTCQX) stock as it has reacted back over the past year or so to a zone of strong long-term support that we can see to advantage on its 20-year chart below.

On this chart, we can also see that when it broke out of the giant bullish Falling Wedge downtrend early in 2021, it soared before settling into a broad trading range over the past several years.

Superficially, it looks like it may have broken down from this trading range late last year and this year, but an advantage of this long-term chart is that we can see that it has not broken below the strong long-term support that dates back as far as 2008 – 2009. So, this is a very good point for it to make a major reversal to the upside.

Zooming in now via the 5-year chart, which shows all of the action so far this decade, we see that Graphite One has a habit of making dramatic spikes higher that are followed by long cooling-off periods or reactions.

The current reaction within the downtrend shown has been going on for something over a year now, which is about "par for the course," and with it having brought the price back to the zone of strong long-term support that we saw on the 20-year chart and also to the more recent support arising from the support level just beneath the current price associated with the trading range that formed during the latter part of 2020, this is considered to be a good point for it to break out of the downtrend into a new uptrend, which if past performance is anything to go by, could be sharp.

The recent rising Accumulation line and gradually improving momentum (MACD) are supportive of such a breakout soon.

On the 6-month chart, we can see that a quite prominent bull hammer formed on good volume on the first of this month, which suggests that the short-term downtrend in force from March has run its course.

On this chart, we can also see the positive divergence of the Accumulation line this year and that the stock is oversold now on its MACD indicator, which increases the chances of it reversing to the upside.

The conclusion is that this looks like a very good price area to buy Graphite One, which is expected to break out soon from the downtrend shown on the 5-year chart, which is "getting long in the tooth," and if it does it should be noted that, as on prior occasions, the resulting rally could be sharp, and even if it only makes it back up to the vicinity of its highs of recent years (this decade) it will still result in a more than three-fold gain from its current price.

<P>

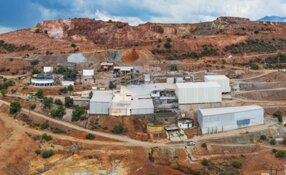

Graphite One's website.

Graphite One Inc. (GPH:TSX.V;GPHOF:OTCQX) closed for trading at CA$0.70, US$0.513 at 11.35 am EDT on May 3, 2024.

Want to be the first to know about interesting Critical Metals, Battery Metals and Alternative - Cleantech investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

-

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.