BioLargo Inc. (BLGO:OTCQB) is a cleantech company that, over the course of many years, has developed a broad range of products, solutions, and technologies that are now beginning to make serious inroads into the marketplace, so that, even though the company has in the past had to battle serious "cash burn" and cost issues that necessitated stock dilution, it is now winning through with revenues growing rapidly as sales accelerate dramatically.

BioLargo supports four subsidiaries that develop and commercialize cleantech products and specialty services. BioLargo holds the intellectual property for each technology and product. These four subsidiaries are:

- ONM Environmental Products and Services, whose flagship product CupriDyne Clean, eliminates odors in an environmentally friendly way — and that's eliminate, not mask. A derivative product, the Pooph pet odor control product, is hugely popular with consumers.

- BioLargo Engineering Science and Tech, whose flagship product, the Aqueous Electrostatic Concentrator (AEC), eliminates FFAS (polyfluoroalkyl substances) from contaminated water in a cost and energy-efficient manner.

- BioLargo Water, whose flagship product, the Advanced Oxidation System (AOS), confers exceptional disinfection performance of water with concurrent decontamination. This technology affords lower costs than competitors and is modular, flexible, and scalable with ultra-low energy consumption.

- BioLargo Energy Technologies, whose flagship product is the Sodium – Sulphur Long Duration Energy Storage (LDES) Battery Technology, has the potential to revolutionize the industry for reasons that become clear when you look at its features. This battery technology is safer as it eliminates runaway fire risk and is longer lasting, more energy dense, and more efficient than existing technologies and it does not require the use of Rare Earth Metals that are threatened with supply shortages. This commercial-ready no-maintenance design is ideal for long-duration storage, offloading renewable energy, EV charging stations, and commercial or residential charging stations.

In addition, there is a medical technologies subsidiary, Clyra Medical Technologies Inc. that has developed advanced wound care products.

The key point for investors to grasp is that these subsidiaries of BioLargo represent years of developmental work and investment by the company that is now being brought to fruition with market-ready products and services that are being rolled out and gaining widespread acclaim and uptake, which is why the company's revenues are taking off higher in the way that they have been, with a lot of "blue sky" potential in many cases, a notable example being the new battery technologies.

Now, we will proceed to look at the stock charts for Biolargo.

He wrote, "Modeling expectations are difficult to time, but we endeavored to incrementally include PFAS-related revenues and developed a bull case Price Target of CA$0.45."

Starting with the long-term 20-year arithmetic chart for BioLargo, we see that the company has been "at it" for a long time. The reason that the stock has made no net progress during the life of this chart is simple — the company has been burdened with high developmental costs for its broad range of products and services, and this necessitated stock dilution to keep going but as we have discussed these are now perfected or close to being perfected and being rolled out and gaining wide acceptance and interest in the marketplace resulting in robust sales and revenue growth.

A major bull market in the stock is therefore expected, and it looks like it just started this January.

Oakridge Financial analyst Richard Ryan agreed in a January 29 report, saying, "Modeling expectations are difficult to time, but we endeavored to incrementally include PFAS-related revenues and developed a bull case Price Target of CA$0.45."

A very important point worth observing on this chart is that even though the price hasn't moved much yet, comparatively speaking, there are strong technical indications that a major bullmarket has been incubating for a long time, which is the persistent heavy volume since early 2019 that indicates a healthy rotation of stock to newer buyers who will not be inclined to sell until they have turned a good profit, and the steep rise in the Accumulation line since 2021 which shows that there has been persistent "Smart Money" buying of the stock.

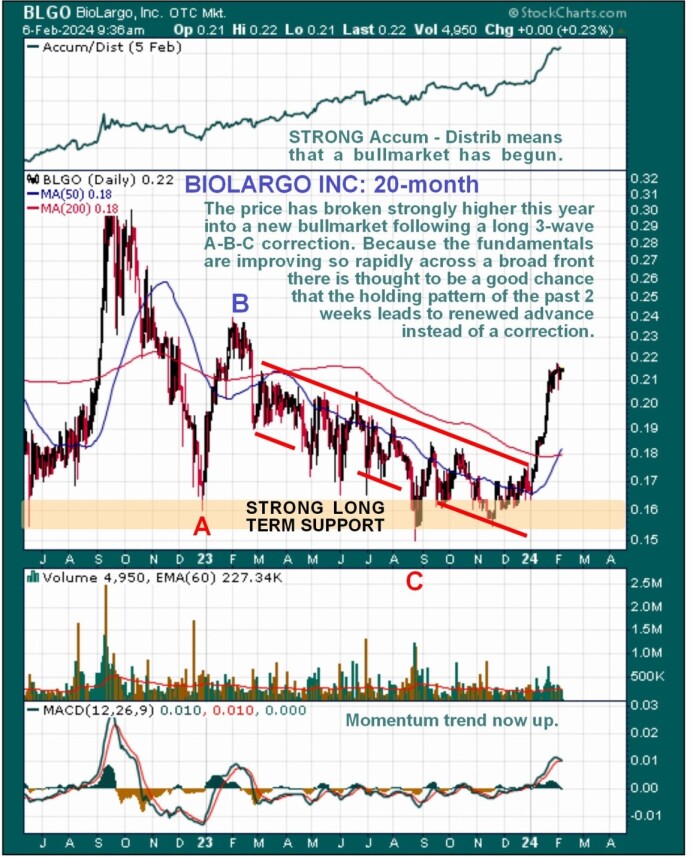

Zooming in via the 20-month log chart, we see a breakout into a strong first upleg by BioLargo just last month following the completion of a lengthy 3-wave A-B-C correction.

This breakout had been presaged for a long time by the positive divergence of the Accumulation line, which had been trending higher for many months and now its even stronger. The momentum trend (MACD), which had been neutral for almost a year, is now up.

The stock is still rather overbought after last month's sharp rally, so the question now is whether we will see something of a reaction before it resumes the upward path.

The conclusion is that BioLargo is a solid long term investment with a lot more upside than many might expect, and if, as suspected, it is indeed marking out a bull Flag, then it is even a Buy for shorter-term traders whilst it remains within the confines of the Flag.

The first point to make regarding what the stock does next is a fundamental one, which is that the prospects for the company's businesses are now so bright that any near-term reaction — if there is one — is likely to be minor.

The company is posting big revenue gains quarter after quarter, and on the fifth of this month, there was the big news that Jeffrey Kightlinger, a recognized water industry leader who is renowned for his distinguished service as the longest-serving CEO of the Metropolitan Water District of Southern California, the nation's largest municipal water provider serving over 19 million Californians, has Joined the Board of BioLargo's Water Equipment and PFAS Solutions Company.

With these positive factors in mind, we will now proceed to look at the 6-month chart.

On the 6-month log chart, we can see the strong runup last month that took the price way above its 200-day moving average with the result that this average has now turned up, and we have already seen a bullish cross of the moving averages, which traditionally marks the start of a new bullmarket.

After this strong move, it is obviously somewhat overbought on a short-term basis, which raises the question of whether it will soon react back, ordinarily made more likely by the number of shares in issue. The answer is thought to be no because of the pace at which the company's revenues and prospects are improving, and technically, on the chart, it looks like a small bull Flag is forming that will soon lead to another upleg of similar magnitude to the first — so the minor shakeout a few days back looks like all the reaction we are going to see — and even if it does break lower temporarily, it should quickly flip back to the upside.

The conclusion is that BioLargo is a solid long term investment with a lot more upside than many might expect, and if, as suspected, it is indeed marking out a bull Flag, then it is even a Buy for shorter-term traders whilst it remains within the confines of the Flag.

On the long-term chart, we can see that if it really gets moving, it could get as high as $1.00 - $1.10 over a one to two-year timeframe, and while this may seem improbable given the number of shares in issue, the rapid growth prospects for the company's various businesses bring this well within the realms of possibility.

BioLargo Inc. closed at US$0.216 on February 6, 2024.

Want to be the first to know about interesting Alternative - Cleantech investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- BioLargo Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500 in addition to the monthly consulting fee.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of BioLargo Inc.

-

Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

- This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.