Technically, this looks like an excellent point at which to pick up North Shore Uranium Ltd. (NSU:TSX) stock. Before looking at its chart we will now drill down swiftly and succinctly into the fundamentals to see why North Shore is such a good investment.

Having now gotten over Fukushima, the nuclear power industry is in growth mode and is deemed to be of critical importance in meeting CO2 emission reduction goals with the recent COP28 declaration to triple nuclear power by 2050. The uranium price has surpassed its 2007 highs and is in a vigorous uptrend, and this is reflected in the powerful bull markets that we are seeing in big uranium stocks like Cameco Corp. (CCO:TSX; CCJ:NYSE), and we are now seeing increased "trickledown" into the mid-cap and smaller stocks.

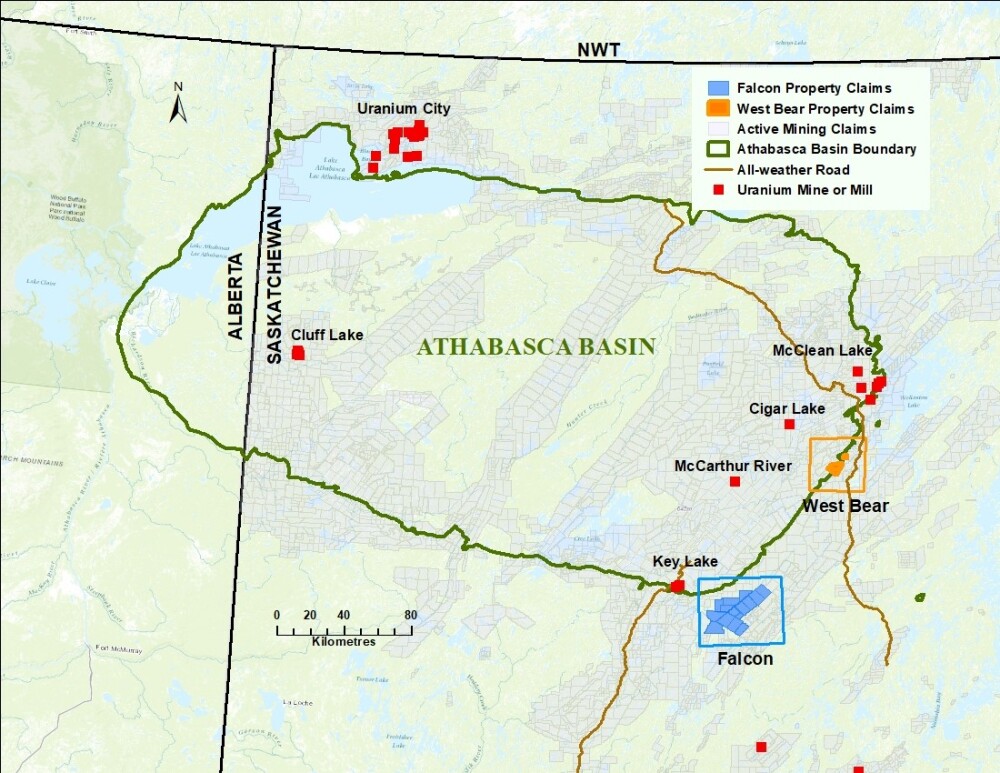

North Shore's exploration properties are situated in the prolific Athabasca basin in Saskatchewan, Canada, which is home to the world's highest-grade uranium deposits that provide over 20% of the world's uranium supply. Whilst North Shore's Falcon claims are technically just outside the perimeter boundary of the Athabasca basin, as can be seen on the map below, new exploration methods and technical developments have yielded multiple significant discoveries on and near the perimeter of the basin where there is the advantage of much less overburden than exists towards the center of the basin.

North Shore's exploration claims are close to properties where mines have already been constructed and are in operation, such as Cigar Lake, McCarther River, McClean Lake, and Key Lake, this last one being very close to the company's Falcon claim and big names in the industry are working these mines such as Cameco, Denison Mines Corp. (DML:TSX; DNN:NYSE.MKT), NexGen Energy Ltd. (NXE:TSX; NXE:NYSE.MKT), and Rio Tinto Plc (RIO:NYSE; RIO:ASX; RIO:LSE; RTPPF:OTCPK).

Since they are in the same belt along the east side of the Athabasca basin, the prospects for significant discoveries on North Shore's claims are clearly very good.

Lastly, we have an important catalyst that is likely to get the stock moving which is the fact that the company will be starting a drilling program this Spring, probably within a month from now. North Shore has been granted its Falcon claim by prospect generator Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE), which has many other claims in the area and adjacent to Falcon, in return for a stake in the outcome of its exploration activity.

Turning now to the stock, on its 4-month chart below, we can see that immediately after coming to market early in November, it dropped steeply for about a week before settling into a quite narrow trading range within which we can see that a Double Bottom base pattern has completed. During the latter part of this base pattern, in January, the accumulation line has been trending steadily higher, which is an indication that it is ready to break out into a new bull market.

With the second low of the Double Bottom having formed early last month and the price still not far above it and about in the middle of the range, it is clear that we are at a good entry point here, especially from the point of view of timing as the stock looks ready to break out of this base pattern soon to commence the expected new bull market.

North Shore Uranium is therefore rated an Immediate Strong Speculative Buy. There are 38.6 million shares in issue fully diluted, of which insiders and founding investors who are not insiders hold approximately 45% of issued shares.

North Shore Uranium's website.

North Shore Uranium closed at CA$0.17 on February 2, 2024.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Skyharbour Resources Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000. In addition, North Shore Uranium Ltd. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000. For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500 in addition to the monthly consulting fee.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of North Shore Uranium Ltd. , Skyharbour Resources Ltd., and Cameco Corp..

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.