For those of you who are interested in and can handle junior mining stocks, Nexgen Mining Inc. (NXGM: OTCPK) is looking like an Immediate Buy here.

After shooting higher from a low level last July, it has been drifting sideways on light volume ever since in a converging triangular pattern, marking out what is believed to be the Handle of a low-level Cup & Handle base, but just over the past week or so there has been more persistent buying and yesterday this buying became aggressive, although it has not yet moved the price.

However, since supply at this level is clearly being bought up, we can expect it to advance soon.

Nexgen is therefore rated an Immediate Speculative Buy here. There are a relatively modest 30.3 million shares in issue, of which only 4.2 million are in the float, so any serious buying pressure will hike the price.

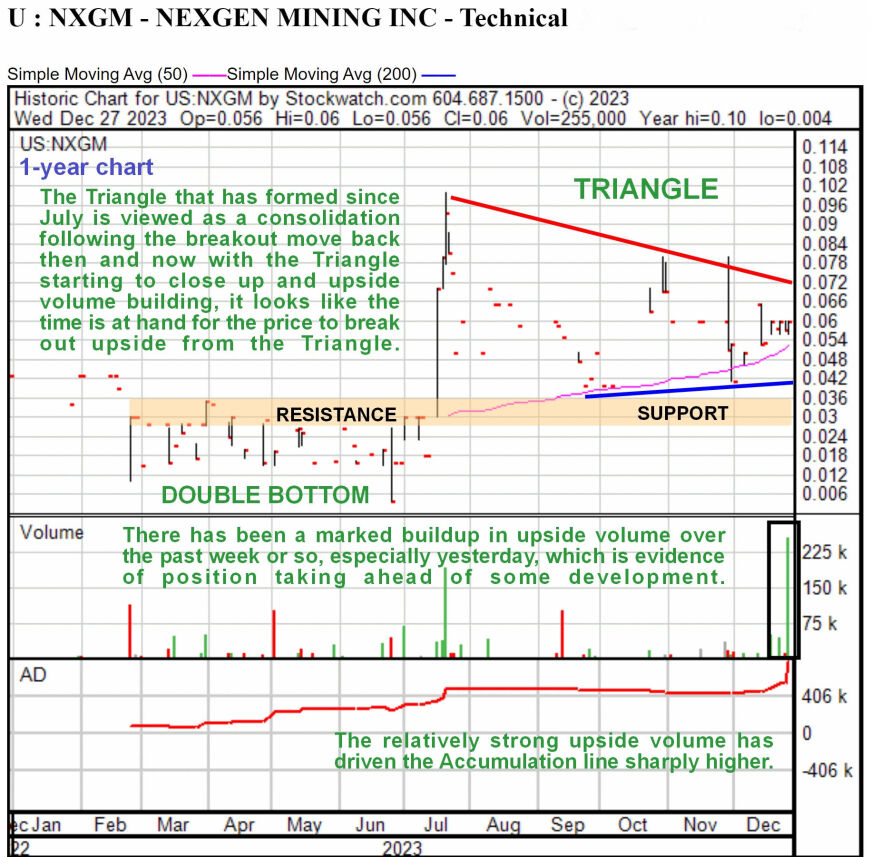

On the 1-year chart, Nexgen looks like it has been consolidating since the breakout move last July out of a low Double Bottom, this consolidation pattern taking the form of a Triangle. This Triangle could also be viewed as the Handle of a Cup and Handle base pattern, with the Cup also being the Double Bottom.

The volume buildup of the past week, especially yesterday that has driven the Accumulation sharply higher is a sign that it is ready to break out upside from the Triangle, and it is being supported in this by the rising 50-day moving average now coming into play just beneath.

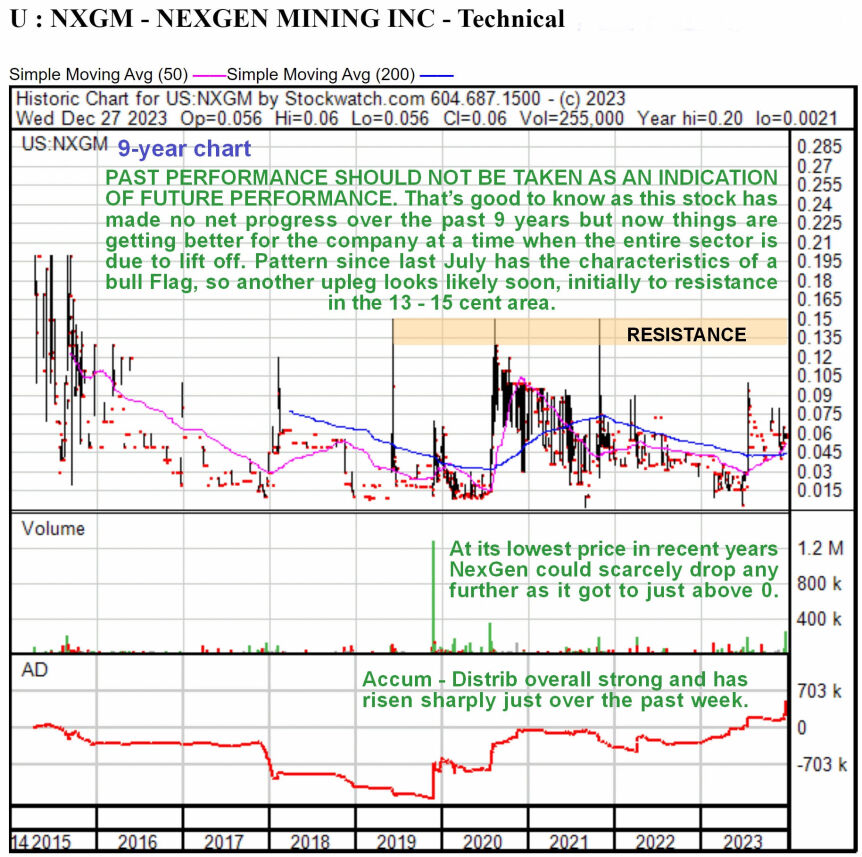

The 9-year chart shows the entire history of the stock from inception and lays bare its overall dismal performance over the years, but as the saying goes, "Past performance should not be taken as an indication of future performance," which in this case is just as well. The outlook for the company is believed to have improved significantly at a time when the entire sector is set to take off higher in response to boundless money creation by Central Banks and growing uneasiness amongst the holders of intrinsically worthless paper securities who are just starting to take up to the growing risk of Banks plundering their assets in the manner of pirates.

On this chart, the pattern from July looks rather like a bull Flag or Pennant following a breakout move, an interpretation that is supported by the strong Accumulation line. A breakout from the Triangle should lead initially to a rally to the resistance shown in the CA$0.13 – CA$0.15 zone.

Nexgen Mining's website.

Nexgen Mining closed at US$0.06 cents on December 27, 2023.

Originally posted at Clivemaund.com on December 28, 2023 at 9:20am EST.

| Want to be the first to know about interesting Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of [Nexgen Mining Inc.].

- [Clive Maund]: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.