Drill rigs are in position and getting ready to start the season. So I thought it would be a good time to cover why I think Azincourt Energy Corp. (AAZ:TSX.V; AZURF:OTC) is a great pick and why this season is especially auspicious.

In its entire history, the uranium explorer has been able to drill 17 holes over three seasons. They have run into to typical setbacks like late funding and early springs and showed caution with shareholders' money and the environment by not continuing to drill last spring when the ice bridges began to deteriorate.

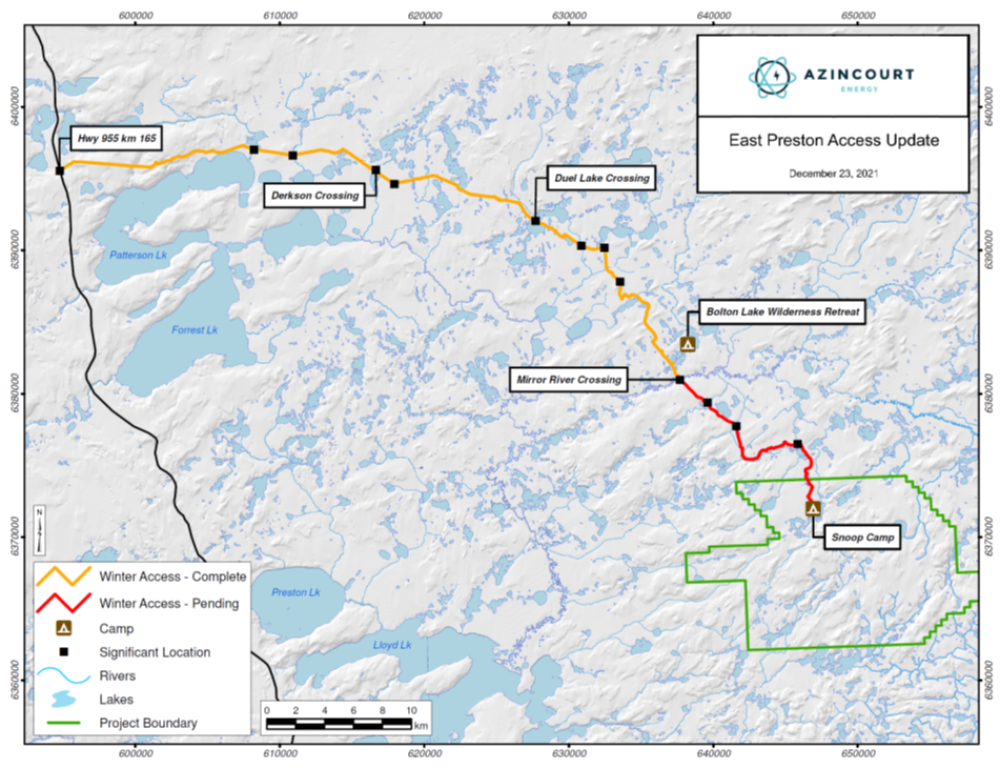

How is this year different? What was a needle in a haystack search is becoming easier with a metaphorical metal detector of positive factors. We are set up early with a massive 73 kilometer road constructed and are planning 30 to 35 drill holes.

If we hit all 35 holes, we will have, in essence, done six seasons of work. (I only say we, because I like to remember that as a shareholder, it is my money out there looking for pay dirt; I am not and will not be paid in any way for this report.)

They have built in efficiency this year; instead of commuting to the sites, they are constructing a camp for their employees. They also have not one, but two drilling rigs that will be running full time, along with a company contracted to maintain the road and run in supplies.

Be sure to sign up to receive PennyQueen's next stock picks exclusively available for Streetwise Reports' Readers. Sign Up Now!

PennyQueen is an investor who focuses mostly on clean tech and does her own independent analysis. She has created a social media community of over 10,000 like-minded investors with whom she has shared her progress of taking a $329k nest egg and building it to over $6 million within a year.

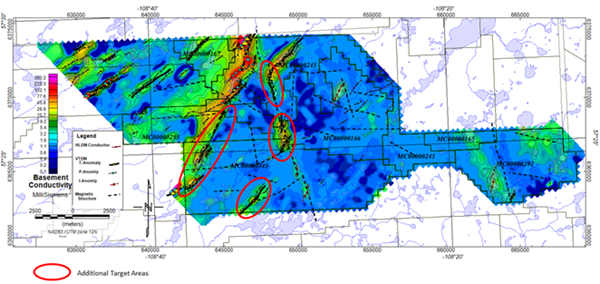

The primary areas are already scouted out with the G zone to be drilled first. If you remember from last year’s drill results, they had elevated uranium levels, somewhere between three to five times the average. This, along with an increase in pathfinder elements, is a great sign that they are looking in the right area. I should also note that they did an aerial radiometric survey this summer to fine tune their drill sites. They are still working with Fobi AI Inc. (FOBI:TSX) to further refine and guide their drilling.

The area they are working in has minimal overburden and they are expecting each drill hole to be 100 meters to 200 meters deep. So, the total drilling for the season should come in over 6,000 meters. It sounds like a lot, but with two drill rigs running two 12-hour shifts a day and a well thought out plan, it should be easily achievable.

The area they are working in has minimal overburden and they are expecting each drill hole to be 100 meters to 200 meters deep. So, the total drilling for the season should come in over 6,000 meters. It sounds like a lot, but with two drill rigs running two 12-hour shifts a day and a well thought out plan, it should be easily achievable.

The uranium spot price is sitting at $45.50. For this same day one year ago, it was sitting at $30.35. Our needle is now about 50% more valuable! I expect the price of uranium to keep rising, the Sprott Physical Uranium Trust has continued to gobble up uranium supplies. All while non-utility buyers have begun to enter the market.

Many believe that uranium is at the beginning of a bull cycle, and anyone who remembers its 2007 run to $140 a pound knows that it can make a rapid ascent. One critical piece to be watching right now for the overall uranium market is the unrest in Kazakhstan. Kazatomprom, the Khazak National Atomic Company, supplies 23% of nuclear fuel and a shutdown or slowdown of their operations would cause an immediate spike in the price of uranium. Yesterday, they reported that their operations have not been largely impacted. Hopefully, tension will continue to decrease in the region.

There are 440 working nuclear reactors worldwide. There are another 55 being built, 100 planned, and 300 proposed, and we know demand is increasing. Just remember, as the price of uranium goes up, so does the share price of uranium exploration companies. The biggest change for an exploration company, of course, comes from a successful find and Azincourt has taken all the steps necessary to increase our odds as shareholders exponentially. At less than 6 cents a share, I like our chances.

If you have not already, be sure to sign up to receive PennyQueen's next stock picks exclusively available for Streetwise Reports' Readers. Sign Up Now!

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

PennyQueen Disclosure: I own shares of Azincourt Energy Corp. I have not and will not be compensated for this report in any way. I write reports on my favorite picks; this is meant to be educational and not investment advice as I am not an investment advisor, just a mom on a mission to make the world better and make money along the way.

Streetwise Reports Disclosures:

1) The PennyQueen's disclosures are listed above.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. An affiliate of Streetwise Reports is conducting a digital media marketing campaign for this article on behalf of Azincourt Energy Corp. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this report. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This report is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Azincourt Energy Corp. and Fobi AI Inc., companies mentioned in this article.