Perpetua Resources Corp.

The gold sector has long been viewed as a strategic sector that can enhance portfolio returns by preserving value over time, improving portfolio diversification and providing liquidity. Gold project development companies like Perpetua have historically provided leveraged exposure to gold prices and upside potential.

Antimony is a listed critical mineral by the U.S. Department of the Interior. It is used in a wide variety of military, energy, industrial and consumer applications, but there is no domestically mined source of antimony in the U.S. today. Instead, antimony is primarily sources directly or indirectly from China and Russia which pose risks to national supply chains. Perpetua Resources offers a unique opportunity for investors to gain exposure to antimony as well as gold.

Perpetua Resources Corp. is a billboard sponsor of Streetwise Reports and paid a fee for this company profile page. Please refer to the important disclosures below for additional details.

Recent Articles:

Antimony Co. in US to Benefit from China's Export Controls

China's New Export Rules Positive for US Co. with Antimony Mine

China's Antimony Export Curbs Spark Global Concerns, Boost Western Opportunities

China's recent announcement to limit antimony exports has sparked significant concerns across global markets, particularly in the U.S. and Europe. Read on to find out how Perpetua Resources Corp. (PPTA:TSX; PPTA:NASDAQ) could benefit from this news.Critical Minerals Project Gains Momentum with Strong Financials and Strategic Advances

Perpetua Resources Corp. (PPTA:TSX; PPTA:NASDAQ) reported its unaudited condensed consolidated financial results for the second quarter of 2024, ending June 30. Read on to learn about its primary focus moving forward.Antimony Mine in Idaho Warrants U.S. Support, Says Analyst

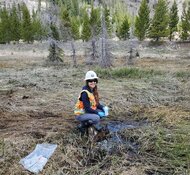

Gold and Critical Mineral Antimony Co. Reports on ESG Goals

Perpetua Resources Corp. (PPTA:TSX; PPTA:NASDAQ) releases its 2023 Sustainability Report as it works to move its critical Stibnite gold and antimony project toward production. Find out why antimony is so important to the United States.More Articles

Expert Comments:

More Expert Comments

Experts Following This Company

|

Gerardo Del Real, Newsletter writer – Resource Stock Digest |

|

Heiko Ihle, Managing Director – H.C. Wainwright & Co. |

| Mike Kozak, Analyst – Cantor Fitzgerald | |

| Clive Maund – CliveMaund.com | |

|

Mike Niehuser, Analyst – ROTH Capital Partners |

Important Disclosures

Perpetua Resources Corp. is a Billboard advertiser of Streetwise Reports and pays a flat fee. Fees fund both sponsor-specific activities and general report activities. Sponsor-specific activities may include aggregating content and publishing that content on the Streetwise Reports site, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases.

The fees also cover the costs for Streetwise Reports to publish and syndicate investment opinion and comments, and also to curate or create sector-specific content.

Billboard advertising monthly fees range from $3,000 to $5,000.

This landing page contains a summary of the company that was prepared by that company.

Some landing pages contain investing highlights and a catalyst calendar that are prepared by that company.

The Expert Comments and Experts Following This Company sections of the landing page are compiled by Streetwise Reports.

There may be other information about the company that is not placed on the landing page, and Streetwise Reports does not guarantee the accuracy or thoroughness of the information contained on the landing page.

Readers should conduct their own research for all information publicly available concerning the company.

This landing page may be considered advertising for the purposes of 18 U.S.C. 1734.

| Attractive valuation with upcoming milestones. | |

| Recently appointed a new VP of Projects to lead construction readiness activities | |

| Share prices trades at a significant value to our project's net present value and expect a re-rating once permitting process advances |