Streetwise Articles

Gold: The Ultimate Crisis Barometer

Source: Clif Droke, Stockhouse (9/6/12)

"It's no secret that one of gold's best attributes is as a barometer of economic crisis. It would appear that the yellow metal is once again serving this function."

More >

How Green Crude Oil Is Becoming A Better Investment By The Day

Source: Josh Grasmick, Penny Sleuth (9/6/12)

"Green crude oil —algae-based fuel —could be on the verge of taking a slice out of petroleum's market share, and sooner than you think."

More >

Obesity Drug Developers Post Steady Gains

Source: Alex Philippidis, Genetic Engineering & Biotechnology News (9/6/12)

"With the U.S. and the Western world increasingly overweight, companies that succeed at reversing obesity will, sooner rather than later, find themselves in Fat City."

More >

Fact-Checkers Find Few Flaws in Clinton's Healthcare Claims

Source: The Hill, Sam Baker (9/6/12)

"Self-proclaimed fact-checkers have drawn plenty of criticism from both parties, as well as neutral observers, and many individual assessments of 'fact' are highly debatable. In the aggregate, though, the fact-checkers haven't found much to complain about in Clinton's healthcare comments."

More >

Arie Papernick's Formula to Profit from Canada's Booming Gold Exploration

Source: Peter Byrne of The Gold Report (9/5/12)

Bonanza-grade discoveries in precious and base metals are energizing exploration across Canada. Arie Papernick of Secutor Capital Management Corp. believes that unflappable investors stand to be rewarded for buying at the bottom of the market. In this exclusive interview with The Gold Report, Papernick points to promising developments for issuers prospecting in Canadian gold fields, including the mineral-rich black tar sands and the Labrador Trough. He also suggests techniques for preserving capital so to survive the coming black swans.

More >

Insider Secrets for Finding Winning Colombia Juniors

Source: Sally Lowder of The Gold Report (9/5/12)

Living in Colombia gives Paul Harris, publisher of the Colombia Gold Letter, invaluable first-hand knowledge of the exploration scene there. On a macro level, mining development in Colombia will create opportunities for massive wealth generation for company shareholders, for local communities and for the government and could move Colombia into the ranks of the developed nations. On a micro level, junior explorers still have to navigate through an as-yet-untested permitting process. Once the first junior does that, Harris sees the floodgates opening up. Read more in this exclusive Gold Report interview.

More >

Gold Turns Higher, Keeps $1,700 in Sight

Source: MarketWatch, Claudia Assis and V. Phani Kumar (9/5/12)

"Gold prices turned modestly higher Wednesday, with investors remaining tentative ahead of Thursday's European Central Bank policy meeting and the U.S. jobs report on Friday."

More >

S. Africa's Mining Unrest Upsets Risk/Reward Outlook

Source: Reuters, Ed Stoddard (9/5/12)

"SBG Securities forecast downsizing at almost all South Africa's mature gold operations over the next three years in the face of 'declining reserves and unrelenting inflationary pressures.'"

More >

Gold Speculation Vehicles: Gold Stocks Versus Options

Source: Bob Kirtley, SK Trading Options (9/5/12)

"Gold stocks used to be the best way for the ordinary investor to increase exposure in the search for higher returns. Nowadays, leverage is extremely easy to come by, even for retail investors."

More >

Gold 'Has Seen the Lows for the Year'

Source: Ben Traynor, BullionVault (9/5/12)

"A stronger Euro and weaker Dollar could see gold move above $1,700/oz."

More >

Roche Vows to Keep Up Drug Hunt

Source: Reuters, Caroline Copley (9/5/12)

"The world's biggest maker of cancer drugs said it would build on long-term growth momentum and keep up R&D spending."

More >

Small-Cap Rally Indicates Increasing Risk Appetite

Source: Neena Mishra, Zacks Investment Research (9/5/12)

"Because small-cap stocks are generally more volatile than their large-cap counterparts, their outperformance indicates that the investors are now willing to take on more risk."

More >

Gold Standard To Be Reinstated Through The Back Door

Source: Chris Vermeulen, TheGoldAndOilGuy (9/5/12)

"For the first time in over 30 years, talk of a return to the gold standard has become part of mainstream U.S. politics."

More >

Investing in Silver: Double Down on the White Metal's Gains

Source: Don Miller, Money Morning (9/5/12)

"Thanks to wildly bullish technical and fundamental indicators, silver could soon retest its 2011 high, or even blow through it."

More >

Medtech Deals Buoyed by Cost Pressures, Device Tax

Source: Reuters, Debra Sherman and Soyoung Kim (9/5/12)

"Medical device mergers look poised to take off in 2013 as the industry compensates for shrinking reimbursements, a new U.S. tax and executive shake-ups at its biggest companies."

More >

Has QE3 Already Begun?

Source: Toby Connor, GoldScents (9/4/12)

"With the recent breakout of the frustrating consolidation zone that always follows a B-Wave bottom I think gold is now ready to begin the initial phase of the next C-Wave advance."

More >

Gold, Silver, Mining Stocks: Breakout Time, Not Bubble Time

Source: Jeb Handwerger, Gold Stock Trades (9/4/12)

"Precious metals and miners appear to be making constructive and powerful breakouts."

More >

Near-Term Targets for Gold, Silver and Mining Shares

Source: Jordan Roy-Byrne, The Daily Gold (9/4/12)

"It's amazing. Two months ago you couldn't give away mining shares or silver. Suddenly, everyone is bullish again."

More >

Don't Push the Panic Button on Rare Earths: Lisa Reisman

Source: Brian Sylvester of The Critical Metals Report (9/4/12)

Lisa Reisman describes herself as a "classic libertarian," but the managing editor of MetalMiner.com nonetheless believes government has a role to play in protecting and developing domestic supplies of critical metals. In this exclusive Critical Metals Report interview, Reisman argues for private/public partnerships and explains why today's low prices don't faze her—or surprise her.

More >

Could More Lithium Mining Stocks Benefit from Merger Mania?

Source: Zig Lambo of The Energy Report (9/4/12)

Rockwood Holdings' deal with Talison Lithium means more consolidation in an already tight market. With demand on the rise and supply lagging behind, lithium juniors and their partners are jockeying for market share. Analyst Jonathan Lee dissects the deal's implications in this exclusive interview with The Energy Report and champions both low-cost producers and Argentinean plays in this growing industry.

More >

Colombia Oil Stocks: Time to Invest Once Again?

Source: Keith Schaefer, Oil and Gas Investments Bulletin (9/4/12)

"Now, these stocks have not only fallen to earth, they've crashed through the floor into the basement—despite good oil prices. What happened? And more importantly, is this an opportunity for investors?"

More >

The Real Answers in China Are Never That Simple

Source: Keith Fitz-Gerlad, Money Morning (9/4/12)

"Rather than tackling the incessantly 'they'll never succeed because they're not democratic' or 'ghost cities' arguments, let's dig into the subtleties that escape most Westerners."

More >

U.S. Shale Glut Means Gas Shortage for Mexican Industry

Source: Reuters, Carlos Manuel Rodriguez (9/4/12)

"Mexican gas prices are tied to rates in its northern neighbor, where soaring supplies from shale fields drove gas to a 10-year low and reduced Mexico's wholesale price 32% in the past year. Manufacturers can't get enough of the energy."

More >

Invest in Silver Before Prices Climb Higher

Source: Deborah Baratz, Money Morning (9/4/12)

"For silver investors, news of stimulus measures would be just the bounce they need."

More >

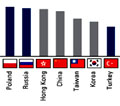

The Case for Emerging Europe

Source: Frank Holmes, U.S. Global Investors (9/4/12)

"Many investors have interpreted the underperformance of the iShares S&P Europe 350 ETF as a contrarian sign to hunt for bargains in developed Europe. However, even greater opportunity may lie to the east—in Poland, Russia and Turkey."

More >