Streetwise Gold Articles

How Strong Is Gold Demand?

Source: Eric McWhinnie, Wall St. Cheat Sheet (2/22/13)

"Gold's price action has discouraged some investors, but others are still purchasing the precious metal in record amounts."

More >

When It Comes to Gold, Stick to the Facts

Source: Frank Holmes, U.S. Global Investors (2/19/13)

"During short-term gold corrections, it's important to focus on the facts, including the fact that gold is increasingly viewed as a currency."

More >

David Baker's Three Must-Haves for the New Generation of Gold Companies: Accountability, Accountability and Accountability

Source: Brian Sylvester of The Gold Report (2/18/13)

Mining companies have lost the trust of investors, says David Baker, managing partner at Baker Steel. Baker sees the gold market as at a watershed point and the miners must change to stay afloat. In this interview with The Gold Report, Baker sets out his prescription for nursing the industry back to health. Will the restrictions his company and other investors are putting on gold companies increase reporting clarity, investor trust and money earned?

More >

Gold Fails to Hold Asian Gains

Source: Ben Traynor, BullionVault (2/18/13)

U.S. dollar gold bullion prices failed to hold onto gains made in Monday's Asian session, falling to $1,611/oz by lunchtime in London, just a few dollars above Friday's six-month low, as the U.S. dollar extended recent gains.

More >

John Kaiser: Can the TSX Venture Be Saved?

Source: JT Long of The Gold Report (2/15/13)

Is the end near for the TSX Venture Exchange, the victim of "algo traders," low volume and lack of institutional investors? If newsletter writer John Kaiser is right, as many as 500 of the 1,484 resource companies listed on the Venture Exchange will go under this year due to lack of money in the bank. In this Gold Report interview, Kaiser suggests that a crowdsourced valuation system may give the investors the information they need to invest with confidence and fend off the proprietary traders.

More >

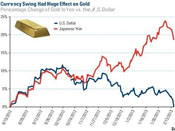

Currency 'War' or 'Revolution'?—And Gold?

Source: Julian Phillips, Gold Forecaster (2/15/13)

"The competitive devaluations of currencies, which has gone on for such a long time—many years in fact—is going to become destructive to real currency values."

More >

Why You Can Bet on Platinum Prices Going Higher

Source: Jeff Uscher, Money Morning (2/15/13)

"Platinum prices, which have been below gold prices since mid-2011, are once again higher than the yellow metal, and the spread's widening."

More >

Buy Gold Stocks Like a ROTH Capital Price Taker

Source: Sally Lowder of The Gold Report (2/13/13)

The risk-reward profile of resource companies resemble those of healthcare and biotech companies, according to Brian Post, an analyst at ROTH Capital Partners, an investment bank dedicated to the small-cap public market. Part of Post's mission is to educate his institutional clients about the value to be found in the resource sector. The value to be found in Mexico as a mining jurisdiction is one of the first lessons he offers. In his first interview with The Gold Report, Post focuses on Mexican silver names and ventures to both North and South America to talk copper.

More >

The risk-reward profile of resource companies resemble those of healthcare and biotech companies, according to Brian Post, an analyst at ROTH Capital Partners, an investment bank dedicated to the small-cap public market. Part of Post's mission is to educate his institutional clients about the value to be found in the resource sector. The value to be found in Mexico as a mining jurisdiction is one of the first lessons he offers. In his first interview with The Gold Report, Post focuses on Mexican silver names and ventures to both North and South America to talk copper.

More >

Chris Ecclestone: Gold Will Fall, Time to Switch to Specialty Metals?

Source: Brian Sylvester of The Metals Report (2/12/13)

The U.S. and Europe may have been skirting the edge of financial peril for years, but Christopher Ecclestone, who is the principal and mining strategist of London-based Hallgarten & Co., told The Metals Report that the gold price should drop this year as investors realize that there's no more cause for panic. However, the frank and expressive Ecclestone has plenty of other suggestions for what's "sexy" this year (zinc, copper and specialty metals), even as he rips into "business as usual" gold majors and chastises any management team with the nerve to offer a 0.5% dividend.

More >

Why You Can Trust Your Analyst Again: Ingrid Rico

Source: Brian Sylvester of The Gold Report (2/11/13)

Within the universe of junior mining companies, investors need to be choosy, says Ingrid Rico, mining analyst at Toronto-based investment bank M Partners. In this interview with The Gold Report, Rico explains how analysts value miners and reveals how she will be looking at junior mining companies in 2013—with a skeptical eye, preferring those funded to complete exploration plans for the year and a management track record to deliver results. She shares names of some companies whose projects stand out.

More >

John Williams: How to Survive the Illusion of Recovery

Source: JT Long of The Gold Report (2/8/13)

There is no economic recovery, and there are no signs that a recovery is coming, says Shadowstats.com author John Williams. In this Gold Report interview, he blames mal-adjusted inflation statistics for creating an alternate reality that overestimates economic activity in a way that is unsustainable. Williams warns that eventually the painful truth will be so difficult that even government manipulation won't be able to deny it and that is when hyperinflation will take its toll on those who have not taken his advice for preserving purchasing power and securing wealth.

More >

'Money Stimulus Marathon' Good for Gold Price: Eric Winmill

Source: Brian Sylvester of The Gold Report (2/8/13)

Eric Winmill, mining equities research analyst with Casimir Capital, sees great potential for small-cap metals producers and developers in the Americas—home to good infrastructure, skilled workers and great geology. In this Gold Report interview, Winmill also explains how "all-in" cash costs are making it easier for companies and investors to understand—and predict—cash-flow generation and identifies companies that he expects to take off.

More >

What the Major Breakout in the Platinum to Gold Ratio Signifies

Source: Jeb Handwerger, Gold Stock Trades (2/8/13)

"Platinum is breaking out compared to gold as South Africa, which supplies three quarters of world production, continues to struggle with labor issues and possible nationalization."

More >

Ian Gordon: Economic Winter Could Thaw Gold Equities

Source: Brian Sylvester of The Gold Report (2/6/13)

Ian Gordon has said it before: We're on the edge of an economic maelstrom that will breathe new life into the gold exploration industry. While his cautionary tales may be beginning to sound like the boy who cried wolf, Gordon, the founder and chairman of Longwave Group, gives some persuasive evidence to support his doomsday scenario for the greater market. In this Gold Report interview, Gordon talks about what he forecasts as an unprecedented period of growth and investment in gold, which is just about to get underway as the market sinks.

More >

What's Behind Moving Swiss Bank Clients from 'Unallocated' to 'Allocated' Gold Accounts?

Source: Julian Phillips, Gold Forecaster (2/4/13)

"Swiss banks UBS and Credit Suisse, have moved to offer 'allocated' gold and silver accounts to their clients, including high net worth individuals, hedge funds, other banks and institutions."

More >

Chen Lin Places His Bets on Self-Financing Producers

Source: Zig Lambo of The Gold Report (2/4/13)

The tough financing markets of the past few years have taken their toll on many junior resource companies, as continuing needs for capital have led to dilution and lower stock prices. In this tricky environment, Chen Lin likes to place his bets on companies that can minimize dilution through internal cash flow that helps to finance expansion and exploration activities. In this interview with The Gold Report, Lin talks about how he has played the difficult market in 2012 and where he sees some of the best opportunities in 2013.

More >

Harry Dent: Roller Coasters, Megaphones, Addictions and Comas—What Kind of Economy Is This?

Source: JT Long of The Gold Report (2/1/13)

Booms and busts in the economy are based on predictable demographic cycles such as those studied by Harry Dent, founder of HS Dent, chairman of SaveDaily.com and author of "The Great Crash Ahead: Strategies for a World Turned Upside Down." In this Gold Report interview, Dent predicts a global crash between mid-2013 and early 2015, in an ongoing decade of economic coma. For now, gold and gold equities are great investments, but when the crash comes, read on to find out what he suggests will be a good sector until the echo generation enters the workforce and starts buying potato chips and houses.

More >

Mike Niehuser: Modern-Day Gold Rush Puts Nevada on Top

Source: Special to The Gold Report (2/1/13)

These days, monetary policy moves stock prices more than economic data releases, says Mike Niehuser, founder of Beacon Rock Research. While the potential for higher gold prices is compelling, the decline in the number of discoveries and grades of resources makes mining stock selection intriguing. Niehuser has scoped out jurisdictions and finds the stars are aligning to put Nevada on top. In this interview with The Gold Report, Niehuser shares the names of companies that he feels have the right stuff.

More >

Consolidation Over? Is Gold at the Turning Point?

Source: Lawrence Williams, Mineweb (2/1/13)

"I do get the feeling in my bones that the yellow metal’s flat performance of the past 15 months or so may be coming to an end–not in a collapse, but in an upwards surge."

More >

Michael Fowler: The New Strategy for Adding Value to Junior/Midtier Gold (Hint: It's Not by Making Big M&A Deals)

Source: Brian Sylvester of The Gold Report (1/30/13)

A lackluster U.S. economy is creating a positive environment for gold, according to Michael Fowler, senior mining analyst with Loewen, Ondaatje, McCutcheon Ltd. By calculating ounces-in-the-ground values and assessing risk, Fowler has concluded that the junior/midtier sector offers the best growth potential. He expects to see companies of all sizes try to control costs instead of looking for mergers and acquisitions to add value. Read on in this Gold Report interview for Fowler's take on companies that he believes fit the bill.

More >

A lackluster U.S. economy is creating a positive environment for gold, according to Michael Fowler, senior mining analyst with Loewen, Ondaatje, McCutcheon Ltd. By calculating ounces-in-the-ground values and assessing risk, Fowler has concluded that the junior/midtier sector offers the best growth potential. He expects to see companies of all sizes try to control costs instead of looking for mergers and acquisitions to add value. Read on in this Gold Report interview for Fowler's take on companies that he believes fit the bill.

More >

Mining in Canada’s North Could Almost Double by 2020: Report

Source: Dorothy Kosich, Mineweb (1/30/13)

"The annual gross domestic product of mining in the North, which was CA$4.4B in 2011, is expected to reach CA$8.5B in 2020, according to the report 'The Future of Mining in Canada's North.'"

More >

The World According to Doug Casey

Source: Karen Roche of The Gold Report (1/28/13)

Doug Casey's new book is entitled "Totally Incorrect," and, true to form, the chairman of Casey Research doesn't mince words. "Most Europeans believe the state owes them a living; the society is corrupt through and through." "Government acquires income by theft." "Nobody reads a book from the classical era in school; it's now mostly committee-approved pablum." Casey considers speculation in gold and silver junior miners and holding physical gold among the correct moves investors can make to protect themselves in a market headed for disaster. In this Gold Report interview, hear the world according to Doug Casey.

More >

Gold Carpet Treatment Promised for Miners in the Dominican Republic: Alexander Medina

Source: Peter Byrne of The Gold Report (1/25/13)

The Gold Report caught up with Alexander Medina, the newly appointed director of mining for the Dominican Republic. With gold discoveries popping up all over Hispaniola—the country shares the metal-rich island with Haiti—Medina is a very busy government minister. But he was happy to spare a little time to talk to The Gold Report about what his office is doing to ensure that mining companies get the gold carpet treatment under the new administration.

More >

The Gold Report caught up with Alexander Medina, the newly appointed director of mining for the Dominican Republic. With gold discoveries popping up all over Hispaniola—the country shares the metal-rich island with Haiti—Medina is a very busy government minister. But he was happy to spare a little time to talk to The Gold Report about what his office is doing to ensure that mining companies get the gold carpet treatment under the new administration.

More >

Platinum’s Neglected Cousin

Source: Byron King, Daily Reckoning (1/25/13)

"We could see substantial gains in palladium over the next two years."

More >

Four Sensational Facts About Gold Investing that You Might Not Know

Source: Frank Holmes, Money Morning (1/25/13)

"Given that every gold move is analyzed and dissected by the media, it may surprise you that this precious metal was actually the least volatile of the 14 commodities."

More >