Streetwise Gold Articles

Strong Contrarian Buy Signal on Gold Stocks

Source: Jordan Roy-Byrne, The Daily Gold (7/19/13)

"One should consider the gold stocks a venture capital type of investment."

More >

'Mexico Mike' Kachanovsky Believes the Best Cure for Low Prices Is Low Prices

Source: Brian Sylvester of The Gold Report (7/17/13)

Even though precious metals stocks are going through a nasty and unpleasant interval, Mike Kachanovsky, founder and partner of smartinvestment.ca, looks at the market through a bullish lens. Shrewd accumulators are buying all the gold and silver juniors they can. When prices recover, investors will realize that mining stocks have been driven down to generational lows and money will rapidly flow back into the juniors. In this interview with The Gold Report, Kachanovsky details actions smaller juniors can take to survive the downturn and discusses companies with the resources to stay afloat until the markets rebound.

More >

Timing Gold's Bottom

Source: Louis James, Casey Research (7/16/13)

Why the pros don't care if gold gets whacked some more.

More >

Why Stephan Bogner Believes You Should Be 100% Invested in Precious Metals

Source: Brian Sylvester of The Gold Report (7/15/13)

Now is the time to be brave, to buy when everyone else is selling, advises Stephan Bogner, analyst with Rockstone Research and CEO of bullion dealer Elementum International. Content to go against the grain, Bogner believes investors should be 100% invested in precious metals, both in physical metals and equities. He is interested not only in companies that are profitable now but also in ones that will someday be in the black again. In this interview with The Gold Report, he describes his ideal portfolio, which includes companies operating in far-flung places.

More >

Breakdown: British Columbia Explorers

Source: Visual Capitalistm (7/15/13)

"Using 20+ variables, we've analyzed over 50 exploration companies and their main projects in B.C."

More >

Something's Got to Give in the Precious Metals Market: Heiko Ihle

Source: Brian Sylvester of The Gold Report (7/10/13)

These are scary times for precious metal investors. Resource equities are in the tank and, adding insult to injury, the gold price took a precipitous fall just days before summer, notoriously one of the slowest seasons for precious metals. Heiko Ihle, an analyst with Euro Pacific Capital in Connecticut, tells The Gold Report that something has to give. And soon. Ihle sets out a likely scenario and highlights some miners that are able to produce profitably at current metals prices.

More >

What the Fundamentals Say About Gold

Source: Julian Phillips, Gold Forecaster (7/9/13)

"The fall in the gold price changed the entire dynamics of the gold market."

More >

John Kaiser's Strategies for Success in a Bloody Market

Source: JT Long of The Gold Report (7/8/13)

With so many junior mining companies going into hibernation, John Kaiser of Kaiser Research Online fears that the entire mining sector could fall dormant. In this interview with The Gold Report, he outlines approaches to discovery and development that smart, nimble companies are deploying to stay alive. Whether precious, base or critical metals, or in jurisdictions as exotic as Morocco and as familiar as Nevada, these are the basics required for survival in today's brutal market.

More >

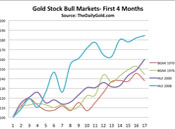

A Rare Anomaly in the Gold Market

Source: Jeff Clark, Daily Resource Hunter (7/8/13)

"While the waterfall decline in gold stocks is painful for those of us already invested, the reality is that this is a setup we get a shot at only a few times in our investing life."

More >

Is the Bubble Phase in Gold About to Begin?

Source: Toby Connor, Gold Scents (7/1/13)

"We now have the necessary conditions for the bubble phase in gold to begin."

More >

Stay the Course with Gold as Mixed Signals Move Markets

Source: Frank Holmes, Frank Talk (7/1/13)

"Ever since the Federal Reserve hinted in May that signs of a stronger economy could allow for a slowdown of stimulus, markets have protested the news."

More >

Jeff Killeen: C is for Cash and Catalysts in a Chaotic Market

Source: Brian Sylvester of The Gold Report (6/28/13)

Resource equities remain under siege and Jeff Killeen, an analyst with CIBC World Markets in Toronto, preaches the importance of the two Cs, cash and catalysts, to investors in this shaky market. In this interview with The Gold Report, Killeen discusses what fundamentals he looks for and names some companies that have strong balance sheets and potentially market-moving news on the horizon.

More >

Epic Opportunity in Gold Stocks

Source: Jordan Roy-Byrne, The Daily Gold (6/28/13)

"When the S&P 500 and economy struggle, it's going to be glorious for precious metals."

More >

Ian Gordon: Who Killed the Gold Price?

Source: Brian Sylvester of The Gold Report (6/26/13)

The gold price may have taken a tumble, but Ian Gordon, chairman and founder of the Longwave Group in British Columbia, is watching for a recovery. As bullishness in gold reaches some of its lowest levels, Gordon, in this interview with The Gold Report, says he believes that is indicative of a turn and he discusses where he has invested his money to ride the upswing.

More >

After Labor Strikes, What's Next for Platinum?

Source: Brian Sylvester of The Metals Report (6/25/13)

Violent South African mining labor strikes shocked the globe in 2012, but the resulting negotiations underway could create more stable supply flows in the long term—that's how CPM Commodity Analyst Erica Rannestad sees it. In this interview with The Metals Report, Rannestad discusses the key developments that could signal a price rise and which producers could clean up big on high-priced PGMs.

More >

Roger Wiegand Predicts a Brand New World for Gold

Source: Peter Byrne of The Gold Report (6/24/13)

The quant who produces Trader Tracks newsletter tells The Gold Report that the technical charts project a brightening future for precious metals. Technical market analyst Roger Wiegand tracks annual trading cycles while keeping an expert eye on potentially disruptive world events. He is a stickler for fundamentals, though, when it comes to picking out the best juniors for safe bets in a cash-poor industry.

More >

Ben Bernanke's Real Message for Gold Investors, Translated by John Williams

Source: JT Long of The Gold Report (6/24/13)

Don't fall for propaganda from the Federal Reserve about tapering quantitative easing, says ShadowStats editor John Williams in this interview with The Gold Report. His corrected economic indicators show the U.S. is nowhere near a recovery and the Fed will have to increase rather than decrease bond buying to prop up the banks and push off inevitable dollar debasement. That could be very bad for savers, but good for gold.

More >

Final Capitulation Coming in Precious Metals

Source: Jordan Roy-Byrne, The Daily Gold (6/21/13)

"A close examination of history tells us that this could be the final capitulation that would lead directly to a huge rebound in the ensuing months."

More >

Five Miners Chen Lin Expects to Buck the Trend

Source: Zig Lambo of The Gold Report (6/21/13)

For most investors, the market for gold and silver stocks resembles a battlefield littered with the dead and dying, especially after the last day or two. The key for investors is picking those stocks that have the best chance for survival, and sticking with them until they are able to recover. In this interview with The Gold Report, Chen Lin tells us what he looks for to make that critical decision and why he believes that platinum and palladium should do well regardless of what is happening with gold and silver.

More >

Get Ready for Stupid Cheap Silver Prices:

David H. Smith

Source: Brian Sylvester of The Gold Report (6/19/13)

It's a jungle out in the silver markets. Investors are holding on for their lives as the price of metals swings to higher highs and lower lows and junior equities bounce along the bottom. In this interview with The Gold Report, David H. Smith, senior analyst at silver-investor.com's The Morgan Report, navigates the jungle by advising which explorers, midtiers, stalwarts and royalties to consider buying in tranches on the way down and selling on the inevitable way up.

More >

Jay Taylor: In Precious Metals, Cash Flow Is King

Source: Kevin Michael Grace of The Gold Report (6/17/13)

The price of gold remains in the doldrums, but Jay Taylor, host of the radio show "Turning Hard Times into Good Times," expects the bull market to come roaring back. In this interview with The Gold Report, Taylor cautions that not all miners are equal and advises investors to look for companies with cash flow and the potential for organic growth.

More >

FOMC Is the Big Driver for Precious Metals this Week

Source: Ben Traynor, BullionVault (6/17/13)

"On the New York Comex, the so-called speculative net long position in gold futures and options—calculated as the number of 'bullish' long minus 'bearish' short contracts held by traders classed as speculators—fell in the week ended last Tuesday."

More >

The Hidden Costs of Precious-Metals Miners' Optimism

Source: Andrey Dashkov, Casey Research (6/17/13)

"We believe gold will rebound and head higher, as you know, but that hasn't happened yet, and some mines that went into construction or production based on unrealistic assumptions are facing greater costs and lower revenues, resulting in net incomes far below investors' expectations."

More >

Three Rules of Thumb for Watching Insider Trading: Ted Dixon

Source: Brian Sylvester of The Gold Report (6/14/13)

Data on trades made by company insiders—key executives and directors—demonstrates to Ted Dixon, co-founder and CEO of INK Research, that most of them are contrarian in their approaches. Lately, Dixon finds that insider indicators in the gold and junior gold miner sectors are "off the charts." In this interview with The Gold Report, Dixon shares the names of frequent traders in recent months, along with insights into why, when and how insiders are trading.

More >

George Soros Joins Michael Ballanger on the Goldbug Side of the Market

Source: Brian Sylvester of The Gold Report (6/14/13)

In his 36-year career, Michael Ballanger, director of wealth management at Richardson GMP, has seen good markets and bad. As a true contrarian, he sees opportunity in undervalued precious metals assets and lauds George Soros' recently reported large gold-related positions. In this interview with The Gold Report, Ballanger discusses market sentiment and some companies that he expects to take off when the market turns.

More >