Streetwise Gold Articles

Repositioning into Royalties for Richer Returns: Kwong-Mun Achong Low

Source: Brian Sylvester of The Gold Report (3/8/13)

Royalty plays may have once been strictly the domain of larger companies, but smaller names are shifting gears to enter the space. Can the smaller players make the numbers work for their shareholders? Kwong-Mun Achong Low, an analyst with Jennings Capital, believes they can. Achong Low tells The Gold Report about which juniors are making the leap into royalties.

More >

International Mining Bids a Not-so-fond Farewell to Hugo Chávez

Source: Dorothy Kosich, Mineweb (3/8/13)

"The death of President Hugo Chávez could eventually usher in a new era of foreign mining investment in Venezuela, only if the opposition wins an uphill battle for the presidency."

More >

Leonard Melman: Are You Prepared for Hyperinflation?

Source: Brian Sylvester of The Gold Report (3/6/13)

As looming inflation, currency wars and a possible run on gold threaten to derail markets, Leonard Melman, author of The Melman Report, is setting his sights on the midtier and near-term producers that he wants to scoop up when the blood is in the streets. In this interview with The Gold Report, Melman explains why gold, silver and the companies bringing them out of the ground could do very well in the second half of 2013.

More >

Gold Prices Are Being Manipulated and Here's What to Do About It

Source: Keith Fitz-Gerald, Money Morning (3/6/13)

"If you've ever suspected gold prices are being manipulated, you're not alone--and you're right, they are."

More >

Eric Sprott: Central Bankers Are Gaming Gold

Source: JT Long of The Gold Report (3/4/13)

Some people may look at the stock market and see economic recovery. Eric Sprott of Sprott Asset Management and Sprott Money looks at myriad other economic indicators and sees an economy still in decline. Despite his suspicions that central banks are keeping gold prices artificially low, he tells The Gold Report that he favors gold, platinum, palladium and especially silver, over the near and long term.

More >

Bullion: Bring It On—Sprott Precious Metals Round Table Webcast

Source: Special to The Gold Report (3/4/13)

When it comes to bullion enthusiasts, you're unlikely to find more ardent fans than those in the Sprott Group of Companies. Three of its leading experts, Eric Sprott, John Embry and Rick Rule, joined the Sprott Precious Metals Round Table webcast and conference call on February 12, with John Budden serving as host. The Gold Report summarized this treasure trove of knowledge for readers. Bottom line: While their bullishness on gold and silver has been common knowledge for years, the addition of the platinum group metals (PGMs) to the Sprott fold of precious metals trusts brings an intriguing new dimension to the bullion mix.

More >

Alka Singh: Is a False Perception of Risk Pummeling Your Profits?

Source: Brian Sylvester of The Gold Report (3/1/13)

Emotions, especially irrational ones, can drive markets. Investors who are spooked by risks like nationalization and political upheaval are pulling dollars out of promising mining projects in some African and South American jurisdictions. But many of these companies are only guilty by association, Alka Singh, founder of Mine2Capital in Toronto, tells The Gold Report. It's time for investors to look beyond the headlines and the fear to find bargains that aren't as risky as they seem at first glance.

More >

The Looming Gold Production Cliff That Will Drive Prices Higher

Source: Tony Daltorio, Money Morning (3/1/13)

"This coming decline in production can mean only one thing: higher gold prices."

More >

Mike Berry's New Secret for Finding Winners—Optionality

Source: Brian Sylvester of The Gold Report (2/27/13)

You will not find it in the dictionary, but a company's "optionality"—the condition of having choices—signals its chances of success according to Dr. Michael Berry. In this Gold Report interview, Berry, the editor of Morning Notes and discoveryinvesting.com, talks about junior mining firms in Nevada and Mexico that display optionality and sustainability in a market stuck in the mire.

More >

Value Market in Gold Will Work for Patient Investors: Jocelyn August

Source: George S. Mack of The Gold Report (2/27/13)

Even in a depressed gold market, knowing your catalysts in mining stocks is indispensable and is still the fundamental yardstick for buy-sell decisions. Senior Analyst Jocelyn August of San Diego-based Sagient Research understands the impact that events can have on your portfolio, and she has mastered the art and science of fortunetelling by keeping an eye on the calendar and those occurrences that will move shares. In this interview with The Gold Report,

August discusses top ideas that should move investors out of winter and into stocks with a shiny golden future.

More >

Why the Casey Research Brain Trust Is Convinced That Precious Metals Will Rise Again

Source: Casey Research (2/27/13)

Casey Research investment strategists weigh in on how to play precious metals in the current bear market.

More >

Time to Buy Precious Metals Now

Source: Jordan Roy-Byrne, The Daily Gold (2/25/13)

"The technicals show the precious metals complex as extremely oversold and nearing strong support."

More >

Spotting the Miners That Can Survive the Long Capital Drought: Eric Coffin

Source: Peter Byrne of The Gold Report (2/25/13)

In order to make wise investment decisions, gold investors must coldly assess economic realities, says Eric Coffin. As the publisher of Hard Rock Analyst Advisories, Coffin tracks a range of gold explorers with the bling to weather the long capital drought. He has figured out how to separate the winners from the losers and, in this interview with The Gold Report, he shares the names of some strong ventures.

More >

BMO Advisor Coxe: "This Is the Worst Trading Situation I Have Ever Seen"

Source: Peter Byrne of The Gold Report (2/22/13)

Taking inspiration from George Orwell's "1984," renowned BMO advisor Don Coxe has coined the expression "Weakness is Strength" to describe the current economic situation. In a far-ranging interview with The Gold Report, Coxe explains how an international regime of weak currencies has set the scene for an upsurge in the price of gold shares. He believes that gold will return as a preferred hedge against loss of value because inflation is inevitable.

More >

Discover 35 Mining Stocks with Potential: Henk Krasenberg

Source: Brian Sylvester of The Gold Report (2/22/13)

Henk Krasenberg, founder of the European Gold Centre, is back from the INDABA Mining Conference in South Africa with plenty to report. He has seen a sea change in mining in Africa over the last few years; countries are growing more confident and have a greater awareness of mining's potential. In this interview with The Gold Report, Krasenberg provides a European perspective on a whole slew of miners working in Africa, as well as in all corners of the world.

More >

How Strong Is Gold Demand?

Source: Eric McWhinnie, Wall St. Cheat Sheet (2/22/13)

"Gold's price action has discouraged some investors, but others are still purchasing the precious metal in record amounts."

More >

When It Comes to Gold, Stick to the Facts

Source: Frank Holmes, U.S. Global Investors (2/19/13)

"During short-term gold corrections, it's important to focus on the facts, including the fact that gold is increasingly viewed as a currency."

More >

David Baker's Three Must-Haves for the New Generation of Gold Companies: Accountability, Accountability and Accountability

Source: Brian Sylvester of The Gold Report (2/18/13)

Mining companies have lost the trust of investors, says David Baker, managing partner at Baker Steel. Baker sees the gold market as at a watershed point and the miners must change to stay afloat. In this interview with The Gold Report, Baker sets out his prescription for nursing the industry back to health. Will the restrictions his company and other investors are putting on gold companies increase reporting clarity, investor trust and money earned?

More >

Gold Fails to Hold Asian Gains

Source: Ben Traynor, BullionVault (2/18/13)

U.S. dollar gold bullion prices failed to hold onto gains made in Monday's Asian session, falling to $1,611/oz by lunchtime in London, just a few dollars above Friday's six-month low, as the U.S. dollar extended recent gains.

More >

John Kaiser: Can the TSX Venture Be Saved?

Source: JT Long of The Gold Report (2/15/13)

Is the end near for the TSX Venture Exchange, the victim of "algo traders," low volume and lack of institutional investors? If newsletter writer John Kaiser is right, as many as 500 of the 1,484 resource companies listed on the Venture Exchange will go under this year due to lack of money in the bank. In this Gold Report interview, Kaiser suggests that a crowdsourced valuation system may give the investors the information they need to invest with confidence and fend off the proprietary traders.

More >

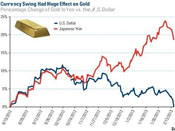

Currency 'War' or 'Revolution'?—And Gold?

Source: Julian Phillips, Gold Forecaster (2/15/13)

"The competitive devaluations of currencies, which has gone on for such a long time—many years in fact—is going to become destructive to real currency values."

More >

Buy Gold Stocks Like a ROTH Capital Price Taker

Source: Sally Lowder of The Gold Report (2/13/13)

The risk-reward profile of resource companies resemble those of healthcare and biotech companies, according to Brian Post, an analyst at ROTH Capital Partners, an investment bank dedicated to the small-cap public market. Part of Post's mission is to educate his institutional clients about the value to be found in the resource sector. The value to be found in Mexico as a mining jurisdiction is one of the first lessons he offers. In his first interview with The Gold Report, Post focuses on Mexican silver names and ventures to both North and South America to talk copper.

More >

The risk-reward profile of resource companies resemble those of healthcare and biotech companies, according to Brian Post, an analyst at ROTH Capital Partners, an investment bank dedicated to the small-cap public market. Part of Post's mission is to educate his institutional clients about the value to be found in the resource sector. The value to be found in Mexico as a mining jurisdiction is one of the first lessons he offers. In his first interview with The Gold Report, Post focuses on Mexican silver names and ventures to both North and South America to talk copper.

More >

Chris Ecclestone: Gold Will Fall, Time to Switch to Specialty Metals?

Source: Brian Sylvester of The Metals Report (2/12/13)

The U.S. and Europe may have been skirting the edge of financial peril for years, but Christopher Ecclestone, who is the principal and mining strategist of London-based Hallgarten & Co., told The Metals Report that the gold price should drop this year as investors realize that there's no more cause for panic. However, the frank and expressive Ecclestone has plenty of other suggestions for what's "sexy" this year (zinc, copper and specialty metals), even as he rips into "business as usual" gold majors and chastises any management team with the nerve to offer a 0.5% dividend.

More >

Why You Can Trust Your Analyst Again: Ingrid Rico

Source: Brian Sylvester of The Gold Report (2/11/13)

Within the universe of junior mining companies, investors need to be choosy, says Ingrid Rico, mining analyst at Toronto-based investment bank M Partners. In this interview with The Gold Report, Rico explains how analysts value miners and reveals how she will be looking at junior mining companies in 2013—with a skeptical eye, preferring those funded to complete exploration plans for the year and a management track record to deliver results. She shares names of some companies whose projects stand out.

More >

John Williams: How to Survive the Illusion of Recovery

Source: JT Long of The Gold Report (2/8/13)

There is no economic recovery, and there are no signs that a recovery is coming, says Shadowstats.com author John Williams. In this Gold Report interview, he blames mal-adjusted inflation statistics for creating an alternate reality that overestimates economic activity in a way that is unsustainable. Williams warns that eventually the painful truth will be so difficult that even government manipulation won't be able to deny it and that is when hyperinflation will take its toll on those who have not taken his advice for preserving purchasing power and securing wealth.

More >