Omineca Mining and Metals Ltd.'s (OMM:TSX.V; OMMSF:OTCQB) share price jumped 73% in about 26 hours on recent news that it began recovering gold at its Wingdam underground paleoplacer project in south-central British Columbia's Cariboo mining district after a months-long delay.

"[This marks] the first underground placer gold production since the 2012 bulk test," wrote Bill Newman, Research Capital Corp. analyst, in a Dec. 8 research report. "Early results [are] in line with expectations."

OMM jumped to CA$0.095 per share on Dec. 5, the day Omineca announced the update, from CA$0.055 on Dec. 4.

Before mining could begin, equipment needed to be upgraded and the ground optimally stabilized, the latter requiring various grout formulations with different spiling sizes and patterns, the analyst noted. Once that work was done, Omineca's joint venture partner D&L Mining entered the paleochannel and began processing placer gold-bearing gravels from crosscut 3A, the release explained. The operator is recovering the placer gold through Omineca's water wash plant and gold shaker table.

The size, shape, and amount of initial recoveries are similar to the recoveries during Omineca's 2012 test crosscut. Back then, 173.40 ounces of placer gold were recovered from a single 2.4-meter-wide (2.4m-wide) x 2.4m-high x 24m-long tunnel cut across the channel.

Wingdam is a placer gold project with "highly attractive" potential economics, particularly given today's spot gold price around US$4,200 per ounce (US$4,200/oz), or CA$5,900/oz, Newman highlighted in his report.

"While operations began later than we anticipated, the silver — more appropriately, gold — lining is that gold prices have moved to near record highs, materially improving expected cash flow margins," he added.

Research Capital now forecasts about CA$32 million (CA$32M) in potential annual cash flow from the Wingdam gold placer project, based on US$3,000/oz gold, a fixed operating cost of CA$1,000/oz, and net gold production of 10,000 ounces per year (10 Koz/year).

Also for the project, the investment firm estimates a CA$122M, or CA$0.47/share, net present value discounted at 10%. This is based on annual production of 20 Koz/year (10 Koz/year net) and US$3,000/oz gold.

New Drill Program Begun

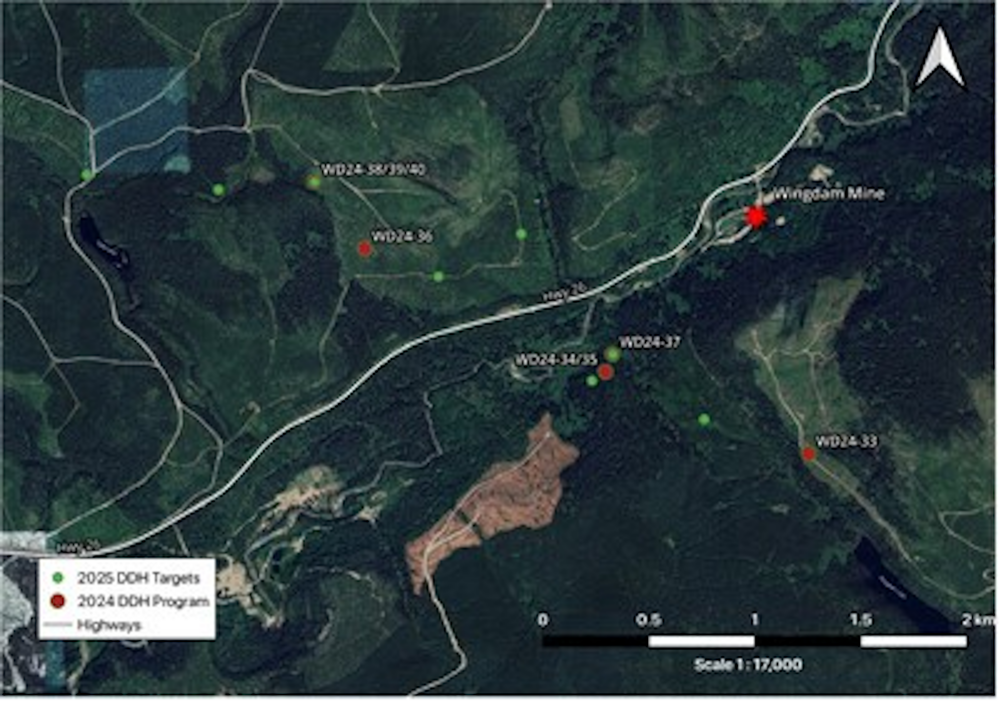

Omineca announced another new development on Dec. 4, which also perhaps contributed to its fast and sharp share price increase. That is, the company launched its 2025 winter diamond drill program at the Wingdam exploration project, consisting of eight holes over 4,000m. Drilling is expected to take place throughout this month.

"The objective is to build on the 2024 results, improve geological continuity and narrow in on potential lode-gold targets that could represent the source of the placer system," Newman explained.

This new drill program is based on the assumption that Lightning Creek once may have flowed west to east before reversing to its present westward direction, the release explained. The lode source of the rich placer gold beneath Lightning Creek may be related to the Eureka Thrust Fault system that is downstream, or west, of the Wingdam underground placer project, and where 2024 drilling intercepted anomalous gold, copper, lead, and zinc concentrations.

This new drill program is based on the assumption that Lightning Creek once may have flowed west to east before reversing to its present westward direction, the release explained. The lode source of the rich placer gold beneath Lightning Creek may be related to the Eureka Thrust Fault system that is downstream, or west, of the Wingdam underground placer project, and where 2024 drilling intercepted anomalous gold, copper, lead, and zinc concentrations.

During the current campaign, continuation drilling will be done there further to depth, at elevations below the Wingdam underground placer workings, specifically in areas downdip of mineralization in the ultramafic unit intersected in hole WD24-37. Some drilling will be done southeast of WD24-37, along strike of the mapped Eureka Thrust Fault towards the UAV magnetic high. Also, deep holes will be drilled to determine if the quartz veins identified in WD24-38 to WD24-40 continue at depth.

Dual Focus at Flagship Project

Headquartered in Saskatoon, Saskatchewan, Omineca Mining and Metals is a Canadian junior gold miner with two programs underway: the resumption of an underground placer gold bulk sample program and a diamond drill campaign focused on discovering the potential multiple bedrock sources of that placer gold, according to the company's website.

The flagship Wingdam projects encompass about 500 square kilometers of hardrock tenures and 15 linear kilometers of placer claims along the Lightning Creek valley. The rich, placer gold-bearing channel spans 2.4 kilometers and is buried 50m underneath Lightning Creek. The channel, as described by Geologist Stephen Kocsis, contains "some of the highest placer gold concentrations historically reported in all of the Cariboo Mining District and perhaps British Columbia that remains unmined."

Under Omineca's joint venture agreement with D&L Mining, the latter is to supply all equipment, labor, and services required to complete the initial 300m bulk sample at Wingdam in exchange for a 50% interest in the placer claims there, Newman explained. Omineca is to purchase its 50% share of recovered gold at a fixed price of CA$1,000 per ounce (CA$1,000/oz).

Gold Still Has Legs

Gold began the year at a spot price of about US$2,624/oz and climbed 60% to where it is today, about US$4,234/oz. This bull run is not yet over, and gold likely will keep rising to at least US$5,000/oz, the consensus among analysts and experts seems to be.

J.P. Morgan expects gold to top this price by the end of next year, Bloomberg News reported. Heraeus, in its 2025 Precious Metals Outlook, wrote that gold could hit US$5,000/oz next year but likely in H2 after trending lower in H1, reported Kitco News on Dec. 8. Van Eck, the money manager behind the VanEck Gold Miners Exchange-Traded Fund (ETF) (GDX:NYSEARCA), predicts gold will reach US$5,000/oz but will take until 2030 to do so, according to a Dec. 7 article by The Street.

James West wrote in his Dec. 4 Midas Letter, "This bull market has legs that will carry well into 2026 and beyond. Gold above US$5,000 isn't a question of if — it's a question of when." He pointed to ongoing, persistent central bank gold purchasing, sharp acceleration of exchange-traded fund inflows, and the increasing dominance of gold market buyers not concerned about price and willing to accumulate on strength, generally monetary authorities and high-conviction investors.

Research Capital Corp.'s Newman rates Omineca Speculative Buy. His target price on the company, as well as the consensus target price according to Refinitiv, imply a 366% return from OMM's Dec. 9 midday price.

"That means any future macro shock — whether from weaker global growth, renewed tariff escalation, or a sharper-than-expected Fed easing path — is likely to trigger a demand spike into an already tight physical pipeline," West wrote. "I'm convinced there is a date in the future where gold trades at US$100,000/oz."

Stewart Thompson wrote in a Dec. 9 edition of Graceland Updates that he, too, believes gold can go higher, everyone should own gold, and there is no downside to it. If the price increases, investors are happy. If the price drops, they may buy more. Thompson also highlighted mineral exploration companies as an investment.

"Junior mine stock investing isn't for everyone, especially with size, but as this gargantuan gold bull era rollout continues, these miners look set to outperform everything!" he wrote.

During the rest of this year, Brien Lundin of Gold Newsletter expects gold to experience its usual seasonal bottom in the middle to end of this month, he wrote in the Dec. 4 edition. However, he added the caveat, "But again, no one knows, as the metal has been giving precious little in the way of signals lately."

The Catalysts: Results

Omineca noted in its two recent press releases possible catalysts expected in the near term. Sometime this quarter, the explorer is expected to release initial gold recovery figures from the Wingdam underground paleoplacer project, once it completes its standard verification procedures and as mining progresses toward the higher-grade central portion of the paleochannel.

"As mining advances through crosscut 3A, continued updates on gold recovery rates and production efficiency will be important catalysts," Newman wrote.

A little further out, in early 2026, Omineca expects to release the results from its winter 2025 drill campaign at the Wingdam exploration project.

Analyst: 366% Return Potential

Research Capital Corp.'s Newman rates Omineca Speculative Buy. His target price on the company, as well as the consensus target price according to Refinitiv, imply a 366% return from OMM's Dec. 9 midday price. He noted that operational execution is still a key risk to the story, given the challenges associated with mining in unconsolidated paleochannel gravels.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Omineca Mining and Metals Ltd. (OMM:TSX.V; OMMSF:OTCQB)

On that same note, Chris Temple, editor/publisher of The National Investor, wrote this about the placer gold recovery at Wingdam, in a Dec. 8 note: "If the miners/engineers who have put all this together make it to the bottom, then the other side, of the channel with no more hiccups, then it will REALLY be, 'Game on!'"

The takeaway from Temple's visit with Omineca President and Chief Executive Officer (CEO) Tom MacNeill late last week is that further announcement(s) from the company will come "not many days away." Temple rates Omineca Buy.

Ownership and Share Structure1

Canadian resource investment and advisory firm, 49 North Resources Inc., owns 17.41% of Omineca. Three insiders own 4.48%: President/CEO MacNeill with 2.99%, Chief Financial Officer and Director Andrew Davidson with 1.37% and Director Sylvain Laberge with 0.12%.

Omineca has 261.8 million shares outstanding. Its market cap is CA$16.06M. Its 52-week range is CA$0.04–0.10/share.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Omineca Mining and Metals Ltd. is a billboard sponsor of Streetwise Reports.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Omineca Mining and Metals Ltd.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

1. Ownership and Share Structure Information

The information listed above was updated on the date this article was published and was compiled from information from the company and various other data providers.