Brazil is quietly resetting how gold is found, traced, and permitted in the Amazon.

At the same time, gold itself is in a powerful long-term uptrend, and Brazil's equity market looks like it is trying to break out of a deep, decade-long funk.

Sitting right at the intersection of those trends is Canary Gold Corp. (BRAZ:CSE; CNYGF:OTC; K5D:FSE), a junior explorer with a large land position in Brazil's Madeira Basin and a clear plan to drill test what could be a district-scale gold system.

About the Company

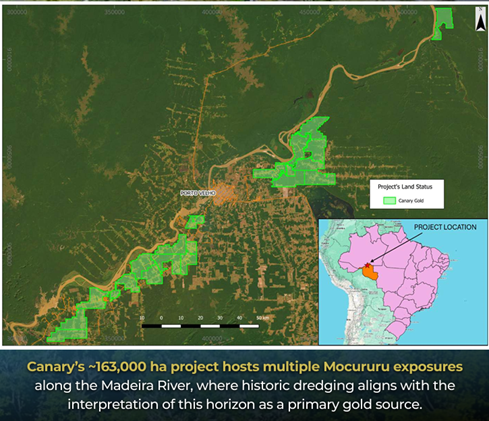

Canary Gold is a Canadian-listed exploration company focused on advancing the Rio Madeira Gold Project in Rondônia, Brazil. The company controls roughly 163,000 hectares along the Madeira River system, one of South America's richest historic placer belts, where more than 7 million ounces of gold were dredged from the river between the 1970s and 1990s.

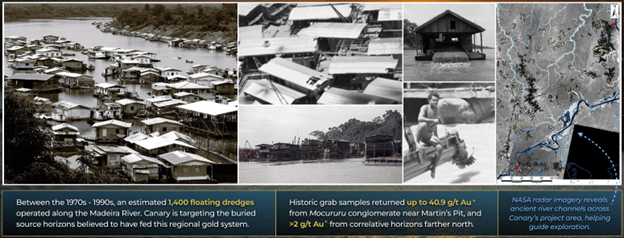

The working thesis is straightforward but ambitious. The gold that fed decades of artisanal dredging did not appear out of nowhere. It was shed from the Bolivian Andes, transported down into the Madeira Basin, and trapped in a cemented, iron-rich horizon known as Mocururu. Canary's technical team believes this horizon forms a preserved paleoplacer surface that extends across much of its project area and may represent the primary source of the region's alluvial gold.

Over the last three years, the company has completed resistivity surveys, radiometrics, sonic drilling, and aircore drilling to map this horizon and confirm that it is present beneath shallow cover across an ~80-kilometer corridor. Visible gold has been observed in Mocururu sediments and pan concentrates, and high-resistivity bands interpret the duricrust horizon 20–30 meters below the surface.

Canary is now moving from concept to systematic drill testing.

Key Property: Rio Madeira Gold Project, Rondônia

The Rio Madeira Project lies just southwest of Porto Velho, with direct access via paved highway, power line, and river transport. That combination of Amazonian scale and easy logistics is unusual and allows year-round work.

Several elements of the story stand out:

- A preserved gold-bearing horizon

Resistivity lines show >2,000 ohm-meter responses interpreted as cemented Mocururu layers, while field programs have recovered visible gold grains from Mocururu sediments and pan concentrates across multiple blocks. These are early-stage, qualitative indicators, but they support the idea of a preserved gold system beneath the iron duricrust. - Historic context and modern targeting

The Rio Madeira has already proven its fertility. At the peak of the dredging rush, more than 1,400 floating dredges worked the river, pulling millions of ounces from the riverbed. NASA radar imagery and local geophysics now highlight abandoned paleochannels that cross Canary's licences, guiding where the Mocururu horizon may be thickened and enriched. - Multi-year groundwork and a major drill program

Since its IPO, Canary has:

- Consolidated and expanded its land position, including the Talisman package, bringing the total project area to ~163,000 ha.

- Completed five resistivity lines, a sonic drill hole, an aircore program, and 3D modelling to map the Mocururu and key paleochannels.

- Established an in-country sample prep facility in Porto Velho to shorten turnaround times and strengthen QA/QC.

The next step is a multi-rig, ~20,000-meter aircore and screw-auger drill program starting in January 2026, designed to test roughly 89 kilometers of prospective strike across Domains B and C. First assay results are expected in Q2 2026.

At the same time, Brazil is cracking down on illegal gold mining in the Amazon and rolling out policies to trace and certify legally produced gold. For a company holding a large, permitted land position and emphasizing responsible exploration and planned reforestation, that policy shift could become an important tailwind over time.

Management

Canary's leadership team combines technical discovery experience with capital markets and governance depth.

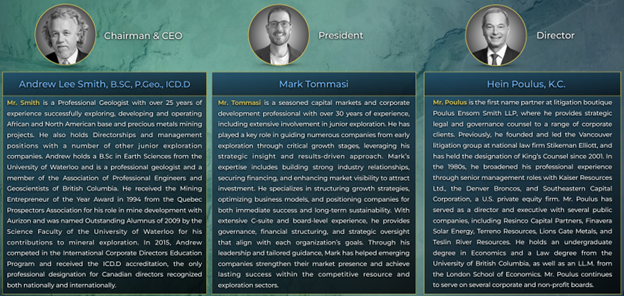

- Andrew Lee Smith, P.Geo. – CEO, Executive Chairman & Director

A Professional Geologist with over 25 years of experience, Smith has a track record of exploring, developing, and operating mines in Africa and North America. He previously led Aurizon Mines, earning the Quebec Prospectors Association's Mining Entrepreneur of the Year Award, and holds the ICD.D designation in corporate governance. He also serves as the Qualified Person for the company's technical disclosure. - Mark Tommasi – President

Tommasi brings more than 30 years of experience in capital markets and corporate development, with extensive work guiding junior explorers through critical growth stages. In this story, he is the bridge between exploration progress, financing, and market awareness, including the recent oversubscribed financing that allowed the company to accelerate its program. - Hein Poulus, KC – Director

Poulus is a senior lawyer and corporate director who previously led the Vancouver litigation group at Stikeman Elliott. He provides governance and legal oversight and has held board roles across multiple public companies.

Share Structure

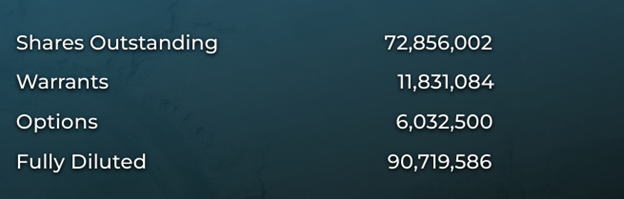

- Shares outstanding: 72,856,002

- Warrants: 11,831,084

- Options: 6,032,500

- Fully diluted: 90,719,586

- Listings: CSE: BRAZ OTC: CNYGF FSE: K5D

The share count is still reasonable for a junior about to run one of the larger first-pass drill programs in Brazil. With the recent oversubscribed financing, the company appears positioned to complete its planned 2026 work without blowing out the capital structure.

Technicals

From a technical standpoint, BRAZ looks like a stock moving through its early Point of Recognition (POR) phase.

After a long consolidation, the shares broke out in 2025, reaching your first target at CA$0.37 and the second at CA$0.45. That move coincided with growing awareness of the Rio Madeira story and the oversubscribed financing.

Following those highs, the stock pulled back, but it has done so in a constructive way:

The pattern of higher lows remains intact, anchored by a rising trendline that has been building since early 2025.

Recent trading suggests a possible island reversal, often a sign that a corrective phase is ending.

Volume has expanded on rallies and dried up on pullbacks, consistent with quiet accumulation rather than distribution.

Momentum (MACD) has turned positive again, and the 50-day moving average is trying to flatten and curl higher above the longer-term 200-day.

At recent prices in the CA$0.30–0.33 range, the stock is sitting near support with the next technical objective around CA$0.60. If the January drill program begins delivering encouraging results into a strong gold tape, a move toward your longer-term "big picture" target becomes more realistic.

The chart suggests the stock is coiled rather than broken and could respond quickly to positive news.

Conclusion

Canary Gold Corp. (BRAZ:CSE; CNYGF:OTC; K5D:FSE) is entering 2026 with a rare combination: district-scale land position, road and river access, a well-defined Mocururu geological model, visible gold in early field work, and a fully financed, multi-rig drill campaign targeting roughly 80 kilometers of prospective horizon. The company can finally test the hard-rock source behind millions of ounces of historic placer gold along the Rio Madeira.

This is happening against a supportive backdrop. Gold appears to be in a secular bull market, Brazil's equity market is trying to break out of a long downtrend, and the country is pushing to trace and formalize gold production in the Amazon. Canary's large, contiguous land package in a proven placer belt, combined with a technically supported ~20,000-meter drill program scheduled to start in January 2026, means the next 12–18 months should tell us whether Rio Madeira can move from concept to discovery.

With the shares trading around CA$0.30–CA $0.33, we view Canary Gold Corp. as a Speculative Buy for investors seeking leveraged exposure to an emerging Brazilian gold story with meaningful drill catalysts ahead.

More information is available at the company's website: https://canarygold.ca/.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Canary Gold Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, between US$3,500.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Canary Gold Corp.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.