There are no tungsten mines currently producing in North America. Yet tungsten sits at the heart of modern defense systems, aviation, data centers, microchips, and nuclear energy. It is the hardest metal on the periodic table after diamond, and roughly 80–85% of global supply still comes from China, which has tightened export controls over the last two years.

American Tungsten Corp. (TUNG:CSE; TUNGF:OTCQB; RK9:FSE) is trying to change that by bringing a past-producing, high-grade tungsten, silver, and molybdenum mine in Idaho back into production, and by building a domestic processing hub that could handle feed from third-party deposits as well.

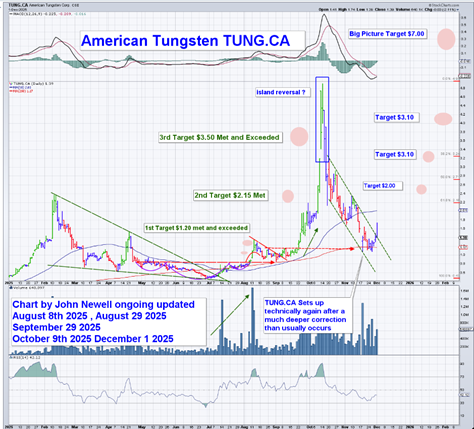

After meeting all three of my initial upside targets earlier this year, the shares corrected sharply and then began to base again.

With a new technical setup in place, fresh capital in the treasury, and additional support from U.S. agencies, the stock is lining up for a potential second leg higher.

About the Company

American Tungsten's sole focus is restarting the historic IMA Mine in Idaho to become one of the first (and potentially the first) North American tungsten producers since 2015.

The project sits on privately owned, patented land, which gives the company more permitting flexibility than projects located on U.S. federal (BLM or Forest Service) ground. Good road access, low-cost Idaho power, and a local, mining-experienced workforce round out the basic infrastructure.

The business model has also evolved. What started as a direct-shipping ore concept has moved toward a more robust vision: building an on-site mill to produce two saleable concentrates, a tungsten oxide concentrate and a silver-molybdenum concentrate, capturing more margin and reducing dependence on third-party processors.

Why Tungsten and Why Now?

Tungsten has been classified as a critical mineral by U.S. and allied governments for decades. Roughly four-fifths of primary production and most downstream processing are still concentrated in China. Over the past couple of years, Chinese authorities have tightened export controls on various critical metals, including tungsten, helping push prices to multi-year highs and sharpening Western interest in domestic supply.

Beyond defense, tungsten is embedded in:

- Jet engine and industrial turbines

- Semiconductor fabrication and high-end electronics

- Data centers and power infrastructure

- Nuclear energy systems

American Tungsten's IMA Mine carries a historic record of very high-grade material: roughly 0.63% WO₃ in the main zones, along with about 0.15% molybdenum and ~2 oz/t silver in past estimates.

The company believes that, at an initial 500-tonne-per-day milling rate, the mine could ultimately satisfy on the order of 8% of U.S. tungsten demand, with plenty of room to scale toward 1,000 tonnes per day as the resource grows.

The IMA Mine: Brownfield with Built-In Advantages

IMA is a classic Idaho porphyry-related system with tungsten-rich veins overprinting molybdenum and silver:

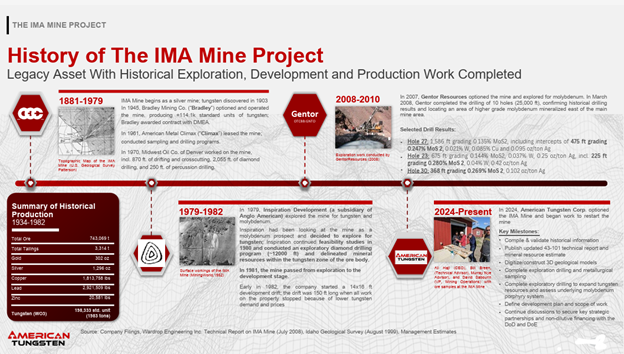

History. The Bradley Mining Company operated the mine from the late 1800s through 1959, making it one of the largest tungsten producers in North America at the time. Later work by Inspiration (Anglo American) and Gentor advanced it toward modern development before market downturns shut the window on financing. In today's dollars, management estimates roughly US$440 million of historical work has gone into underground development, drilling, and infrastructure.

Underground workings. There are roughly 15 miles of historical underground workings across multiple levels. American Tungsten has rehabilitated key access adits on the D and 0 levels and is now establishing underground drill stations to validate and grow the resource.

Resource and upside. Historic work outlined several hundred thousand tonnes of high-grade tungsten-bearing material plus a 5.7-million-tonne molybdenum resource at 0.15% Mo. The current program is focused on confirming and expanding those volumes, tracing continuity of the main veins, and testing the underexplored south side of the valley, where surface mapping shows similar mineralization.

The large patented land package gives the company space to build its own mill, dry-stack tailings, and related infrastructure without having to acquire additional surface rights.

Path to Production: On-Site Mill and Government Support

In 2024–2025, the company raised approximately CA$25 million across two financings, giving it the capital to:

- Complete key underground rehabilitation

- Launch an expanded underground drill program from five planned drill bays on two levels

- Advance engineering on a modular on-site mill, initially sized at roughly 500 tpd

At the same time, American Tungsten has been actively engaging with U.S. agencies focused on critical minerals. The company recently announced a non-binding US$25.5 million Letter of Interest from the U.S. Export-Import Bank (EXIM), which, if converted into a facility, allows TUNG to be fully funded to production.

Because IMA sits on patented ground, the permitting pathway is shorter and more focused than many U.S. hard-rock projects. Key workstreams are:

- Completing underground drilling and an updated NI 43-101 resource estimate, targeted for Q1 2026

- Delivering a PEA/feasibility-level mine plan and metallurgy, targeted for Q2 2026

- Finalizing state-level permits tied mainly to water use and surface facilities

Management's stated goal is to commission the mill and begin initial production in late 2026 or early 2027, subject to permitting and construction timelines.

Management

American Tungsten has been steadily upgrading its leadership bench:

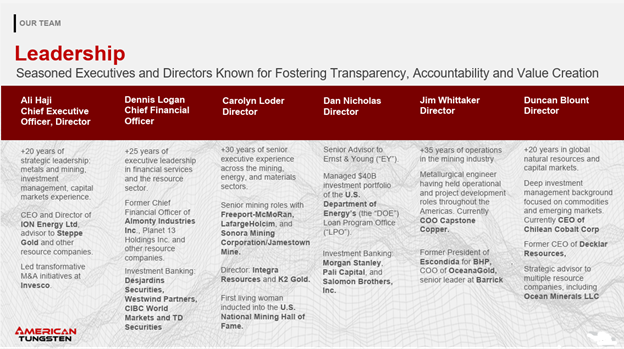

CEO Ali Haji has a capital markets and asset development background; previously involved with Steppe Gold, the Mongolian gold producer, and a lithium company sold via joint venture to an Asian group.

CFO Dennis Logan, Former CFO of Almonty Industries, one of the world's largest listed tungsten companies, with experience raising capital and executing uplists to senior U.S. exchanges.

Operations and geology team includes veterans with deep Idaho experience and senior roles at producing companies such as Capstone Copper. Underground rehab and planning are overseen by engineers who have built and operated mines before.

Board and advisors. Recently strengthened with the addition of mining Hall of Fame-level technical talent and policy experts with direct experience at the U.S. Department of Energy and in Washington, D.C., which is important as the company navigates the critical minerals policy landscape.

This is a team that understands both the engineering and the financing side of mine-building, and that has already demonstrated an ability to raise meaningful capital for the project.

Share Structure & Capitalization

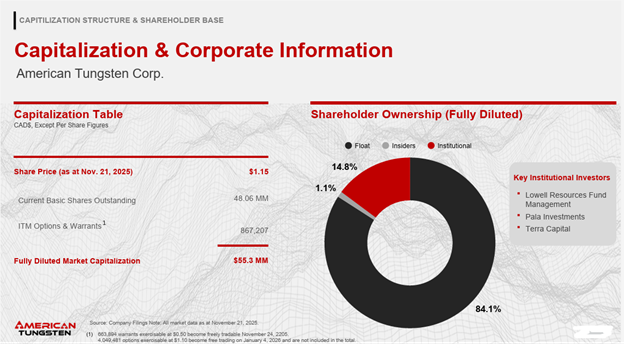

American Tungsten's capital structure remains tight for a company at this stage:

Shares outstanding: ~48 million

Recent financings: CA$7 million private placement in mid-2025, followed by an ~ CA$18 million bought deal / life-offering later in the year

Cash position: Management has indicated a treasury of roughly CA$22 million after the latest raise, intended to fund rehab, drilling, and engineering through the next major set of de-risking milestones.

Institutional ownership: Approximately 15% held by institutions, with strong daily trading liquidity in Canada and the U.S.

On December 1, 2025, American Tungsten closed at CA$1.39 on the CSE, well below the levels reached during its first breakout earlier in the year.

Technical Analysis: All Targets Hit, Deep Reset, New Setup

Earlier this year, American Tungsten staged a powerful advance that met and exceeded our three initial upside targets of CA$1.20, CA$2.15, and CA$3.50. The move culminated in a sharp spike and potential island-reversal pattern, followed by an unusually deep correction that shook out late buyers.

The new chart (December 1, 2025) shows a very different structure:

- A full round-trip and reset

From the peak above CA$4, the stock retraced aggressively back toward its rising 200-day moving average, giving back much of the prior parabolic move.

This kind of deep correction, while uncomfortable, is not unusual after a first leg in a strong bull move. It often clears weak hands and allows a more sustainable second leg to develop.

- Falling wedge and first signs of a turn

The pullback has taken the form of a classic falling wedge, with lower highs and lower lows converging toward a support zone anchored by the 200-day average and prior congestion.

Recent trading shows price pushing back up off those lows, with the possibility of an “island reversal” if the stock can hold above the recent gap-up area.

- Moving averages and momentum

The 50-day moving average has rolled over after the correction but is now flattening, while the longer-term 200-day remains in a clear uptrend. A successful breakout from the wedge would likely see the 50-day turn back up and eventually cross higher again, confirming a renewed bullish alignment.

MACD has already worked off its overbought condition from the earlier spike and is curling higher from deeply negative territory, often an early sign that downside momentum is exhausted.

RSI has reset from overbought extremes back into the low-40s, leaving plenty of room for a new advance before any overbought readings appear.

- Volume

Turnover remained strong throughout the first advance and into the correction, reflecting a broadening shareholder base. Recent days show constructive buying on up-moves and lighter volume on pullbacks, consistent with early accumulation.

New Upside Targets

Given the completed first leg, the deep corrective phase, and the fundamentals now catching up via funding and engineering progress, I see the following technical objectives over the next 6–18 months, assuming the broader market and tungsten prices remain supportive:

- First Target CA$2.00

A recovery to the CA$2.00 area would represent a retest of the initial breakdown zone and roughly the 38.2% retracement of the decline from the highs. This is a logical first resistance level. - Second Target CA$3.10

The next objective is the CA$3.10 region, which aligns with a Fibonacci retracement cluster and prior congestion on the way up. A sustained move through this level would signal that the second leg is firmly underway. - Third Target Re-test of the prior spike zone (CA$3.50–CA$4.00)

If the company continues to hit its operational milestones (resource update, economic study, and clear visibility on capex funding), a re-test of the Q4 2025 spike zone in the mid-CA$3s to ~ CA$4 becomes reasonable. - Big Picture Target CA$7.00

On a multi-year view, a measured-move projection from the multi-month base and the prior advance suggests a big picture target in the CA$7.00 area. Reaching that level would likely require:

- A completed mill financing package (including potential EXIM participation)

- A clear production schedule

- Confirmation that IMA can deliver the kind of cash flow implied by internal scoping work

For now, that CA$7 level should be treated as an aspirational target that frames the upside leverage if the company executes.

Conclusion Speculative Buy

American Tungsten offers a combination that is exceptionally rare in today's market: a past-producing U.S. tungsten mine, existing infrastructure, strong jurisdictional advantages, and a commodity experiencing renewed strategic urgency.

The shares have already delivered one full technical cycle: a powerful breakout that met all initial targets, followed by a deep reset. Today, investors can revisit the story with a potential do-over like move.

American Tungsten Corp. is a Speculative Buy at the December 1, 2025, closing price of CA$1.39, for investors seeking exposure to a potential first mover in North American tungsten with meaningful exposure to both metal prices and critical minerals policy.

For more information, start with the company's website.

For my previous article on TUNG, you can click here.

| Do you want the latest investment ideas delivered to your inbox? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of American Tungsten Corp.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.