Orestone Mining Corp. (ORS:TSX.V; 02R2:FSE) is entering a new phase of growth with a refreshed portfolio and a strategy built around two complementary gold assets: the newly acquired Francisca oxide gold system in Salta, Argentina, and the long-established Captain gold-copper porphyry project in British Columbia. Together, they give the company something rare in the junior sector: the ability to operate, explore, and generate news year-round in two mining-friendly jurisdictions.

Francisca provides near-surface, open-pit, heap-leach oxide gold potential in a region known for majors and mid-tiers. Captain, by contrast, offers the leverage of a deeper porphyry discovery model situated in a proven district that has produced some of BC's largest copper-gold systems.

It's that combination that gives Orestone multiple exploration pathways, a steady cadence of catalysts, and exposure to gold and copper at a time when both are attracting strong speculative interest.

Key Property #1 Francisca Oxide Gold System (Salta, Argentina)

The acquisition of Francisca introduced a new dimension to the Orestone story. Located in Salta Province, consistently ranked the top jurisdiction in Latin America by the Fraser Institute, the project hosts a large, at-surface oxide gold stockwork system with grades well-suited for open-pit heap-leach development.

Historic work, though limited and now two decades old, leaves the company with a compelling starting point:

Highlights from prior programs include:

- 50 meters of 3+ g/t Au in trenching

- 100 meters averaging nearly 1.0 g/t Au in trenching

- Significant surface exposure with broad alteration zones

- Continuous stockwork mineralization, typical of scalable oxide deposits

As CEO David Hottman noted in a recent Ahead of the Herd interview, the mineralization style is strategic because it fits Orestone's experience base. The team has worked on multiple open-pit, heap-leach operations at companies such as Eldorado Gold, Bema Gold, and Greenstone, mines that they drilled, built, and operated.

The 2025–2026 program includes mapping, resampling of the historic trenches, geologic modeling, and drilling designed to define the geometry of the system and establish a maiden resource. Permitting is nearly complete, opening the door to work beginning shortly.

Francisca is the type of deposit that a small, technical team can rapidly advance into a development scenario without requiring major company budgets. That optionality is one of the reasons investors are beginning to pay attention.

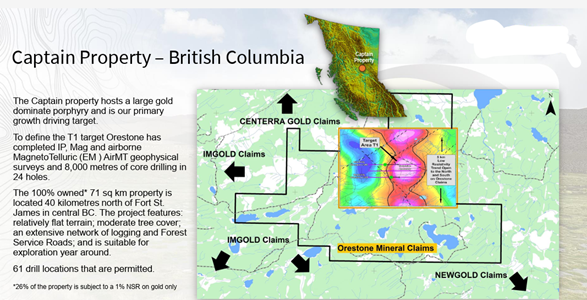

Key Property #2 Captain Gold-Copper Porphyry (British Columbia)

While Francisca anchors the gold-oxide growth story, Captain remains a core asset with multi-year upside potential. Located in a district that has hosted the likes of Mt. Milligan and other significant porphyry systems, Captain is built around the T1 target, a large, deep conductive body supported by 3D MT survey data, porphyry alteration signatures with dykes and high-grade xenoliths encountered in earlier drilling.

The scale of the porphyry potential gives Orestone leverage to gold and copper in one of the safest jurisdictions globally. With Francisca providing near-term catalysts during the South American field season and Captain ready for follow-up during the Canadian season, the company can maintain continuous news flow and exploration momentum across both hemispheres.

This dual-jurisdiction structure is a strategic advantage, allowing Orestone to avoid seasonal gaps and ensure steady development on both fronts.

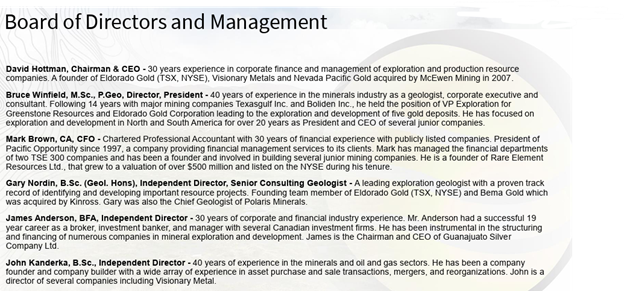

Management

Orestone is led by a team that has discovered, built, operated, and sold multiple mines across the Americas.

CEO David Hottman brings decades of experience in discovery, development, and mine-building, including roles with Eldorado Gold and Bema Gold.

The broader technical team includes individuals with backgrounds in porphyry exploration, oxide gold deposit development, and international project management, the right mix for a company running two simultaneous programs.

Their track record with open-pit heap-leach projects provides a strong operational foundation at Francisca, while their experience with porphyry deposits supports the long-term potential at Captain.

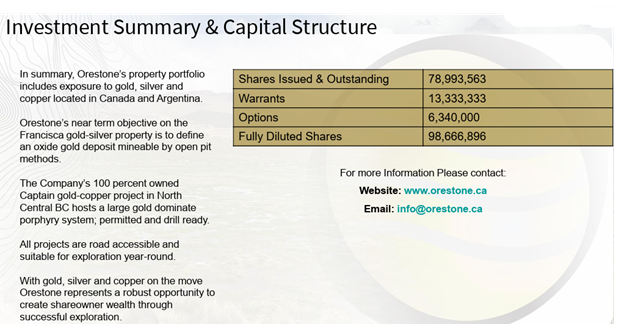

Share Structure

As of late 2025, Orestone reports:

- Shares Outstanding: 78.9M

- Fully Diluted: 98.6M

With two advancing projects and tight dilution to date, the current valuation sits at an early stage relative to the scale of the targets.

Technical Analysis

Orestone Mining is showing the early signs of a base-breakout pattern that has the potential to develop into a new uptrend.

After a multi-year decline and a prolonged period of low-volume drift, the shares have carved out a double bottom and have now tested the breakout point successfully.

Price Structure

The stock broke above long-term resistance around CA$0.06–CA$0.07, pulled back to retest the breakout, and held.

This type of retest is constructive and often marks the beginning of a new rising trend. Recent trading shows a series of higher lows, a classic hallmark of early accumulation.

Moving Averages

The 50-day MA has turned up and is now acting as support.

Price is consolidating just above the 200-day MA, creating a supportive technical base.

A sustained move above CA$0.10 would solidify the new uptrend.

Volume

Volume has started to expand, a key confirmation.

The accumulation spikes match the timing of the Francisca acquisition news, suggesting the market is responding to the refreshed story.

Momentum Indicators

RSI remains below overbought levels, leaving room for additional upside. MACD is hovering around a positive cross, consistent with a continuing base-building phase.

Upside Targets

Based on historic resistance and measured move potential:

- The First Target: CA$0.15

- The Second Target: CA$0.23

- The Third Target: CA$0.40

A decisive move through CA$0.10–CA$0.11 would be the next confirmation of strength.

Risk Levels

Key supports include CA$0.07 (breakout zone) and CA$0.06 (double-bottom floor). A close below CA$0.06 would weaken the pattern.

Overall, the technical picture is improving, with the structure now aligned for a potential multi-quarter advance as exploration news begins to flow.

Conclusion Speculative Buy

Orestone is entering 2026 with a different posture than in recent years. The company now has two meaningful gold projects capable of generating results throughout the entire calendar year, providing steady catalysts and visibility for investors.

Francisca offers near-surface gold in a top-tier jurisdiction with grades that fit well within an open-pit heap-leach development model. Captain adds long-term porphyry leverage in British Columbia, giving shareholders exposure to both copper and gold in a proven district.

The technical setup supports the fundamental story: a completed double bottom, a successful breakout retest, rising volume, and a series of higher lows. At the December 1, 2025, closing price of CA$0.09, the shares present an attractive speculative entry point with clear upside targets, and is a Speculative Buy.

For more information, visit: www.orstone.ca.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,500.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Orestone Mining Corp.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.