Azincourt Energy Corp. (AAZ:TSX.V; AZURF:OTC) has announced that it has acquired an ownership interest in Nuclea Energy Inc., a company focused on designing and advancing scalable micro-modular and small-modular nuclear reactors. The investment marks Azincourt's first move into the nuclear technology deployment space, aligning with its broader strategy to support zero-emission energy solutions for industrial and remote operations.

Based in Ontario, Nuclea Energy is developing the Morpheus reactor, a lead-cooled, enriched uranium-fueled micro modular reactor (MMR) capable of producing between 4 and 50 megawatts of clean, continuous power. The reactor design features passive safety systems, low-pressure operation, and hydrogen-free containment, which aim to mitigate traditional nuclear risks while delivering consistent baseload energy.

Nuclea's compact design is targeted at sectors requiring reliable off-grid electricity, such as remote mining operations, data centers, and isolated communities. In addition to Morpheus, the company is in discussions with Canadian Nuclear Laboratories to license two other microreactor technologies, broadening its technological platform.

"Nuclea is advancing one of the most promising new nuclear technologies in North America," said Azincourt President and CEO Alex Klenman in the company's news release. "As global power demand accelerates, micro modular reactors can deliver the safe, scalable, and carbon-free baseload power the world urgently needs. This investment aligns perfectly with our long-term vision to participate across the full nuclear energy value chain."

Nuclear Gains Strategic Ground in Clean Energy Mix

Small modular reactors (SMRs) are defined by the International Atomic Energy Agency (IAEA) as advanced nuclear reactors with a power capacity of up to 300 megawatts electric (MW(e)) per unit, or roughly one-third the output of a conventional large-scale reactor. According to the IAEA, SMRs are designed to be smaller in size and modular in construction, allowing components or entire reactor systems to be factory-assembled and transported to installation sites. This makes them suitable for deployment in remote communities, industrial operations, data centers, and areas with limited electrical grid capacity.

The IAEA highlights several advantages of SMRs, including simplified reactor designs, enhanced passive safety systems, and the ability to deploy units incrementally to match demand. Because of their size and modular approach, SMRs can reduce construction timelines and upfront costs compared to traditional nuclear power plants. These characteristics position SMRs as a potential solution for expanding access to clean, reliable energy in areas underserved by conventional infrastructure, while supporting the global shift toward low-carbon power.

On November 6, The Market Online published remarks from Nuclear Vision Ltd. CEO Derrick Dao, who addressed the rising importance of nuclear power in meeting growing electricity demand. Dao cited the rapid adoption of artificial intelligence and digital infrastructure as key drivers of this trend. "To scale AI, you must scale power, and nuclear is the most efficient source we have," he said. He emphasized nuclear energy's reliability and scalability, particularly for AI systems, electrification initiatives, and high-demand industrial settings.

In a November 13 commentary, Jeff Clark reported that uranium had been officially added to the United States Geological Survey's Critical Minerals list. The update follows earlier remarks from the White House and signals a formal recognition of uranium's strategic role in national energy security. Clark noted that "around 95% of the uranium that fuels America's reactors comes from outside the country," and highlighted that critical mineral status may support improved access to capital through government programs, offtake agreements, and strategic partnerships.

According to Inside Climate News on November 29, 10 uranium mines were in operation across the U.S. as of late 2025, up from just three in 2021. Several mines in Wyoming, Texas, and Arizona have resumed or expanded operations, with additional projects in Colorado, Utah, and New Mexico advancing under expedited permitting processes introduced by recent executive orders. This renewed activity follows a period of dormancy where domestic production lagged behind foreign imports due to lower costs abroad and a stagnant nuclear market.

Despite the momentum, significant bottlenecks remain. The U.S. currently lacks the infrastructure to fully convert and enrich uranium oxide concentrate — known as yellowcake — into nuclear fuel at a commercial scale. Nearly all enrichment is performed overseas, with much of the supply still tied to Russian sources despite a phased ban signed in 2024. Companies such as UR Energy and Energy Fuels have restarted production at key sites but continue to operate below capacity as they await the buildout of a domestic fuel supply chain. Analysts and industry executives cited in recent reporting noted that while expectations for uranium demand have risen, large-scale ramp-ups in mining and processing will require time, regulatory clarity, and investment.

Positioning Across the Nuclear Ecosystem

Azincourt's acquisition of a stake in Nuclea represents a strategic step toward full-spectrum participation in the nuclear sector. While the company continues to advance its Harrier and East Preston uranium exploration projects, the Nuclea investment expands its exposure into the technology side of the clean energy equation.

According to Azincourt's corporate materials, nuclear power is expected to play a central role in meeting net-zero emissions targets, with uranium demand forecast to outpace supply through 2040. The inclusion of microreactor deployment in its strategic roadmap reflects a broader recognition of emerging demand for distributed, carbon-free baseload energy.

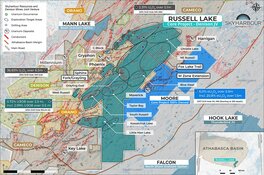

The Harrier Project in Newfoundland's Central Mineral Belt and the East Preston Project in Saskatchewan's Athabasca Basin remain the company's primary exploration assets. Azincourt began initial fieldwork at Harrier in August 2025 and plans to complete an NI 43-101 resource estimate for the Snegamook Uranium Deposit in 2026, where historical drilling intersected multiple broad zones of mineralization, including 0.974% U₃O₈ over 0.5 m. The project is located near several large-scale uranium deposits and hosts over a dozen uranium mineralized zones, including surface samples returning up to 7.48% U₃O₈, and >1% U₃O₈ in ten separate areas.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Azincourt Energy Corp. (AAZ:TSX.V; AZURF:OTC)

With the addition of downstream exposure through Nuclea's modular reactor technologies, Azincourt now holds a unique position within the nuclear supply chain — from uranium exploration through to clean energy deployment. The company stated that it views small-scale nuclear systems as essential for powering off-grid infrastructure, industrial sites, and other applications requiring consistent energy delivery where traditional grid connections may not be feasible.

Ownership and Share Structure 1

Institutions hold 0.78% of Azincourt Energy. Institutional investors include Arrow Capital Management LLC and Tidal Investments LLC.

Management and insiders own 0.9%. President, CEO, and Director Alex Klenman is the major shareholder, with 0.34%. Other insider shareholders are Director Paul Reynolds and Vice President of Exploration Trevor Perkins.

The rest is in retail.

Azincourt has 453.92 million (390.54M) outstanding shares and 387.5M free float traded shares. Its market cap is CA$5.64 million. Its 52-week range is CA$0.01–CA$0.045 per share.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Azincourt Energy has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Azincourt Energy.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

1. Ownership and Share Structure Information

The information listed above was updated on the date this article was published and was compiled from information from the company and various other data providers.