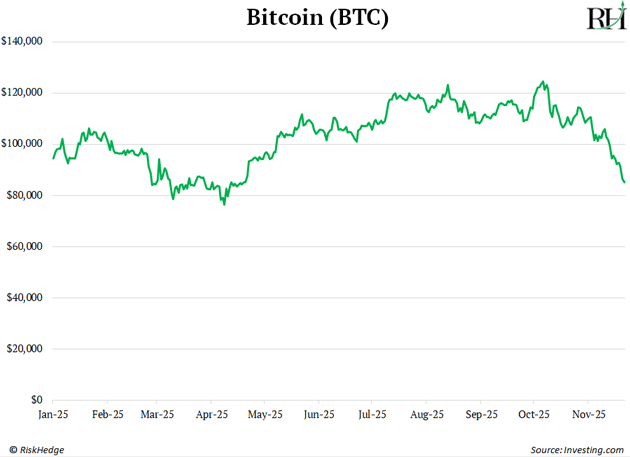

Bitcoin (BTC) continues to slide.

At the time of writing this, it is around $83,000.

BTC has lost over a third of its worth since hitting $126,000 a little over a month ago.

A significant factor contributing to this market downturn is investors offloading their crypto holdings in anticipation of the four-year Bitcoin cycle. This cycle suggests that 2026 will be a disastrous year for cryptocurrencies.

"3 up, 1 down."

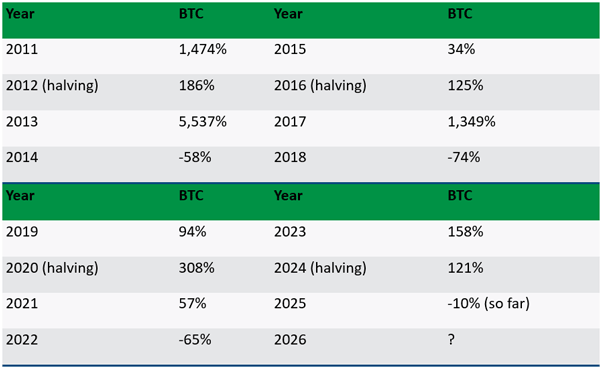

This is the historical pattern that Bitcoin and crypto prices have adhered to. The four-year cycle was so reliable that you could synchronize your timepiece to it, as demonstrated by this chart of Bitcoin's yearly performance:

As evident from the data, Bitcoin experiences an average decline of over 60% in the third year following the halving event. If past trends persist, now would be the ideal moment to make a swift exit.

However, that's not the course of action I advise. On the contrary, I believe this market pullback presents a prime buying opportunity. The four-year cycle that everyone is fretting about has come to an end, and in a positive way.

January 11, 2024…

The day that Bitcoin's cycle was disrupted. What transpired on that date? The inaugural Bitcoin ETFs commenced trading in the United States. Bitcoin had always been a niche asset.

Purchasing it required setting up a crypto wallet, transferring funds to a suspicious-looking exchange, and hoping it wouldn't fall victim to a hack. Moreover, it was nearly impossible to own within a retirement account. Too cumbersome for most individuals.

Now, acquiring Bitcoin is as simple as buying shares of Apple Inc. (AAPL:NASDAQ) or Tesla Inc. (TSLA:NASDAQ). ETFs have flung open the gates to Wall Street capital, and billions flooded in almost instantaneously.

BlackRock's (BLK) Bitcoin ETF — the iShares Bitcoin Trust ETF (IBIT) — has become the fastest-growing ETF in history. In less than two years, $72 billion has poured into it. It's the most triumphant ETF debut ever, and by a wide margin.

To put this into perspective, the largest gold ETF — the SPDR Gold Trust (GLD) — has existed for over two decades and currently manages $141 billion in assets. I predict that IBIT will surpass GLD in 2026.

Greetings, infinite bid…

The fact that anyone can now effortlessly purchase BTC and Ethereum (ETH) through an ETF has fundamentally transformed crypto markets forever. The "infinite bid" from wealth managers represents the single most significant tailwind in crypto's history.

When crypto was predominantly retail-driven, psychology revolved around the Bitcoin halving. In 2020, people literally hosted "halving parties." It evolved into a self-fulfilling cycle.

Crypto is now substantially owned by professional investors who are theoretically less inclined to engage in wild speculation, such as the four-year cycle. Though I'll let you in on a secret: Many of those I know are still degenerate gamblers.

Financial advisors don't hastily liquidate their clients' investments because Bitcoin dropped 15% on some arbitrary Tuesday. They adhere to quarterly review cycles, annual rebalances, and long-term retirement strategies. This translates to steady, consistent buying pressure — something crypto has never experienced until now.

What this signifies is that the explosive peaks and devastating 80% crashes we've become accustomed to will likely transition into more stable uptrends punctuated by modest corrections.

The conventional four-year cycle is likely dead, and in a positive way. Less manic booms. More sustainable accumulation.

Pull up a Bitcoin chart pre-ETF vs post-ETF, and the difference is stark. It now resembles the S&P 500 more than "internet casino money."

This transition mirrors the evolution of financial markets. The early stock market experienced full-blown panics every other year, while modern markets face crises every 20-30 years.

Crypto is undergoing the same maturation process, just compressed into an accelerated timeline.

This steady inflow of capital didn't exist in crypto…

Until the advent of ETFs. . .

When tens of millions of Americans receive their paychecks every other week, they automatically purchase stocks through their retirement accounts. This generates continuous demand for equities, providing a price floor.

Now, the world's largest asset managers — including BlackRock, Fidelity, VanEck, and others — are advising their clients to buy and hold BTC in their 401(k)s.

A teacher in Alabama purchasing a Bitcoin ETF through her 401(k) isn't timing halvings. The floodgates have opened. Billions of dollars of Wall Street money are flowing into crypto for the first time ever.

There's $8 trillion currently parked in 401(k) plans. If crypto captures a mere 1% of 401(k) assets, that equates to $80 billion of fresh capital entering the market.

I anticipate new Bitcoin all-time highs within the next six months.

This pullback is nothing extraordinary. It marks the sixth instance of BTC dropping over 20% since 2023. And thanks to the infinite bid, each of those dips presented a buying opportunity.

On average, Bitcoin rallied 68% six months from the low. These washouts serve as a market reset. Weak hands get shaken out... astute investors scoop up crypto at a discount... and the next leg higher commences.

I know pullbacks like this can be tough to sit through. That’s why I write The Jolt — a free letter that helps you tune out market noise and focus on what really matters, rain or shine. Sign up today if you haven't already.

| If you enjoyed this, make sure to sign up for the Jolt, Stephen McBride's twice-weekly investing letter-where innovation meets investing. | Go here to join |

Important Disclosures:

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Tesla Inc. and Apple Inc.

- Stephen McBride: I, or members of my immediate household or family, own securities of: Ethereum. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.