Coppernico Metals Inc. (COPR:TSX; CPPMF:OTCQB; 9l3:FSE) has commenced field exploration programs at the Nioc and Antapampa targets within its Sombrero copper-gold project in southern Peru. The program is the company's first sustained campaign in these specific areas and is being conducted by its wholly owned Peruvian subsidiary, Sombrero Minerales SAC.

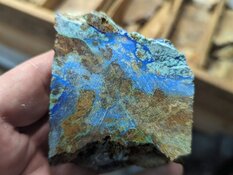

The current campaign includes soil geochemistry on a 200-by-200 meter grid, geological mapping, rock sampling, and channel sampling of key outcrops. The aim is to expand on known surface mineralization, define geochemical signatures, and identify new areas for potential drilling. The company stated that Nioc represents a garnet–magnetite skarn domain over an area of approximately 2 by 3 kilometers. with visible copper oxides and sulphides in select surface exposures. It overlies a modeled induced polarization anomaly measuring approximately 1.8 by 1.4 kilometers and interpreted to extend to a depth of 400 meters.

Recent surface channel sampling at Nioc returned multiple continuous intervals of copper-gold mineralization, including 93.5 meters at 0.87% copper, 0.19 g/t gold, and 0.60 g/t silver; 52 meters at 1.06% copper, 0.19 g/t gold, and 1.20 g/t silver; and 36 meters at 1.10% copper, 0.32 g/t gold, and 3.44 g/t silver. These samples were cut across exposed skarn and overlie elevated chargeability geophysical anomalies.

Antapampa, located approximately 2 kilometers north of Nioc, is a newer skarn target identified during recent pipeline evaluations. It hosts iron skarn mineralization with visible magnetite and garnet associated with altered monzonite intrusions. Surface work will include mapping and reconnaissance sampling to characterize the mineral system.

Coppernico Chair and CEO Ivan Bebek stated in the announcement, "The commencement of these programs, along with additional geophysical studies that will follow in the near future, are indicative of our continued, active efforts to refine and further establish a premier pipeline of significant copper-gold targets within our large land position."

Copper Gains Momentum With Critical Mineral Designation and Stable Market Fundamentals

A November 6 article from Mining.com reported that the United States Geological Survey (USGS) has officially added copper to its updated list of critical minerals. The expanded list is intended to identify materials essential to national economic and security interests. The USGS based its decision on an economic model that analyzed over 1,200 potential trade disruption scenarios across 84 mineral commodities. The agency concluded that copper's essential role in industrial systems warranted its inclusion.

Adam Estelle, president and CEO of the Copper Development Association, commented that "copper holds the key to achieving America's top policy objectives, including energy dominance, AI supremacy, national security, and re-industrialization." The reclassification is expected to encourage U.S. investments in domestic mining and mineral processing, and could streamline permitting processes for future copper projects.

In a November 9 commodities update from Excelsior Prosperity, analyst Shad Marquitz noted that copper prices had "largely treaded water around US$5 a pound" through early November, showing relative stability compared to other metals. Marquitz described copper's trajectory as "even-keeled" and highlighted its "constructive trend" on long-term charts, reflecting balanced market conditions despite corrections elsewhere in the resource sector.

A November 17 update from Couloir Capital added that copper prices rose 2.3% for the week, driven by improved risk appetite following the resolution of the U.S. government shutdown. Additional support came from lower output at major mines and falling inventories in China, contributing to bullish sentiment in the copper market.

Analyst Highlights Scale Opportunity at Nioc and Sombrero

In a September 4 research note, Steven Therrien of 3L Capital stated that recent surface sampling results significantly enhanced the exploration outlook for Coppernico Metals' Nioc target and the broader Sombrero Project in Peru.

Therrien wrote that if the interpreted skarn systems at Nioc's Zones 1 and 2 prove to be mineralized at depth, the potential exists for a system measured in the hundreds of millions of tonnes. He referenced historical drilling at the Fierrazo target, located within the Ccascabamba area, which returned results including 116 meters grading 0.42% copper and 0.24 g/t gold. These intervals, according to Therrien, support the presence of widespread mineralization.

He added that the overall Sombrero property displays indicators of multiple mineralized centers and large-scale potential, noting that several high-priority targets remain untested by drilling or modern sampling.

Channel Results Position Nioc and Antapampa for Advanced Targeting

Coppernico's current exploration activities at Nioc and Antapampa build on its broader goal of establishing a pipeline of drill-ready targets across its approximately 56,400-hectare land position. According to the company's investor presentation, Nioc's recent high-grade surface results make it the highest-grade known copper-gold outcrop within the Sombrero Project, and its alignment with strong chargeability anomalies supports further geophysical modeling.

Antapampa, which shares geological similarities with Nioc and Fierrazo, is considered an early-stage but promising target within the broader Sombrero cluster. As part of its ongoing expansion, Coppernico is also integrating targets such as Tipicancha, Milpoc, and Macha Machay into its regional pipeline.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Coppernico Metals Inc. (COPR:TSX; CPPMF:OTCQB;9l3:FSE)

The company is concurrently working to expand drill permits beyond the current 49-hole authorization at the Ccascabamba target, and continues to build social access agreements in new areas of interest. With a reported cash position of approximately CA$4.1 million as of September 30, 2025, Coppernico noted that its treasury is expected to fund operations through the first quarter of 2026.

Ownership and Share Structure1

Coppernico Metals is owned by strategic investors, including Teck Resources Ltd. (TECK:TSX; TECK:NYSE) with 9.9% and Newmont Mining (NEM:NYSE, NGT:TSX, NEM:ASX) with 5.6%.

Overall, the ownership of Coppernico is 18.37% by institutions, 15.54% strategic entities, 5.13% management and insiders, and the rest, 60.96%, is retail.

Coppernico has 177.3 million outstanding shares and 145.47 million free float trading shares. Its market cap is CA$39 million. Its 52-week range is CA$0.12–CA$0.54 per share.

| Want to be the first to know about interesting Copper and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Coppernico Metals is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Coppernico Metals.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

1. Ownership and Share Structure Information

The information listed above was updated on the date this article was published and was compiled from information from the company and various other data providers.