Azincourt Energy Corp. (AAZ:TSX.V; AZURF:OTC) has announced preparations for a 2,000-meter diamond drilling campaign at its Snegamook Uranium Deposit within the Harrier Project in Labrador's Central Mineral Belt. The program is designed to confirm historical uranium mineralization and support a new resource estimate compliant with NI 43-101 standards. Historical drilling at Snegamook previously intersected uranium-bearing zones, including a notable interval of 0.974% U₃O₈ over 0.5 meters in drill hole SN-08-06.

According to the company, the project area remains significantly underexplored, with only 124 historical drill holes completed across a 49,400-hectare land package. Azincourt has identified over a dozen mineralized zones within the Harrier Project, including several surface samples that returned uranium grades above 1% U₃O₈, and up to 7.48% U₃O₈ in one case. The upcoming drill program is expected to focus on the Snegamook Deposit and nearby targets such as Boiteau Lake, where recent site visits uncovered new uranium showings.

The Snegamook Deposit was last explored between 2006 and 2008 by Silver Spruce Resources, which conducted 17 drill holes targeting uranium-bearing brecciated and altered monzodiorite. These efforts traced four shallow-dipping lenses over a 300-meter strike length, with vertical extents reaching 200 meters. Although a preliminary resource estimate was prepared at the time, it was never finalized or filed.

Azincourt's 2025 field program included helicopter-supported reconnaissance and validation of past drill sites, where historical drill core was located and examined. Many drill pads and casings were still intact, allowing for easy confirmation of hole orientation and positioning. Azincourt also identified two new uranium showings on the property, which have been added to the Company’s pipeline of high-priority drill targets. As part of the 2026 program, Azincourt intends to rehabilitate and reassess legacy core samples, twin select holes to verify historical results, and expand drilling in open directions.

"We are excited to commence drilling in Labrador," said Trevor Perkins, Vice President of Exploration at Azincourt, in the press release. "Our priority is to confirm the historical results and begin an expansion of the Snegamook Deposit in preparation for a preliminary resource estimate for the deposit. At the same time, we want to advance other targets on the property to unlock the value this property contains."

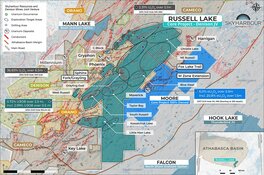

The Harrier Project is adjacent to other significant uranium assets in the Central Mineral Belt, including ATHA Energy Corp.'s (SASK:TSX.V; SASKF:OTCMKTS; X5U:FRA) Moran Lake (9.6 million pounds U₃O₈ and 11.8 million pounds V₂O₅) and Anna Lake (4.9 million pounds U₃O₈) deposits, as well as Paladin Energy Ltd.'s (PDN:TSX; PDN:ASX) Michelin deposit, which contains 127.7 million pounds of U₃O₈. These neighboring projects situate Azincourt within a well-established uranium exploration corridor.

Policy Shifts and Global Momentum Reinforce Uranium's Strategic Role

A November 6 report on international uranium by Henry Lazenby highlighted a major policy shift in Sweden, where lawmakers have officially repealed the country's 2018 moratorium on uranium mining. The change allows for full bedrock exploration and permitting under Sweden's existing Minerals Act. The move followed a two-year effort by the Climate and Enterprise Ministry, which identified uranium as essential to national energy security. Maria Sunér, CEO of the Swedish Mining Association, described the decision as "very positive," adding that "there are no factual reasons for uranium to be treated differently than other metals." She emphasized that the repeal opened new opportunities to explore and utilize the country's geological resources.

Also on November 6, The Market Online published comments from Nuclear Vision Ltd. CEO Derrick Dao on the role of nuclear energy in meeting rising global power needs. Dao pointed to digital transformation and artificial intelligence as key drivers of electricity demand, stating that "to scale AI, you must scale power, and nuclear is the most efficient source we have." He emphasized the scalability and reliability of nuclear energy in powering AI infrastructure, electrification initiatives, and high-demand industrial sectors.

On November 13, Jeff Clark reported that uranium had been added to the United States Geological Survey's Critical Minerals list, alongside metals like copper, nickel, and tungsten. Clark noted that this designation followed earlier White House remarks and marked a formal acknowledgment of uranium's strategic importance. He pointed out that "around 95% of the uranium that fuels America's reactors comes from outside the country," underscoring the significance of secure domestic and allied supply chains. Clark also observed that critical mineral status often enhances access to capital through government programs, strategic partnerships, and offtake agreements.

Aiming for New Discovery in a Proven Uranium District

Azincourt Energy has outlined several key activities planned for 2026 that may shape the trajectory of its Harrier Project. According to the company's corporate presentation, a significant focus will be placed on preparing a compliant NI 43-101 resource estimate for the Snegamook Deposit. This includes twinning historical drill holes and expanding the known footprint of mineralization, particularly southeast of previous intercepts.

Additional diamond drilling is planned for the Boiteau Lake and Moran Heights areas, where 2025 fieldwork identified new uranium-bearing structures and surface mineralization. The company also intends to conduct detailed geological and structural mapping at these zones, which could inform the design of follow-up drill programs.

Strategically, Azincourt's land position in the Central Mineral Belt provides proximity to multiple large-scale uranium resources in a stable Canadian jurisdiction. With renewed global interest in nuclear energy and a stated aim to update resource data using modern exploration techniques, the company is positioned within a historically rich yet underexplored region.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Azincourt Energy Corp. (AAZ:TSX.V; AZURF:OTC)

The Harrier Project's historical high-grade surface results and untested targets underscore the potential for further mineral discoveries, particularly as Azincourt applies updated geochemical and geophysical methods to guide its exploration efforts. The company's 2026 plans also include working with a qualified person (QP) to support the resource estimate, marking a technical advancement in bringing the project forward.

Ownership and Share Structure 1

Institutions hold 0.78% of Azincourt Energy. Institutional investors include Arrow Capital Management LLC and Tidal Investments LLC.

Management and insiders own 0.9%. President, CEO, and Director Alex Klenman is the major shareholder, with 0.34%. Other insider shareholders are Director Paul Reynolds and Vice President of Exploration Trevor Perkins.

The rest is in retail.

Azincourt has 453.92 million (390.54M) outstanding shares and 387.5M free float traded shares. Its market cap is CA$5/64 million. Its 52-week range is CA$0.01–CA$0.045 per share.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Azincourt Energy has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Azincourt Energy.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

1. Ownership and Share Structure Information

The information listed above was updated on the date this article was published and was compiled from information from the company and various other data providers.