Western Exploration Inc. (WEX:TSX.V; WEXPF:OTC) announced results from the first five reverse circulation (RC) drill holes targeting a section of the Tomasina area, located about one kilometer west of Gravel Creek at the company's fully owned Aura gold-silver project in Nevada.

Hole WG467, drilled to the northwest of Wood Gulch on section T4760N, encountered 3 meters at 7.1 grams per tonne gold (g/t Au) and 4.8 g/t silver (Ag) within a broader interval of 44.2 meters at 0.38 g/t Au and 1.71 g/t Ag. This zone remains open for over one kilometer of strike length both to the northwest and southeast, the company said in a release.

Hole WG463 revealed extensive oxidation and clay silicification alteration, characteristic of high-level epithermal systems similar to those above the Gravel Creek deposit, WEX said. The altered zone in WG463 included a segment of 15.24 meters at 0.13 g/t Au and 10 g/t Ag, indicating proximity to a potentially mineralized system at depth.

"We are very encouraged that the current drill program has confirmed the resource growth potential at the Tomasina fault area," Chief Executive Officer Darcy Marud said. "Initial drill results from WG466 and WG467 northeast of Wood Gulch show similar geology, alteration, and mineralization to Gravel Creek, located just one kilometer to the east. Importantly, the target remains open for one kilometer of strike length."

Drilling to the southeast of the Wood Gulch open pit identified high-level epithermal alteration and mineralization that is similar to that discovered above the Gravel Creek resource, he said. Legacy hole WG355, completed down dip and to the east of this area, returned 13.17 meters of 1.67 g/t Au and 28.5 g/t Ag, including 1.52 meters of 10.9 g/t Au and 101 g/t Ag, demonstrating the prospectivity of this area.

"To have this degree of success in an initial drill program is truly exciting!" Marud noted in the release. "Considering that Western Exploration has drill tested less than 20% of the Tomasina Fault trend strike length, we are very encouraged about the future resource growth potential of this area. The strength and continuity of alteration, together with the consistent mineralized intercepts, provide a clear case for continued step-out and follow-up core drilling."

About the Target

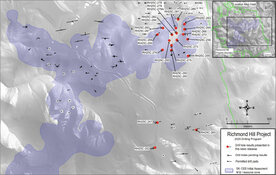

The Tomasina target is a 2.5-kilometer-long structural zone located down dip from the Saddle and Wood Gulch NI 43-101 resources and the Hammer Head mineralization, the company said.

The goal has been to assess mineralization within the highly favorable Frost Creek tuff, which is the main host rock at Gravel Creek, at the faulted unconformity with the underlying Schoonover Formation. The five RC drill holes discussed in the release explored targets along approximately 1 kilometer of the Tomasina structural zone, positioned to the northwest and southeast of the down dip projection of Wood Gulch mineralization.

Last month, WEX released more RC results from the zone highlighting the potential for resource expansion at the Aura Project, particularly down dip and along strike from existing NI 43-101 resources.

On November 6, the company announced it had enlisted Stantec Consulting Servinces Inc. to prepare and initiate a Notice of Intent (NOI) and Mine Plan of Operations (MPO) for the Aura project. Stantec, located in Elko, Nevada, has been a long-standing partner on the Aura Project. The firm brings expertise in environmental assessments, baseline reporting, and regulatory processes specific to mineral development in Nevada. Their current role will align with ongoing baseline environmental studies and engineering optimization efforts previously outlined in Western Exploration's Preliminary Economic Assessment (PEA).

Western Exploration holds full ownership of the Aura Project, which includes three known deposits: Doby George, Gravel Creek, and Wood Gulch. The project is situated approximately 120 kilometers north of Elko, Nevada.

Expert 'Really Likes' Co.

Jeff Clark of TheGoldAdvisor.com filmed a video commentary filmed at Western Exploration's Reno headquarters in November. In it, he disclosed his own investment in the stock and described it as a "likely long-term Hold" as the company progresses with project development and ongoing drilling. He characterized the recent 28% drop in the share price from its September high as "a clear buying opportunity for a first tranche," and suggested that those already holding shares could consider increasing their position. According to Clark, Western Exploration remained one of his favored holdings in the gold sector, stating, "I really like this company . . . I own this stock, and you might want to check it out."

On November 17, he released an update on TheGoldAdvisor.com noting that the "headline hole intersected 3 meters of 7.1 g/t Au and 4.8 g/t Ag, within a broader interval of 44.2 meters 0.38 g/t Au and 1.71 g/t Ag."

"What’s significant about today’s results is that it shows Tomasina’s geology is the same as Gravel Creek," Clark said. "This is very positive: it means Tomasina is a precious metals bearing system and that management’s model is working."

Chen Lin of What Is Chen Buying? What Is Chen Selling? on November 18 called the results "significant."

He suggested watching a three-minute video from the company on its discovery. "They have a lot of news coming," he wrote.

In a research report dated September 30, Don MacLean of Paradigm Capital highlighted significant advancements by Western Exploration Inc. at its fully owned Aura Gold-Silver Project in Nevada. MacLean noted that "WEX offers leveraged exposure to a district-scale Nevada gold-silver growth story," underscoring the company's capacity to expand its resources across various deposits. He mentioned that Paradigm had been monitoring Western Exploration "for some time now" and was "impressed by the progress it has made in the past year unlocking Nevada's emerging high-grade epithermal potential."

The report detailed the Doby George deposit as being ready for development following a preliminary economic assessment completed in May, which proposed an open-pit, heap-leach operation producing 7,500 tons per day at an average grade of 1 gram per tonne gold over five years. MacLean pointed out that the study projected annual cash flow exceeding US$100 million, with an after-tax net present value of US$71 million at US$2,150 per ounce gold and US$211 million at US$3,000 per ounce gold.

He also highlighted that the Gravel Creek deposit had developed into a "material, high-grade gold-silver system" due to ongoing exploration success, with recent drilling confirming "bonanza-grade veins, up to 75 g/t gold and more than 4,000 g/t silver." The updated mineral resource estimate showed a 54% increase in inferred ounces compared to the previous estimate.

MacLean drew attention to the company's exploration efforts at the past-producing Wood Gulch deposit, where drilling was being conducted along the untested Tomasina Fault corridor. He summarized Western Exploration's broader goals, stating that the company was "targeting greater than 2 Moz gold and 30 Moz silver in its next resource update."

In evaluating the company's financial and operational status, MacLean noted that Western Exploration had a market capitalization of approximately CA$50 million and maintained around CA$3.5 million in cash. He also highlighted the company's strong institutional support and management expertise, emphasizing that its leadership team had been involved in discoveries at other major gold projects.

The Catalyst: Gold's Wild Ride This Year

Gold prices have pulled back recently, prompting speculation about whether the yellow metal's remarkable rally this year is nearing its conclusion, according to a report by TheStreet on November 17.

After soaring to record highs close to US$4,400 per ounce in October, the precious metal fell below US$4,000 per ounce by late October, according to the report. Since then, it has fluctuated, trading between US$3,900 and US$4,205, before settling at US$4,054 on November 17. This recent movement has left gold enthusiasts debating whether to "buy the dip" or sell to secure profits.

Gold and silver prices surged sharply in early U.S. trading on Wednesday, according to a report by Jim Wyckoff for Kitco News on November 19.

The mid-week rise was driven by safe-haven demand amid a nervous U.S. stock market and in anticipation of significant U.S. economic data. December gold climbed US$50.70 to reach US$4,117.10, while December silver increased by US$1.549 to US$52.07.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Western Exploration Inc. (WEX:TSX.V;WEXPF:OTC)

Traders and investors are eagerly awaiting key U.S. economic releases, Wyckoff noted. The main points of focus include the FOMC meeting minutes due later today and Thursday’s jobs report from the Labor Department, both of which could shed light on the U.S. interest rate outlook. U.S. agencies have begun releasing economic data that was delayed due to the federal government shutdown.

There is concern among traders and investors that upcoming economic data might restrict the Fed’s ability to ease further, given policymakers’ skepticism, he said. Concerns over high valuations in tech stocks have dampened risk sentiment, boosting the safe-haven appeal of gold and silver amid the recent stock market downturn.

Goldman Sachs President John Waldron commented that stock indexes might face further declines as investors anticipated the quarterly earnings report from tech giant Nvidia Corp. (NVDA:NASDAQ) on Wednesday.

"It strikes me the market could pull back further from here," Waldron said in an interview at the Bloomberg New Economy Forum in Singapore on Wednesday. "I do think the technicals are kind of more biased for more protection, and more downside."

Ownership and Share Structure1

Directors and management own 3% of the company, high net worth individuals hold 9%, Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) has 12%, Auramet holds 4%, and Institutions hold 48%. The rest is retail.

Western Exploration has 52.58 million outstanding shares and 24.96M free float traded shares. Its market cap is CA$36.63 million. Its 52-week range is CA$0.58–CA$1.18 per share.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Western Exploration Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Western Exploration Inc. and Nvidia Corp.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

- Ownership and Share Structure Information

The information listed above was updated on the date this article was published and was compiled from information from the company and various other data providers.