In a recent update, I said a big gold price rally (short-term, basis the daily chart) was imminent, and of course, that rally promptly occurred and is now over basis the double top in silver and key senior miners like Barrick Mining Corp. (ABX:TSX; B:NYSE) and IAMGOLD Corp. (IMG:TSX; IAG:NYSE).

I've also been suggesting that investors need to be open to "several months of time in the consolidation hopper" before the next super-sized surge begins, a surge that could take gold to somewhere between $6,000-$9,000.

Gold isn't a hot mining stock even though it comes from mines. It's a currency (the ultimate currency) and so a move of 100%+ (like has occurred over the past two years) needs to be consolidated before there can be much more glorious upside action against vile government fiats.

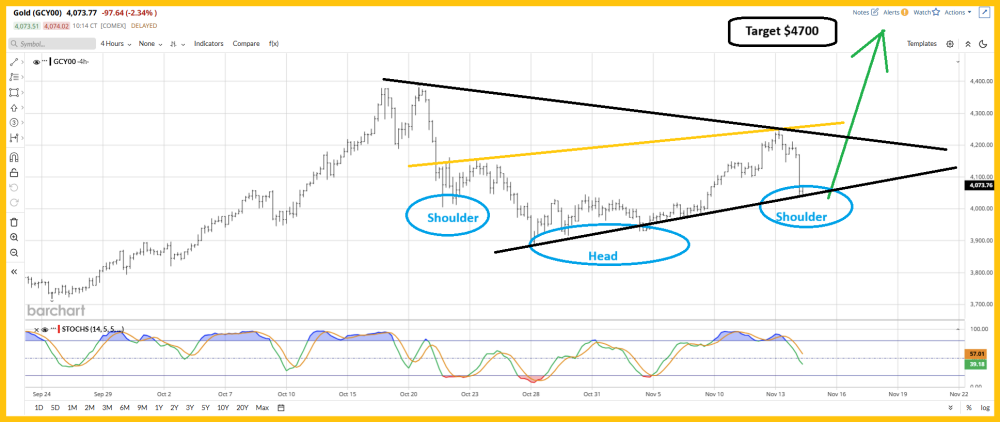

Here's a look at a key daily chart for gold:

The good news is that every one of these scary dips is making the chart even more bullish!

Note the inverse H&S pattern and the bull triangle. These are both positive for gold, and both target the $4700 zone.

Bull moves for gold generally involve debt and inflation. What makes the current market particularly exciting is the global loss of confidence in U.S. government debt, and by extension, the dollar.

Governments and central banks are now leery of buying U.S. government debt because they fear they could be blackmailed or have their holdings frozen . . . or even confiscated.

Because other governments also have huge debt and spending problems, they are turning to gold.

This is a "here to stay" theme, and it means that while corrections in the price will continue to happen, they will tend to be more short-lived than in the dollar-dominated past.

What about the miners? Well, here's the GDXJ chart:

As with gold, the technical action is all positive. There's a lot of volatility, but none of it has damaged the overall bullishness of the chart.

Here's the CDNX:

Individual "hotties"? Here's a snapshot of Omai Gold Mines (OMG:TSXV; OMGGF:OTC), which I've highlighted numerous times:

Guyana is a pretty stable jurisdiction, even though it's basically second world, economically.

Here's a technical look at it:

There could be, not only a massive bull flag, but a breakout from it now in play on this weekly chart.

The implications for investors who bought my earlier buy alerts for the stock? Very positive indeed!

Here's a look at another junior-priced stock of interest, Bear Creek Mining Corp. (BCM:TSX.V):

The company has an operation in North America and South America, and a move to the middle of the channel on the chart at 40 cents seems imminent.

Note the volume! Anytime there's a huge volume bar on a CDNX stock after a big decline, it warrants investor attention. A fast 50% gain is often what happens soon after volume appears.

In a nutshell, junior mine stock investors should expect the current gold market volatility not only to continue, but to increase. Excitingly, each bout of new volatile price action is making the charts even more bullish than they already are.

Here's a great chart for investors to peruse as they begin the weekend:

It is of course the fabulous weekly CDNX chart, featuring the massive inverse H&S pattern. The expected recoil at the neckline zone is in play, and when that line is taken out, it will up, up, up, and junior mine stocks away!

Special Offer for Streetwise Readers: Please send me an Email to [email protected] and I'll send you my free "CDNX: The Next Ten Baggers!" report. I highlight some of the most exciting component stocks in this incredible index, with winning buy and sell tactics included for investors! Junior mine stock investing isn't for everyone, especially with size, but as this gargantuan gold bull era rollout continues, these miners look set to outperform everything! I write my junior resource stocks newsletter 2-3 times a week, and at just $199/12mths it's an investor favourite. I'm doing a special pricing this week of $169 for 14mths. Click this link or send me an email if you want the offer and I'll get you onboard. Thank-you!

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Important Disclosures:

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Barrick Mining Corp.

- Stewart Thomson: I, or members of my immediate household or family, own securities of: GDX. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Stewart Thomson Disclosures

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?